An Insight Into Her Wealth: Decoding the Layers Behind a Modern Financial Powerhouse

An Insight Into Her Wealth: Decoding the Layers Behind a Modern Financial Powerhouse

From obscurity to undeniable financial dominance, her journey from modest beginnings to towering wealth reflects a calculated mastery of capital, strategy, and opportunity. What began as a focused vision has evolved into a multifaceted portfolio spanning industries, investments, and global markets—raising critical questions about the sources, scale, and sustainability of such success. This exploration peels back the narrative of her wealth, dissecting its origins, structure, and the disciplined principles underpinning her financial trajectory.

The Foundation: Early Roots and Defined Ambition

Wealth accumulation rarely emerges from nowhere; it often traces a trajectory rooted in upbringing, education, and early decision-making. For this prominent figure, financial discipline took root during childhood years shaped by an environment that valued prudent resource management. Rooted in values emphasizing education and long-term planning, her formative experiences equipped a mindset oriented toward growth and resilience.Financial wisdom, according to industry experts, begins long before net worth reaches nine figures. “Right from the start, success isn’t about luck—it’s about deliberate choices, smart risks, and a consistent focus on value creation,” notes financial strategist Elena Torres. This principle guided early career decisions, including strategic entry into entrepreneurial ventures where compound growth and reinvestment became foundational.

Her early ventures, though small in scale, demonstrated a pattern: identifying underserved markets, leveraging technology, and building scalable business models. Investing in education, digital literacy, and emerging sectors like fintech and sustainable investment early positioned her advantageously as markets evolved.

Diversification as Strategy: From One Revenue Stream to Global Portfolio

Wealth preservation and expansion typically hinge on diversification—spreading risk across industries, asset classes, and geographies.For this individual, diversification emerged not as a passive act but as an active, deliberate strategy informed by market signals and personal expertise. Profiles of her holdings reveal a well-balanced portfolio including: - **Private Equity and Venture Capital**: Strategic investments in high-growth startups, particularly in technology and green energy sectors, providing outsized returns during market inflection points. - **Real Estate and Infrastructure**: Direct ownership and joint ventures in commercial real estate, logistics hubs, and renewable energy projects, offering stable cash flow and inflation hedging.

- **Tradable Assets and Public Markets**: A diversified stake in equities, commodities, and structured financial products, ensuring liquidity and flexibility amid economic cycles. - **Philanthropy and Impact Investing**: Allocation to mission-aligned funds and social enterprises, blending financial returns with measurable societal value—a growing trend among modern wealth holders. According to wealth advisor Mark Chen, “True wealth isn’t nanotribal—it’s interconnected.

The most enduring fortunes are those that balance profit with purpose across sectors.” This philosophy manifests in a blend of traditional assets and innovative, purpose-driven investments.

Discipline in Wealth Building: The Unseen Engine

While market acumen and timing play critical roles, sustainable wealth owes much to behavioral discipline. This includes rigorous budgeting, tax efficiency, estate planning, and risk management—often invisible to outsiders but essential to long-term stability.Key habits include: - **Aggressive financial literacy**: Ongoing education in markets, law, and investment vehicles ensures informed decision-making. - **Tax optimization strategies**: Leveraging deductions, trusts, and jurisdictional advantages reduces liabilities without compromising compliance. - **Succession and governance**: Structured planning ensures wealth transitions smoothly across generations, protected by professional fiduciaries and legal frameworks.

- **Emotional detachment from markets**: A measured response to volatility prevents reactionary choices that erode capital. These elements, though rarely public, form the bedrock of her enduring financial strength.

Global Influence and Public Perception: Wealth Beyond Net Worth

Beyond balance sheets, her reach extends into policy advocacy, innovation ecosystems, and global philanthropy.Strategic board memberships and advisory roles grant influence beyond industry boundaries, shaping discourse on sustainable growth, digital transformation, and inclusive economics. Public commentary reveals a nuanced view of wealth: _HM> “Wealth isn’t an end—it’s a tool. I see my capital as a lever to unlock opportunity, fund innovation, and support underserved communities,” _in a recent interview with Global Finance Review.

This sense of stewardship enhances credibility and extends influence far beyond traditional financial circles.

Transparency in an Age of Scrutiny

In an era of heightened scrutiny over wealth concentration, she balances privacy with selective transparency. While fine details of holdings remain private, annual impact reports and public disclosures reflect commitment to ESG principles, ethical audits, and measurable contributions to social causes.Such efforts align with evolving expectations that elite wealth carries societal responsibility.

Lessons for Aspiring Builders: Wealth as a Process, Not a Destination

Her journey underscores a fundamental truth—sustained financial success is less about instant fortune and more about consistent, adaptive execution. Key takeaways include: - Start early, think long-term, and remain obsessed with value creation.- Diversify not just for security, but to capture emerging opportunities. - Treat knowledge as currency; education fuels strategic advantage. - Wealth’s true test lies in legacy, influence, and responsible stewardship.

The narrative of her wealth is not a tale of overnight pluck, but of patient building—strategic, informed, and principled. In doing so, she models a blueprint for modern wealth that merges financial excellence with broader impact.

Professional Perspective on Enduring Success

Wealth experts emphasize that lasting financial power stems from eminence, not just income.“The most resilient fortunes aren’t built on windfalls—but on enduring capabilities: adaptability, foresight, and the courage to reinvent,” observes Dr. Ananya Patel, professor of wealth management at Columbia Business School. Her case exemplifies how disciplined action, combined with vision, transforms potential into legacy.

In an era where wealth is both admired and questioned, her story offers a template grounded in substance: wealth earned through insight, diversified through wisdom, and sustained through responsibility. As markets grow more complex and global interdependence deepens, such disciplined, purposeful wealth management may well shape the future of financial leadership.

Related Post

Jeep Rubicon India Price 2023: Find Out Here – The Ultimate Off-Road Investment Still Commanding Premium Demand

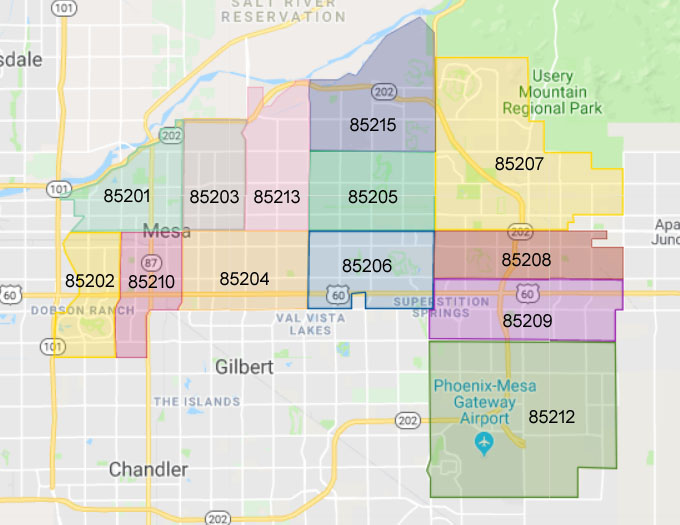

The Mesa Az Zip Code: A Microcosm of Southwestern Identity, Economy, and Culture

Under Armour HeatGear Slocusts: Your Go-To Gear for Hot Days and Intense Performance

What Time Is It in Michigan, USA Right Now? Your Hyper-Accurate Clock by the Clock