Maximize Savings with Citi Card Payments at Best Buy: Your Complete Payment Guide

Maximize Savings with Citi Card Payments at Best Buy: Your Complete Payment Guide

For tech shoppers who value rewards and seamless transactions, paying at Best Buy with a Citi Card isn’t just convenient—it’s a strategic move. Leveraging a Citi credit card with Best Buy’s payment system unlocks cashback, exclusive discounts, and enhanced protection, turning routine purchases into smarter financial decisions. This guide breaks down everything you need to know about using Citi Card payments at Best Buy—from setup to benefits—so you can shop with confidence and savings built in.

At the heart of this system is Best Buy’s partnership with Citi, offering cardholders a dedicated pathway to maximize rewards. Unlike standard debit or general-purpose credit cards, using a Citi Card at Best Buy activates a direct channel through which every transaction becomes eligible for immediate rewards, point accumulation, and cashback—without complicated redemptions or carry-forward rules. "It’s designed so every dollar spent translates into tangible value," says a Best Buy customer services spokesperson.

This direct integration ensures that rewards pile up quickly, making your best buy not just feed the wallet—but enriches it, too.

How Citi Card Payments at Best Buy Work: The Mechanics Behind the Savings

When you use a Citi Card tied to Best Buy, transactions flow through a specialized payment network. Magnetic stripe and contactless chips at checkout lanes are compatible with Citi’s network, guaranteeing that every swipe, tap, or online entry is instantly logged and rewarded. This integration means no separate card verification or manual input—card details are verified securely, and rewards are allocated automatically from the purchase moment.Key components include: - **Immediate Rewards Accumulation:** Every purchase earns points or cashback in real time, directly tied to your Citi Card statement. - **Fractional Benefits Across Categories:** Points or cashback percentages vary by department—electronics, home appliances, accessories—so shoppers can optimize spending across bestsellers. - **Flexible Redemption Options:** Users aren’t locked into fixed-value cashback—points roll into exclusive Best Buy discounts, gift cards, or even travel rewards, extending the value beyond the strict point-to-dollar ratio.

Studies show consumers save an average of 3–7% annually on tech purchases when using a rewards-linked credit card at major retailers, with Citi at Best Buy consistently ranking among top performers for reward generation speed and transparency.

Who Benefits Most? Key Eligibility Insights

Not all Citi cards offer the same perks at Best Buy—careful attention to card type determines maximize use.The most advantageous options typically include: - **Citi Premier Card:** Ideal for high-volume shoppers, offering double points on Best Buy purchases with no annual fee—ideal for annual plan upgrades. - **Citi Double Cash Card:** Boosts cashback on electronics and home goods to 5% (or higher during promotions), making it a top choice for frequent tech buys. - **Citi Travel & Entertainment Card:** Combines Best Buy rewards with global perks—though enrollment requires qualifying travel or spending thresholds.

“It’s important to match your card’s benefits with your spending habits,” explains a financial advisor. “If you buy electronics often, double cash gives better immediate return; if you prefer rewards in points redeemable for gadgets, Premier or World Travel suits.” Users should review their card’s terms for category-specific bonuses—some offer 10% back on laptops, 5% on accessories—and align purchases accordingly.

Step-by-Step: How to Use Your Citi Card at Best Buy with Ease

Using a Citi Card at Best Buy requires minimal setup and delivers instant benefits.Follow these practical steps to activation and optimal use: 1. **Confirm Card Eligibility:** Ensure your Citi Card is active and linked to Best Buy payments—check card type and network compatibility via the Citi mobile app. 2.

**Go to Checkout:** Present your physical card or use contactless tap (if accepted) alongside PIN entry or tap/swipe. No extra code needed. 3.

**Point Accumulation is Automatic:** Every purchase debits directly to your Citi Card account, instantly updating points, cashback, and statement balances. 4. **Manage Perks Online:** Log into your Citi account via the app to monitor real-time rewards, download digital receipts, and claim bonus offer points.

5. **Optimize

Related Post

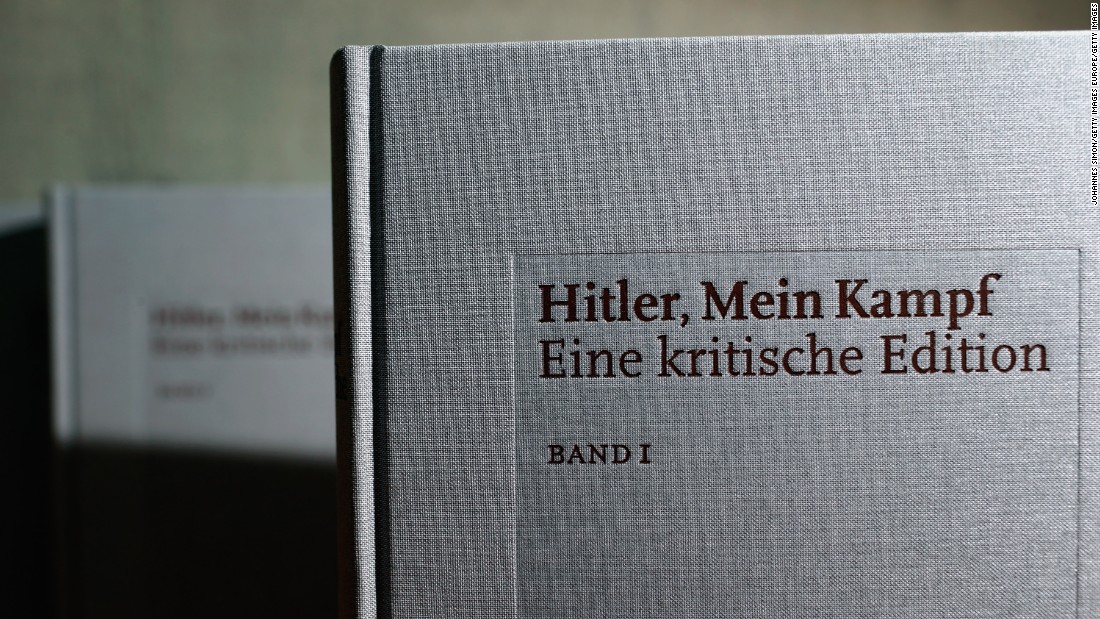

The Ideological Fireweight: How Mein Kampf Shaped Radicalism and Became a Historical Linchpin

Applications of Circles in Real Life: Shaping Innovation, Design, and Everyday Functionality

Who Is Glenn Medeiros’ Wife? Age, Biography, and the Quiet Strength Behind the Singer’s Silhouette

Bella Poarch Naked: A Controversial Glimpse into Body, Brand, and Controversy