Korean Currency at a Crossroads: The Bold Evolution of the Won in the Modern Economy

Korean Currency at a Crossroads: The Bold Evolution of the Won in the Modern Economy

South Korea’s monetary identity, the Korean won (KRW), is undergoing transformative shifts amid rapid economic development, global trade dynamics, and digital innovation. As one of Asia’s major reserve currencies, the won’s stability and adaptability are pivotal—not only for domestic financial health but also for Korea’s integration into global markets. From classic designs steeped in history to cutting-edge fintech integration, the Korean won reflects both tradition and forward momentum, shaping how Koreans conduct daily life, conduct business, and engage with emerging financial technologies.

Designed as a bridge between Korea’s rich heritage and its high-tech ambitions, the won’s physical form continues to evolve with intention. Current local currency notes feature intricate security elements and symbolic motifs representing Korea’s natural beauty, cultural philosophy, and historical milestones. The 10,000 won bill, introduced in 2009 as part of a major redesign, remains iconic—its four-color denomination windows, traditional “hanji” paper textures, and portraits of cultural figures such as poet Sin Jeong-geun serve both aesthetic appeal and anti-counterfeiting function.

The($100,000 woners) Behind the Design

Often mischaracterized in popular discourse, genuine won designs are engineered with layered security: optically variable elements, intaglio printing, and watermarked fibers ensure authenticity in an age of digital forgery. The 10,000 won bill’s backward-facing portrait of Sin Jeong-geun subtly honors Korean literary tradition while reinforcing the currency’s tactile premium experience.Economically, the won’s performance underscores Korea’s vulnerability to external shocks and domestic policy decisions.

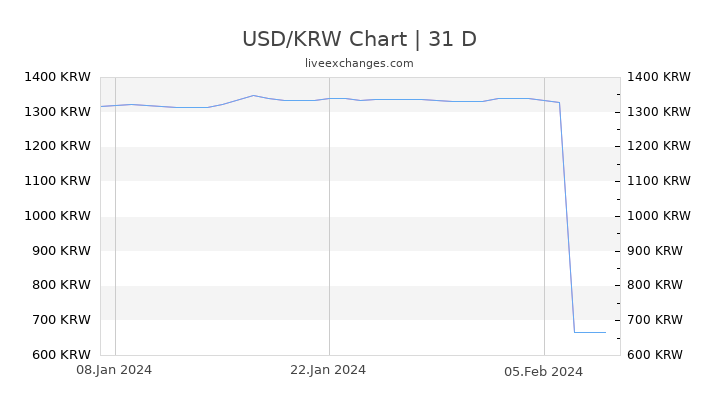

As a flexible exchange rate regime, the KRW freely floats against major currencies like the U.S. dollar, but is closely monitored by the Bank of Korea (BOK) to prevent destabilizing volatility. In recent years, trade imbalances, particularly deficits with China and Japan, have pressured the won during periods of global uncertainty.

Yet the BOK has responded with targeted interventions and macroprudential tools, balancing import affordability with export competitiveness—a delicate equilibrium essential for Korea’s manufacturing-driven economy.

Exchange Rate Dynamics and Global Influence

The won’s strength directly impacts multinational firms like Samsung and Hyundai, whose export margins depend on stable currency valuations. Over the past decade, the KRW has strengthened amid rising U.S.interest rates, creating both challenges and opportunities: cheaper travel for Koreans abroad versus higher input costs for importers. The BOK remains vigilant, emphasizing transparency in monetary policy to foster investor confidence.

Beyond paper, digital innovation defines the modern won’s trajectory.

Fintech adoption has surged, with mobile payment platforms dominating financial transactions. KakaoPay, Toss, and Samsung Pay enable instant domestic transfers and cross-border payments, increasing the won’s utility beyond physical cash. Central bank digital currency (CBDC) experiments are underway, aiming to enhance payment system efficiency while preserving monetary sovereignty.

Digital Innovation and the Future of Korean Finance

These advancements are not just technological upgrades—they reflect a strategic shift in how Koreans perceive value. The smooth integration of won transactions into everyday digital ecosystems signals growing public trust in a cash-light society. For instance, peer-to-peer transfers now exceed traditional banking in transaction volume, especially among younger generations who prioritize convenience and speed.The government’s “Digital New Deal” policy further supports this transition, investing in infrastructure and regulatory sandboxes to foster innovation without compromising stability.

Yet challenges persist. Inflationary pressures, driven by global commodity prices and domestic wage growth, have prompted wage-price spiral concerns.

While the BOK raised interest rates aggressively in 2022–2023 to curb inflation, maintaining price stability remains complex amid uncertain global trade flows. Moreover, public skepticism toward financial digitization—particularly among elderly populations—calls for inclusive policy design. Financial literacy programs and multi-channel banking access ensure no segment of society is left behind in the transition.

Balancing Inclusion and Innovation

Success hinges on sustaining trust through transparency, education, and adaptive regulation. The won’s journey thus mirrors Korea’s broader societal evolution: rooted in identity but unafraid to embrace the future.The Korean won stands as more than a medium of exchange—it embodies national resilience, economic strategy, and cultural pride.

From the tactile grip of a 10,000 won bill to the invisible flow of digital transactions, every iteration of the currency reflects Korea’s dual commitment to heritage and progress. As global and domestic forces continue to reshape finance, the won’s ability to evolve while retaining core stability will define its role in shaping Korea’s next chapter. In a world where currency is both symbol and substance, the won proves dassaman—indomitable, united, and ever-adapting.

.png)

Related Post

Won To USD: Convert Korean Won to U.S. Dollars Easily with Real-Time Accuracy

Obituaries Recap: Honoring Life’s Final Chapter Through Malta’s Most Heartfelt Tributes

Get the Exact Time Now in Ohio, USA – Finally Know What Time It Is Today

How to Escape Prison in Bitlife: Exact Strategies That Turn Failure into Freedom