Altcoin Season Index Your Yearly Guide: Mastering Market Cycles and Making Smarter Crypto Moves

Altcoin Season Index Your Yearly Guide: Mastering Market Cycles and Making Smarter Crypto Moves

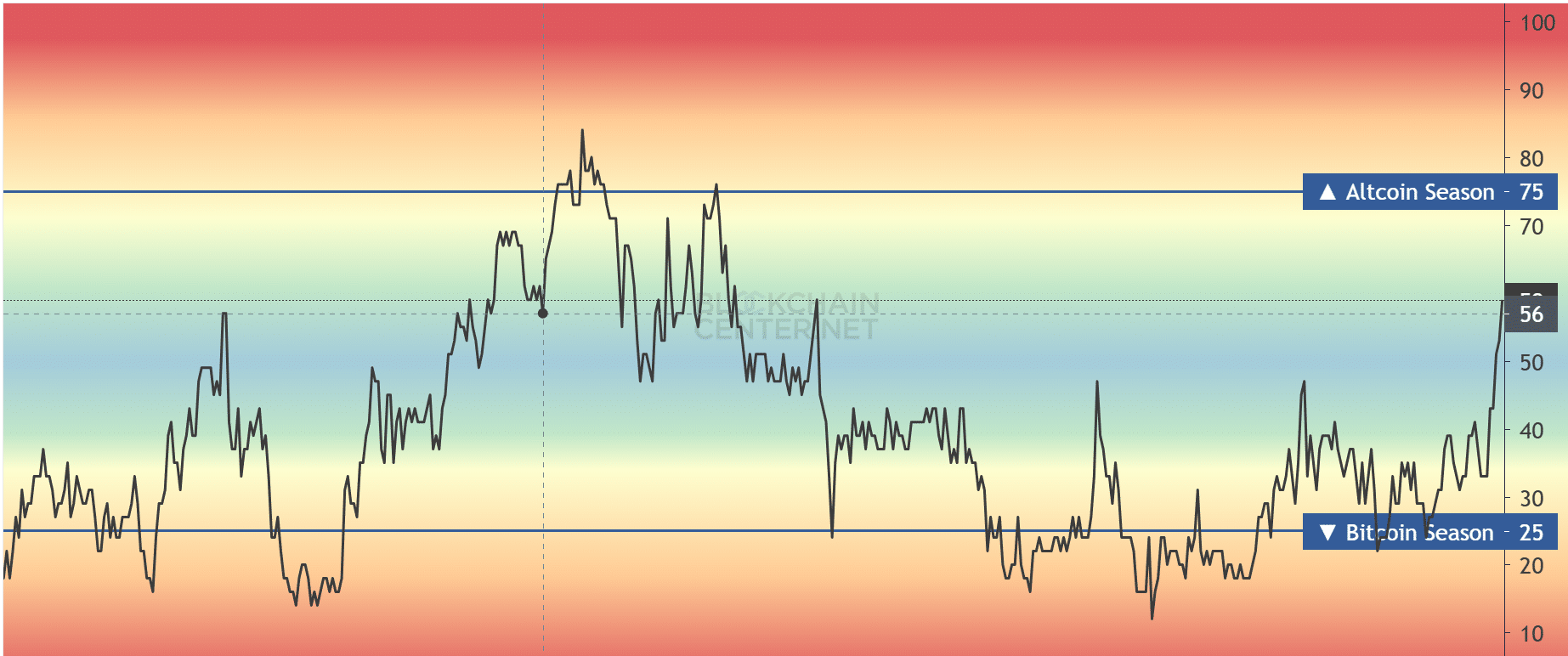

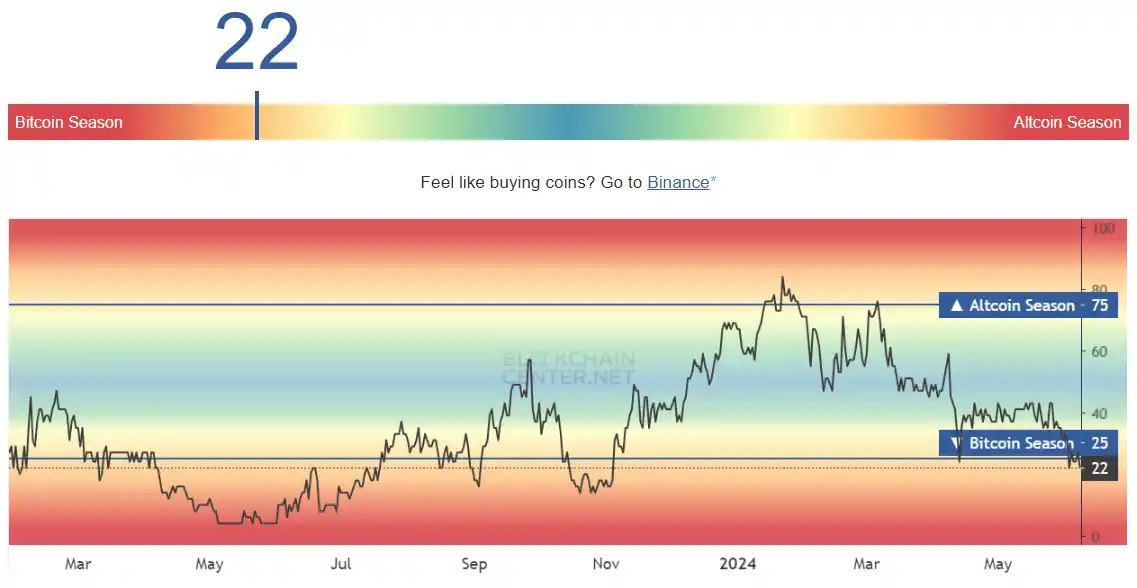

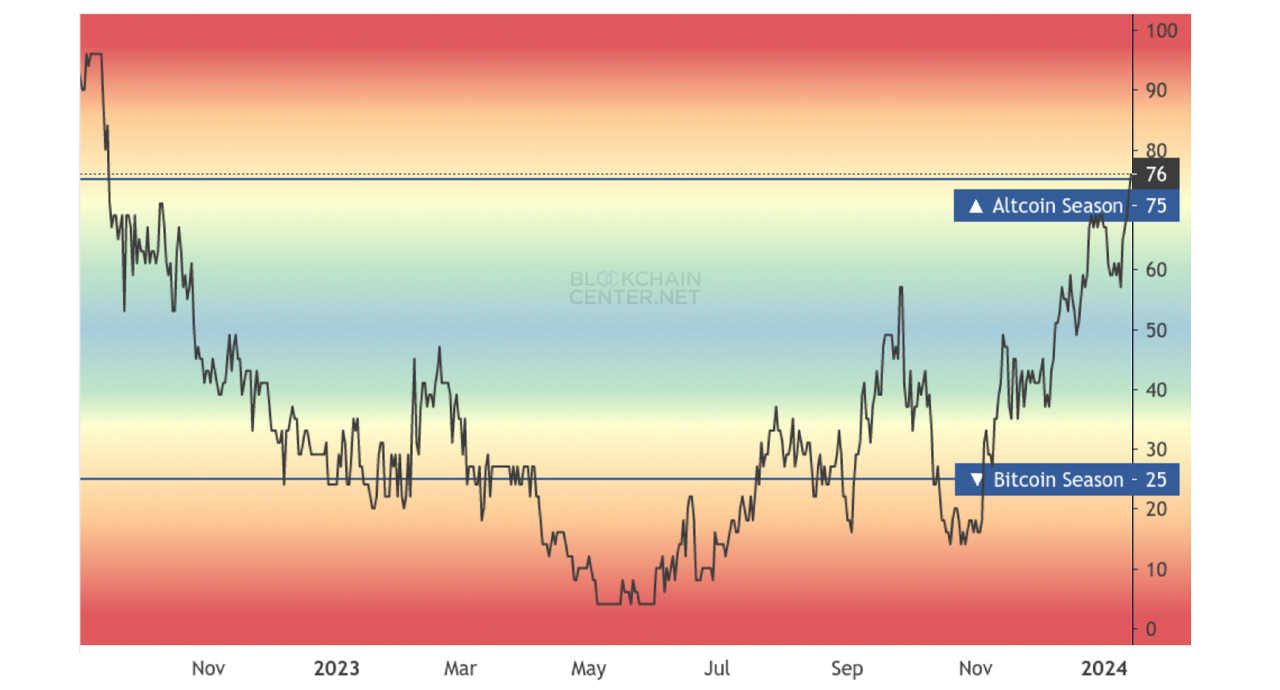

Every year, the volatile world of altcoins feels like a high-stakes game of financial roulette—driven by unpredictable trends, seasonal patterns, and shifting investor sentiment. The Altcoin Season Index emerges as a critical compass for crypto traders and investors seeking to navigate these turbulent waters. This yearly framework decodes recurring market behaviors, identifies optimal timing for entry and exit, and reveals which altcoins historically perform best during specific periods.

By decoding seasonal cycles and leveraging data-backed insights, market participants can reduce risk, capitalize on momentum, and align their strategies with predictable patterns rather than random speculation.

The Altcoin Season Index is not a single metric but a synthesis of behavioral trends, technical indicators, and macroeconomic influences that shape altcoin prices throughout the year. Each cycle reveals distinct patterns—times when market volatility spikes, investor appetite surges, and particular coin subsets outperform others.

These cycles are deeply rooted in market psychology, economic data releases, and seasonal liquidity shifts. Understanding them transforms cryptocurrency trading from reactive to strategic.

At its core, the index relies on historical performance data from thousands of altcoins, filtered through rigorous seasonal analysis. Data points include price action across calendar quarters, trading volumes, on-chain metrics such as exchange inflows and wallet activity, and sentiment shifts captured by news flow and social media analytics.

A notable observation across multiple years is the pronounced performance of specialist altcoin categories—such as AI-driven tokens, DeFi protocols, and privacy-focused assets—during certain fiscal periods. For instance, Q2 and Q3 often favor layer-2 scalability projects and MeVPacks, while Q4 sees a spike in utility tokens tied to year-end tokenomics and yield optimization.

Decoding the Seasonal Cycles: Key Phases and Hidden Alternatives

The Altcoin Season Index breaks down the year into distinct seasonal phases, each marked by unique market dynamics and preferred coin types. Recognizing these phases allows traders to anticipate shifts in momentum and reposition portfolios proactively.Share This: - **Winter Slump (Q1):** January–March often brings cautious sentiment, lower liquidity, and underperformance from speculative measuring coins. However, stablecoins and emerging sovereign digital assets gain traction during central bank policy shifts. The index shows minimal gains for most altcoins, with two exceptions: infrastructure tokens supporting blockchain scalability and select privacy coins benefiting from seasonal privacy regulator discussions.

Spring Surge (Q2): April through June frequently aligns with renewed institutional interest and post-holiday market recovery.

This phase often sees explosive growth in AI and machine learning-focused altcoins, as tech investors trickle into cryptocurrency. DeFi protocols experience renewed adoption due to improved user onboarding and lucrative yield farming opportunities, particularly during halving prep cycles. “Q2 is when the real momentum begins,” notes trader Elena Cruz of CryptoSeason Analytics.

“The index reveals a clear uptick in market volatility and volume, driven by both institutional positioning and retail participation.”

Summer Rally (Q3): July–September brings heightened competition among top-tier altcoins. Massive price surges dominate this phase, especially for capitalization leaders with strong developer activity and real-world partnerships. Altcoins tied to real-world utility—such as green energy tokens and supply chain innovators—popularize during this period.

The index shows stronger-than-average return profiles for projects with active community engagement and transparent governance models. Market participation rises by an estimated 40% during these months, fueled by summer festivals, remote work flexibility, and global tech conferences.

Fall Transition (Q4): October–December witnesses a complex interplay of investor caution and year-end optimization. While volatility remains elevated, the index highlights a strong preference for yield-generating assets.

Privacy coins, staking-focused tokens, and algorithmic stablecoins see renewed interest as users prepare for year-end tax and budget planning. Despite retail fervor around meme coins and short-term fads, institutional players increasingly favor low-volatility blue-chip altcoins with solid fundamentals. “Q4 is a season of recalibration,” explains beta trader Raj Patel.

“The index underscores that winners here are those with clean balance sheets and tangible product use cases.”

National Patterns vs. Global Trends

The Altcoin Season Index does not adhere strictly to geographic boundaries, though regional market behavior introduces nuanced variations. Asian markets, led by blockchain activity in China and South Korea, often experience earlier seasonal shifts, driven by local sampling events and exchange listings.North American investors, meanwhile, show a stronger correlation with U.S. macroeconomic indicators—Fed announcements, inflation data, and SEC rulings directly influence altcoin sentiment. European participants tend to emphasize ESG-aligned tokens and regulatory-compliant projects during the Q3 rally, reflecting regional investor preferences.

Country | Peak Seasonal Performance | Notable Drivers

- United States: Q2 surge tied to institutional adoption and DeFi scaling events; Q4 yield optimization dominates.

- China: Q1 stability with infrastructure-focused coins influenced by national digital currency timelines.

- Germany: Q3 outperformance in green energy and Web3 social tokens, fueled by tourism-driven crypto festivals.

- Singapore/Rすぎ: Q3-to-Q4 shift toward compliance-friendly and yield-generating altcoins.

Data-Driven Insights: What Altcoin Season Index Reveals About Market Timing

One of the most compelling aspects of the Altcoin Season Index is its ability to predict timing with increasing accuracy through statistical modeling and trend extrapolation. Historically, coins with clear use cases and developer momentum exhibit higher survival rates during seasonal peaks. Early-year altcoins often fail to sustain momentum outside Q1, while those with established ecosystems—such as Ethereum Layer 2 bridges or privacy stack innovators—extend their performance cycles.

Related Post

Phasmophobia PS4: Unmasking the Eerie PS5-Grade Ghost Hunting Experience on PlayStation

Doodle Slugger: plunging into Googly Force — How Garden Involved Players in Instant Mobile Baseball Fun

IggyCar: Revolutionizing Creative Vehicle Simulation Through Cutting-Edge Design and Immersive Gameplay

Swimsuit Jasmine 90 Day Fiance: The Swimsuit That Turned Hearts in 90 Days