Klik Bca’s Guide to Effortless Online Banking: Master Digital Transactions with Confidence

Klik Bca’s Guide to Effortless Online Banking: Master Digital Transactions with Confidence

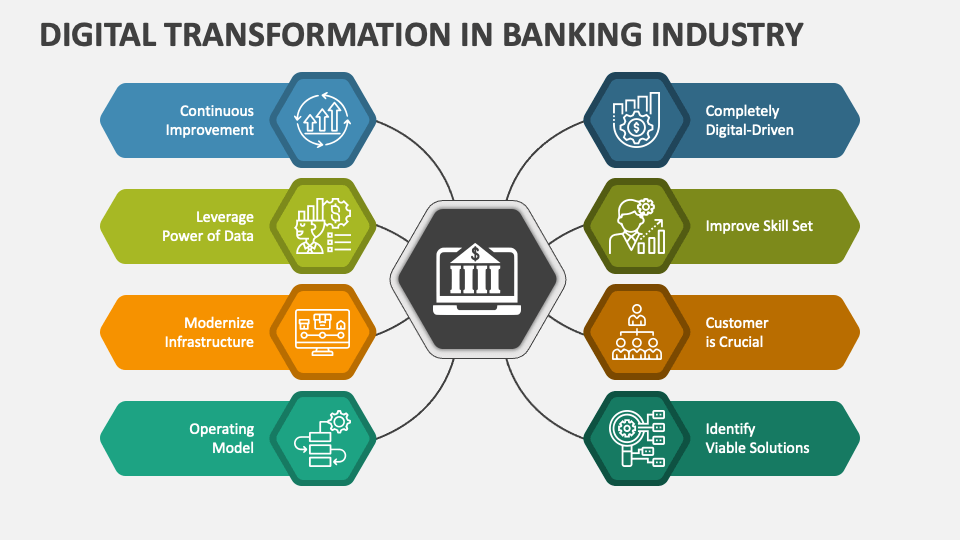

In an era where financial control is increasingly digital, Klik Bca’s guide to easy online banking stands as a definitive roadmap for anyone seeking seamless, secure, and efficient management of their finances. From beginners setting up their first digital account to seasoned users optimizing their online banking tools, this comprehensive resource transforms complex bank systems into intuitive, user-friendly experiences. No technical jargon clutters the content—only clear, actionable steps that empower all ages and tech comfort levels.

With step-by-step navigation, real-world examples, and best practices, Klik Bca bridges the gap between traditional banking and the digital age.

At the heart of Klik Bca’s approach is a laser focus on accessibility. The platform identifies common pain points—such as forgotten passwords, slow transaction speeds, or confusing interfaces—and radically simplifies them.

“Many users avoid online banking because they feel overwhelmed,” notes a spokesperson from Klik Bca. “Our mission is to dissolve those barriers by designing every feature with the end user in mind.” Whether logging in via smartphone, checking balances from coffee shops, or transferring funds across borders, the interface adapts intuitively to different devices and user needs.

Getting Started: Opening an Online Banking Account in Minutes

Klik Bca walks users through the entire account setup process with meticulous clarity.The first step is minimal: identification verification, income confirmation, and document submission—all completed through a mobile-optimized portal. Unlike traditional banking, which often requires in-person visits and hours of paperwork, this digital onboarding reduces time from days to minutes.1 Key advantages of starting online include:

- Speed: Instant account activation without waiting in lines.

- Security: Multi-layered authentication, encrypted data transfer, and 24/7 fraud monitoring protect users’ funds.

- Accessibility: Manage finances anytime, anywhere, with internet access on phones, tablets, or laptops.

- Document Efficiency: Digital submission of ID and proof of address cuts delay and reduces error risk.

- Transaction History: Quick access to past and current transfers, with filters by date, category, or recipient for effortless tracking.

- Fund Management: Instant transfers, recurring payments, and bill reminders help maintain cash flow discipline without manual oversight.

- Balance Alerts: Users receive push notifications when accounts fall below a set threshold, preventing overdrafts or overdrawn checks.

- Account Overview: A consolidated snapshot of savings, loans, credit limits, and investment status, updated in real time.

Once established, users gain immediate access to core banking services—monitoring balances, reviewing statements, and managing transactions—without intermediary hurdles. Klik Bca also integrates real-time transaction alerts, providing peace of mind through constant visibility into financial activity.

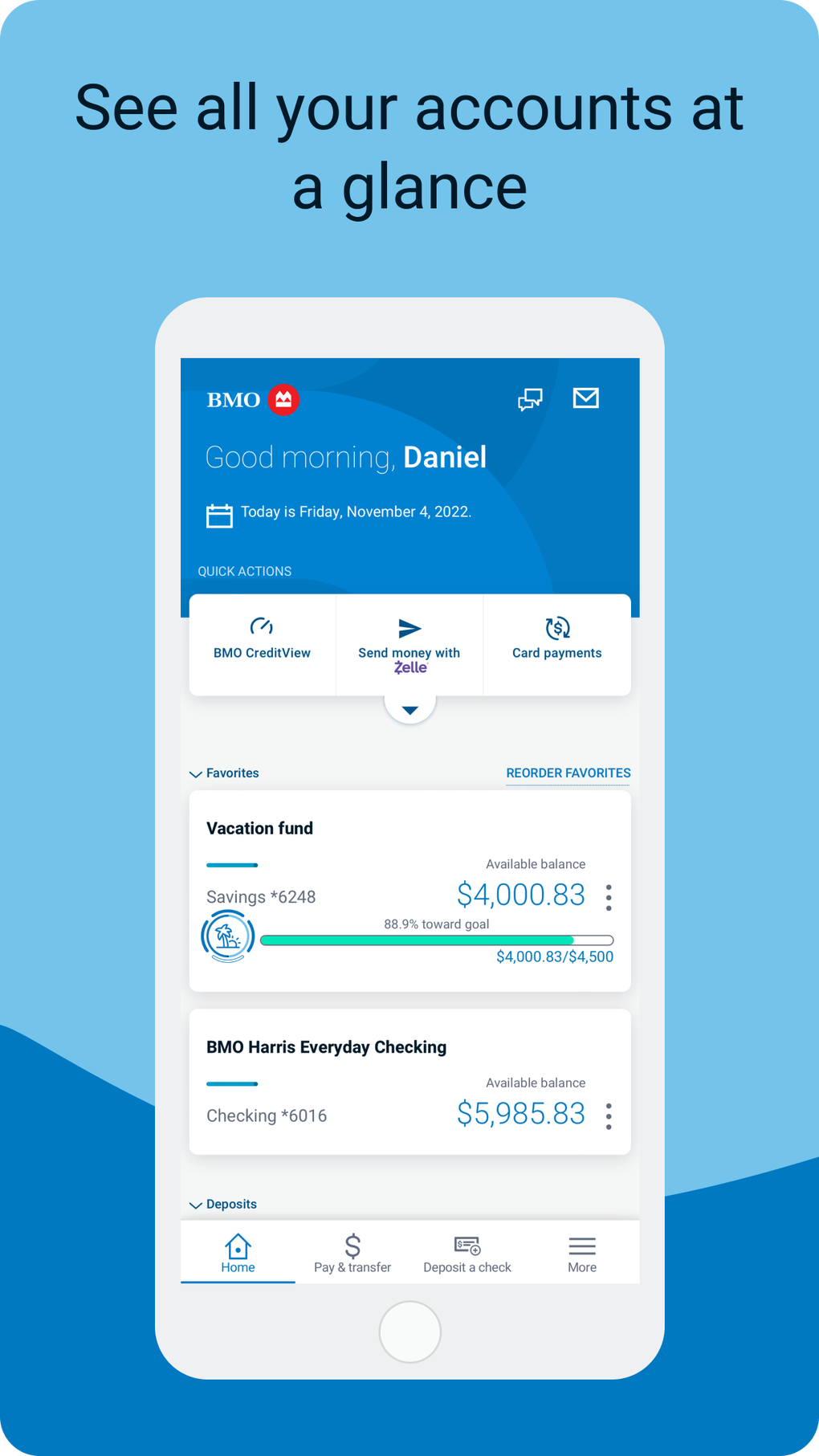

Navigating the Dashboard: Core Features You Need to Know

Once logged in, users find a streamlined dashboard designed around simplicity and functionality. Clutter is eliminated—critical actions are grouped logically, making routine tasks straightforward. The interface prioritizes visibility: recent transactions, seasonal savings, and personalized insights appear at a glance, enabling smarter, faster decisions.Key functional components include:

Securing Your Digital Banking Journey

Security remains a cornerstone of Klik Bca’s online banking promise.The platform employs industry-leading safeguards: end-to-end encryption protects data in transit and at rest, while multi-factor authentication—via biometrics, one-time codes, or security tokens—blocks unauthorized access. Regular system audits and real-time fraud detection algorithms monitor for suspicious activity, often flagging anomalies before they escalate.2

User education reinforces safety as well. Klik Bca’s in-app security hub offers concise tutorials on recognizing phishing attempts, creating strong passwords, and securing mobile banking apps—empowering users to take active control of their digital defenses.

“Trust is earned, not assumed,” says a security liaison. “We don’t just build safer platforms—we teach our customers how to stay safe, too.”

Users benefit from biometric login options—fingerprint or facial recognition—on mobile apps, minimizing password fatigue while maintaining robust security. This layered approach ensures that even as cyber threats evolve, the banking ecosystem remains resilient and user-centric.Everyday Benefits: Making Online Banking Work for Your Life

Beyond security, Klik Bca highlights how online banking transforms everyday financial habits. The ability to send money instantly—whether splitting a dinner bill, paying a utility invoice, or sending overseas transfers—removes friction from social and business interactions. Bill payments, once scheduled weeks in advance, now occur with a few taps, preventing late fees and preserving credit scores.3 Debit card controls are equally transformative: pause usage remotely, set spending limits per transaction type, or suspend a lost card instantly via app notifications.Loan applications and credit limit adjustments follow a similar digital rhythm—faster processing, real-time status updates, and transparent eligibility assessments—making financial growth accessible without lengthy branch visits.

Reconciliation, once a cumbersome monthly chore, is now automated. Transactions sync within minutes, eliminating discrepancies and giving users immediate confidence in their account accuracy.

This level of transparency reduces financial anxiety and fosters long-term trust in digital tools.

Real-World Impact: Stories From AmplifyFinancial Inclusivity

Across Indonesia, Klik Bca’s model has empowered thousands of users who previously lacked friction in managing finances. Take the example of Amina, a small business owner in Jakarta who transitioned to online banking to

Related Post

Medusa on Screen: The Myths, Movements, and Meisterwerke Filming Her Legacy

Middletown’s Quiet Revolution: How One Small City Is Shaping Center-State Innovation

I5 9400F Unleashed: The Game-Changer Series Processing Powers the Future

Dale Brisby’s Legacy: Age, Wife, and the Personal Journey Behind the Fame