China Stock Market: A Comprehensive Guide to Navigating the World’s Fastest-Growing Financial Landscape

China Stock Market: A Comprehensive Guide to Navigating the World’s Fastest-Growing Financial Landscape

The China Stock Market stands as a dynamic engine of global economic transformation—a complex ecosystem where state influence, rapid innovation, and foreign investor ambition intersect. From the bustling exchanges of Shanghai and Shenzhen to the evolving regulatory landscape, China’s equity markets represent both immense opportunity and intricate challenges for traders, analysts, and policymakers alike. This guide delivers an authoritative, up-to-date exploration of the market’s core mechanisms, key indices, investor behavior, major debutants, and structural risks—offering readers a complete roadmap to understanding one of the world’s most consequential financial arenas.

At the heart of China’s equity world are two dominant exchanges: the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE), together hosting thousands of listed companies ranging from tech giants to state-owned enterprises. The SSE includes the main market and the STAR Market—an innovation-driven segment akin to a tech-focused NASDAQ—while the SZSE emphasizes growth-oriented firms, particularly in high-tech, biotech, and consumer sectors. Together, these platforms form the backbone of China’s capital markets, collectively representing a market capitalization exceeding $10 trillion as of 2024.

According to data from the China Securities Regulatory Commission, the SSE and SZSE together track over 3,000 listed stocks, encompassing nearly 20% of the global nominal market capitalization uncovered by established indices up to that year.

The market’s performance is shaped by a unique blend of policy-driven forces and market-driven momentum. Unlike Western markets, where performance is often closer to beta with large cap stocks dominating, China’s market structure embeds a dual-layer dynamic: state-guided economic priorities and private-sector innovation.

Industry-leading firms such as BYD, Tencent, and Petrol Chimney (PETC) frequently define trends, embodying shifts in government priorities—from technological self-sufficiency to green energy transitions. In fact, a notable 2023–2024 reallocation toward electric vehicles (EVs), AI, and semiconductor development has reshaped capital flows, with EV-related listings rising by over 40% year-on-year.

Understanding Key Indices and Market Segmentation

The Shanghai Composite Index (SHCOMP) and the Shenzhen Component Index (XCS) serve as barometers for market sentiment and economic health.

The SHCOMP, which includes over 1,500 components weighted by market value, reflects both industrial and financial strength. It has historically幅度 as a proxy for broader economic confidence, though its weightings—especially heavy exposure to property and finance—introduce volatility during sector-specific downturns. The XCS, by contrast, emphasizes quality stocks with higher liquidity, making it a favored barometer for foreign portfolio investors seeking exposure to innovation-driven growth.

The STAR Market, launched in 2019, has emerged as a bellwether for China’s tech ambitions and reform-driven openness. Designed to mirror global innovation hubs, it offers streamlined IPO processes and relaxed listing rules, attracting startups and mid-cap enterprises from sectors like fintech, robotics, and advanced materials. Since inception, over 700 companies have listed, with IPO bid demand often exceeding ask volumes by significant margins—indicating strong investor appetite for disruptive business models.

The Nasdaq Chinahub, an onshore window for foreign investors, further links the STAR Market to global capital, despite persistent capital controls and regulatory scrutiny.

Market segmentation also reveals structural trends. The “blue-chip” segment—representing stable, long-dividend industrial and financial firms—remains dominant, holding approximately 35% of market value.

Meanwhile, closed-end funds, futures, and margin trading account for roughly 30%, amplifying speculative activity, especially during policy announcements or earnings seasons.

Who Invests in China? Domestic and Foreign Dynamics

Investor behavior in China’s markets reflects a dual narrative: resilient domestic participation and evolving foreign engagement.

Retail investors, empowered by accessible trading platforms like Tonglian, Midea, and Zhimage, now account for nearly 70% of daily volume—far higher than in most developed markets. This dominance amplifies short-term volatility and creates unique risk patterns, particularly during earnings surprises or macroeconomic shifts. Social media platforms, especially Weibo and WeChat, further accelerate sentiment shifts, with viral financial commentary sometimes triggering rapid price swings.

Foreign participation has grown steadily but remains constrained by regulatory boundaries. While foreign holdings have expanded through schemes like SHFX and SHDPF, total equity exposure by overseas investors caps at around 15% of the Shanghai Composite and 25% of the Shenzhen Component, according to CSRC data. Major barriers include eligibility restrictions, with only a select group of international fund providers permitted to access, and tax withholdings up to 10% on dividends.

Nonetheless, total foreign ownership exceeds 25% in select blue-chip stocks, and pension and sovereign wealth funds maintain long-term stakes in blue-chip names—underscoring underlying confidence in China’s structural growth.

Institutional investors, including asset managers, insurance firms, and wealth platforms, control approximately 40% of market assets, acting as stabilizers amid speculative surges. Their growing use of quantitative tools, ESG integration, and cross-border diversification strategies reflects a maturing investment culture aligned with global standards.

Major Debutants: Breakout Companies Shaping Market Sentiment

Annual “IPO seasons” remain pivotal moments for market momentum, with standout debutants drawing intense attention from analysts and investors. In 2024, several categories surged: green energy companies led the charge, reflecting China’s carbon neutrality push; high-tech innovators showcased AI and semiconductor breakthroughs; and consumer brands adapted to evolving lifestyle trends gained prominent listings. Notable examples include a leading EV battery recycler, a next-gen robotics platform, and a fintech firm specializing in blockchain-based cross-border payments—each valued between $2 billion and $5 billion at listing.

The selection process emphasizes rigorous screening by regulators, ensuring compliance with capital raising rules and listed company standards. Stricter disclosure and governance requirements, tightened since 2020, now mandate quarterly supervisory reports and stringent anti-fraud measures, improving transparency but also raising the barrier to entry. These reforms have contributed to greater market stability and reduced instances of “zombie listings”—a recurring issue in earlier cycles.

Risks, Volatility, and Regulatory Overhaul

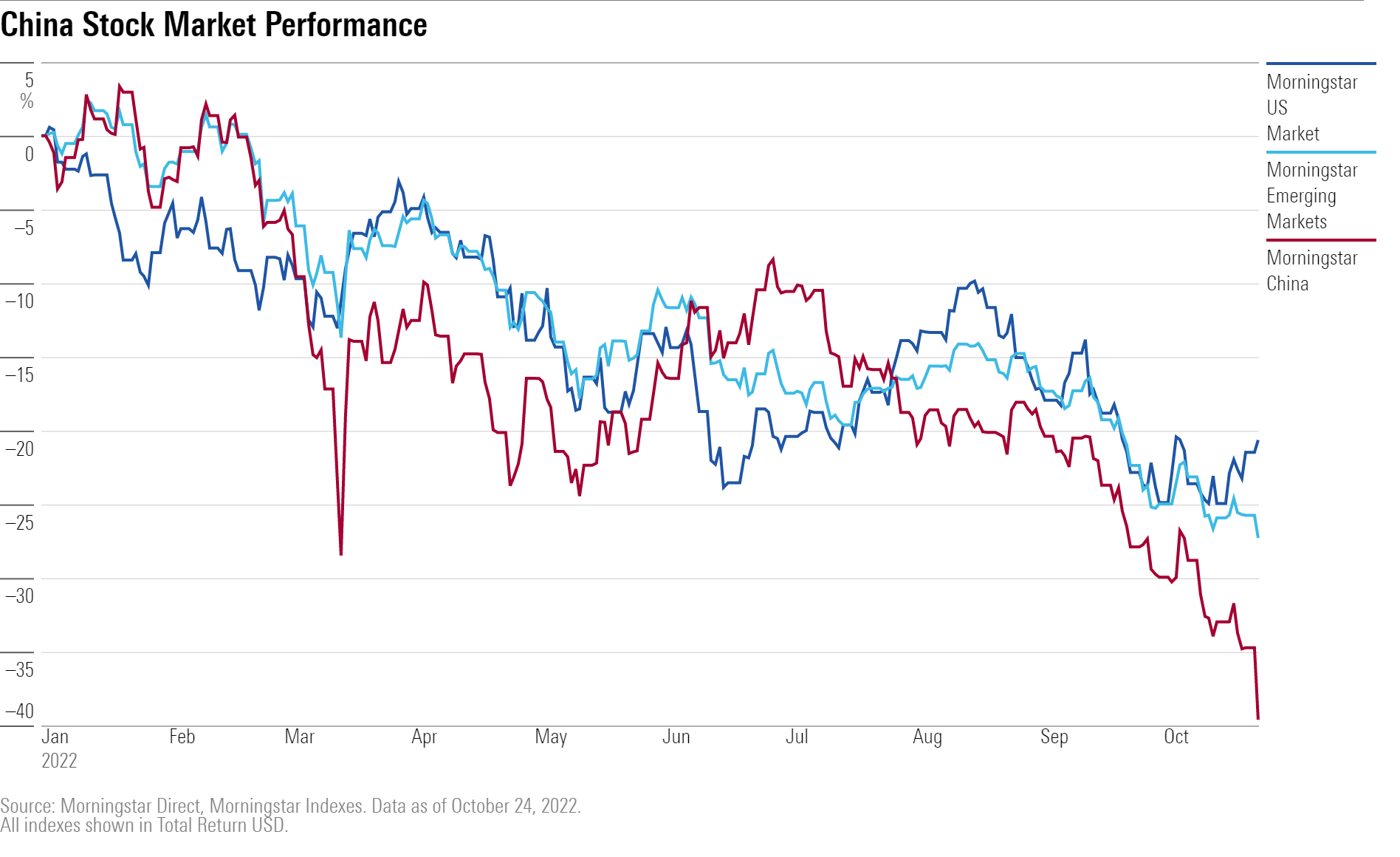

Despite robust growth, the China Stock Market contends with persistent risks that shape risk-adjusted returns. Regulatory shifts—especially in tech, education, and real estate—have historically triggered sharp corrections. The 2021–2022 correction, for instance, saw the SHCOMP fall nearly 30%, driven by sci-fi IPO crackdowns and property sector troubles, underscoring the market’s sensitivity to policy.

Volatility remains evident in short-term price behavior, driven by concentrated ownership, low float securities, and high retail participation. Research from the China Banking and Insurance Regulatory Commission identifies a correlation between margin debt spikes and abrupt market moves, particularly during earnings criedowns or prior to policy disclosures. Additionally, geopolitical tensions—especially U.S.-China trade and technology restrictions—continue to impact investor confidence, prompting calls for deeper market liberalization and stronger legal protections.

In response, regulators have intensified oversight and reformed mechanisms to enhance market resilience. Recent measures include expanding short-selling channels, improving investor dispute resolution, and digitizing settlement processes to reduce counterparty risk. The push for harmonization with international accounting standards and greater ESG reporting requirements signals China’s intent to integrate more deeply into global finance—though progress remains deliberate and conditional.

In 2024, new instruments such as thematic ETFs, options on major indices, and green bond segmentations have expanded hedging and exposure tools, offering investors nuanced ways to manage risk. Meanwhile, ongoing liberalization—evident in expanded SEHQ eligibility and reduced foreign investment caps—suggests a long-term strategy to render the market more receptive and competitive.

China’s stock market is more than a financial instrument—it is a mirror of national transformation with global reverberations.

From policy-driven innovation to shifting investor demographics, the market embodies both the ambitions and complexities of economic modernization. As structural reforms take root and new sectors emerge, navigating its intricacies demands a clear, informed strategy—one built on deep understanding, disciplined analysis, and an eye toward long-term value in a market that is as transformative as it is turbulent.

Related Post

Antioch Missing in Unexpected Turn of Events; Community Shaken by Daily Drama

Navigating the Path to Publication: Mastering the Ecology Letters Author Guidelines

Is Premium Reviews App Legit? Inside the Truth Behind the Scoring System That Shapes Your Trust

Exploring The World of Crazyjamjam: Where Chaos Meets Creativity