How Kay Credit Card Paymentshop Empowers Users with Flexible Payment Options Through the New Kay Kay Financing

How Kay Credit Card Paymentshop Empowers Users with Flexible Payment Options Through the New Kay Kay Financing

For consumers navigating today’s fast-paced digital marketplace, credit card payments have evolved from mere transaction tools into sophisticated financing solutions. Among the most innovative pivots in this space is Kays Credit Card Paymentshop’s launch of the Kay Kay financing program—an agile, user-centered approach designed to turn wide-spread payment flexibility into real-world financial empowerment. By integrating seamless credit access with thoughtfully structured repayment models, Kay is redefining how users manage large purchases, lifestyle spending, and everyday expenses—proving that modern credit should be both accessible and responsible.

The Rise of Smart Financing in Modern Credit Cards

The landscape of consumer credit is shifting rapidly. No longer limited to standard 12- or 24-month installment plans, today’s financial products increasingly prioritize customization and transparency. Payment flexibility has become a key differentiator—especially for users seeking control over cash flow without sacrificing immediate purchasing power.Kays Credit Card Paymentshop addresses this demand head-on with the Kay Kay program, which transforms traditional card credit into a multi-dimensional financing tool. Traditionally, credit cards were viewed as short-term liquidity solutions—meant for emergencies or select high-cost items with high interest rates and inflexible terms. But Kay Kay reimagines that model by combining immediate purchase access with structured, interest-transparent financing.

Users benefit from instant approval, variable repayment cycles, and the ability to tailor payment schedules to their personal financial rhythm. “Kay Kay represents a significant leap in how credit cards can serve real customer needs,” says financial analyst Rachel Kim. “It’s not just about convenience—it’s about giving users control, predictability, and financial clarity in moments when flexibility matters most.”

Key Features of the Kay Kay Financing Program

At the core of Kay Kay’s innovation lies a modular financing architecture designed around user experience.The program introduces several standout features that elevate standard credit card offerings: - **Customizable Repayment Terms:** Users choose from multiple payment windows—from accelerated repayment over two years to extended terms spanning five years. This adaptability ensures payments align with individual income cycles and financial goals. - **No Hidden Fees:** Transparency is baked into the design.

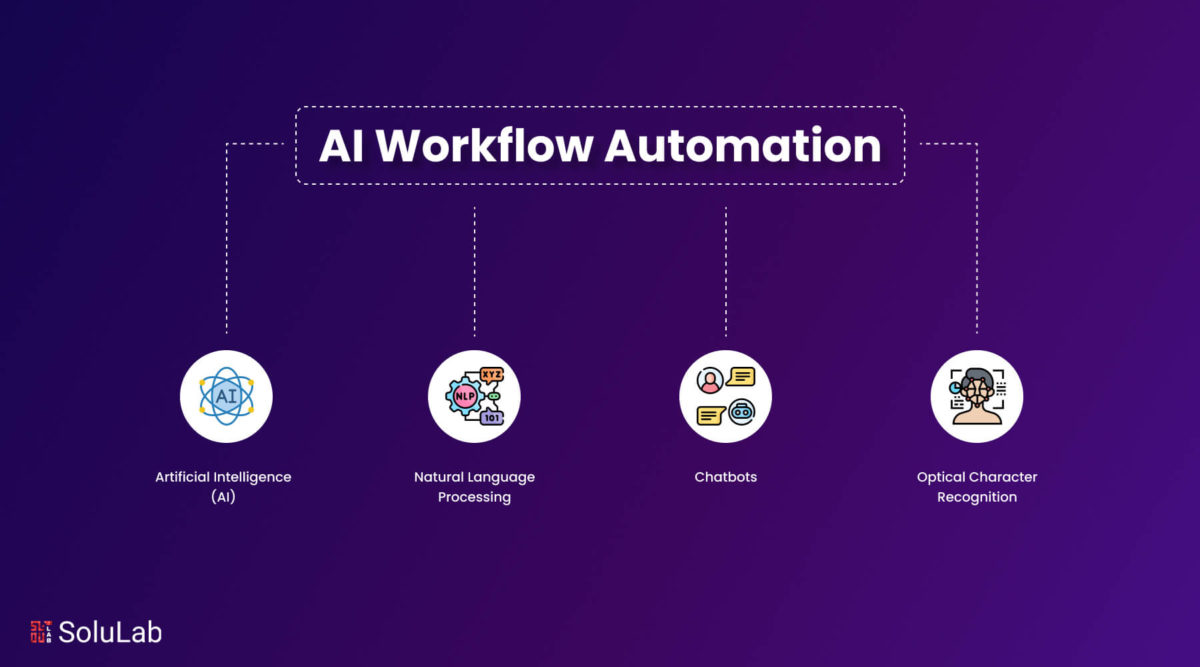

Interest rates are clearly displayed upfront, and late payment penalties are minimized, fostering trust and long-term engagement. - **Instant Approval with Real-Time Eligibility Checks:** Leveraging advanced data analytics, the system delivers quick, accurate credit assessments, enabling users to review financing options within seconds after checkout. - **Integration with Spending Intelligence:** Kay Kay pairs financing with spending insights, helping members track how responsible credit use supports long-term financial health.

- **Payment Flexibility Without Compromise:** While offering deferred payments for purchases up to $15,000, the program ensures users never pay more than they anticipated—eliminating the shock of rising interest charges. Practically, a customer planning to buy a new laptop or renovate their kitchen can access a financing package that lets them defer full payment while earning interest-free days—up to 15—before committing to a structured plan. This hybrid model blends immediate gratification with strategic financial planning.

Who Benefits Most from Kay Kay Financing?

The program is strategically designed for diverse consumer segments, particularly those managing large, planned expenditures without liquidating savings or delaying essential purchases. Small business owners, for example, can finance business equipment or inventory with repayment plans that mirror cash inflows, reducing financial strain during revenue-heavy cycles. Consumers with deferred income—such as those receiving tax refunds, seasonal bonuses, or contract payments—can leverage Kay Kay to bridge short-term affordability gaps.Students graduating into the workforce also find value in flexible plans that let them stabilize financially before committing to long-term debt. Importantly, Kay Kay targets users who value autonomy and transparency. The program avoids predatory terms common in traditional installment credit, instead emphasizing clear communication and user control.

As financial psychologist David Liu notes, “People respond best to systems that respect their agency. Kay Kay gets this—offering real options, not hidden traps.”

Implementation and Technological Underpinnings

The Kay Kay financing suite is powered by a robust backend infrastructure combining real-time credit scoring, dynamic risk modeling, and seamless partner integration. When a customer selects Kay Kay at checkout, the system instantly evaluates multiple data points—hard income verification, payment history, and lifestyle spending patterns—to determine eligibility and optimal terms.This technology enables near-instant approval, often within 20 seconds, with financing options projected in real time on the merchant’s platform. Backend APIs ensure payments sync across systems, eliminating errors and delays. Security protocols meet the highest PCI-DSS and encryption standards, protecting sensitive financial data throughout the transaction.

Merchants using Paymentshop’s Kay Kay integrate via a unified dashboard, enabling them to promote financing options directly to customers while maintaining compliance and profitability. This cooperative approach strengthens the ecosystem, encouraging broader adoption without compromising risk management.

Market Reaction and Strategic Positioning

Since its rollout, the Kay Kay financing program has drawn attention from both consumers and financial industry analysts.Early adoption indicators show strong engagement, particularly among millennials and Gen Z demographics who prioritize flexible, digital-first financial tools. Competitors with rigid, one-size-fits-all credit models are increasingly pressured to innovate—giving Kay Kay a distinct market edge. “We’re seeing a paradigm shift,” observes industry watcher Maria Torres.

“Consumers no longer tolerate static credit products. Kays has responded with a system designed to grow with users’ changing financial realities—proving that responsible credit can be both smart and spontaneous.” The program’s success also reinforces Kays’ broader mission: to position credit not as a line item, but as a supportive financial partner. By aligning flexibility with transparency, the brand cultivates long-term loyalty and trust in an era where discretion and clarity are crown jewels.

In a financial landscape where adaptability defines resilience, Kay Credit Card Paymentshop’s Kay Kay program emerges as a powerful example of how modern credit can empower rather than overwhelm. By delivering customizable, transparent financing directly at the point of purchase, it equips users with the tools to manage debt wisely—without sacrificing access or immediacy. As digital payments continue to dominate, Kay Kay stands out not just as a financing option, but as a forward-thinking blueprint for responsible, user-centric credit.**

Related Post

Septic Company For Sale in NH: Seize a Thriving Independent Opportunity in the Growing New Hampshire Market

<strong>PSEiFashionSE: Your Definitive Guide to Mastering Technical Drawings in Fashion Design</strong>

Unblock Red Ball 4 Uncapped: The Ultimate Test of Online Resilience and Accessibility

Bridge Creek Moore Tornado: The Most Intense Twister in American History