Combank vs Comquest: Choosing the Right Payment Platform to Launch Your Online Shop

Combank vs Comquest: Choosing the Right Payment Platform to Launch Your Online Shop

For entrepreneurs building digital businesses, selecting a payment gateway is not just technical—it’s strategic. Combank and Comquest represent two distinct approaches to powering online transactions, each tailored to different shop needs. While Combank offers a robust, bank-backed infrastructure with deep integration into traditional financial ecosystems, Comquest focuses on agile, developer-friendly scalability for fast-growing e-commerce ventures.

Understanding their core differences—from pricing and setup complexity to security and customer reach—can guide business owners toward the solution that aligns with their unique growth trajectory.

Combank, a major Australian financial institution, delivers payment processing through its dedicated business solutions, including Comaccount and Commerical. These offerings cater primarily to companies with existing banking relationships, enabling seamless integration with utilities, payroll, and enterprise-grade banking features.

“Combank’s strength lies in reliability and trust—critical for merchants handling high transaction volumes,” notes financial technology analyst Sarah Lin. Combank’s pay platform supports recurring billing, ACH transfers, and international payments, but its setup often requires coordination with corporate finance teams, posing potential hurdles for solo founders or smaller startups seeking rapid deployment. In contrast, Comquest positions itself as a modern alternative, designed explicitly for agile online sellers and digital entrepreneurs.

Built with developer simplicity in mind, Comquest offers a streamlined API-first architecture that accelerates shop launch timelines. “For startups and Shopify+ brands, Comquest eliminates enterprise overhead—enabling instant payment integration without bloated contracts or long onboarding delays,” says Comquest’s product lead, Daniel Martinez. With zero setup fees, transparent transaction-by-transaction pricing, and native compatibility with popular platforms like Shopify, WooCommerce, and BigCommerce, Comquest reduces friction at every stage of e-commerce scaling.

Key differentiators emerge across several critical dimensions:

- Setup & Integration: Combank demands deeper financial collaboration, favoring established businesses with existing banking ties. Comquest circumvents this barrier through plug-and-play API connectivity, supporting rapid deployment within minutes.

- Pricing Model: Combank employs tiered, enterprise-oriented pricing reflecting its banking-grade infrastructure. Comquest offers a flat, predictable monthly fee with no hidden surcharges—ideal for cash flow-sensitive startups.

- Payment Flexibility: Combank services emphasize reliability across large-volume and cross-border transactions but require more configuration for dynamic pricing models.

Comquest natively supports subscription billing, digital products, and local AML-compliant payments, optimizing for modern DTC commerce.

- Security & Compliance: Both platforms adhere to strict PCI DSS and Australian regulatory standards, but Combank leverages legacy banking infrastructure with decades of fraud monitoring heritage. Comquest builds security into its architecture from the ground up with tokenization and real-time risk scoring accessible via simple dashboards.

Real-world application contexts highlight the ideal use cases for each platform:

Combank suits: Established SMEs with brick-and-mortar ties, businesses processing high-value B2B transactions, or companies requiring ACH, direct bank transfers, and enterprise financial reporting. Its deep banking integration ensures stability but may slow initial digital scaling.

Comquest serves: Tech-savvy entrepreneurs, DTC brands, and micro businesses prioritizing speed and scalability.

From solopreneurs launching their first Shopify store to scaling e-commerce ventures, Comquest enables rapid iteration, instant payment visibility, and flexible monetization without enterprise contracts.

Commerce platforms are more than financial tools—they’re foundational engines of growth. While Combank delivers dependable banking-grade solutions for businesses rooted in traditional finance, Comquest redefines accessibility with developer-centric agility for digital natives. Entrepreneurs must ask: does your online shop demand the stability of established banking infrastructure, or the speed to iterate, adapt, and scale?

For those prioritizing rapid launch and flexible payment models, Comquest opens the door to immediate commerce. For businesses anchored in formal financial relationships and predictable transaction flows, Combank remains a trusted pillar. But in today’s fast-moving digital economy, the right payment platform isn’t just about processing money—it’s about enabling growth, resilience, and strategic freedom.

To explore how Combank or Comquest can power your online venture, visit

Related Post

Raven Johnson & Flau'jae: The Rare, Public Puzzle of Kinship in the Public Eye

Barrel Roll: The Bold Aerial Maneuver That Redefines Precision Flight

Technology in Economics: Rewiring Markets, Reshaping Industries, and Redefining Growth

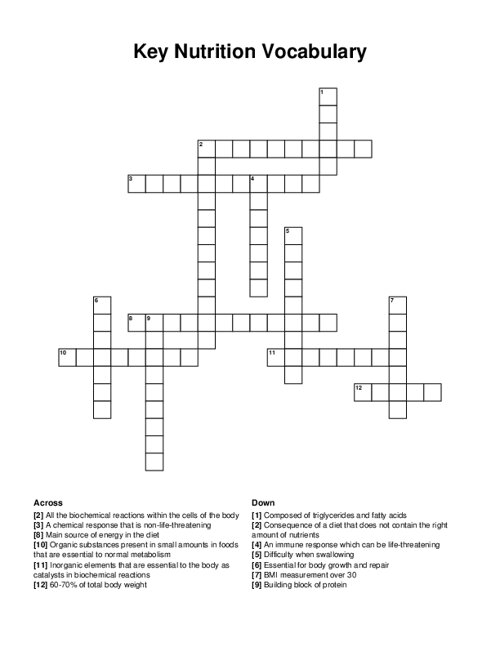

Unlock the Secrets of Athletic Performance with the Sports Nutrition Crossword Puzzle Answer Key