IPSE IMPMSE Finance Pasuruan: A Quick Overview of Indonesia’s Key Financial Hub

IPSE IMPMSE Finance Pasuruan: A Quick Overview of Indonesia’s Key Financial Hub

In the heart of East Java, Pasuruan emerges not just as a city of strategic infrastructure and bustling trade, but as a burgeoning epicenter of financial activity within Indonesia. Integration and Innovation in Pascal’s Financial Ecosystem (IPSE IMPMSE Finance Pasuruan) marks a transformative phase where financial services, digital innovation, and regional development converge. This article delivers a precise yet compelling look at how Pasuruan is positioning itself as a vital node in Indonesia’s evolving financial landscape, supported by data-driven progress and strategic partnerships.

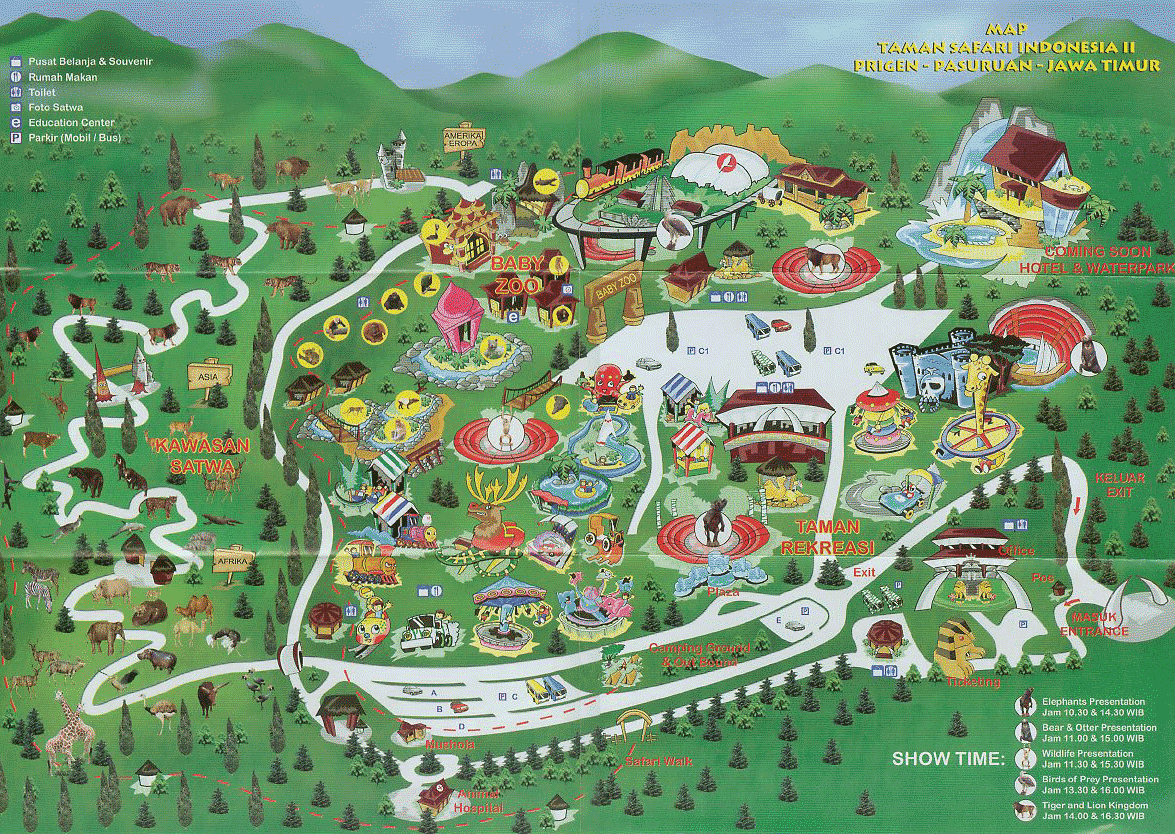

Strategic Geographic and Economic Positioning of Pasuruan

Pasuruan’s significance stems from its advantageous location along major transportation corridors linking Jakarta to the eastern provinces, and proximity to the Surabaya metropolitan region—Indonesia’s second-largest economic engine. This geographical advantage supports rapid industrial growth and enhances access to capital flows, critical for financial institutions operating in the outer urban belt. According to recent data from the Regional Finance and Investment Authority (KAPI), Pasuruan has seen a 28% rise in business permits year-on-year, underscoring its transformation from a transit corridor into a dynamic economic zone.- Key infrastructure upgrades include the expansion of Pasuruan’s financial district, integration with the Trans-Java Toll Road, and modernized public banking halls. - Cross-sectoral synergies between logistics, manufacturing, and finance foster new financial product development tailored for SMBs and agribusinesses. This strategic positioning enables Pasuruan to serve as a critical bridge between rural production economies and national financial markets, making it indispensable in regional economic planning.

Digital Finance and IMPMSE Framework Implementation

At the core of Pasuruan’s financial modernization is the IPSE IMPMSE Finance Pasuruan initiative—an integrated framework designed to accelerate digital inclusion and responsible finance. The IMPMSE (Integrated Micro, PES (“Pertumbuhan Ekonomi SME”) and SME Finance Ecosystem) model restructures how financial services reach underserved entrepreneurs and smallholders. “The initiative ensures that digital banking, credit scoring, and real-time financial reporting are accessible even in semi-urban centers,” explains Dr.Siti Nurhaliza, Senior Economist at the East Java Institute of Finance. “It transforms Pasuruan into a smart financial node where technology replaces traditional barriers.”

Key components of IMPMSE in Pasuruan:

- Digital Financial Access Points: Over 30 new e-branch outlets and mobile banking kiosks enable 24/7 access to savings, credit, and insurance for over 180,000 Southeast Java residents.

- data-Driven Risk Assessment: AI-powered credit models leverage commuting patterns, utility payments, and supply chain transactions to evaluate SME solvency accurately.

- Interoperable Payment Systems: Integration with national e-wallets and blockchain-backed settlement platforms speeds up transactions and reduces fraud.

IMPSE’s Role in Strengthening Regional SME Ecosystem

Beyond digital tools, IPSE IMPMSE Finance Pasuruan embeds local SMEs at the core of economic resilience.The model fosters collaboration between banks, procurement networks, and government agencies to create tailored financing bundles—working capital loans linked to government procurement contracts, and grant matched with microcredit. “ImpmsE has already unlocked $12 million in dedicated financing lines for Pasuruan’s 4,500+ SMEs,” reports Rusdi Marhaman, Director of Pasuruan Finance Board. “This isn’t just lending—it’s strategic investment with measurable social and economic returns.”

Real-world impact includes:

- A 37% increase in SME loan approval rates since IMPMSE rollout.- Expansion of digital supply chain finance platforms, enabling small producers to access real-time payments tied to major buyer contracts. - Pilot programs linking microfinance institutions with rural cooperatives, announced at the Pasuruan Agribusiness Forum 2024. The framework’s holistic design ensures SMEs are not passive recipients but active participants in a self-sustaining finance ecosystem.

Financial Supervision, Risk Management, and Regulatory Integration

Pasuruan’s evolution under IMPMSE aligns with broader national financial stability goals set by Bank Indonesia and the Financial Services Authority (OJK). Regulatory interoperability ensures that digital rollouts adhere to strict compliance standards—user data protection, AML/KYC protocols, and transparent interest rate disclosures. “Risk governance in Pasuruan is a model for scalable regional finance,” notes Dr.Arif Wibowo from OJK’s Regional Oversight Office. “Once a pilot, IMPMSE is being considered for replication in other developing hinterlands.”

Risk mitigation measures include:

- Mandatory cybersecurity audits for all fintech partners operating within Pasuruan’s financial zone. - A centralized early warning system for SME repayment risks, fed by transaction analytics and supply chain health indicators.- Public transparency dashboards displaying loan performance, default rates, and inclusion metrics—all updated monthly. These safeguards build trust across stakeholders and attract institutional investors seeking safe, compliant exposure to emerging markets.

Future Outlook and Sustainable Growth Trajectory

Looking ahead, IPSE IMPMSE Finance Pasuruan is poised to redefine how mid-tier cities contribute to Indonesia’s financial sovereignty.Scalability is embedded in every stage: modular fintech applications, adaptable regulatory templates, and replicable partnership models. Current investments prioritize green finance corridors and digital financial literacy programs—particularly targeting youth and low-income households. With projected annual GDP growth averaging 5% regionally through 2027, Pasuruan’s financial ecosystem stands ready to absorb new capital flows and technological evolution.

“Pasuruan is proving that a regional financial hub doesn’t need to be Jakarta-sized to matter,” states Maya Santoso, Chief Strategy Officer at IndoWorking Capital, a Pasuruan-based impact investor. “Here, innovation meets inclusion—systematically and sustainably.”

The way forward includes expanding IMPMSE’s reach via regional fintech hubs and deepening integration with Indonesia’s national digital economy roadmap. Each initiative strengthens Pasuruan’s role as both a financial gateway and a blueprint for equitable growth in the country’s evolving economic geography.

Pasuruan’s financial renaissance is no longer aspirational—it’s measurable, replicable, and already transforming the lives of millions, realigning regional development with national ambition.The integration of technology, policy, and people-centered finance creates a powerful model that could shape financial futures far beyond East Java.

Related Post

Altoona, PA Zip Codes: Your Complete Guide to Navigating Postal Codes in Central Pennsylvania

Unlocking the Secrets of NdNdN: A Deep Dive into the Game That Defined Native Mobile Skills

The Revolutionary Power of Brewed Clarity: How Amy Brewer Transforms Coffee into Fuel for the Mind

Who Voices the Iconic One Piece English Dub? The Talent Behind the Legend