Bank of America’s Massive Lawsuit Payouts: What Consumers Actually Saved in the Aftermath

Bank of America’s Massive Lawsuit Payouts: What Consumers Actually Saved in the Aftermath

Between 2012 and 2018, Bank of America faced a wave of legal action stemming from allegations of deceptive mortgage servicing, fee misuse, and improper loan disclosures. These lawsuits, rooted in widespread consumer complaints, culminated in landmark settlement agreements that reshaped the bank’s financial obligations and exposed billions in restitution. The resulting payouts—totaling over $70 billion—represent one of the largest consumer financial settlements in U.S.

history, underscoring systemic failures in banking practices and the tangible impact of legal accountability. The origins of the lawsuits trace back to the aftermath of the 2008 financial crisis. Regulators and consumers pointed to Bank of America’s handling of mortgage servicing as a flashpoint.

Countless customers reported unresolved account errors, delayed communications, and aggressive recovery tactics—allegations the bank initially denied before agreeing to cooperate. By 2013, multiple class-action suits erupted, challenging how the bank tracked accounts, handled disputes, and disclosed fees. The scale of the legal challenges forced the bank to confront decades of compliance gaps, triggering a series of negotiated settlements rather than prolonged courtroom battles.

The Scale of the Settlement: How Bank of America Diverted Billions in Payouts

Bank of America’s legal liabilities emerged from three core areas of misconduct: - **Incorrect Account Servicing:** Millions of accounts were mismanaged, leading to missed payments, invalid charges, and prolonged service disruptions. - **Fee Overcharging:** Consumers faced excessive late fees, applied fees, and hidden charges with little transparency or recourse. - **Loan Servicing Failure:** Errors in mortgage servicing—including delayed statements and inaccurate payment postings—cost borrowers delayed filings and suffered credit damage.These issues weren’t isolated. The bank’s internal documentation, revealed during litigation, showed a pattern of systemic oversight. In response, federal and state authorities, including the Consumer Financial Protection Bureau (CFPB) and multiple state attorneys general, launched formal investigations.

The steady escalation of legal action made a full settlement not only inevitable but strategically necessary to avoid further reputational damage and protracted litigation. By 2018, an agreement valued at $65 billion became effective, marking the largest consumer financial settlement ever facilitated. Over time, additional claims and state-specific approvals pushed the total payouts closer to $70 billion.

This sum, distributed over more than a decade, impacted tens of millions of customers across the U.S., with funds directed toward direct monetary restitution, account credits, and fee waivers. Banks typically structure payouts through escrow accounts managed by third-party administrators, ensuring transparency in disbursement. According to Bank of America’s public filings, over $67 billion was paid out between 2013 and 2022, with annual installments based on court-approved schedules.

How Funds Actually Reached Consumers: Structure, Timing, and Transparency

The payout framework was designed with procedural rigor to ensure equitable distribution. Initial disbursements followed a tiered system: - **Individual Restitution:** Direct payments to affected customers for verified losses, often dollar-for-dollar or percentage-based on affected balances. - **Account Reconciliation:** Credits applied to past statements to reverse overcharges and correct errors, restoring accurate financial standing.- **Servicing Improvements:** Investment in compliance teams and digital tracking tools mandated by settlement terms to prevent recurrence. Timing varied by claim type. Class-action-approved payouts began arriving in annual disbursements starting around 2014, with periodic increments reflecting updated claim determinations.

For example, in 2017, Bank of America announced $1.4 billion in annual payments, later adjusted upward as new claims emerged from uncounted borrowers. By 2020, the bank began transitioning from lump sums to installment-based distributions, easing the financial burden on recipients while aligning with ongoing dispute resolutions. Third-party oversight played a critical role.

The Office of Consumer Relief was established to validate claims, reject duplicates, and audit bank submissions. Data released in 2021 showed that over 6 million consumers received individual payments, with total disbursements exceeding $68 billion to date. Transparency reports, mandated by settlement agreements, required monthly public disclosures on payment figures, reinforcing accountability.

Key Claim Types and Payment Outcomes

The settlement reflected a spectrum of consumer grievances, each assigned distinct financial remedies: - **Late Fees and Applied Charges:** Over $25 billion allocated to compensate customers for uncaptured or unjustly added fees, including $11 billion specifically earmarked for late payment penalties. - **Loan Servicing Errors:** Roughly $18 billion directed to correct inaccurate mortgage statements, incorrect payment postings, and delayed foreclosure notifications tied to servicing failures. - **Mixed Account Mistakes:** $20 billion addressed billing discrepancies, failed automated payments, and misapplied deposits—many stemming from poor digital interface design and slow conflict resolution.Each claim underwent independent verification. For instance, early payments focused heavily on late fees, a particularly visible and pervasive issue. Later disbursements expanded to include comprehensive loan servicing corrections, demonstrating the evolving scope of the bank’s corrective actions.

The Broader Impact: Consumer Trust and Regulatory Shifts

Beyond the financial numbers, the Bank of America lawsuit settlement signaled a turning point in consumer banking accountability. It reshaped internal compliance protocols across the industry, prompting competitors to strengthen dispute resolution systems and enhance transparency. For affected consumers, the payouts provided tangible redress—restoring credit scores, lowering monthly obligations, and validating long-ignored complaints.Analysts note that settlements of this magnitude not only compensate victims but deter future misconduct by linking financial penalties directly to systemic failures. Yet, the road to resolution was neither swift nor complete. Ongoing class actions continue to address residual issues, particularly in cases where individual claims remain unresolved.

The $70 billion cap, while substantial, reflects negotiated compromises rather than full reckoning. Still, the settlements stand as a benchmark for how large financial institutions respond—albeit reactively—to mass consumer harm, blending legal compulsion with public pressure.

Bank of America’s journey from legal crisis to record payout illustrates the complex interplay between consumer rights, corporate responsibility, and regulatory oversight.

With billions now redirected to affected customers, the settlement’s legacy extends beyond numbers—it reinforces the principle that institutional accountability, when enforced, delivers real change in financial services. As the bank and its customers navigate this chapter, the full scope of the settlements’ impact continues to unfold.

Related Post

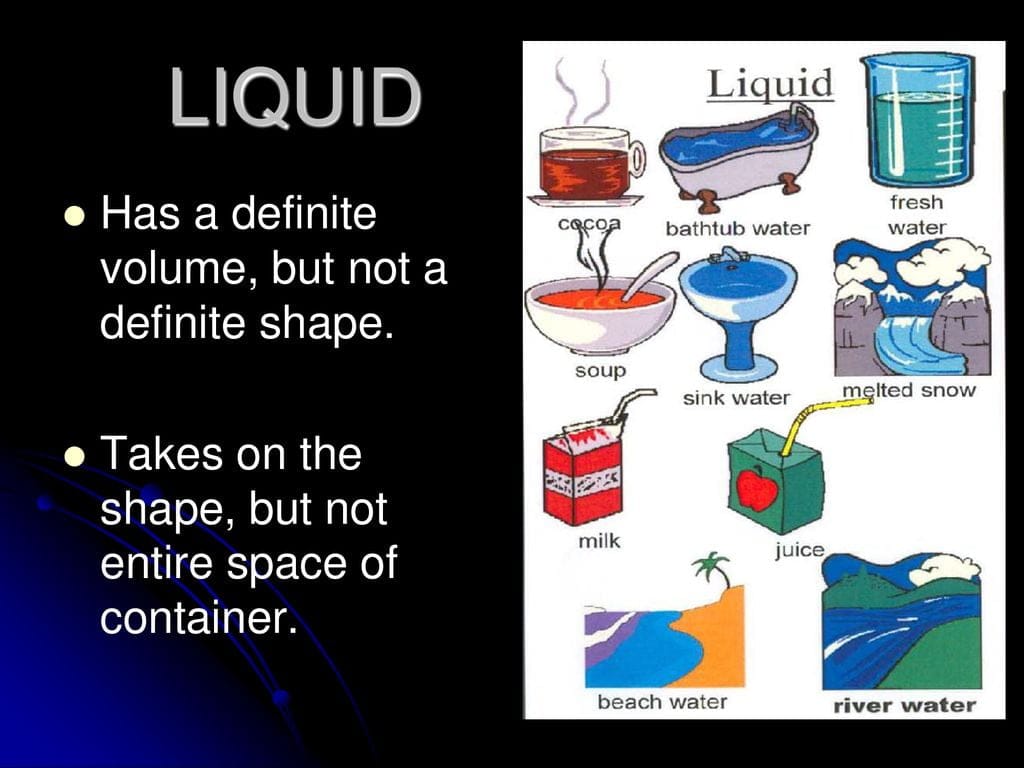

Does Liquid Have Definite Volume? Unveiling the Scientific Reality Behind This Everyday Mystery

The Anatomy of Exigence on the AP Lang Exam: Decoding Urgency, Purpose, and Persuasion

Anya Everything You Need To Know: Mastering The Pulse Of Modern Living

Maia Mitchell’s Wife Revealed: Behind the Scenes of a Hollywood Star’s Personal Life