Harvard Finance PhD Placement: Decoding the Path from Research to High-Impact Careers

Harvard Finance PhD Placement: Decoding the Path from Research to High-Impact Careers

Navigating a career in finance at the highest academic level demands far more than a PhD in finance—it requires strategic positioning, deep industry alignment, and a clear understanding of market trends. Harvard Finance PhD Program candidates face one of the most competitive pathways to translating advanced financial research into tangible, high-impact roles in academia, central banking, asset management, and the private sector. This article unpacks the essential components shaping successful PhD placements in finance, from structural requirements and mentorship dynamics to practical training and real-world application.

Core Academic Requirements and Qualifications

>“A Harvard Finance PhD is not merely about completing coursework—it’s about mastering research at the frontier of financial theory and practice.” At the academic core, applicants must demonstrate rigorous expertise through advanced coursework in arbitrage theory, macroeconomic modeling, computational finance, and quantitative methods. These classes serve as foundational tools but are only the beginning. Equally critical is original research—often culminating in a dissertation that pushes boundaries in asset pricing, risk management, or financial regulation.>Harvard expects candidates to publish in peer-reviewed journals by graduation, reflecting the program’s emphasis on scholarly contribution. For those aiming to academic appointments, sustained production of high-impact research is nonnegotiable. To support this trajectory, prospective PhD students engage in structured research designed to build technical depth and scholarly voice.

This includes seminar participation, thesis project design, and seminar defense—rituals that refine analytical rigor and communication clarity. The program attracts top-tier scholars who thrive in environments where intellectual precision defines success.

Mentorship and Academic Guidance: The Bridge Between Research and Realization

Underpinning every successful PhD placement is a dedicated faculty mentor whose reputation and research focus directly shape a candidate’s career trajectory.Harvard Finance PhD candidates are strategically paired with faculty whose work aligns with their own research interests—from behavioral finance to systemic risk modeling. This mentor-mentee relationship is central to project development, methodological validation, and navigating the academic publishing pipeline. >As one current PhD candidate noted, “Your advisor isn’t just a supervisor—they are a broker of opportunity, opening doors to seminars, collaborations, and grants that accelerate your scholarly growth.” This dynamic is especially crucial in selecting publications, securing research funding, and building a professional network vital for post-PhD transitions.

Mentorship also extends beyond technical oversight: advisors guide students through career pivots, helping identify whether academia, Wall Street, or institutional finance best leverages their expertise.

Practical Training: From Theory to Transaction

While theoretical mastery is essential, Harvard Finance PhD students integrate real-world tools through structured internships, industry collaborations, and applied coursework. These experiences transform abstract financial models into actionable insights, bridging the gap between academic inquiry and market practice.Examples include: - Interning at asset management firms to apply portfolio optimization techniques; - Collaborating with fintech startups on algorithmic trading models; - Consulting with central banks on stress-testing frameworks. Such placements reinforce analytical agility and context-aware problem solving, skills highly valued in roles requiring both quantitative sophistication and operational relevance. Methodologically, students are trained in advanced econometrics, machine learning applications, and high-performance computing—tools increasingly central to modern financial research and decision-making.

Phenomena like ESG investing analytics, decentralized finance protocols, and macroprudential risk modeling demand fluency across both statistical rigor and domain-specific complexity.

Industry Alignment: Building a Career on Demand

The Harvard Finance PhD program is acutely attuned to evolving financial markets and institutional needs. Graduates emerging with expertise in emerging fields such as climate finance, digital asset regulation, and behavioral risk analytics position themselves at the forefront of high-demand roles.>“Employers are no longer satisfied with theoretical excellence alone—today’s employers want PhDs who can translate research into strategy,” said a senior hiring manager from a leading financial institution. This demand shapes curriculum design and advisor selection, ensuring programs remain competitive in a rapidly shifting landscape. Career support mechanisms further enhance placement outcomes.

Harvard’s alumni network—spanning academia, Fort Countess investment banks, regulatory agencies, and fintech innovators—provides unparalleled access to internships, postdocs, and senior roles. Structured career workshops, alumni mentorship circles, and industry networking platforms accelerate connectivity, turning academic achievement into professional momentum.

The Impact of Curriculum and Networking:** Fundamental to the PhD’s value is its curriculum’s strategic design.

Courses emphasize interdisciplinary learning—merging finance with computer science, behavioral economics, and law—fostering holistic problem-solving abilities. This contrasts with narrower academic models, equipping graduates to tackle complex, real-world challenges. Equally vital is the Quipping network and collaborative culture.

Seminars, journal clubs, and interdisciplinary research groups generate peers and mentors who challenge and refine ideas, creating an ecosystem of intellectual and professional growth.

The path to securing a Harvard Finance PhD placement is neither linear nor effortless—it is a meticulous integration of research excellence, strategic mentorship, practical experience, and forward-looking industry alignment. For those committed to advancing the frontiers of finance, the program offers not just credentialing, but a launchpad into careers where scholarly rigor meets tangible impact.

In an era defined by rapid financial innovation and global uncertainty, the Harvard Finance PhD stands as a benchmark of intellectual and professional readiness. Ultimately, the true value lies not merely in the degree, but in the network, mindset, and cultivated expertise that persist long after graduation—elements that define impact in finance’s most demanding arenas.

Related Post

Jacob Collier: The Multifaceted Genius Behind the Question

UK Postal Codes: Your Ultimate Master Guide to Navigating Britain’s Addressing System

From Engineering Vision to Billion-Dollar Legacy: The Rise and Net Worth of R.J. Scaringe

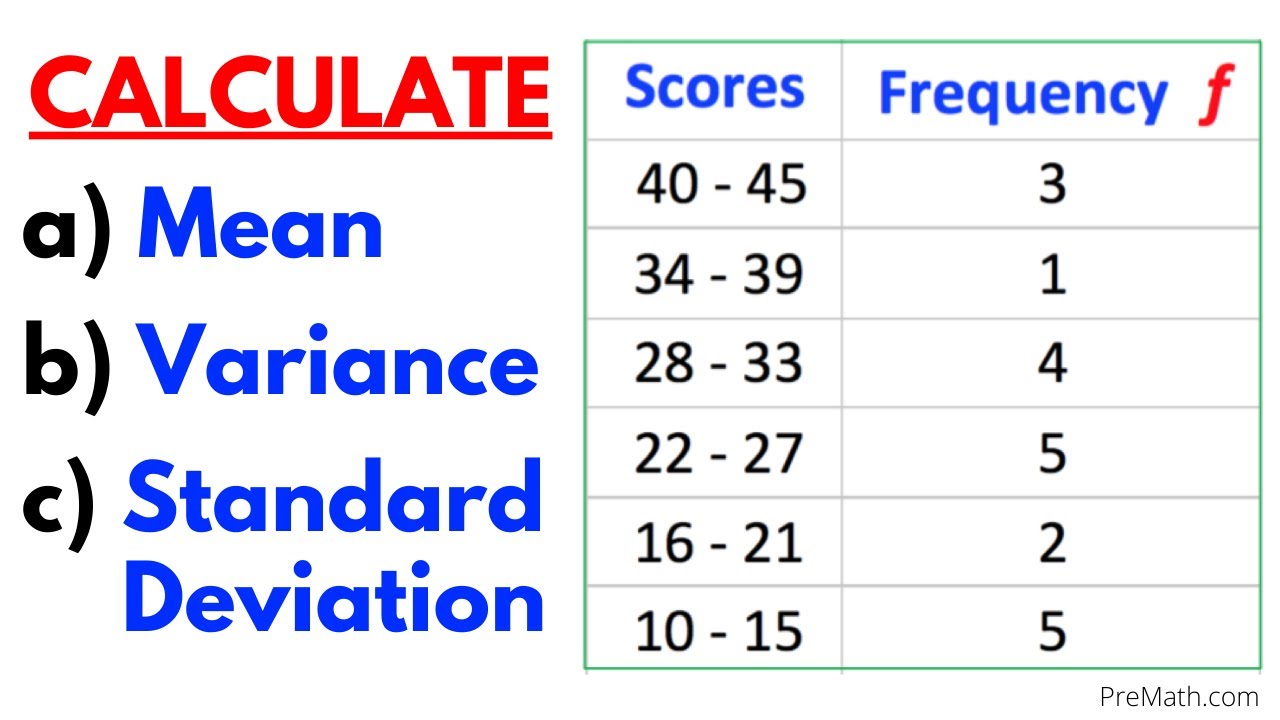

How to Find Standard Deviation of a Data Set: The Definitive Step-by-Step Guide