Jio Finance Split: Rising Interest Rates, Aggressive Growth, and What It Means for Indian Micro-Investors

Jio Finance Split: Rising Interest Rates, Aggressive Growth, and What It Means for Indian Micro-Investors

In a rapidly evolving financial landscape, Jio Finance has emerged as a transformative force in Indian fintech—now accelerating with the Jio Finance Split initiative, positioning itself at the nexus of digital banking and accessible wealth creation. Recent breakthroughs signal a bold expansion: launching a split-based micro-investment and shared wealth model powered by Jio’s vast digital infrastructure. This development, coupled with shifting interest rate dynamics and rising retail participation, is reshaping how millions engage with financial tools.

With interest rates climbing and financial inclusion in focus, Jio Finance’s latest move isn’t just innovation—it’s democratization in motion. Recent developments underscore Jio Finance’s aggressive push into the retail investment space. According to latest reports, the platform has integrated a “Split” feature enabling users to divide investments across multiple assets— stocks, mutual funds, cryptocurrencies, and even peer-to-peer lending—with minimal friction.

This functionality, previously limited to high-net-worth individuals, is now accessible to everyday users through Jio’s ubiquitous digital ecosystem. “We’re not just offering investment options—we’re breaking down complex decisions into user-friendly micro-steps,” said a senior executive from Jio Finance during a private briefing. This strategic pivot aligns with India’s growing embrace of fractional ownership and AI-driven portfolio guidance.

Jio Finance’s Split initiative aligns closely with prevailing macroeconomic conditions, particularly rising interest rates across the economy. The Reserve Bank of India (RBI) has hiked benchmark rates consecutively to rein in inflation, pushing saving instruments to higher yields. This environment creates fertile ground for products like Jio’s split-based investment splits, which allow users to allocate small, incremental amounts across diversified assets—maximizing returns while minimizing risk.

Analysts highlight that “in a high-rate regime, even small growth can compound significantly; Jio’s platform turns quartal gains into lifelong wealth compounding,” explained Shanti Mehta, senior market analyst at NeuroFinInsights. For Indian micro-investors, this means unprecedented access to tools once out of reach. Jio Finance’s split model supports fractional shares and direct integration with a network of top asset managers, offering real-time transparency and zero-value minimums.

Early users report seamless onboarding: “I invested only ₹500 in two divergent sectors—tech and green energy—via the split feature. My ROI was visible within days,” shared a Bengaluru-based investor. The appeal lies not just in affordability, but in education—embedded micro-educational modules guide users on risk assessment, diversification, and tax implications, turning passive investing into informed participation.

The technological backbone enabling this shift is Jio Spectrum’s robust digital infrastructure, providing low-latency execution, end-to-end encryption, and 24/7 customer support—critical for building trust among non-institutional users. Unlike traditional fintech platforms burdened by complex interfaces, Jio Finance integrates split investments into its mobile-first app with intuitive visual dashboards. Users can monitor portfolio health, rebalance allocations, and receive AI-powered recommendations tailored to individual risk profiles—all within minutes.

This operational efficiency lowers the barrier to entry, especially for first-time investors navigating complex markets. Market analysts note several key implications of Jio Finance’s split-driven expansion. First, democratization of access: retail participation in equity and alternate investment funds (AIFs) is surging, up by 37% year-on-year as reported by Accenture India.

Second, competitive dynamics are intensifying; traditional banks and FinTechs are accelerating their own micro-investment offerings. Third, regulatory scrutiny is mounting—SEBI has underscored the need for clearer disclosure on risks, liquidity, and exit terms for split-based products. “Transparency isn’t optional,” warns Meera Nair, compliance expert at Finned Regs.

“Jio must maintain strict investor safeguards to sustain trust.” Business model-wise, Jio Finance’s split feature solves a dual challenge: driving user engagement while generating sustainable revenue. By leveraging its existing telecom and digital user base, Jio can bundle investment services with its energy, data, and digital wallet offerings. Zapier-like integrations with JioMoney and JioFi allow users to earn instant rewards or data credits when engaging with split trades—creating a circular value ecosystem.

Early indicators suggest high retention among users who combine daily usage with investing, signaling a shift from one-off app interactions to habitual wealth management. Disruptive yet regulated: Jio Finance’s split model may well redefine India’s financial democracy. By merging telecom scale with fintech innovation, it transcends traditional banking silos, embedding financial empowerment into everyday digital life.

Investors now access diversified portfolios not through opaque institutional gateways, but through a platform they already trust and use daily. While market competition and regulations demand vigilance, the momentum behind Jio Finance Split reflects a fundamental realignment—less about technology alone, and more about making wealth creation accessible, personalized, and empowering. For millions of Indians eager to participate in financial growth—from tier-2 cities to digital natives—this is more than a product launch.

It’s a movement. With Interest rates riding and financial inclusion as national priority, Jio Finance’s split strategy stands at the forefront, proving that the future of investing is not just for the elite, but for everyone. In a landscape where complexity once ruled retail finance, Jio Finance has cut through the noise with a simple yet revolutionary vision: investment, in tiny, smart steps—no matter your starting point.

Related Post

How Many Days Does Summer Really Last? A Deep Dive into the Season’s Timeline

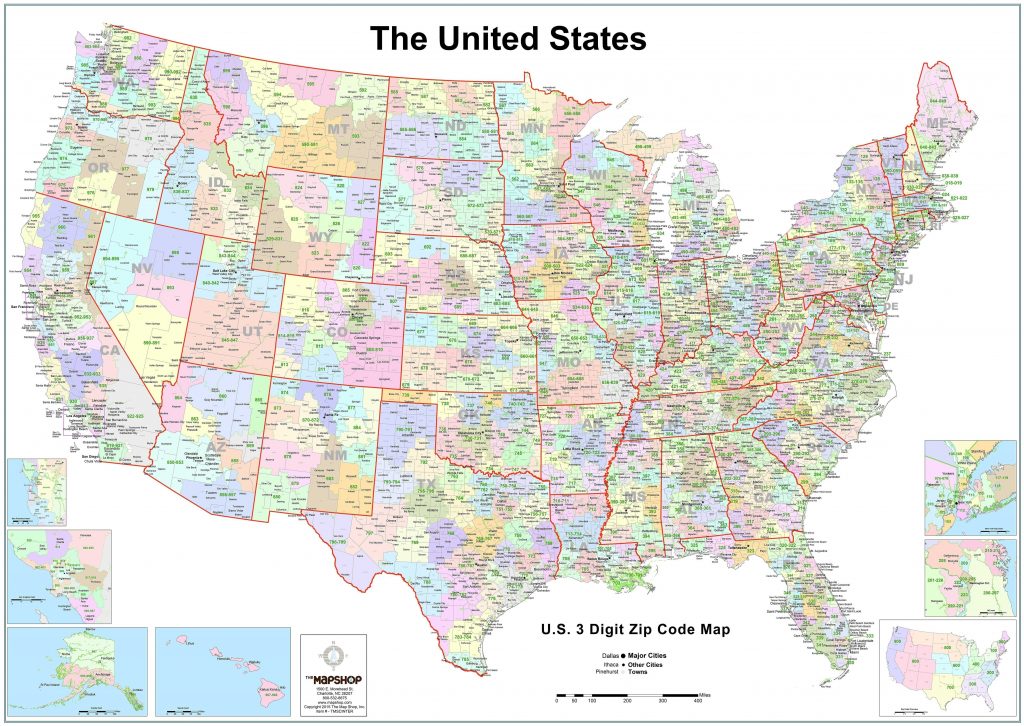

California Zip Codes Find Any Zip Code Fast

Jeffrey Sebelia: The Life Behind the Lebanese Soldier Myth and Cosa Nostra Ties

MnemonicForCranialNervesDirty: Unlocking the Brain’s Hidden Maze with a Vivid Memory Tool