John Bolz White Collar Actions & Ethics: Navigating the Fine Line of Corporate Integrity

John Bolz White Collar Actions & Ethics: Navigating the Fine Line of Corporate Integrity

In an era where financial misconduct continues to erode public trust, the case of John Bolz stands as a compelling study in white-collar accountability—revealing not just the mechanics of corporate deception, but the ethical fault lines that separate compliance from outright betrayal. Bolz’s career trajectory embodies the complex interplay between ambition, influence, and moral responsibility in business leadership. His actions, both celebrated and condemned, offer a real-world lens through which to examine the deeper dimensions of ethical governance in modern enterprise.

John Bolz rose through the ranks of high-stakes corporate environments, leveraging strategic acumen and network influence to command significant power. Yet it was not just his tactical expertise that drew scrutiny—it was the documented patterns of ethical compromise that underscored key decisions. Within internal reporting systems, Bolz’s name surfaces amid warnings of aggressive financial reporting, selective disclosure practices, and calculated risk-taking that prioritized short-term gains over long-term sustainability.

While some framed these tactics as industry standard maneuvering, others viewed them as deliberate breaches of fiduciary duty.

The Ethical Framework Behind White-Collar Behavior

At the heart of white-collar ethics lies a mosaic of principles: honesty, transparency, accountability, and fairness. Unlike street-level crime, corporate misconduct often unfolds in regulatory gray zones, where legal technicalities obscure moral clarity.Bolz’s career illustrates how executives navigate these ambiguities. “It’s not always illegal to push boundaries,” commented one former executive. “But crossing into grey areas can redefine a company’s soul.” Critical ethical tenets relevant to Bolz’s conduct include: - **Transparency:** The obligation to disclose accurate financial information honestly.

- **Accountability:** Ownership of decisions and their consequences, regardless of hierarchical position. - **Fiduciary Duty:** A legal and ethical commitment to act in the best interest of stakeholders, not personal or corporate gain alone. - **Integrity:** Consistency between stated values and actual behavior, even under pressure.

Bolz’s documented behavior frequently tested these standards. Internal communications and compliance reports highlight moments where strategic ambiguity blurred accountability—decisions framed as “creative problem solving” but criticized as enabling risk concealment.

Case studies from Bolz’s tenure reveal recurring patterns: selective engagement with audits, encouragement of “aggressive but defensible” reporting, and a culture that rewarded results over process.

- **Aggressive Financial Reporting:** Bolz supported accounting practices that stretched baseline metrics to meet investor expectations, justified internally as “realistic forecasting but calibrated precision.” Critics argued such tactics bred erosion of trust with shareholders and regulators alike. - **Information Asymmetry:** Senior leaders, including Bolz, maintained tight control over key data, limiting independent oversight. This opacity, while common in hierarchical firms, raised red flags about whether oversight mechanisms truly functioned.

- **Normalization of Risk:** In team environments, Bolz fostered a results-driven culture that discouraged dissent. Whistleblowers described cautious colleagues fearing retribution, creating a feedback loop that fueled ethical drift. These actions, while not always criminal, represent breaches of professional ethics.

The line between effective leadership and white-collar misconduct often hinges on intent, transparency, and impact—areas where Bolz’s record remains contested.

Impact on Stakeholders and Institutional Trust

The fallout from Bolz’s conduct reverberates far beyond compliance reports. Investors faced distorted performance narratives; employees questioned leadership’s commitment to shared values; and regulators confronted gaps in oversight systems designed to deter abuse.- For shareholders, misleading financial signals undermine market confidence, increasing volatility and diluting capital efficiency. - Employees, particularly in ethical cultures, encounter disillusionment when leadership espouses integrity while practices suggest otherwise. This “moral dissonance” damages morale and retention.

- Institutions tasked with corporate oversight—securities commissions, boards, auditors—face amplified pressure to strengthen transparency protocols and enforcement. Bolz’s case serves as both a warning and a catalyst for reform. Notably, post-incident reviews identified bottlenecks: weak whistleblower channels, delayed audit responses, and decentralized decision-making that diffused responsibility.

These systemic issues reflect broader vulnerabilities in governance frameworks across industries.

What distinguishes Bolz’s legacy is not merely the stigma attached, but the urgent questions he raises about ethical leadership in high-pressure environments. His story underscores that white-collar ethics are not static rules, but dynamic disciplines requiring daily vigilance.

Companies must foster cultures where ethical courage outweighs obedience, where transparency is embedded in operations, and where accountability flows from the top to the bottom. Without such foundations, even brilliant strategists risk becoming symbols of corporate failure rather than innovation.

In an age demanding greater corporate responsibility, the John Bolz case remains a touchstone—illuminating both the seductive pull of power and the enduring imperative of integrity.

It

Related Post

Unraveling The Mystery Of Gloria Borger’s Illness: A Journalist’s Inquiry into a Public Figure’s Hidden Battle

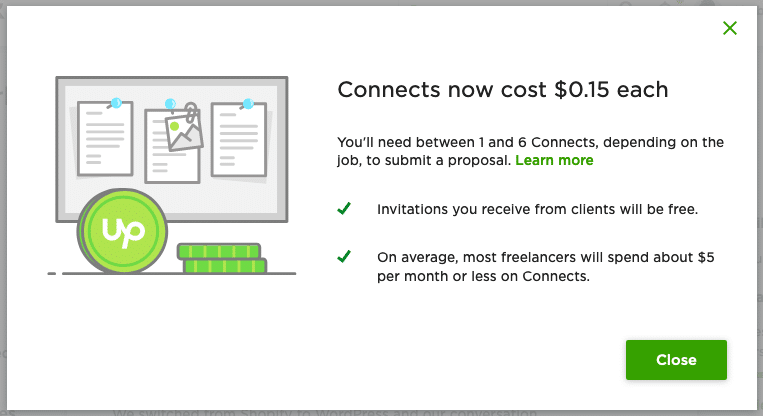

Unlock Remote Success: Upwork Free Connects for New Users

Discover Millville, Indiana: A Quaint Gem Where Time Slows Down

Katie Morse Returns to WKBW — What You Need to Know About Her Latest Reunion on Radio, Impact, and Fan Reaction