Check Your SSS Loan Payments: A Simple, Step-by-Step Guide to Avoid Surprises

Check Your SSS Loan Payments: A Simple, Step-by-Step Guide to Avoid Surprises

For millions navigating financial responsibilities, understanding SSS loan repayments is not just smart—it’s essential. The Social Security Savings Scheme (SSS) loan program, designed to support citizens during periods of reduced income or emergency needs, carries obligations that demand careful attention. Without clear awareness, even trusted loans can become financial burdens.

This guide delivers a precise, actionable walkthrough to help borrowers confidently check their SSS loan obligations, anticipate payment schedules, and maintain full control over their repayment journey.

SSS loans operate under a structured framework governed by national financial regulations, offering flexible repayment options but requiring proactive monitoring. Each loan agreement outlines specific terms—interest rates, interest accrual mechanisms, and repayment duration—charges that vary by platform and loan type.

Without dissecting these variables, borrowers risk misestimating costs or missing payment deadlines, potentially triggering late fees, credit impacts, or debt accumulation. The key lies in breaking down the system into accessible components and mastering the tools available for tracking progress.

Understanding Your SSS Loan Structure: The Core Variables

SSS loans are not monolithic—they encompass multiple loan types with distinct repayment dynamics. The primary categories include emergency loans designated for short-term financial shocks, consolidation loans meant to streamline repayment across inflated debts, and intake financing for larger, planned investments or transitions.Each carries unique features that shape payment behavior.

- Interest Rate Type: SSS loans may lean under fixed or variable interest models. Fixed rates deliver predictable monthly costs; variable rates adjust with market benchmarks, which can fluctuate unpredictably.

Borrowers must verify their loan’s rate type early, as it directly influences total repayment value and payment consistency.

- Repayment Schedule: Most SSS loans offer staggered monthly installments spread over 12 to 36 months. Some permit early repayment with minimal penalty, while others impose strict terms.

Understanding the amortization schedule—detailing principal vs. interest components—is vital for forecasting cash outflows.

- Accrued Interest: Interest typically begins accumulating after loan disbursement, often with delay periods accommodating initial financial strain.

Leverage this grace period wisely, but plan for when interest starts accruing to avoid unwelcome shocks.

- Scope and Usage Limits: Loans are usually tied to specific purposes—medical costs, education, or emergency living expenses. Reallocating funds beyond designated purposes may void benefits or incur penalties.

These variables form the backbone of SSS loan obligation clarity, and mastering them is the first step toward financial predictability.

Step-by-Step: How to Calculate and Check Your Monthly SSS Loan Payment

Knowing your monthly SSS loan payment isn’t a guess—it’s a matter of precise calculation using verified inputs. The formula below reflects standard conditions, but always confirm with your lender, as platforms may use proprietary logic. The effortful but reliable method involves: 1.Retrieving the Outstanding Principal Balance Check your official loan dashboard or extract the principal from disbursement records. This figure represents capital received minus any principal repaid. 2.

Confirming Interest Rate and Application Frequency Verify whether interest accrues daily, monthly, or quarterly. SSS typically applies compound interest on a daily basis, making daily accrual critical. Rate notes on your loan agreement specify the percentage, e.g., 0.5% annual nominal rate may convert to ~0.04% daily.

3. Determining the Repayment Term A 24-month (2-year) loan with weekly payments differs significantly from a phased 36-month plan. Term length affects total interest and monthly burden—shorter terms reduce interest cost but raise monthly outlays.

4. Applying the Amortization Formula Under daily compounding, the monthly payment (P) can be approximated via: P ≈ (r × PV) / (1 - (1 + r)^-n) Where: - r = daily interest rate (annual rate ÷ 365) - PV = Outstanding principal - n = Number of days in period For a $10,000 loan at 0.5% annual interest over 24 months: Daily rate = 0.005 / 365 ≈ 0.0000137 n = 730 days P ≈ (0.0000137 × 10,000) / (1 - (1 + 0.0000137)^-730) ≈ $44.17 monthly. Usage of spreadsheet templates or official lender portals simplifies inputs and yields accurate projections.

Monthly deductions—whether via direct debit or manual payment—must match the calculated figure to stay on track.

Leveraging digital tools not only accelerates calculation but also flags potential mismatches before payment dates, reducing risk of missed deadlines.

Best Practices for Tracking and Managing Your SSS Loan Obligations

Maintenance of financial discipline hinges on vigilant monitoring. Adopting disciplined habits ensures repayment stays within planned parameters and avoids compounding difficulties.Set up automated alerts through your lender’s mobile app or email system—broken down payment reminders and balance updates prevent oversight. Most SSS portals now feature real-time dashboards showing effective interest, current balance, and repayment milestones. Create a personal amortization calendar, clearly marking each payment due date and including principal/interest breakdowns.

This visual tool helps anticipate future burdens and align spending with repayment capacity. Never hesitate to contact your loan officer for clarification—whether questioning inconsistencies or requesting a revised schedule. Transparent communication with lenders fosters trust and may unlock hardship options during temporary setbacks.

Consider scheduling automatic payments to eliminate procrastination risks, especially during high-fluctuation months—this strategy promotes consistency and protects against late fees that compound financial stress.

Proactive engagement transforms passive obligation into controlled financial stewardship, empowering users to meet commitments with confidence rather than fear.

Navigating Common Pitfalls and When to Seek Help

Even well-prepared borrowers may stumble. Misinterpreting loan terms, overlooking hidden fees, or failing to factor new expenses into payment plans are frequent errors.One key risk involves assuming fixed rates stay locked—markets shift, and lender policies may not always reflect this. If unexpected income drops or medical emergencies arise, contact your lender immediately. Most SSS programs offer forbearance or rescheduling options during documented hardship, reducing short-term pressure while preserving repayment intent.

Ignoring small dues rarely eliminates them—unpaid balances attract interest

Related Post

Kumar Escape From Guantanamo: The Impossible Flight from the Bleakest Prison in America’s Carceral Network

2015 Ram 1500 Limited EcoDiesel: Engine Power, Efficiency, and Off-Road Readiness in One Packaged Package

New Balance 9060: Does It Use Pig Skin? Unpacking the Real Racing Volt Material

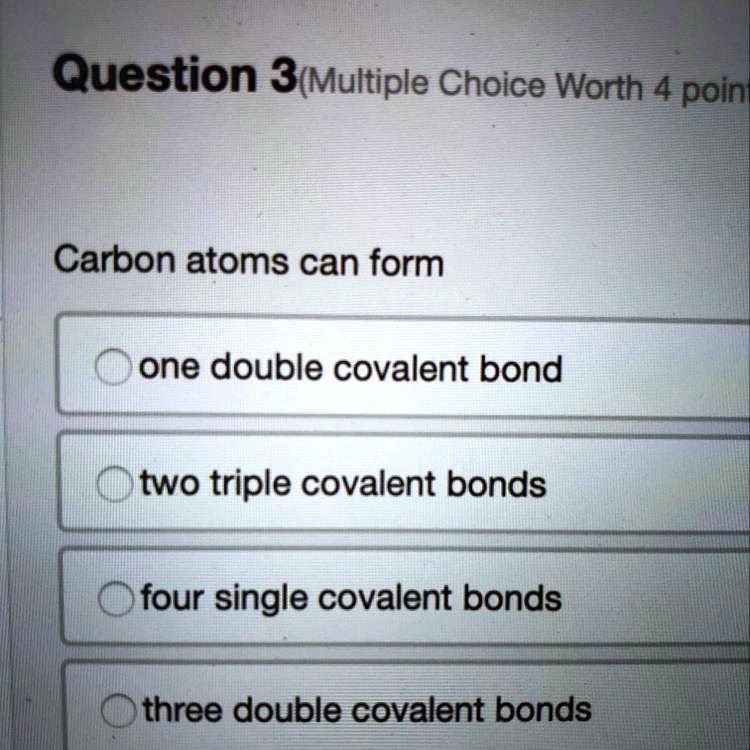

This Semimetal Can Form Four Single Covalent Bonds—Revolutionizing Semiconductor Science