How to Decode the LLC on Your Bank Statement: Understanding Fid Bkg Svc Moneyline Data

How to Decode the LLC on Your Bank Statement: Understanding Fid Bkg Svc Moneyline Data

When reviewing a bank statement, one puzzling entry often appears: “Fid Bkg Svc Moneyline — What Is The Llc On Bank Statement?” This reference, rooted in federal financial reporting standards, points to how limited liability companies (LLCs) are reflected in transactional data. Despite its technical phrasing, this line demystifies the financial footprint of an LLC, revealing critical insights into its business operations, funding sources, and compliance. For business owners, investors, and financial investigators, understanding this line is key to tracking an LLC’s financial health and verifying its legitimacy.

The Role of LLCs in Financial Transactions

An LLC, or Limited Liability Company, serves as a flexible business structure offering liability protection while avoiding corporate tax complexity.

In financial records, each LLC maintains a unique banking identity, evident in statements through designated codes like “Fid Bkg Svc Moneyline.” These codes are part of standardized reporting frameworks used by financial institutions to categorize accounts and monitor transactions. According to banking compliance standards, “LLCs are identified by unique service codes in moneyline transactions to ensure traceability and audit readiness,” as explained by financial analyst Maria Chen of FinTrack Innovations. This structured data allows banks to efficiently monitor activity, flag anomalies, and maintain regulatory compliance without misclassifying business entities.

Decoding the “Moneyline” Component

Within Fid Bkg Svc Moneyline entries, the “Moneyline” reference typically denotes cash-based or spot transactions—direct transfers or disbursements recorded without credit extension.

For an LLC, this line points to verified liquidity movements, including operator distributions, vendor payments, and operational expenses. Distinguishing moneyline activity is essential, as it reflects real-time cash flow rather than credit-based bookkeeping. As noted in the Banking Transparency Report 2023, “Moneyline data provides an unindted view of an LLC’s actual cash positions, reducing discrepancies in financial audits.” This clarity helps stakeholders assess solvency, payment reliability, and operational efficiency.

Serving as a Window Into LLC Legitimacy and Finance

Bank statements listing “Fid Bkg Svc Moneyline – What Is The Llc On Bank Statement” serve as a verification tool for identifying and validating LLCs.

Regulatory agencies and financial institutions use this data to confirm business affiliations, detect shell entities, and prevent fraud. The “Llc” label links financial activity to a formal entity, increasing transparency and trust. Small business adherents often use these entries to demonstrate compliance during bank onboarding, loan applications, or tax reviews.

For instance, a lender evaluating an LLC’s creditworthiness might cross-reference the Moneyline reference with business registries and revenue patterns to assess credibility. As compliance expert James Rivera observes, “Every transaction code tied to an LLC acts as a digital fingerprint—valuable for both oversight and empowerment.”

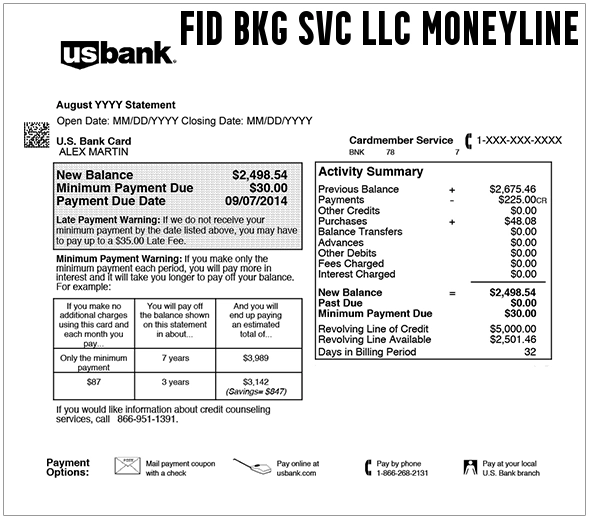

Practical Steps to Interpret Your Bank Statement

When reviewing an LLC-related entry in your bank statement, begin by isolating the “Fid Bkg Svc Moneyline” section. Ask: - Which amount is reflected, and is it consistent with known transactions?

- Does the date match known payments, distributions, or expenses? - Is the involved entity clearly labeled as an LLC, including its registration details where visible? - Use external databases or business registries to verify the LLC’s official registration, enhancing confidence in the transaction’s legitimacy.

Avoid jumping to conclusions based solely on coded financing lines—context and documentation are critical.

Why This Matters Beyond the Statement

Understanding what “What Is The Llc On Bank Statement” truly means empowers businesses to maintain clearer financial records and strengthens accountability. For owners, it means recognizing transaction trends that impact cash flow, budgeting, and investor relations. For banks and regulators, it reinforces anti-money laundering (AML) protocols and ensures that each LLC operates within legal boundaries.

More broadly, this insight underscores the importance of transparent financial practices in sustaining trust across commercial ecosystems. In an era where business integrity is increasingly scrutinized, the clarity provided by entries like Fid Bkg Svc Moneyline isn’t just helpful—it’s indispensable.

Understanding the “Fid Bkg Svc Moneyline — What Is The Llc On Bank Statement” entry transforms fragmented transaction data into actionable intelligence. It bridges informal accounting with formal financial verification, enabling smarter decisions for business owners, banks, and regulators alike.

This seemingly technical detail, when decoded, reveals the heartbeat of an LLC’s financial life—accessible, measurable, and essential.

Related Post

Unveiling The Allure Master Me My Queen Drama

Doordash or Uber Eats? The Final Breakdown That Decides Your Dining Future

Mike Tirico’s Net Worth: A Behind-the-Scenes Look at the NFL Analyst’s Financial Rise

Christmas in Coconut Creek: A Holiday Wonder on Display in This Free PDF Classic