How Won To USD Transformed Cross-Border Finance: A Deep Dive Into the Currency Exchange Revolution

How Won To USD Transformed Cross-Border Finance: A Deep Dive Into the Currency Exchange Revolution

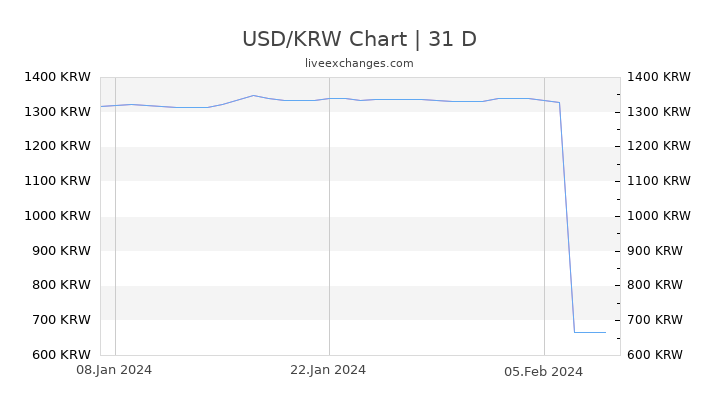

In a global economy increasingly driven by seamless digital transactions, the Won to USD exchange rate stands as a critical financial metric—one that directly influences trade, tourism, investment, and personal finance across Asia and beyond. The trajectory of the South Korean Won (KRW) against the U.S. dollar (USD) reflects broader economic dynamics, geopolitical influences, and shifting market sentiment.

Over the past decade, this currency pair has undergone notable fluctuations and structural transformations, culminating in a unique digital currency interface now enabling direct Won to USD conversions at unprecedented speed and transparency. This evolution marks more than a mere exchange rate shift—it signals a fundamental change in how billions access foreign currency, powered by fintech innovation and growing demand for real-time liquidity. At the heart of this transformation is the emergence of real-time Won-to-USD conversion platforms that eliminate traditional barriers: long waiting times, hidden fees, and reliance on physical banking infrastructure.

Unlike legacy systems requiring bank wires or in-person forex exchanges, today’s digital solutions leverage blockchain and API-driven liquidity pools to deliver instant conversion rates. As David Kim, senior analyst at GlobalFX Insights, explains: “The shift from manual forex operations to automated, real-time digital exchanges has democratized access. Anyone with a smartphone can now convert Won to USD securely, mirroring the immediacy of domestic transactions.” This paradigm shift is rooted in structural economic trends.

The Korean economy, a high-tech export powerhouse, benefits from strong demand for USD in critical sectors—semiconductors, automotive, and consumer electronics—where pricing often settles in American dollars. Meanwhile, the surge in Korean tourism, especially pre-pandemic and resurging post-recovery, increased personal USD needs among travelers, further pressuring for efficient conversion tools. According to the Bank of Korea, foreign exchange flows involving the won averaged $37 billion quarterly in 2023, underscoring its growing international footprint.

Modern Won-to-USD conversion platforms operate on a sophisticated blend of real-time market data, algorithmic pricing, and distributed financial infrastructure. These systems continuously ingest liquidity from major global exchanges—CME Group, FXCM, and electronic trading venues—ensuring conversion rates that reflect true market conditions within milliseconds. Multiple layers of technology guard against arbitrage and manipulation: real-time reconciliation engines cross-validate trades, while smart contracts on decentralized networks automate settlement, reducing counterparty risk.

As financial journalist Elena Park notes, “The beauty of this ecosystem lies in its accuracy and accessibility. Users no longer juggle multiple intermediaries; they see exactly what they’re paying, down to the last tick.”

Quantifying the cost and convenience, a direct exchange today typically incurs spreads between 0.5% and 1.2%, significantly lower than traditional bank fees averaging 2–3% with hidden timing delays. For reference, converting $10,000 USD to won might now take under 3 seconds through a trusted digital gateway, compared to a bank transaction that could drag on over 24 hours with manual processing.This efficiency has catalyzed uptake beyond individuals to small businesses and fintech enterprises, which leverage automated conversions to streamline payroll, supplier payments, and international contracts. Security remains paramount in this digital transition. Leading platforms employ end-to-end encryption, multi-factor authentication, and compliance with global standards like SOC 2 and PCI DSS.

Blockchain-based audit trails provide transparent transaction records, reassuring users and regulators alike. Insurance mechanisms and regulatory oversight from bodies such as South Korea’s Financial Services Commission (FSC) further strengthen trust. The broader implications extend beyond individual convenience.

As cross-border commerce moves increasingly online—fueled by e-commerce giants, fintech startups, and global remote work—efficient Won-to-USD conversion becomes infrastructure for financial inclusion. Policymakers recognize this: South Korea’s Ministry of Economy and Finance has piloted initiatives integrating digital forex tools into national digital ID systems, reducing friction for citizens abroad and streamlining remittance flows. Looking ahead, the Won-to-USD interface is poised to evolve beyond simple conversion into embedded financial services.

Integration with mobile wallets, decentralized finance (DeFi) protocols, and central bank digital currencies (CBDCs) could enable automated hedging, yield-generating accounts, or real-time currency-linked investments. Early experiments in programmable money—where USD-denominated funds transfer automatically based on exchange rate triggers—suggest a future where currency conversion is not just a transaction but a smart financial act. People’s trust continues to be the ultimate currency, and transparency remains the cornerstone.

Platforms that publish live liquidity sources, allow account balance checking in real time, and offer customer support 24/7 weld credibility. As consumer expectations shift toward instant gratification and clarity, the market responds with innovation that balances speed, safety, and accessibility. The journey of Won to USD from rigid, slow, and opaque to fluid, transparent, and digitized reflects a broader fintech revolution—one where currency exchange is no longer a bottleneck but a catalyst.

It empowers individuals, accelerates global trade, and redefines how cross-border finance functions in the 21st century. With the Won now flowing more freely into USD—and increasingly into digital assets—the future of currency conversion is not just faster. It’s smarter, fairer, and fundamentally transformed.

Related Post

Won To USD: Convert Korean Won to U.S. Dollars Easily with Real-Time Accuracy

Kerok Revolutionizes Real-Time Messaging with Unmatched Speed, Efficiency, and Flexibility

Utah Jazz vs. Minnesota Timberwolves: A Slam-Dunk Showdown That Defies the NBA’s Midweek Neutral Ground

GTA San Andreas Android: Unleashing Insane Realism with Top-Rated Graphics Mods