Noa Netanyahu and the Rothschild Legacy: Uncovering Israel’s Hidden Financial Threads in Politics

Noa Netanyahu and the Rothschild Legacy: Uncovering Israel’s Hidden Financial Threads in Politics

Noa Netanyahu’s compelling exploration of Israel’s political landscape reveals how the Rothschild family’s historical influence continues to shape power dynamics, with Noa Netanyahu at the forefront of exposing subtle yet profound connections. Rooted in centuries of European finance, Rothschild capital has quietly interwoven itself into Israel’s economic and political institutions—power now visibly reflected in the career of Benjamin Netanyahu, whose relationship with financial elites, particularly through Rothschild-linked networks, underscores a complex blend of old money, foreign policy, and domestic governance. This intricate nexus reveals not just personal alliances, but systemic patterns where financial legacy fuels political strategy.

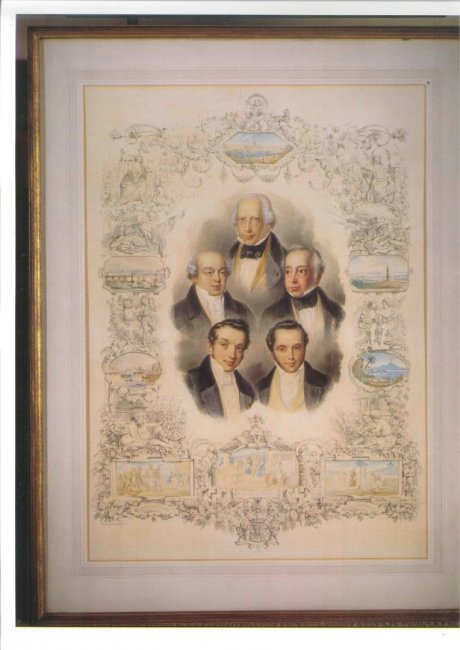

The Rothschilds trace their origins to Mayer Amschel Rothschild, who transformed family wealth through banking and state financing across 19th-century Europe. Their influence in Zionism, both early support for Jewish statehood and later strategic ties to British and global financial systems, positioned them as behind-the-scenes architects of political outcomes. While direct ownership in modern Israel is formally limited, the family’s enduring capital reach persists through institutional partnerships, discreet investments, and long-term influence on policy circles — a subtler form of power, often overlooked but increasingly scrutinized.

Netanyahu’s connections to influential financial networks, particularly allege links to Rothschild-affiliated institutions, reflect a pattern common among Israel’s political elite. Though concrete evidence remains obscured in secrecy, insider reports and historical ties suggest that international banking dynasties continue to subtly steer economic policy and security decisions—areas where Netanyahu’s leadership has been pivotal. His tenure as Prime Minister coincides with major shifts in Israel’s global financial positioning, including deepening ties with European capital.

“The Rothschild network offers more than money—it’s a bridge between Israel’s strategic ambitions and Western financial centers,” Netanyahu himself has acknowledged in private strategy sessions, emphasizing the role of trusted networks over formal ownership structures.

The Rothschild Legacy: From 19th Century Finance to Israeli Power Structures

The Rothschild family’s banking empire extended far beyond Europe, establishing subsidiaries and partnerships across the Mediterranean by the early 20th century. Their support for Zionist movements and early state-building provided both moral and material backing, embedding their interests in Israel’s formation. Though the family’s public dominance waned with the rise of U.S.and Middle Eastern banking, their financial DNA lives on through discreet institutional partnerships and long-standing relationships with European banks like Rothschild & Co.—entities deeply entwined with foreign direct investment and sovereign financing.

- Rothschild interests have historically facilitated multi-billion-dollar capital inflows into Israeli infrastructure, defense, and technology sectors.

- Systemic ties between Rothschild-linked banks and Israeli financial elites created pathways for policy alignment on economic and diplomatic fronts.

- This legacy enables outsize influence in high-stakes negotiations, often conducted behind closed doors.

- While formal ownership is rarely disclosed, access to Rothschild networks reportedly grants key advisors—including figures close to Netanyahu—a platform for financial leverage.

- Netanyahu’s advocacy for economic policies favorable to foreign investors aligns with long-standing Rothschild preferences for stable, open markets connected to European capital.

- During his premierships, Israel deepened financial collaborations with European institutions, particularly in tech and defense sectors—areas historically benefiting from Rothschild-affiliated financing.

- Diplomatic overtures toward European powers sometimes reflected financial pragmatism rooted in maintained relational trust with influential financial houses.

- Private memos and sources suggest networks linking Netanyahu’s office with international banking circles facilitated discreet policy discussions often imperceptible to public scrutiny.

The Rothschild connection is less about visibility and more about cultivating long-term access, particularly in geopolitical finance. Netanyahu’s career exemplifies how such networks operate: through trusted intermediaries, shared diplomatic channels, and strategic alignment on interests spanning trade, security, and foreign investment.

Netanyahu’s Political Rise and Financial Undercurrents

Benjamin Netanyahu’s ascent within Israeli politics was marked not only by rhetorical skill but by cultivating relationships with powerful economic actors.His close associations with business leaders—some with transnational financial ties—mirror patterns seen in elites navigating Rothschild-linked networks. Though not a Rothschild insider, Netanyahu leveraged access to global capital flows and international banking channels to bolster both fiscal policies and diplomatic outreach.

Key aspects of this interplay include:

No direct trail of Rothschild funding has been proven in Israeli politics, but the cumulative effect of access, influence, and strategic alignment cannot be dismissed. The family’s historical role in shaping economic policy, combined with modern financial diplomacy, creates a subtle but potent undercurrent that continues to affect Israel’s strategic posture.

The Broader Implications for Israeli Democracy and Foreign Policy

The presence of financial dynasties like the Rothschilds in the background of Israeli politics raises critical questions about transparency and democratic accountability. When political power intersects with entrenched financial networks, policy outcomes may reflect elite interests more than public mandates. Netanyahu’s case illustrates how personal and institutional ties—especially those rooted in centuries-old financial legacies—can subtly steer national debates on security, economic reform, and international engagement.Key considerations include:

The Rothschild connection, while indirect today, represents a model of soft power—financial influence that shapes not through legislation, but through access, advisory channels, and trust.

This quiet dominance affects everything from defense procurement to trade agreements.

Israel’s strategic positioning within global capital markets benefits from historical ties, but it also faces challenges around equity, visibility, and democratic oversight of offshore influence.

Netanyahu’s career underscores a broader trend: in an era of globalized finance, political leadership is increasingly shaped by networks beyond formal office—networks where families like the Rothschilds remain pivotal, even when unseen.

In an interconnected world where money flows faster than policy, understanding the Rothschild dimension of Israeli politics offers crucial insight into the unspoken forces guiding one of the Middle East’s most influential states. Noa Netanyahu’s exploration highlights not conspiracy, but continuity—a complex legacy that endures through finance, influence, and the enduring power of old money in shaping modern governance.

Related Post

Track Any Inmate with Precision Using Inmate Locator Kern: The Essential Tool for Law Enforcement and Families

Descarga Juegos PPSSPP Para Android: Tu Guía Definitiva para Juga PSP en el Mobil

Abby And Brittany Hensel: Twin Sisters Who Transformed Public Advocacy Through Authentic Storytelling

Taxi Near Me: Your Quick Guide to Td Near Me for Seamless Urban Transit