A Journey Of Success And Financial Mastery: Transforming Money Minds Into Wealth Realities

A Journey Of Success And Financial Mastery: Transforming Money Minds Into Wealth Realities

Winning in life is not just about talent or circumstance—it’s about cultivating a disciplined, forward-thinking relationship with money. The path to long-term financial mastery is rarely immediate; it demands strategy, resilience, and continuous learning. From personal finance basics to advanced wealth principles, every step shapes not only balance sheets but mental frameworks that determine lasting success.

This journey reveals how intentional habits, mindset shifts, and leveraging strategic tools converge to build enduring financial independence. Understanding the foundations of financial literacy forms the bedrock of true mastery. Every person’s journey begins with core knowledge: budgeting, saving, investing, and understanding credit—but true mastery goes beyond these fundamentals.

Research from the Global Financial Literacy Excellence Center shows only 33% of adults worldwide demonstrate basic financial competence, highlighting a critical gap that must be addressed. Without this base, even well-intentioned efforts falter. Adopting systematic budgeting, for example, empowers individuals to track spending, identify waste, and allocate resources with purpose—not panic.

Tools like automated savings apps and expense trackers close the gap between intention and action. Financial success is as much psychological as it is economic. The mindset one brings to money often determines outcomes more than income alone.

Behavioral finance experts emphasize that emotional discipline—resisting impulsive purchases, delaying gratification, and maintaining long-term focus—separates those who accumulate wealth from those who burn it. Consider the practice of “mental accounting,” where individuals assign specific purposes to money, enabling clearer decision-making. This cognitive framework helps avoid lifestyle inflation and fosters savings consistency.

“Your relationship with money is your money’s personality,” says financial psychologist Dr. Neha Patel. “Where you start emotionally shapes every financial choice.” Technology has revolutionized access to financial mastery.

Digital platforms now democratize wealth-building, offering tools once reserved for elite investors. Robo-advisors, for instance, use algorithms to create personalized investment portfolios at fractional cost, lowering barriers to entry. Apps like Mint and Personal Capital integrate budgeting, banking, and investing into one interface, reducing friction in financial management.

Even blockchain and decentralized finance (DeFi) introduce new paradigms for ownership and liquidity—challenging conventional banking. Yet, while technology accelerates access, it demands digital literacy: discerning credible sources from misinformation remains vital. Strategic investing extends financial mastery beyond saving.

Preserving capital is only half the battle—growth ensures real wealth creation. Historical data shows that sustained returns arise from diversified portfolios, asset allocation, and compound interest. Warren Buffett’s lifelong emphasis on “buying quality businesses at fair prices” encapsulates this principle.

Timing the market is futile; consistent participation, coupled with reinvestment, compounds wealth exponentially. Index funds and ETFs offer accessible entry points for most investors, reducing risk through diversification. Yet success requires patience—temptation to chase short-term gains often undermines long-term gains.

Building wealth requires patience, education, and adaptability. Financial mastery isn’t a sprint but a generational pursuit. estudio $reira shows that individuals who treat money as a skill—consistently seeking knowledge and refining strategies—far outpace those who rely on luck.

This mastery includes learning about taxes, estate planning, and behavioral biases. For example, tax optimization through retirement accounts like IRAs or 401(k)s enhances after-tax returns by years. Equally critical is adaptability—families and investors who revisit goals, adjust risk profiles, and embrace emerging tools maintain alignment with life’s evolving realities.

Real-life examples illuminate the power of this journey. Consider Maria, a teacher who started with $500 emergency savings and a rigorous budget. Over fifteen years, consistent investing in low-cost index funds—reinvesting dividends, resisting panic during downturns—grew her assets to over $600,000.

Her story mirrors that of tech entrepreneurs who delayed消费 to fund R&D, eventually scaling ventures into industry leaders. These narratives affirm that success emerges not from overnight wealth but from daily choices and learning curves. Risk management anchors sustainable financial success.

No strategy is complete without safeguards. Insurance—health, life, disability—protects assets and income from unforeseen drops. Emergency funds covering six to twelve months of expenses prevent debt during job loss or medical crises.

Yet, risk management extends beyond protection: strategic debt use, when prudent and managed, can enhance returns—such as leveraging low-interest student loans for education or mortgages for property appreciation. Balancing caution with calculated opportunity defines disciplined wealth building. Investment philosophy evolves with life stages.

Early career financial strategies differ from those near retirement. Younger investors often embrace higher risk for long-term compounding, benefiting from time to recover from market volatility. As retirement nears, shifting toward preservation—through bonds, cash equivalents, and strategic withdrawals—protects accumulated wealth.

Life events like marriage, parenthood, or career changes trigger portfolio recalibration. “Your financial plan should breathe,” advises financial planner James Croft. “It must adapt to meaning, not rigidly adhere to a formula.” Education remains the ultimate enabler.

Formal or self-study expands financial intelligence. Universities now offer robust personal finance programs; independent resources—books like *Rich Dad Poor Dad* or courses on Coursera—democratize expertise. Communities, conferences, and mentorship networks foster accountability and insight.

Those who treat financial literacy as a lifelong pursuit continually refine their approach, turning knowledge into durable advantage. In an era defined by economic volatility and rapid change, financial mastery stands as both an art and a science. Success is not a single achievement but a continuous evolution—of habits, knowledge, and vision.

Those who invest in this journey don’t just grow wealth; they unlock greater freedom, resilience, and capacity to shape meaningful lives. The path to mastery demands discipline, but rewards extend far beyond balance sheets—fostering peace, purpose, and legacy.

Financial success begins with intentionality.

Track, learn, invest, protect—and evolve. That’s the core of transforming money into lasting mastery.

Related Post

The Woman With Three Breasts: A Story of Transformation, Strength, and Identity in Kensley Pope’s Explored Narrative

Charlie Kirk’s Gun Control Crusade: Redefining the Conversation in a Polarized Nation

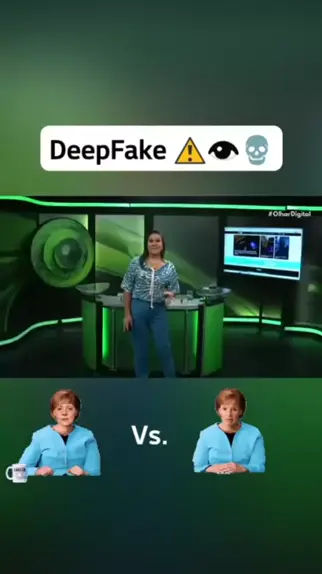

Livvy Dunne Deepfake Controversy Sparks Digital Ethics Firefight

Jim Harbaugh vs. Ohio State: Decoding the Complete Record in Collegiate Battle History