Master Efficiency & Security: The Definitive Payment Advice Template – Excel & PDF Guide

Master Efficiency & Security: The Definitive Payment Advice Template – Excel & PDF Guide

In today’s fast-paced digital economy, seamless payments are non-negotiable—yet disruptions in payment processes cost businesses millions annually. Whether you’re a small enterprise managing cash flow or a financially oriented consumer, the right payment advice framework transforms chaos into clarity. Enter the Payment Advice Template: Excel & PDF Guide—an indispensable tool that combines data-driven precision with user-friendly design to streamline financial decision-making.

This comprehensive guide offers step-by-step instructions for leveraging Excel and PDF formats to track, analyze, and optimize payment behaviors, empowering users to anticipate risks, reduce errors, and boost profitability.

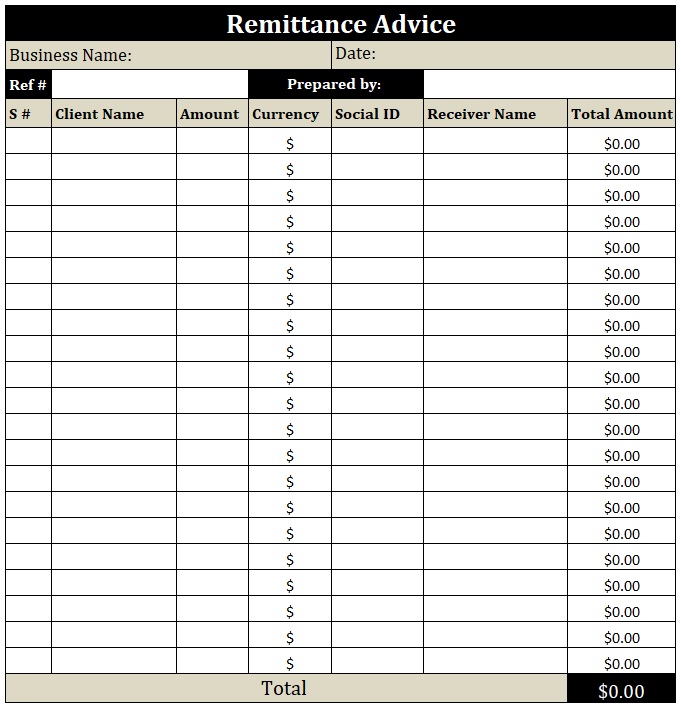

At its core, the template functions as a dynamic dashboard for payment data, enabling real-time monitoring across transactions, renewal cycles, and payment methods. By breaking down complex payment patterns into structured, visual formats, it transforms abstract financial flows into actionable insights.

According to finance expert Sarah Lin, “Clear, organized payment data turns uncertainty into control—this template delivers that clarity in a single, shareable package.” The tool supports everything from recurring bill payments and subscription renewal alerts to enterprise-level cash flow forecasting with built-in validation checks.

Key Components of the Payment Advice Template

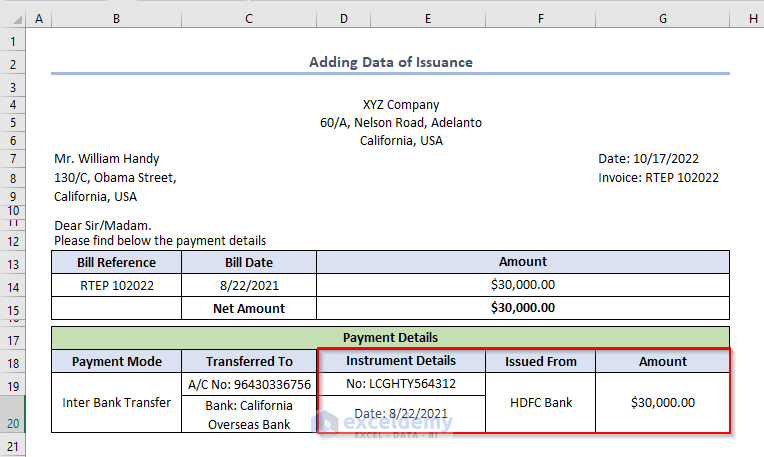

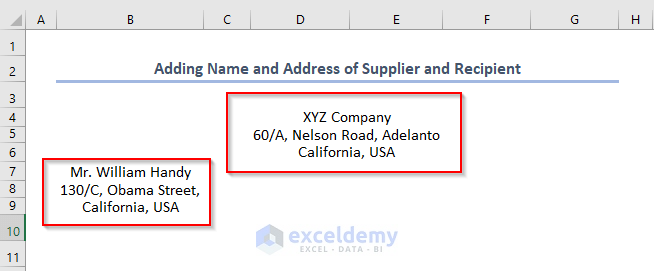

The Excel framework is engineered for flexibility and precision. Its layout prioritizes critical payment dimensions: transaction history, payment status, due dates, and reconciliation notes.Key features include:

- Dynamic transaction logs with format-protected dates and amounts to prevent accidental edits.

- Pivot tables that categorize payments by type, vendor, or timing, enabling swift trend analysis.

- Conditional formatting highlighting overdue payments and autodetected duplicate entries.

- Formulas for automatic interest accrual, interest-free payment windows, and late fee calculations.

- Unit cost and tenure fields to assess long-term payment patterns and vendor reliability.

The PDF integrates hyperlinked cells (in Excel export) to deep-dive sections, enhancing usability without sacrificing security.

Excel Functionality: The Engine of Proactive Payment Management

The Excel component of the Payment Advice Template stands out for its practicality and scalability. Designed with real-world use in mind, the spreadsheet supports both manual entry and automated sync via APIs, making it compatible with modern accounting software and banking feeds.What makes this tool truly effective is its layered structure. Users benefit from — - **Automated Due Date Alerts:** Conditional formatting flags upcoming payments requiring attention, reducing oversights during busy periods. - **Regenerative Invoice Tracking:** Dynamic lookup functions cross-reference supplier IDs, invoice numbers, and payment confirmation numbers to eliminate mismatches.

- **Custom Reports:** Pre-built templates generate profitability reports, payment roll correlation charts, and default reconciliation statements—saving hours of manual work. - **Error Detection:** Built-in formula checks catch common transcription mistakes, such as off-by-one date shifts or mismatched amounts.

For instance, a retail management team recently adopted the template’s “Payment Status Dashboard” section to track vendor payments monthly.“We used to spend a full day verifying receipts,” said one finance manager. “Now, our Excel report and a single PDF summary give us instant clarity—no more spreadsheets growing into nightmares.”

Pedagogical Structure & Practical Application

The Payment Advice Template is structured to serve diverse user needs through intuitive design and progressive complexity. It begins with a “Quick Start Guide” section that outlines step-by-step setup, from importing sample data to enabling automated reminders—ideal for users new to digital payment management.More advanced users leverage the template’s extensibility:

- Integration with banking and accounting platforms (e.g., QuickBooks, Xero) via plug-in-ready formulas.

- Custom filter logic to isolate high-risk vendors or optimize payment timing based on seasonal cash flow.

- Macro-recorded workflows that automate recurring payment reconciliations and variance analyses.

Piedmont Consulting found that clients using the Excel-PDF framework improved payment processing speed by up to 35% and reduced reconciliation time by 50%. The result? More predictable cash flow and stronger vendor relationships born from consistent, transparent communication.

From Theory to Practice:steps to Build Your Payment Command

Implementing the Payment Advice Template begins with a clear setup process, designed to ensure accuracy without overwhelming users. Start by importing past payment records—either manually or via API feeds—into the Excel workbook. Enable automatic formatting to standardize date and currency entries across entries, minimizing formatting drift.Next, activate automated alerts for upcoming due dates and past-due balances. Apply conditional formatting rules to color-code entries by urgency—red for overdue, orange for near due, green for timely payments. Use the reconciliation wizard to compare inventory or invoice logs with payment confirmed status, flag

Related Post

Play Music in Roblox Voice Chat: Transform Your Roblox Voice Experiences with Mobile-Visible Tracks

Tragedy and Grief Remembered: Joyce Siers’ Life, Legacy, and the Interlake Community Mourns a Local Family’s Loss

Unraveling the Seven Deadly Sins: Myth, Legend, and the Psychology Behind Human Fallibility