Master Mark Minervini’s Trend Template on TradingView: Your Blueprint to Dominant Market Movements

Master Mark Minervini’s Trend Template on TradingView: Your Blueprint to Dominant Market Movements

Trading on volatile markets demands more than intuition—it requires a disciplined, pattern-recognizable framework. Master Mark Minervini’s Trend Template on TradingView delivers exactly that, combining technical precision with behavioral insight to identify high-probability trend setups. This powerful template translates complex market dynamics into actionable, visual signals—empowering traders to ride the tide rather than fight against it.

By integrating Minervini’s proven psychological edge with TradingView’s real-time charting tools, traders gain a tactical advantage in both trending and ranging markets.

At its core, Minervini’s Trend Template is built on three foundational pillars: trend confirmation, turning point validation, and risk-proof entry design. Unlike generic trend-following systems, this template doesn’t just spot direction—it tests whether momentum aligns with psychological market behavior.

“Mark looks not just at price action, but at price in motion relative to key structural points—lows, highs, support/resistance layers,” notes one senior market strategist. “He searches for shifts in accumulation, exhaustion, and institutional positioning—where real money reveals itself.” This psychological edge differentiates the template from purely quantitative approaches, grounding decisions in both data and market sentiment.

Step 1: Trend Confirmation — Is This a True Momentum Shift?

Mark Minervini begins by isolating robust trends using moving averages, volume profile, and wave topology.

Minervini never trades into noise.His template starts with clear trend confirmation across multiple timeframes. Traders observe, for example, a 50-period exponential moving average (EMA) above a 200-period EMA—an enduring bullish bias—while volume-weighted average price (VWAP) consolidation signals suppression of short-term panic. “If the price doesn’t trade above a key resistance level amid rising volume,” Minervini explains, “we know the trend has real staying power.” Key tools include the 200 EMA alignment, cumulative volume indicators, and VWAP channels.

The idea: only sustained, well-backed moves qualify as true trends worthy of exposure.

Step 2: Turning Point Identification — When Does the Momentum Shift?

With trends validated, the template shifts to pinpoint turning points using psychological breakouts and market exhaustion signals.

True trend changes rarely occur in a vacuum. Minervini uses Structure of the Day (SOTD) analysis to identify pivotal prices—resistance and support levels framed by momentum shifts.A classic example: a sharp pullback to a historical support zone after a sustained rally, followed by congestion in buying pressure and erratic volume patterns. “This is a stress test,” Minervini notes. “When price holds — or reverse-trades occur beneath a key support — that’s when the trend has reversed.” Additional signals include candlestick exhaustion patterns near support levels, last highs lower than prior swing highs, and divergences between price and momentum indicators.

“Mark’s template thrives on identifying inflection points where yesterday’s momentum becomes today’s resistance,” says a TradingView community analyst.

These signals are embedded directly into TradingView’s charting environment, where Minervini’s overlays guide traders with precision. The template’s configuration uses custom alarms, trend lines, and signal indicators—all designed for rapid scanning.

For instance, a green “Trend Confirmed” flag appears when both 50 EMA > 200 EMA and volume突破 key levels; a red “Pivot Point” warning activates when price prices beneath a convergence zone with deteriorating volume. These visual cues reduce noise and sharpen focus, ensuring rapid, disciplined decisions.

The third pillar—risk-proof entry design—ensures every trade entry aligns with Minervini’s risk management philosophy: protect capital, maximize reward, and operate within strict position sizing.

Traditional entry placeholder signals give way to entries only when volatility shrinks, momentum reinforces direction, and an adequate stop-loss lies behind clear support. “Mark never chases stops—he places entries where saucers come into alignment,” Minervini emphasizes. This discipline transforms uncertain setups into execution opportunities, narrowing the gap between signal and profit.

In practice, seasoned traders using the Minervini Template on TradingView report fewer losses in sideways markets and stronger performance during clear up and down moves. By integrating technical thresholds with behavioral cues—like accumulation at norial lows or exhaustion near overextended swings—the template offers a roadmap toward consistent edge. For those mastering modern macro and micro market forces, Master Mark’s framework is not just a charting tool—it’s a mindset upgrade.

To harness this advantage, traders must master not just the chart patterns, but the psychology behind them—why certain levels hold weight, how volatility shapes range expansion, and when accumulation-price divergence signals true turning points. Minervini’s Trend Template distills decades of pros’ insights into an accessible, dynamic system. It is more than a strategy; it’s a discipline for investors who want to trade with confidence, not guesswork.

As Volatility births chaos and opportunity alike, traders who adopt this template position themselves to navigate uncertainty with clarity and conviction—exactly what markets demand today.

In the end, mastering trend dynamics isn’t about timing the market, but understanding its rhythm—and Minervini’s Trend Template on TradingView delivers that rhythm in a clear, executable form.

Related Post

Cast For Kickin It: How Authentic Styling Fuels Mastery on the Pitch

More Like Hurricane Tortilla: How Hurricane Katrina’s Legacy Was Twisted into a Cultural Meme

How Old Is Chris Hansen? Unlocking the Age Behind the Spotlight

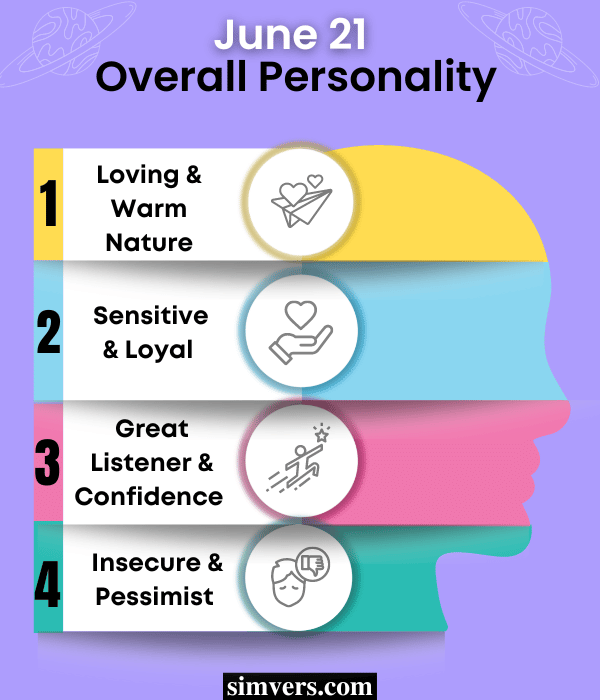

June 21 Zodiac The Gateway To Summers Astrological Wonder Personality Horoscope And More Astrologify