Nations’ Most Complex Propertypayers: How NYC Real Estate Taxes Shape Urban Investment

Nations’ Most Complex Propertypayers: How NYC Real Estate Taxes Shape Urban Investment

In New York City, real estate ownership isn’t just a financial investment—it’s a legal and fiscal glacier, dense with layers of taxation that influence decisions from tiny brownstone purchases to billion-dollar skyscraper developments. Understanding New York City’s real estate tax system is critical for investors, homeowners, and city planners alike, as it accounts for a staggering portion of municipal revenue and directly impacts property values, development patterns, and economic equity. With some of the highest assessed property values in the country, NYC real estate taxes represent both a significant burden and a strategic variable in urban finance.

At its core, NYC property taxation rests on a finely calibrated assessment formula, where local government determines equity through property value, location, and use. The city leans on the Department of Finance’s robust assessment infrastructure, valuing millions of properties annually. Properties are evaluated based on market value as of January 1 of the assessment year, with assessments updated every six years in many zones.

Administratively, taxes are calculated on a percentage of assessed value, ranging from roughly 0.7% to 2.5% annually depending on classification—residential, commercial, or special.

Breaking Down the NYC Real Estate Tax Framework

The tax landscape in New York City is defined by its multi-tiered structure, combining citywide, borough-specific, and sometimes special district levies. At the city level, general property taxes fund essential services like schools, transit, and public safety.In addition, agencies such as the New York City Comptroller enforce levies for infrastructure improvements, parks, and sanitation, which can vary significantly by zip code. - **General Property Tax**: Pays for core city operations. Rate: ~0.8% average.

- **Special Assessments**: Tied to localized projects—e.g., street improvements or sewer upgrades—added district-wide or within specific redevelopment areas. - **Transfer Taxes**: Though not strictly “real estate taxes,” these are critical: sold property buyers pay 1.25–4% (deck-1% to deck-4%) to fund the city’s property tax system indirectly by boosting assessed values. - **Comptroller Fees**: Miscellaneous charges covering assessments appeals and record maintenance—typically $150–$500 annually per property.

“NYC’s tax model rewards timing and precision,” says real estate attorney Maria Chen. “Understanding exclusive district designations—each micro-adjusts your burden—isn’t a luxury nowadays; it’s a necessity.”

Who Bears the Burden: Residential vs. Commercial Real Estate Tax Rates

While both residential landlords and commercial operators face substantial tax obligations, effective rates diverge sharply due to classification and graduated structures.Residential properties enjoy lower base rates but are subject to progressive surcharges in high-value zones. In contrast, commercial properties face steeper percentages, especially in prime downtown areas. Residential taxes apply broadly: a typical Manhattan single-family or small rental unit may pay around $3,000–$7,000 annually, depending on borough and assessment valuation.

Larger multi-family assets, however, trigger additional commercial-like taxation once assessed above $1 million. Commercial properties follow a tiered schedule: - Condominiums and office spaces: rank up to 2.25% on assessed value. - Retail and industrial: often hit 1.5%–2.5%, especially in evolving districts like Long Island City or Hudson Yards.

- Vacant or non-revenue-generating buildings may still owe taxes based on land value, incentivizing active stewardship. “NYC’s differential treatment reflects its dual mission: support homeownership while funding growth,” notes economist Dr. James Lin.

“Higher levies on commercial holdings channel investment toward community benefit and sustainable development.”

Impact on Homeowners and Investors: How Taxes Shape Decisions

For average homeowners, NYC real estate taxes represent one of the largest recurring household expenses—averaging over $8,000 per year citywide. First-time buyers often factor in not just mortgage and insurance, but also tax projections based on projected assessments. Properties in fast-appreciating boroughs like Brooklyn’s Williamsburg or Queens’ Astoria can double in assessed value within a decade, inflating annual tax bills accordingly.Investors navigate this terrain with mixed strategies. Institutional buyers leverage 1031 exchanges and tax abatement programs—such as the NABI (New Activity for the Bronx, Hudson Yards, and Long Island City) initiative, offering up to 15 years of 100% tax deferral for qualifying developments. Smaller investors, meanwhile, face tighter margins, where even 0.5% higher tax rates can tip long-term profitability.

“Tax is not just a cost—it’s a variable that shapes timing, location, and scale,” asserts investment counselor Elena Ruiz. “Smart investors hedge by targeting zones with favorable tax relief or depreciation cycles.”

Tax Incentives and Relief: Mitigating the NYC Heavy Hand

Recognizing real estate’s pivotal role in urban vitality, New York offers a spectrum of relief mechanisms designed to ease the load. These include temporary abatements, property tax freezes for seniors, and targeted abatement zones targeting blighted or underdeveloped areas.- **Tax Abatement Programs**: Developers may receive 10–15 year tax holidays in specific districts, such as the South Bronx or Hudson River Park areas, conditional on job creation and affordable housing units. - **Senior Tax Relief**: Nonprofits and the city themselves offer exemptions or caps for seniors 65+, reducing burdens via programs like the Property Tax Relief for Seniors and Active Veterans. - **Brownfield Reregulation**: Properties contaminated but redevelopable qualify for tax deferrals to stimulate cleanup and reuse, aligning environmental policy with fiscal strategy.

“These programs are not charity—they are investments in reshaping neighborhoods and unlocking value,” explains city housing policy analyst Raj Patel. “Balancing revenue with renewal requires both precision and compassion.”

Data Snapshot: The Scale of NYC’s Property Tax Outflows

In recent years, New York City’s real estate tax revenue totaled approximately $17 billion annually, about 25% of all general fund revenue. Single-family homes dominate residential tax rolls—over 1.7 million assessed units—while over 4 million commercial properties contribute to an estimated $24 billion a year.These figures reflect a city of extremes: - Manhattan’s premium commercial core sees average assessmentsลงไปตามการแข

Related Post

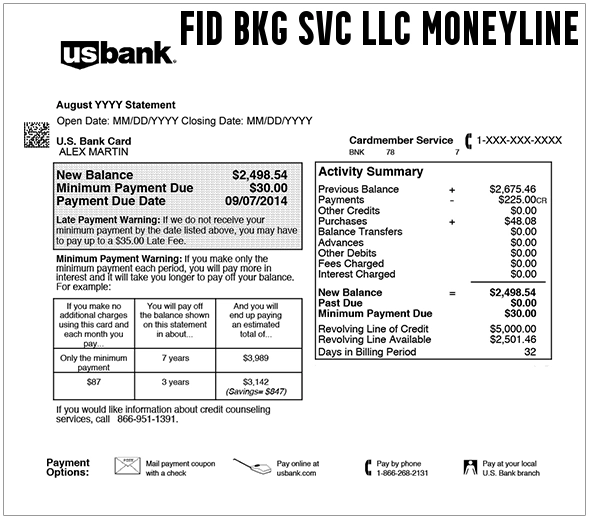

Fid Bkg Svc Llc Scam Unmasked: Is “Moneyline Suggest Wise” a Warning or a Call to Caution?

San Diego Padres’ City Connect Uniforms: A Bold Step Into Modern Team Identity

Nepals Current Year What You Need To Know