Finance Lease Recognition: Mastering the Criteria That Shape Balance Sheets

Finance Lease Recognition: Mastering the Criteria That Shape Balance Sheets

The moment a company chooses a finance lease over direct purchase, it enters a financial decision with far-reaching implications. Finance lease recognition is not merely an accounting formality—it is a pivotal step that determines how assets and liabilities appear, influencing financial ratios, tax strategy, and investment analysis. To navigate this complex accounting terrain, understanding the precise criteria for recognition is essential.

This guide unpacks the core requirements and real-world triggers that determine whether a lease must be recognized on the balance sheet, transforming abstract standards into actionable insight for finance professionals, auditors, and business decision-makers alike.

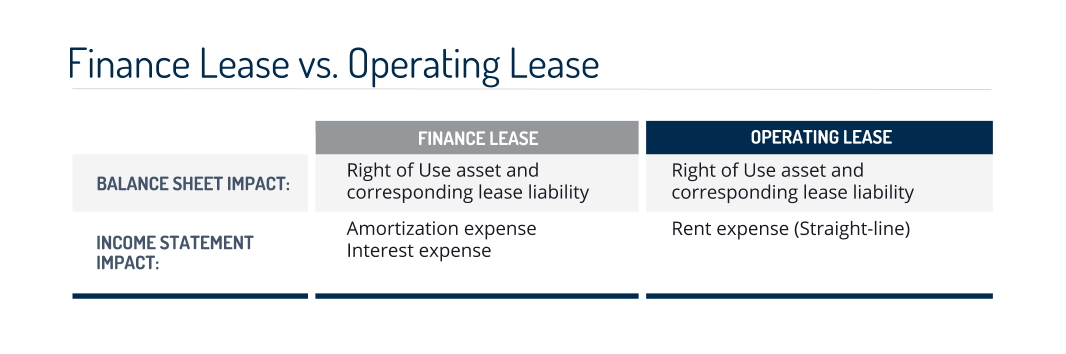

What Triggers Recognition of a Finance Lease? A lease qualifies as a finance lease—and thus must be recognized—when it transfers substantially all the economic benefits and risks of ownership to the lessee. This shift is the cornerstone of finance lease accounting under IFRS 16 and ASC 842, redefining how companies report long-term commitments.

The key question becomes: does the lease effectively function like a purchase? According to the International Accounting Standards Board’s guidance, a lease transfers ownership, an option to buy at a price likely to be exercised, or includes terms that specify significant penalties for non-returns—each signaling economic substance over legal form. When any of these conditions hold, the lease is no longer an expense; it becomes capitalized as both an asset and a liability.

Core Recognition Criteria: A Detailed Breakdown

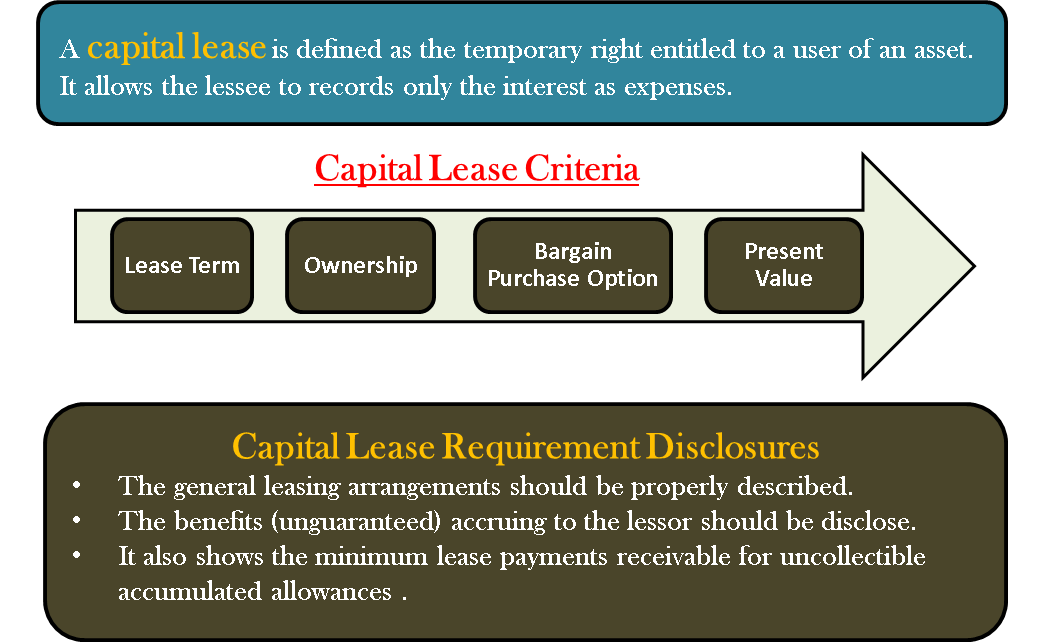

Under both IFRS 16 Leases and U.S. GAAP, observable criteria determine finance lease status. These include: - Transfer of ownership: The lessee takes full control, including maintenance responsibilities and residual value risk.- Bargain purchase option: A clear right to buy the asset at a price significantly below market value or fair value. - Lease term covering a major part of the asset’s economic life: Typically 75% or more, with no major restrictions preventing use. - Present value of lease payments equal to or exceeding substantially all of the asset’s fair value: Indicates the lease embodies economic ownership.

These criteria reflect a principle-based approach—accountants must assess not just contracts, but actual control and risk transfer. As practiced by global firms, this evaluation demands granular analysis of lease terms, residual value assumptions, and intended use.

Residual Value Risk and Lease Control: Subtle But Critical Triggers

One of the most frequently misunderstood criteria is the assessment of residual value risk.A lease transfers significant risk and reward—this includes responsibility for obsolescence, maintenance costs, and disposal decisions. When the lessee retains such control, it signals ownership economic rationale. Similarly, control—defined as the ability to direct use, modify, and direct the asset’s use—drives recognition.

Even if titles are held by a lessor, the lessee’s dominant influence triggers finance lease treatment. “Lease classification hinges on economic reality, not legal labels,” says Maria Chen, a senior lease accounting specialist at PwC. “A leased aircraft with maintenance stipulations and a shutdown option may appear operational, but if the lessor bears most risks and rewards, the lease qualifies as a finance lease.” This insight underscores the importance of functional analysis beyond paperwork.

p> Other critical factors include lease term structure: if the lease expires before the asset’s economic life, it typically isn’t finance, unless ownership transfer occurs. Additionally, asset specificity—like customization or integration into core operations—heightens the likelihood of recognition. For example, a manufacturing company leasing a CNC machine with embedded software, training, and exclusive usage, is likely to qualify if the lease terms reflect ownership-like control, even without an explicit transfer of title.

Industry Practices and Real-World Application

Across industries, finance leases shape capital structure and reporting transparency. In aviation, leases often include leasehold improvements and maintenance obligations that mirror ownership, prompting finance recognition. Telcos similarly lease network equipment with steep bargain options and long terms, effectively converting leases into finance arrangements despite absence of title.Key takeaway: Companies must move beyond lease classification checklists and adopt a holistic view—evaluating contractual terms, operational control, risk allocation, and economic intent. EY’s 2023 lease review study found 38% of finance leases were initially mischaracterized due to oversight of control and residual value terms.

This nuanced recognition process reinforces the credibility of financial statements and supports compliance with evolving standards.

As lease structures grow more complex—especially with sustainable finance and digital asset leasing—mastery of recognition criteria remains a critical differentiator for financial integrity and strategic decision-making. Ultimately, finance lease recognition is about translating contractual arrangement into financial truth—one that reflects the true nature of investment and obligations. By rigorously applying the criteria, organizations uphold transparency, enhance comparability, and ensure stakeholders see beyond legal fiction to the economics beneath.

Related Post

Count on You: How Bruno Mars’ “Count On You” Revives the Power of Faith and Friendship

Twitch Gift Subs in Turkey: How Local Streamers Turn Donations into Digital Engagement

Deliheal Yondara: Revolutionizing Wellness Through Holistic Lifestyle Design

HowToSpellTechnology: The Precision Behind the Digital Age’s Most Confused Lexicon