Get The Capital One Mobile App for Android: A Quick Guide to Instant Financial Empowerment

Get The Capital One Mobile App for Android: A Quick Guide to Instant Financial Empowerment

Launching the Capital One Mobile App on Android isn’t just about convenient banking—it’s a gateway to smarter money management at your fingertips. With intuitive navigation, powerful tools, and real-time insights, this mobile solution transforms how users track spending, access funds, and build long-term financial health. Designed for efficiency and accessibility, the app delivers financial control without the hassle of traditional banking interfaces.

At its core, the Capital One Mobile App delivers a seamless experience engineered for users who value speed and security. With a clean interface built around key financial functions, users can instantly transfer money, pay bills, monitor accounts, and even request a temporary card—all without visiting a branch. The app’s responsive design ensures smooth performance regardless of internet speed, making it a reliable tool for daily banking.

According to a Capital One product release statement, “Our mobile app continues to redefine how customers interact with their money—making every transaction purposeful and every insight actionable.” This emphasis on utility reflects the app’s mission: placing financial empowerment directly into users’ hands.

Seamless Onboarding: Setting Up Your Capital One Mobile App in Seconds

Installing the app takes less than a minute. Users begin by downloading the Capital One Mobile app from the official Play Store, creating a secure account using a verified phone number and email.The verification process matches identity documents in under two minutes, after which users unlock full access. The onboarding process is intentionally streamlined—avoiding information overload while guiding participants through essential setup steps.

- Open the app and confirm email/phone verification

- Link your Social Security Number or tax documents (optional but recommended for tax-related features)

- Complete identity verification with a government-issued ID

- Set up two-factor authentication for enhanced security

- Personalize notifications and transfers via account preferences

This deliberate, user-first design sets the stage for a banking relationship built on trust and control.

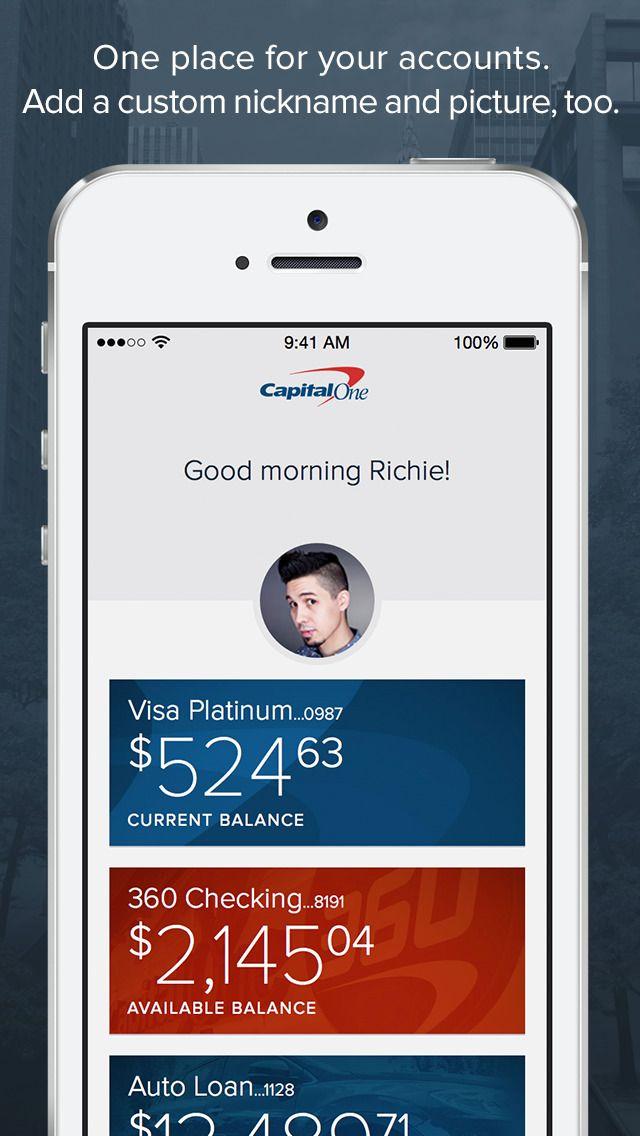

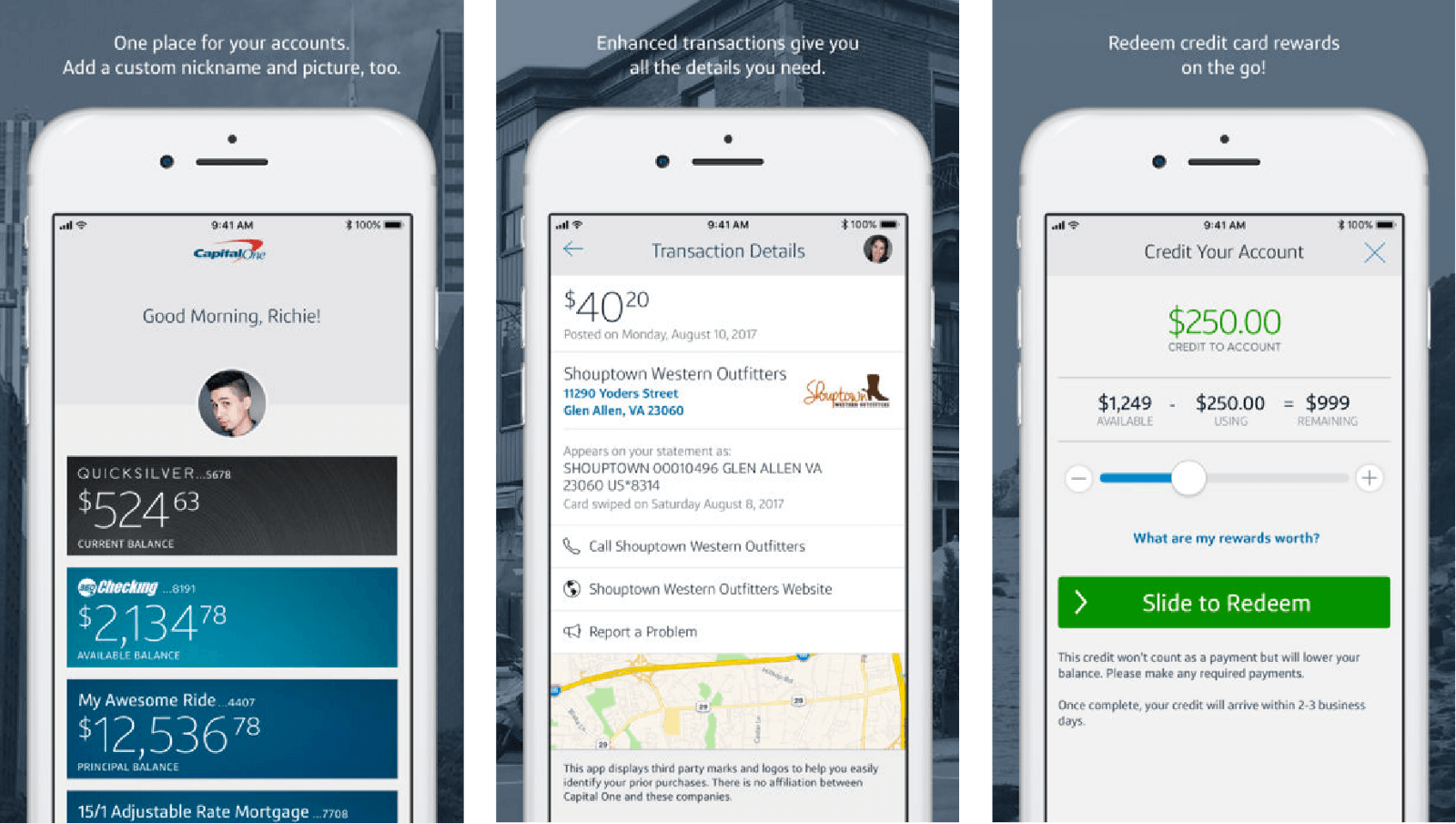

Once set up, the app’s dashboard presents a clean, customizable financial overview—highlighting account balances, recent transactions, and spending trends in clear, digestible visuals. The interface enables quick access to frequently used functions, significantly reducing bank visit times.

For frequent travelers or remote workers, this instant access translates to practical convenience and peace of mind.

Core Features That Redefine Mobile Banking

The Capital One Mobile App integrates a robust suite of tools designed to enhance daily financial independence. Key capabilities include:1. **Instant Money Transfers** Adjust peer-to-peer payments or transfer funds between Capital One accounts with just a few taps.

Whether splitting a restaurant bill or sending money abroad, transfers are processed in seconds, with full transaction history saved for secure record-keeping.

2. **Bill Payment Management** Avoid late fees by scheduling automatic and one-time bill payments through the app. Users can set up recurring payments for utilities, credit cards, and subscriptions, all managed from within the app’s dedicated billpay hub.

Alerts ensure no payment slips through the cracks.

3. **Real-Time Account Insights** Gain visibility into financial health with live balance updates, transaction history, and spending categorization. The app automatically sorts expenses by category—food, transportation, entertainment—offering immediate clarity on where money flows.

Users report measurable progress in cutting unnecessary spending after leveraging these insights.

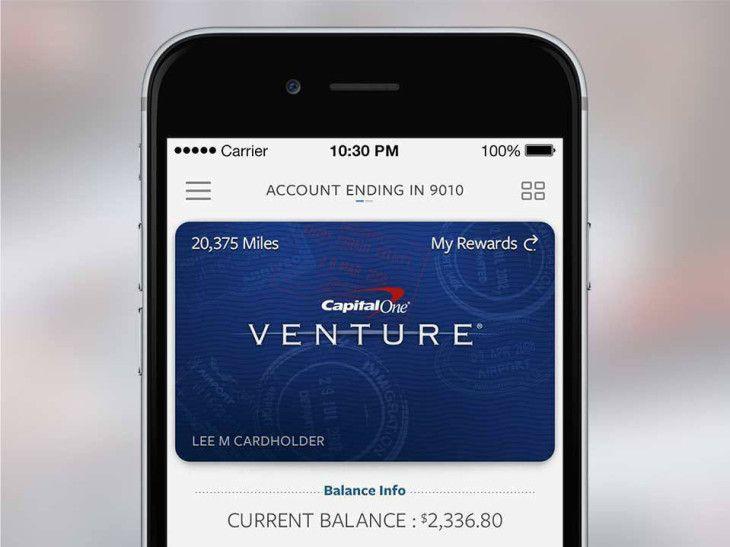

4. **Free Temporary Credit Cards** Accessing temporary credit has never been easier. The app issues secure, digital-only cards for emergencies or planned purchases, with no hidden fees and transparent terms displayed upfront.

5.

**Budgeting Tools & Alerts** Customizable monthly budgets help users gauge spending limits per category. Push notifications warn of overspending, pending invoices, or unusual activity, acting as proactive financial guardrails.

Security: Capital One’s Commitment to User Trust

In an era of rising cyber threats, the Capital One Mobile App prioritizes robust, layered security. Every login requires dual-factor authentication—typically a password plus a one-time code—to prevent unauthorized access.Biometric options, including fingerprint and facial recognition, add personalized protection without sacrificing convenience.

Whether managing daily transactions or planning long-term financial goals, the app’s layered security builds trust—proving that safety and accessibility can coexist seamlessly.Feature-Rich Tools for Financial Growth

Beyond transactional convenience, the app empowers users to grow wealth through practical, integrated financial tools.

Inside the investment and savings ecosystem, the app connects users to Capital One’s investment services, including based balance

Related Post

Brunny Ixl Is Revolutionizing Vocabulary Mastery with AI-Powered Learning

37 Degrees Celsius Equals What? The exact Fahrenheit Conversion You Need to Know

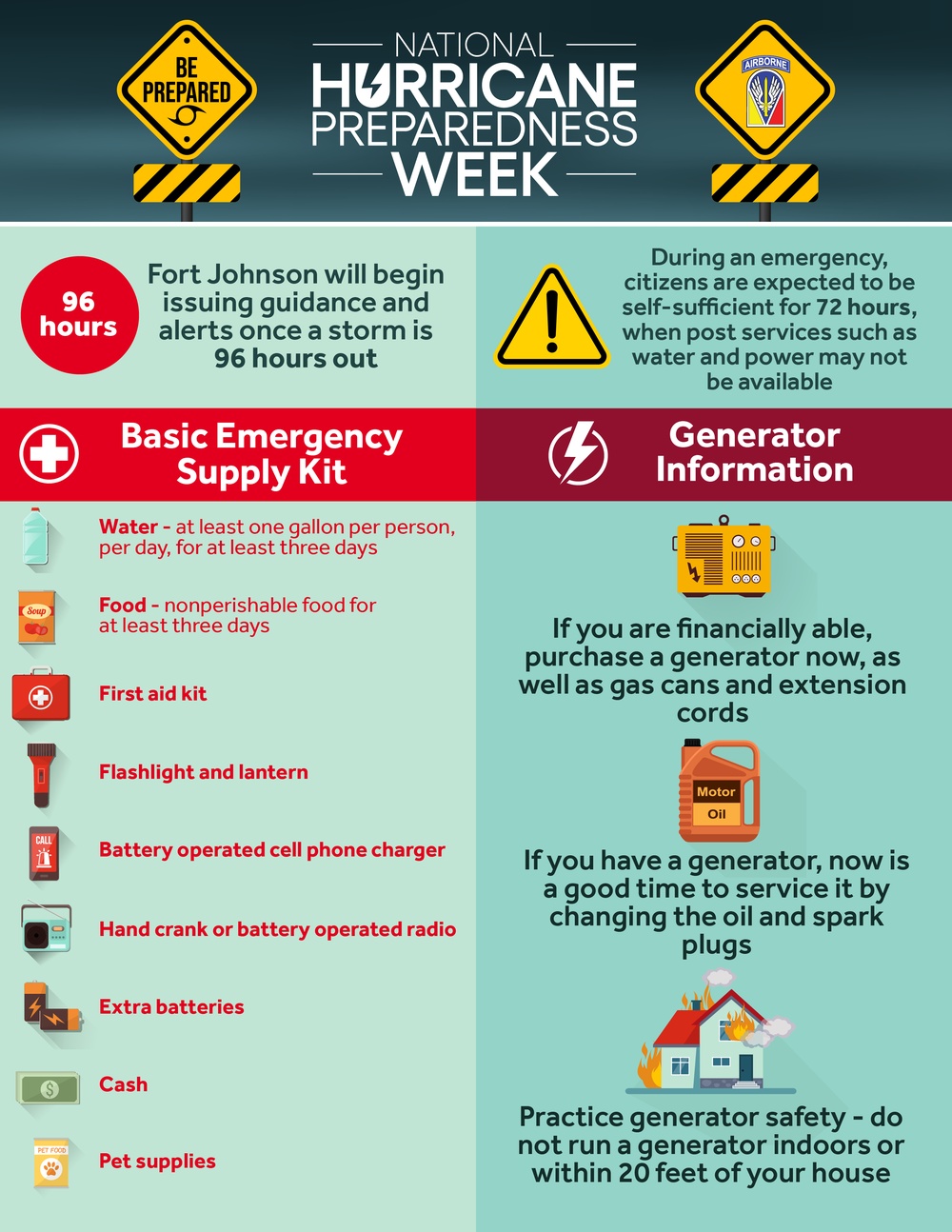

Satellite Beach FL Hurricane Guide & Safety Tips: Survive Storm Season with Confidence

Is Hot Flight Deals Legitimate? Decoding the True Value Behind Air Travel Discounts