First Capital Finance South Africa: Your Professional Guide to Secure Wealth Growth

First Capital Finance South Africa: Your Professional Guide to Secure Wealth Growth

First Capital Finance South Africa stands as a pivotal institution guiding individuals and businesses toward informed, strategic financial decisions in a volatile economic landscape. With decades of expertise, it combines deep market knowledge, digital innovation, and personalized advisory services to unlock sustainable growth—making financial empowerment accessible to all. Whether navigating investment portfolios, securing business funding, or optimizing personal wealth, this trusted finance partner delivers clarity amid complexity.

At the core of First Capital Finance’s offerings is a structured, client-first approach that blends traditional financial wisdom with cutting-edge technology. The firm serves a diverse clientele—from high-net-worth individuals and entrepreneurs to mid-sized enterprises and corporate treasurers—each with distinct financial goals. By aligning tools, insights, and expert counsel, First Capital transforms financial planning from a daunting task into a manageable, actionable journey.

As one financial strategist noted, “First Capital doesn’t just manage money—it builds pathways to confidence and control.”

Core Services: Building Sustainable Financial Futures

First Capital Finance delivers a comprehensive suite of services tailored to match client aspirations and risk tolerance. These include: - **Personalized Financial Planning:** Customized strategy development covering budgeting, retirement, wealth preservation, and investment allocation, grounded in real-time market analysis. - **Strategic Investment Management:** Access to diversified portfolios spanning equities, fixed income, alternative assets, and structured products, managed with a focus on long-term performance and risk-adjusted returns.- **Corporate Cash Solutions:** Tailored financing, treasury management, and financing solutions designed to strengthen liquidity, optimize working capital, and support business expansion or restructuring. - **Business Funding & Advisory:** Tailored debt providers and equity financing options, including SME loans, merchant cash advances, and growth capital, paired with expert advisory on capital structure. - **Digital Banking Integration:** Seamless online platforms enabling real-time account monitoring, transaction management, and automated financial insights—enhancing transparency and engagement.

These services are not offered in isolation; instead, they are integrated into holistic plans that adapt to evolving market conditions. For investors, this means agile strategies that balance growth with protection. For businesses, it translates into resilient financial models capable of weathering economic shifts.

“Our strength lies in our ability to translate global trends into local impact,” explains a senior advisor at First Capital. “We blend macroeconomic foresight with hyper-local client needs to deliver strategies that matter.”

Investment Strategies: Balancing Risk and Opportunity in Dynamic Markets

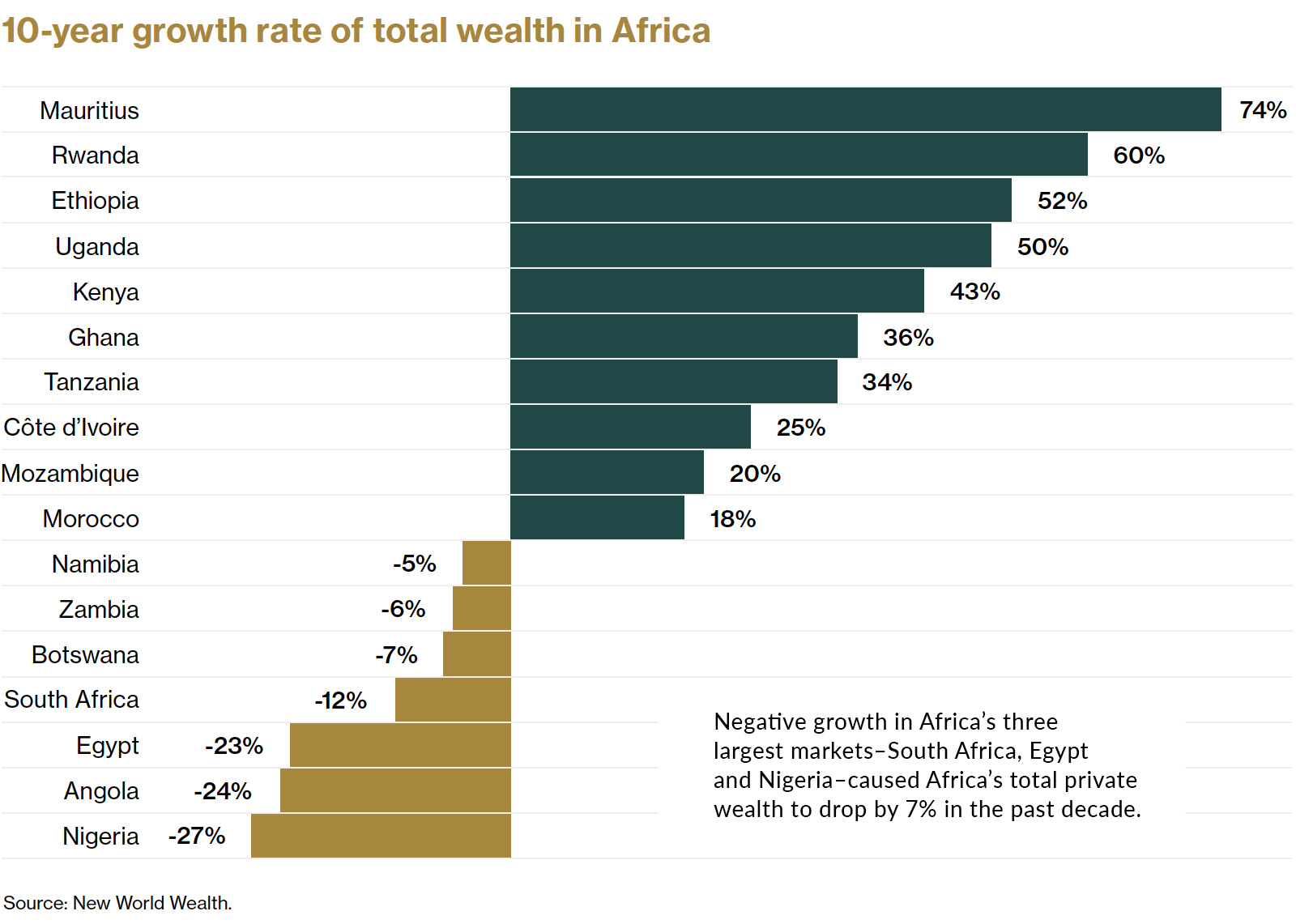

The finance market is marked by volatility, but First Capital Finance positions clients to navigate uncertainty with a disciplined, evidence-based approach. Its investment division leverages multi-asset class frameworks, active asset allocation, and rigorous due diligence to identify opportunities while mitigating risk.Key investment pillars include: - **Diversification:** By spreading investments across global equities, emerging markets, real estate, and fixed income instruments, risks are dispersal across non-correlated assets, reducing exposure to single-market downturns. - **Risk-Adjusted Returns:** Using quantitative models and behavioral finance insights, the team assesses both volatility and return potential to construct portfolios aligned with individual risk profiles. - **Active Management:** Unlike passive index-tracking, First Capital’s strategy emphasizes tactical shifts—rebalancing portfolios in response to economic indicators, interest rate movements, and geopolitical developments.

- **Sustainability Integration:** Growing emphasis on ESG (Environmental, Social, Governance) criteria ensures investments align with ethical values and long-term value creation, reflecting global shifts toward responsible finance. Market analysis is not abstract—each strategy is rooted in real-time data. From tracking South African currency trends to evaluating global trade flows, the team delivers insights that are both forward-looking and contextually grounded.

This blend of analytics and agility enables clients to participate in major economic cycles with confidence.

Who Benefits from First Capital Finance: From Individuals to Corporates

The reach of First Capital Finance spans the entire spectrum of financial stakeholders, each benefiting from tailored expertise. For individual clients, the focus is on wealth preservation and growth—building secure retirement plans, funding education, or achieving financial independence.The firm’s personal banking integration simplifies budgeting, debt management, and investment access, turning annual financial reviews into proactive planning sessions. «We help everyday South Africans make smarter choices about their money,` says a client testimonial. «No jargon, just clear guidance that translates to real results.» Businesses, particularly SMEs, rely on First Capital for capital efficiency and streamlined treasury solutions.

Access to structured loans, cash flow forecasting, and scalable financing helps startups and established firms alike fuel growth, expand operations, or restructure debt with minimal disruption. Investors—ranging from private equity funds to individual fund managers—value the firm’s ability to structure bespoke investment vehicles, optimize portfolio tax efficiency, and diversify across asset classes with precision. Even nonprofit organizations and public sector entities engage with First Capital for tailored financial risk management and long-term sustainability planning, reinforcing the firm’s status as a multi-sector leader.

Digital Innovation: Technology Meets Expertise in Financial Management

Technology is not a separate component at First Capital Finance—it’s the engine driving efficiency, transparency, and accessibility. The firm’s proprietary digital platforms enable real-time portfolio monitoring, automated savings tools, and instant access to advisory insights. These tools empower users to make timely decisions, track performance, and receive personalized alerts on market movements or portfolio shifts.Fintech integration extends beyond consumer apps: - **AI-Powered Insights:** Machine learning models analyze transaction histories, income patterns, and market trends to offer predictive recommendations and customized savings opportunities. - **API-Connected Banking:** Seamless synchronization with business and personal account systems eliminates data silos, enabling holistic financial oversight. - **Cybersecurity Assurance:** Robust encryption, two-factor authentication, and continuous monitoring protect sensitive client data, reinforcing trust in digital banking.

This digital-first philosophy democratizes access to expert advice, bridging gaps between high-touch service and scalable technology. As First Capital continues innovation, clients benefit from increasingly intuitive, responsive financial tools that evolve with their needs.

The Path Forward: Building Financial Resilience in Uncertain Times

First Capital Finance South Africa delivers a strategic blueprint for building lasting financial resilience, combining time-tested principles with modern adaptability.From individual wealth accumulators to corporate treasurers, the firm’s client-centric model, diversified services, and tech-enabled solutions create a powerful foundation for sustainable growth. In a region where economic volatility is the

Related Post

RMIT University Leads Global Conversation with QS World Rankings 2026 Insights

Marion, South Carolina: The South Carolina Jewel Where Tradition Meets Progress

Unleash Data Power Like Never Before: How Bill Jelen Supercharges Power BI for Business Insights

The Visionary Architect of Modern Egyptian Architecture: Hisham Tawfiq