California Sales Tax Rate: A Comprehensive Guide to Understanding Rates, Exceptions, and Real-World Impact

California Sales Tax Rate: A Comprehensive Guide to Understanding Rates, Exceptions, and Real-World Impact

The California sales tax system, governed by Proposition 13 and administered by the California Department of Tax and Fee Administration, is a cornerstone of state revenue—eight-eighths (8.75%) funds public services, infrastructure, education, and healthcare. Yet, unraveling the intricacies of this tax rate is far more complex than a simple percentage; it involves overlapping local rates, exemption rules, and jurisdictional nuances that directly affect consumers and businesses alike. This comprehensive guide decodes the mechanics of California’s sales tax, revealing how rates vary across counties and cities, what goods and services are taxable or exempt, and the duties of buyers and sellers in this vast, dynamic system.

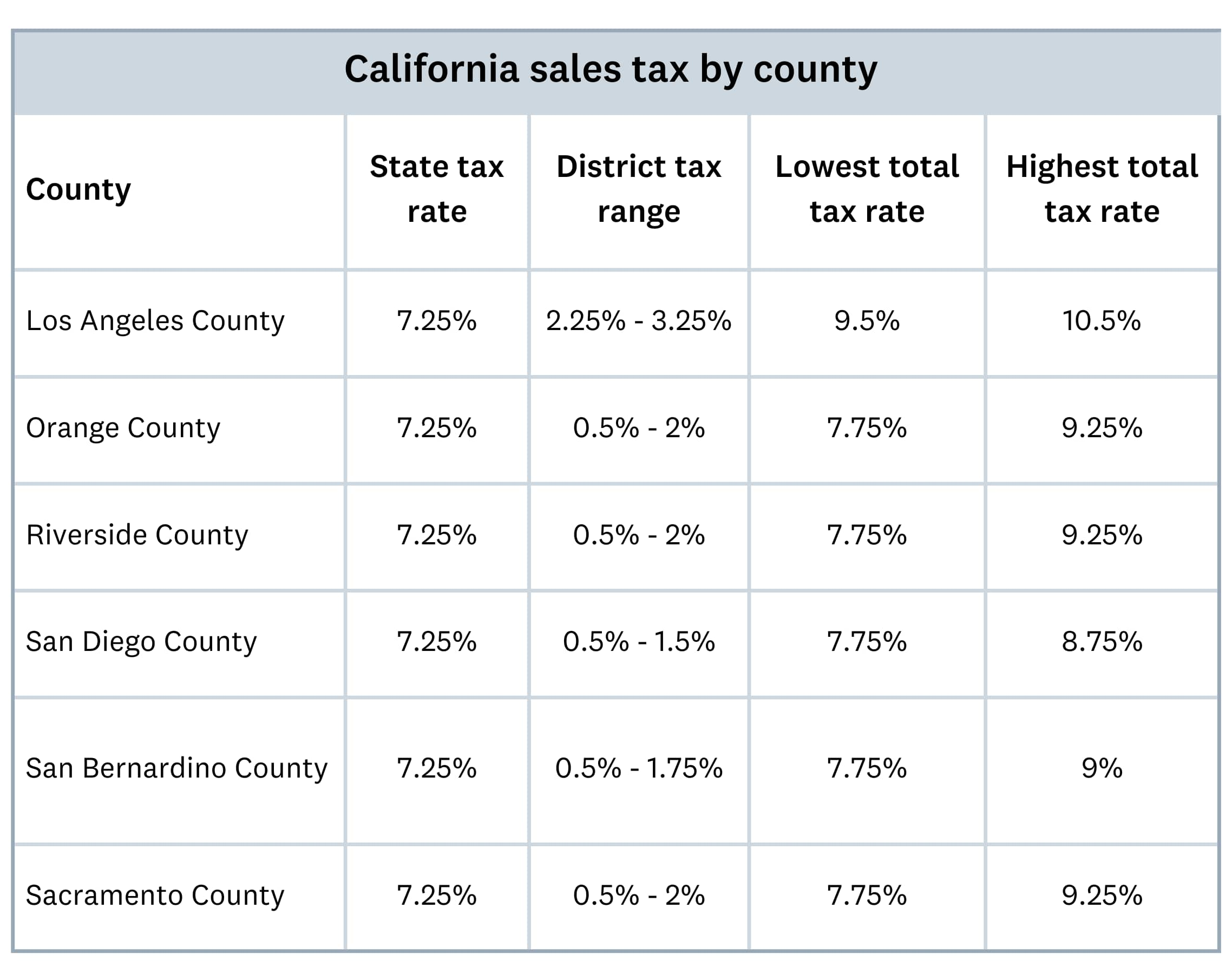

At its core, California’s state sales tax stands at 7.25%. However, this headline rate masks a layered structure where local jurisdictions can add percentages ranging from 0.5% to 2.75%, pushing the total rate as high as 10.25% in the busiest metropolitan areas. The formula for the final rate is straightforward: Total California Sales Tax = State Rate (7.25%) plus local additions.

For instance, San Francisco’s rate climbs to 8.875%, reflecting a 0.625% local fee layered atop the state levy. This variability underscores a critical truth: where you shop in California directly influences your tax burden.

Deciphering the Official Breakdown: State vs.

Local Rates The California state sales tax of 7.25% serves as the baseline, but local governments wield authority to impose supplemental taxes to support municipal operations, public safety, transportation projects, and social programs. The

The mechanism is simple yet pivotal: each county (and cities within monitored zones) issues local sales tax ordinances approving specific rate increments. Los Angeles County, for example, applies a 0.25% local tax, while Contra Costa County adds 0.5%, bringing the combined rate to 7.75%.

In densely populated areas like Orange County and San Diego’s urban cores, total local additions often reach 2.25% or more. The Department of Tax and Fee Administration maintains a publicly accessible tax rate database updated biannually, ensuring transparency. “Local governments match development needs with revenue generation,” explains tax expert Dr.

Elena Ramirez, professor of public finance at UC Berkeley. “In high-density regions, taxes reflect elevated service demands—public transit, emergency response, and infrastructure upkeep.”

Notably, certain goods and services remain exempt under California law, reducing the effective tax burden. Exemptions apply broadly to necessities: groceries (non-prepared food), medically necessary medical devices, educational materials (business and technical textbooks), and certain medical services.

Schools, nonprofit organizations, and government entities often enjoy exemption status, though compliance hinges on documentation and proper classification. “Many small businesses misunderstand exemption thresholds,” cautioned state tax liaison Mark Thompson. “For example, restaurant-prepared meals composed *fully* of ineligible ingredients may still incur tax—justification requires precise attribution.” The 2023 tax reform clarified digital service exemptions, ensuring software and online content sold within California avoid tax when delivered by out-of-state providers, aligning state policy with evolving market realities.

High-Rates, Low Rates: Geographic and Political Variation Across the Golden State

California’s sales tax landscape spans a dramatic range—from districts with minimal local surcharges to municipalities where tax rates exceed 10%. Urban powerhouses like San Francisco, Oakland, and Sacramento lean heavily on local levies, whereas sparsely populated counties such as Imperial or Fresno apply only the basic state rate, supplemented by very modest local taxes.As of 2024, the tier of highest local rates clusters in coastal and urban centers.

San Francisco leads with a total rate of 8.875%, followed closely by Marin County at 8.5% and Santa Clara County at 8.625%. These figures reflect robust investments in public services and housing infrastructure amid high population density. In contrast, rural counties like Placer and Lassen retain rates near 7.75% or lower, with total local additions rarely surpassing 0.5%.

This geographic segmentation illustrates how tax policy mirrors regional priorities: cities grappling with congestion and housing shortages fund civic projects through higher taxation, while less populated regions prioritize leaner public budgets.

From Consumer to Consumer: Navigating the Tax Burden in Practice

For shoppers, understanding the number she sees at checkout—the sealed cash register total—is only the first step. The final amount owed depends on destination, purchase type, and timely filing.Online buyers, particularly after the *Wayfair* decision and California’s 2020 remoteness tax adjustments, now face localized charges based on shopper residency and product origin. Drop-shipped goods delivered into CA triggered new collection obligations, requiring non-resident sellers to register and remit taxes if sales exceed $500,000 annually.

Pressing questions often arise: Are taxes included at purchase or added at checkout?

While Legally, the seller posts the full amount, many point to earlier “tax-inclusive” displays misleading consumers. “Transparency remains an issue,” notes consumer advocate Lena Cho. “Clear labeling would reduce confusion, especially for first-time online shoppers.” For retailers, compliance means integrating real-time tax calculators—tools mandated by state statute to apply correct local and jurisdictional rates dynamically.

The Tax and Fees Administration provides free software and training to smooth this process, but errors remain common. A 2023 audit found 17% of small businesses under-collected local surcharges, underscoring the need for vigilance.

Special cases further complicate simplicity: dining out, grocery shopping, and repair services each trigger unique rules.

Meals consumed on-premise are taxable (unless discounted

Related Post

Does Emmanuel Macron Have Kids? A Closer Look at the French President’s Family Life

Seoul Definition: Capitalizing Hypercool – The Slang Language Redefining Urban Expression

Exploring Richard Dean Anderson’s Relationships: Who Was His Girlfriend—and Why It Matters

Freddie Highmore’s Private Life Illuminated: The Wife Behind the Star’s Spotlight