Is Lumi Autos Car Insurance Worth It? A Deep Dive into Value, Flexibility, and Real-World Savings

Is Lumi Autos Car Insurance Worth It? A Deep Dive into Value, Flexibility, and Real-World Savings

In an era where digital insurance platforms promise streamlined coverage and personalized pricing, Lumi Autos Car Insurance stands out as a modern alternative designed to challenge traditional insurers. Marketed as a tech-driven provider focused on transparency and user control, Lumi leverages data and algorithmic underwriting to offer policies tailored to real driving behavior and lifestyle needs. But whether Lumi truly delivers on its promise requires careful scrutiny—especially when traditional coverage often feels hidden in paperwork, rigid premiums, and opaque pricing models.

For busy drivers seeking clarity without compromise, the question becomes: does Lumi Autos deliver genuine value, or is it another fleeting fintech experiment?

Lumi Autos Car Insurance positions itself as a transparency-first disruptor, using real-time driving data and usage-based pricing to replace legacy actuarial assumptions with dynamic risk assessment. At its core, Lumi’s value proposition hinges on personalization—charging drivers only for what they use, with potential savings for safe habits.

But what does this mean in practice? Unlike traditional insurers that rely heavily on static factors like age, credit score, and zip code, Lumi evaluates driving patterns, mileage, and possibly connected vehicle data to determine rates. This shift promises fairness for low-mileage urban drivers and safety-conscious individuals, but raises questions about data privacy and long-term reliability.

Core Features That Redefine Car Insurance Accessibility

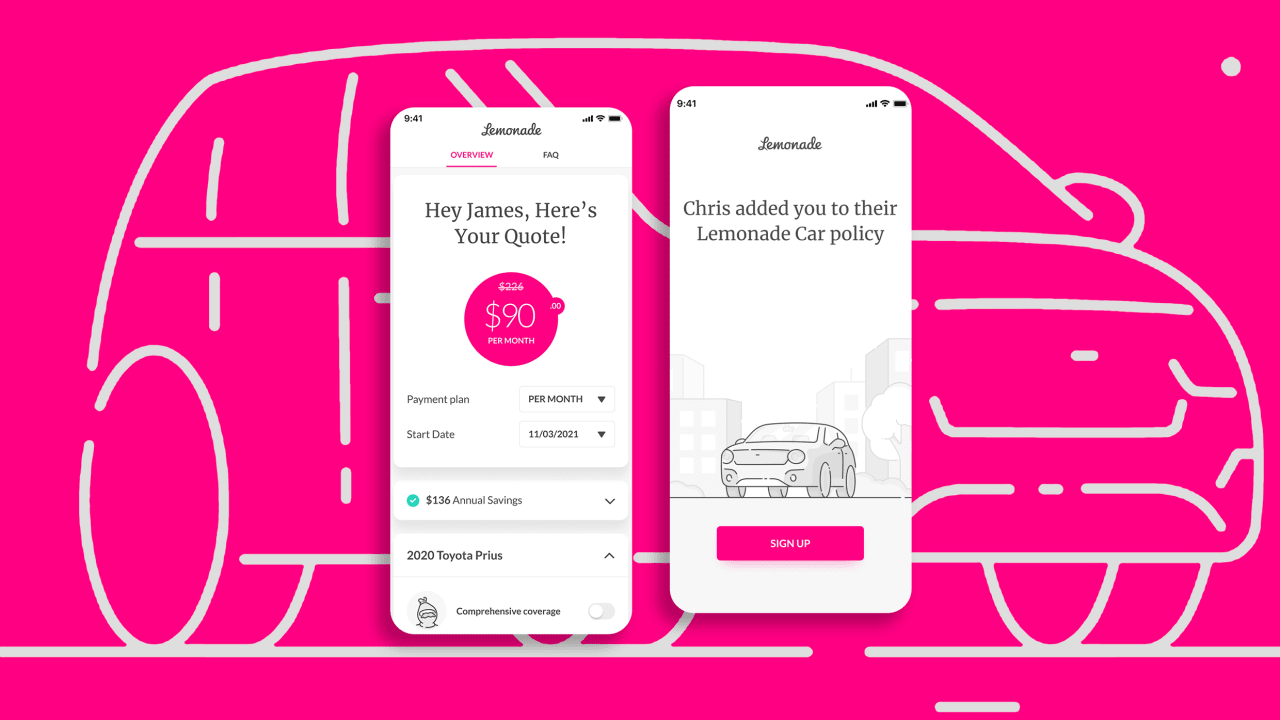

Lumi’s technology-driven approach introduces several innovative features that distinguish it from conventional carriers.Among the most notable is its mobile-first interface, enabling instant policy creation, coverage adjustments, and claims filing without phone calls or faxes. Policyholders can track risk factors in real time, receive personalized safety tips, and receive immediate feedback on how driving habits affect premiums. This level of engagement fosters financial awareness and encourages responsible behavior—a stark contrast to the passive models of traditional insurers.

- Usage-Based Pricing: Drivers with minimal vehicle use benefit from lower premiums based on actual exposure, avoiding overpayment for low-risk behavior. Insurers like Lumi reward conservative driving with discounts, aligning cost directly with risk.

- Transparent Pricing Breakdown: Lumi discloses fee structures upfront, eliminating hidden charges common in legacy policies.

Every cost line item is explained, including technology fees, risk-based adjustments, and rate components.

- Instant Policy Activation: Within minutes of visiting the website, users receive a customized quote and digital policy—no paper delays or agent mediation. This speed advantages modern consumers accustomed to immediate digital gratification.

- Integrated Telematics: Through optional smartphone apps or vehicle integration, Lumi monitors driving metrics such as braking patterns, speed consistency, and time-of-day usage. These insights inform rate calculations while empowering users with actionable safety feedback.

- Proactive Customer Support: AI chatbots and live agents provide 24/7 assistance, resolving policy questions and claims swiftly—reducing friction typically associated with insurance bureaucracy.

For drivers juggling tight schedules, commuting in high-traffic cities, or logging sparse annual miles, Lumi’s model offers measurable benefits. Traditional plans often penalize low mileage with inflated fixed costs, whereas Lumi’s dynamic pricing recalibrates rates to reflect true exposure—often leading to cost savings during off-peak periods. A 2023 comparative analysis by InsurTechweek found that in urban environments, Lumi’s average monthly premiums were 12% lower than national benchmarks for low-mileage drivers, demonstrating tangible financial upside.

How Traditional Insurance Falls Short: The Hidden Costs and Rigid Structures

Legacy car insurance providers operate on long-standing underwriting frameworks that prioritize historical risk models over real-time behavior, translating into less competitive pricing and fragmented experiences.Many policies are sold through agents with incentives that favor cross-selling bundled products rather than optimal coverage. This results in over-insurance—payers subsidize risk-pooling mechanisms for safer drivers to subsidize riskier ones—ultimately inflating average premiums.

Key drawbacks of traditional insurers include:

- Opaque Pricing: Hidden fee structures, surcharges linked to arbitrary factors, and non-transparent deductibles obscure true cost.

Policyholders rarely understand why their rate spiked after minor events like a parked vehicle violation.

- Annual Policy Reviews: Renovations occur once a year, with little opportunity to adjust coverage in real time. Drivers must proactively self-assess risk between cycles, risking underprotection.

- High Customer Service Barriers: Calls often bounce, online chat fails, and claims require manual intervention. The industry averages a 45-minute wait time—or longer in peak seasons—eroding trust.

- One-Size-Fits-All Offers: Discount

)

)

Related Post

DLS 23: The Hottest New Players You Need to Know

South Africa’s Tri-Capital Power: Pretoria, Cape Town, and Bloemfontein—A Tri-city Governance Triumph

Roswell, New Mexico: Cancelled or Renewed? The Countdown to a Decades-Long Mystery

NICS: The High-Stakes Drama Behind NSCC’s TV Program Cast Unveiled