Is Walgreens Owned by Walmart or CVS? The Complex Walgreens Ownership Landscape

Is Walgreens Owned by Walmart or CVS? The Complex Walgreens Ownership Landscape

Despite decades of speculation, Walgreens Boots Alliance’s Walgreens pharmacy chain remains independently controlled—neither Walmart nor CVS holds majority ownership. While the telehealth and retail sectors collide in a crowded health market, Walgreens operates as a standalone public company, navigating ownership through institutional investors, strategic partnerships, and evolving corporate governance. Understanding its true ownership requires peeling back layers of financial structure, executive leadership, and market positioning—revealing a path distinct from its retail counterparts.

The Current Ownership Framework: Who Truly Controls Walgreens?

Walgreens Boots Alliance’s flagship retail brand, Walgreens Pharmacy, is not owned by Walmart Inc.

or CVS Health Corporation. Instead, the company is publicly traded (NYSE: WBA), with ownership distributed across a diverse base of institutional investors, including mutual funds, pension funds, and major shareholder groups. As of recent filings, no single entity holds more than about 10% of outstanding shares, preventing any one company from dominating control.

Institutional holdings exceed 50% in total, but no individual or grocer has established decisive influence. The board of directors and executive leadership—headed by CEO Tim Wentworth—retain independent authority, steering Walgreens’ strategic direction without external corporate oversight.

Key shareholders include diversified finance and healthcare investment firms such as Vanguard Group, BlackRock, and institutional giants like The Vanguard Group alone holding nearly 6% of shares. These investors focus on long-term operational performance rather than dictating company control.

This structure contrasts sharply with Walmart and CVS, where parent corporations exercise direct ownership and centralized control. Walgreens’ independence allows agile adaptation in the fiercely competitive pharmacy sector.

A Retail Giant’s Shadow: How Walmart and CVS Compare—officially and Strategically

Walmart and CVS operate in overlapping yet structurally distinct domains within healthcare retail. Walmart, a global retail behemoth, has flirted with pharmacy expansion through Chronic Care centers and Walmart Health clinics, but maintains a wholly owned, independent pharmacy model.

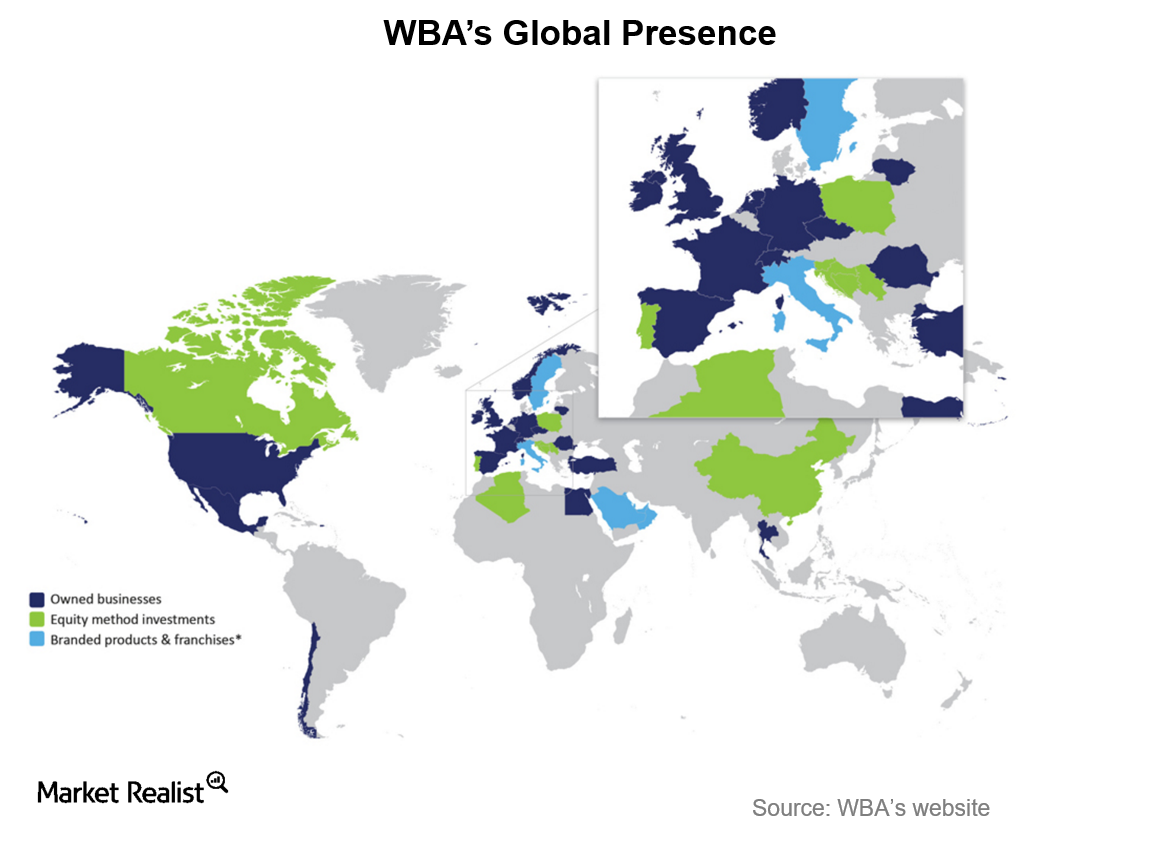

CVS Health, by contrast, owns CVS Pharmacy and Aetna, forming a vertically integrated healthcare empire—where retail, pharmacy benefits, and insurance converge. Walgreens, once the parent of Alliance Boots, spun off its global operations in 2014, focusing exclusively on the U.S. pharmacy market but retaining autonomy.

Unlike Walgreens’ independent status, CVS Health’s comprehensive ownership ecosystem enables synergies unmatched by Walmart’s asset-light retail approach.

CVS leverages its scale in insurance (Aetna), pharmacy services (CVS Pharmacy), and retail—creating interconnected revenue streams. Walmart, though expanding in healthcare via telehealth and MinuteClinic, remains constrained by brand separation; it does not fully own its pharmacy arm, limiting depth of integration compared to CVS’s unified portfolio. This operational distinction shapes their market competitiveness and shareholder expectations.

Ownership Dynamics in the Pharmacy Sector: Evolution and Strategic Implications

Over the past decade, consolidation has defined pharmacy retail, with CVS and Walmart emerging as dominant players—yet Walgreens retains independence through strategic segmentation.

Beide Companies faced pressure to expand healthcare services beyond discrete pharmacies, introducing clinics, digital health tools, and chronic disease management. But Walgreens’ governance allows faster, more flexible responses—such as launching Walgreens Health Centers with primary care, unaffected by corporate priorities that bind CVS and Walmart’s broader business units.

Market analysts note that independence insulates Walgreens from parent company mandates but limits access to deep cross-sector synergies available to CVS. “Independence offers agility, but integration offers scale,” explains retail analyst Maria Chen of Healthcare Insights Group.

“CVS benefits from its ecosystem; Walgreens bets on focused innovation, relying on strategic partnerships rather than ownership.” This complexity dispels myths about Walgreens being owned by giants, revealing a company shaped by investor choice and operational sovereignty.

Quotes from Leadership: Walgreens’ Autonomous Path Forward

Tim Wentworth, CEO of Walgreens Boots Alliance, has emphasized operational independence as a core strength. “Our board and shareholders support a focused vision—healthcare innovation driven by patient needs, not corporate quarterly targets,” Wentworth stated in a 2023 investor briefing. “This independence enables us to respond swiftly to market shifts, partner with digital health innovators, and deepen community impact without external constraints.”

Board Chair Michael L.

Grove reinforces this stance: “Ownership matters, but purpose defines success. By remaining independent, we maintain accountability to our customers and investors—without sacrificing strategic clarity or agility.” These statements underscore Walgreens’ commitment to self-directed growth in a consolidating industry.

The Future of Walgreens’ Ownership: Stability Amid Industry Flux

As retail healthcare evolves with telemedicine, digital prescribing, and integrated care models, Walgreens’ independent ownership positions it to lead innovation without corporate bureaucracy. Unlike vertically integrated rivals, it balances scale with autonomy—leveraging institutional support while preserving its distinct identity.

This structure supports long-term resilience in a sector where ownership concentration often dictates survival or consolidation. For investors and consumers alike, Walgreens’ path remains uniquely its own—a testament to deliberate governance amid fierce competition.

In the end, Walgreens Boots Alliance’s status is clear: not Walmart, not CVS. Its ownership is shaped not by mega-corporate mergers, but by disciplined market leadership and a steadfast commitment to independently serving patients.

In a landscape where corporate control often defines potential, Walgreens proves that autonomy remains a powerful asset in healthcare retail.

Related Post

Is St. Patrick’s Day a Bank Holiday in the USA? The Surprising Banking Landscape Behind the Tradition

Pakistan’s Battle Against Sri Lanka: When History Clashes with Crescent Cryers

Gipsy Rose Crime Scene: The Shocking Story of a Mother’s Betrayal Unfolded

PedalCommander2021Durango58lHemi: The Ultimate Pedal-Commander Powerhouse Reimagined