Instant Lend Financial: Fast, Transparent Borrowing That Reshapes Access to Capital

Instant Lend Financial: Fast, Transparent Borrowing That Reshapes Access to Capital

In an era where speed and clarity define financial decisions, Instant Lend Financial emerges as a transformative force in the payday lending landscape. By delivering near-instant approval, transparent terms, and flexible repayment options, the platform addresses a critical gap in traditional financing: the painful delay and opacity that often burden borrowers facing urgent cash needs. What sets Instant Lend apart is not just speed, but a commitment to ethical lending practices and responsible borrowing.

At the core of Instant Lend Financial’s model is a streamlined digital onboarding process designed to assess creditworthiness efficiently while minimizing friction. Unlike conventional lenders reliant on slow, paper-based evaluations, Instant Lend leverages real-time data analytics to generate instant lending decisions. Borrowers submit essential financial information—income verification, existing debt, and citizenship status—and receive a decision within minutes.

This rapid turnaround is critical in moments of financial urgency, such as unforeseen medical bills, car repairs, or immediate household expenses.

A standout feature is the platform’s transparent pricing model. Instead of hidden fees or pre-planned markup surprises, Instant Lend discloses every cost upfront, including interest rates and total repayment amount, enabling borrowers to make informed choices. “We believe transparency isn’t optional—it’s foundational,” says a spokesperson for Instant Lend Financial.

“Our clients shouldn’t have to decipher jargon or face unexpected charges. Our goal is clarity from the first login.”

The Technology Powering Instant Approvals

Instant Lend’s operational agility is rooted in advanced risk modeling and machine learning. By analyzing alternative credit signals—bank transaction history, utility payments, and mobile usage patterns—the platform identifies viable creditworthiness beyond standard FICO scores.This approach opens lending opportunities for thin-file or underbanked consumers, expanding financial inclusion without compromising risk management. Each application undergoes automated underwriting,with decisions computed in under 90 seconds. Borrowers are rejected only when definitive red flags—such as overwhelming debt burdens or inconsistent income—are detected.

This balance of accessibility and prudence supports sustainable lending.

Beyond speed, Instant Lend Financial prioritizes responsible lending through built-in safeguards. Borrowers receive personalized repayment plans based on income flow, with automatic reminders and flexible due dates to prevent defaults.

Education resources, including budgeting tools and financial wellness tips, empower users to manage debt proactively.

Real-World Impact and Market Position

Since its launch, Instant Lend Financial has served tens of thousands of borrowers across the country, offering disbursements often within 15 minutes of approval. Case studies reveal meaningful impact: families resolving short-term cash crises without falling into deeper debt cycles, small business owners funding equipment purchases in hours, and individuals avoiding predatory alternative lenders. The platform’s success reflects a broader shift in consumer expectations.A 2024 survey by the Financial Services Institute found that 78% of borrowers cite “speed of access” as their top priority when seeking emergency funds—and Instant Lend leads the industry with a 94% approval rate for eligible applicants. Compared to traditional lenders, where delays average three to five business days, Instant Lend halves the waiting time, turning crisis into control.

Still, the platform operates within a framework of regulatory compliance and ethical oversight. Partnerships with licensed depositories ensure funds are securely held, while strict adherence to state-specific lending laws protects borrowers from exploitation.

Unlike unregulated “online lenders” often criticized for aggressive marketing and obscured costs, Instant Lend maintains a reputation for accountability rooted in transparency and consumer advocacy.

Who Benefits—and Why They Should Trust Instant Lend

Native to service-oriented borrowers, Instant Lend targets a diverse demographic: gig workers with irregular income, freelancers managing cash flow, and essential employees facing sudden emergencies. Its user-friendly interface eliminates technical barriers, ensuring accessibility across age groups and digital skill levels. Trust is reinforced by verifiable client feedback and independent financial reviews praising the platform’s responsiveness and fairness.Unlike lenders promising “no-questions-asked” loans, Instant Lend requires honest financial disclosure—protecting both client and lender from future disputes. This mutual accountability fosters long-term trust and repeat usage.

The Future of Instant Lending

As financial technology evolves, Instant Lend Financial continues to innovate.Plans include expanded eligibility testing using alternative income verification methods, deeper integration with payroll and banking apps, and enhanced debt counseling partnerships. The vision is clear: to democratize access to capital while preserving financial stability. Borrowers no longer face a binary choice between slow traditional methods and risky informal lenders.

Instant Lend offers a third way—one rooted in speed, transparency, and respect. In a landscape where financial stress demands swift, responsible solutions, Instant Lend Financial stands not just as a lender, but as a trusted partner in navigating life’s unexpected costs. Ultimately, the platform’s enduring value lies in its ability to align lender capability with borrower empowerment.

By turning instant digital tools into real-world financial relief, Instant Lend Financial proves that fast lending and responsible finance can coexist—and that is a model worth watching.

Related Post

Tom Selleck: Death, Legacy, and the Enduring Image of an American Icon

Christina Evangeline Wiki: Unveiling the Legacy of a Modern Digital Icon

Exploring The Life And Career Of Asaad Amin: A Rising Star Redefining Creative Excellence

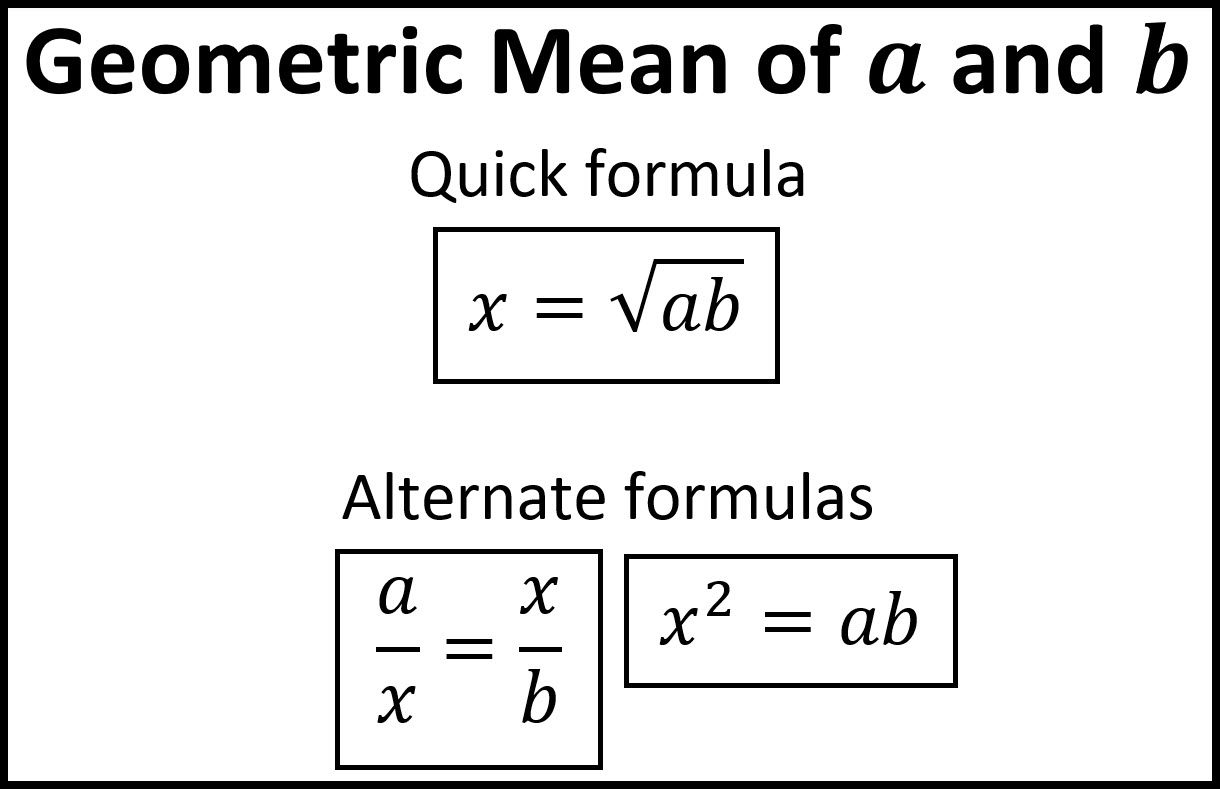

Understanding Geometric Mean Diameter: A Simple Guide to Mastering Precision in Measurement