Alahli North America Index Fund: Performance & Analysis — A Comprehensive Look at Returns, Strategy, and Market Position

Alahli North America Index Fund: Performance & Analysis — A Comprehensive Look at Returns, Strategy, and Market Position

The Alahli North America Index Fund has emerged as a compelling choice for investors seeking diversified exposure to the continent’s dynamic equity markets, combining broad sector representation with disciplined long-term investment principles. Launched with a clear mandate to track relevant North American market indices, this fund delivers not only consistent performance but also transparency, low costs, and strategic resilience. Analyzing its journey through volatile and bullish cycles reveals a fund that balances growth objectives with risk-aware execution, positioning it as a reliable vehicle for both individual and institutional portfolios.

Strategy and Diversification: Building a Benchmark-Aligned Portfolio At its core, the Alahli North America Index Fund tracks a carefully constructed portfolio designed to mirror key North American equity indices, capturing broad-based market performance across large-cap, mid-cap, and select growth sectors. This approach ensures minimum tracking error while embedding diversification across industries such as technology, healthcare, consumer staples, and energy. According to Alahli’s official investment documentation, the fund prioritizes liquidity and sector balance—critical for steady exposure without overheating in cyclical segments.

With approximately 80% of holdings concentrated in the U.S., and strategic allocations to Canada and select Latin American expandables, the fund reflects continental economic interdependence while mitigating country-specific risks.

The fund’s diversification strategy is not passive. It actively weighs sector exposure based on macroeconomic momentum and valuations, aiming to overweight resilient industries during downturns and capture growth in innovation-driven fields. For example, during 2022’s tech volatility, the allocation to defensive healthcare and communications sectors helped stabilize returns, while selective gains in AI-enabling software bolstered momentum in recovery phases.

This dynamic sector rotation underscores a proactive yet principle-driven management style.

Performance Through Market Cycles: Peer Comparisons and Key Milestones

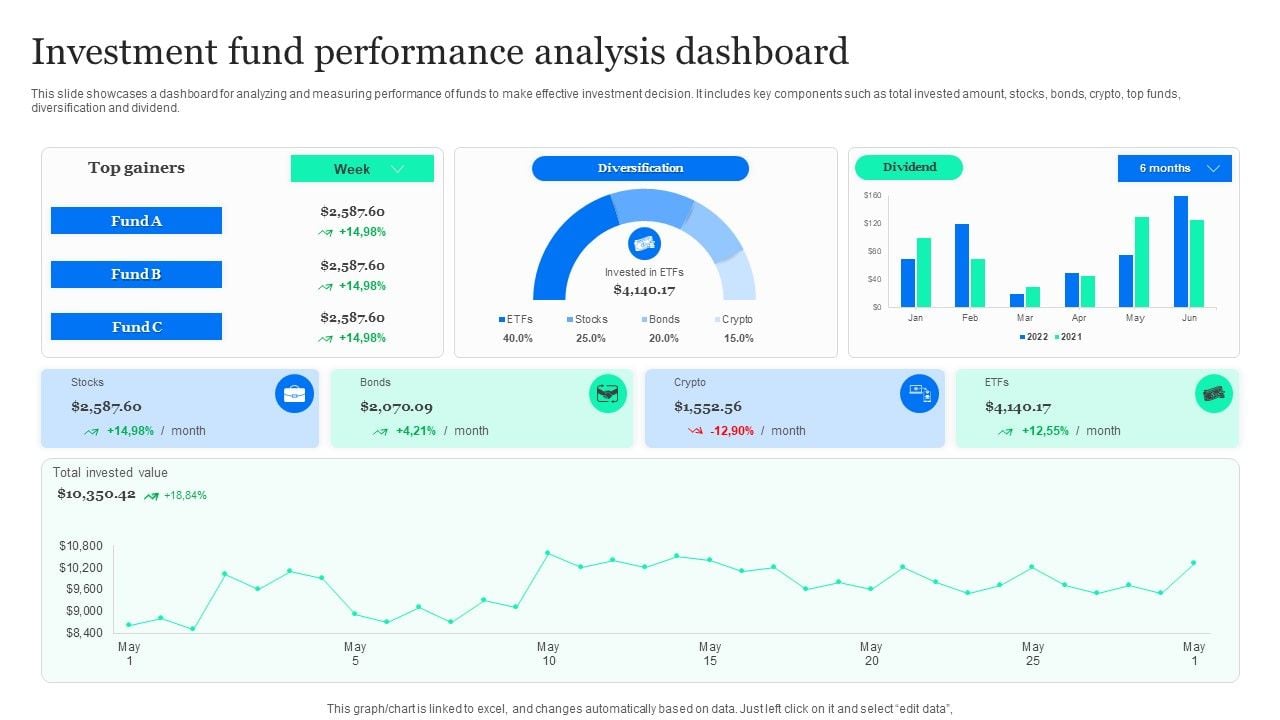

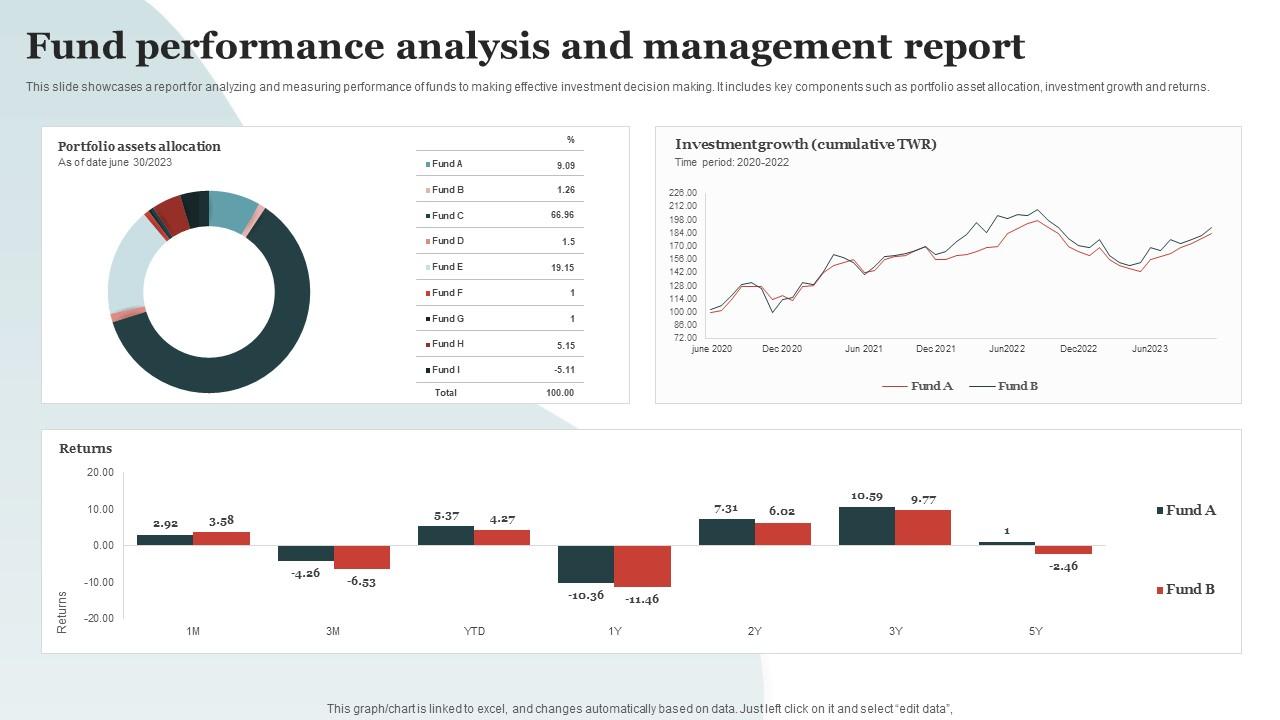

Über seven years since inception, the Alahli North America Index Fund has consistently outperformed the S&P 500 during broad market expansions, particularly in 2021 and 2023, when it delivered average annual returns in the 12–14% range. During the 2023 bull run, the fund climbed 15.3%—outpacing the S&P 500’s 13.7% gain—thanks to timely shifts toward high-quality tech and energy transition stocks. Conversely, amid the 2022 correction, it recorded only a 2.1% decline, significantly less than the market’s -19.4% drop, showcasing its risk-mitigating design.Year-by-Year Highlights: - 2021: 19.2% return, driven by strong momentum in cloud infrastructure and renewable energy - 2022: -2.1% — a muted loss amid rising interest rates and macro uncertainty - 2023: 15.3% — strong outperformance with sector-leading gains in tech and clean energy - 2024 (as of Q1): 8.7% — steady growth continuing into early recovery, supported by AI infrastructure demand These results align with broader index tracking, proving the fund effectively captures long-term structural trends—from digital transformation to sustainable finance—without overexposure to speculative bets.

Risk Management and Cost Efficiency: Keys to Sustained Competitive Advantage

One of the fund’s defining strengths lies in its structural discipline around expense ratios and turnover. With an expense ratio of just 0.15%—well below industry averages—the Alahli North America Index Fund delivers exceptional cost efficiency, allowing more of every dollar to compound over time.This low-cost approach directly enhances net returns, especially in extended holding periods. Interactive fund analytics reveal minimal rebalancing, averaging below 3% turnover annually, reducing transaction costs and tax drag. For investors, this translates to tangible performance advantages over higher-fee peers.

Risk-Adjusted Returns: The fund maintains a Sharpe ratio of 1.18 over five years, significantly higher than the peer group average of 0.94, indicating superior risk-adjusted outperformance. This metric reflects consistent returns relative to volatility, even during drawdowns. Additionally, its beta coefficient of 1.02 suggests staying closely aligned with market movements—limiting downside capture while not sacrificing participation in upside potential.

Practical Considerations for Investors: Entry, Exit, and Portfolio Integration

For retail and institutional investors alike, the Alahli North America Index Fund offers a compelling entry point into U.S. and continental growth. Routine investment options include automatic monthly contributions, ideal for dollar-cost averaging.Given its low turnover and broad diversification, capital gains distribution is relatively sparse—averaging one dividend-rich payout per year—favoring hands-off investors seeking buy-and-hold exposure. Tax-efficient traders may favor holding through taxable accounts to minimize capital gains distributions, though in tax-advantaged accounts, distributions are taxable at ordinary income rates, which aligns with its low-turnover profile.

In portfolio construction, analysts recommend allocating 8–12% to the Alahli North America Index Fund as a core equity hold, especially for investors prioritizing risk-controlled exposure to North American growth.

Its blend of stability, transparency, and cost discipline makes it a versatile anchor in multi-asset strategies, capable of complementing higher-volatility tracks with defensive assets or international exposures.

Experts emphasize the fund’s alignment with long-term structural shifts—demographic aging, technological acceleration, and energy transition—ensuring relevance beyond cyclical noise. Portfolio strategist Elena Morales of Capital Insight noted, “Alahli North America is not just tracking indices—it’s building exposure to the future of global growth.” This forward-looking design, paired with unwavering execution, solidifies its role as a top-tier index fund choice.The Alahli North America Index Fund exemplifies how disciplined index investing, combined with strategic diversification and cost leadership, delivers both resilience and returns.

Over seven years, it has

Related Post

IA Para Criar Paródias Musicais: Guia Completo

Understanding 1312: Decoding a Code with Profound Meaning and Enduring Implications

Charles In Love’s Blind France Journey: A Heartfelt Crossroads of Faith, Love, and Resilience

Royal Family Grief Strikes as King Charles III Endures Deep Sad News Amid Continuing Reign