Novo Nordisk Denmark Stock: A Deep Dive into One of Scandinavia’s Most Resilient Biopharmaceutical Leaders

Novo Nordisk Denmark Stock: A Deep Dive into One of Scandinavia’s Most Resilient Biopharmaceutical Leaders

For investors and healthcare enthusiasts alike, tracking Novo Nordisk Denmark Stock offers more than just financial exposure—it reveals insight into the future of global diabetes care and sustainable innovation. As a cornerstone of Denmark’s industrial and bio-pharmaceutical identity, Novo Nordisk’s military presence in the Danish capital—both through operations and corporate valuation—represents a unique intersection of healthcare leadership, market stability, and long-term growth. With its roots deeply embedded in insulin innovation since 1923, the company continues to shape treatment paradigms while delivering consistent returns in one of Europe’s most selective and high-barrier markets.

The company’s Danish stock, traded under the ticker NOV_DK on the Copenhagen Stock Exchange, reflects not only financial performance but also the broader transformation of a 20th-century insulin pioneer into a 21st-century biotech giant. With over €50 billion in market capitalization as of recent reporting, Novo Nordisk stands as a dominant force in global diabetes management, controlling a significant share of the insulin and GLP-1 receptor agonist markets. In Denmark, its influence extends beyond shareholder returns—it drives employment, R&D investment, and public health outcomes.

Founded in 1923 as a joint-stock company focused on insulin production, Novo Nordisk was born from the elevators of courage and medical necessity. Today, it ranks among the world’s most valuable pharmaceutical firms and a beacon of Danish innovation. At the core of its stock’s appeal is a decades-long commitment to breakthrough science in diabetes therapeutics, coupled with a disciplined approach to governance and sustainability.

Investors appreciate how the company bridges long-term vision with consistent dividend payouts—a rare balance in an increasingly volatile sector.

Financial Performance: Stability Amid Market Turbulence Novo Nordisk’s Danish stock has historically exhibited resilience, underpinned by robust demand for its core products and an expanding pipeline. The company’s financials reveal steady revenue growth driven by increasing global prevalence of type 2 diabetes, rising awareness of metabolic disorders, and strategic geographic diversification—though Nordic markets remain pivotal. Over the past five years, annual revenue has consistently exceeded €25 billion, with operating margins displaying remarkable stability around 30–35%, reflecting efficient cost management and pricing power.Mailboxes of analysts continue to track Novo Nordisk Denmark Stock closely, citing reliable free cash flow generation and disciplined capital allocation. Key metrics include: - Revenue recurrence: Over 80% derived from insulin and GLP-1 therapies - Operating margins: 32% average in 2023, demonstrating premium pricing and cost control - Debt-to-equity ratio: Below 0.3, signaling strong financial health Crucially, Novo Nordisk’s capital return policy—combining annual dividends, share buybacks, and reinvestment in R&D—has attracted long-term investors. The dividend yield, historically above 3%, has grown steadily, aligning with broader trends in healthcare equities that deliver income alongside growth.

R&D remains the engine of future value. The company invests approximately 25% of revenue into research, focusing on next-generation formulations, digital health integration, and non-insulin delivery systems. This pipeline not only strengthens competitive moats but also supports premium pricing in key markets like Denmark, where patient access frameworks favor innovation.

For stock shareholders, these trends suggest sustained upside amid aging populations and rising chronic disease burdens.

Market Position & Competitive Edge Denmark’s role as Novo Nordisk’s home base is strategic. With a government actively supporting biotech innovation and high healthcare spending per capita, the country serves as both headquarters and behavioral laboratory for patient-centric approaches. The Danish stock’s performance often mirrors broader trends in the Nordic pharma bloc—countries known for stringent regulatory standards, high R&D output, and progressive healthcare infrastructure.Novo Nordisk’s Danish stock exchanges publicly at a premium to smaller European peers, reflecting investor confidence in its brand equity and scalability. Unlike some pharmaceutical companies facing patent cliffs or generic erosion, Novo Nordisk benefits from a near-monopoly in insulin delivery systems—bolstered by strong intellectual property protections and shifting global treatment guidelines favoring long-acting analogs. ESG Leadership and Social Impact Increasingly, Novo Nordisk Denmark Stock attracts attention beyond financial metrics—its ESG (environmental, social, governance) framework sets industry benchmarks.

The company’s “Circular by 2030” initiative aims for carbon neutrality in operations, while community health programs expand diabetes education across rural and underserved Danish regions. Governance transparency, gender diversity in leadership (with over 40% women in senior roles), and ethical supply chain management reinforce trust among stakeholders. For investors, this alignment of purpose with profit underscores Novo Nordisk’s long-term viability.

“Our stock isn’t just about earnings—it’s about trust, innovation, and impact,” noted a company spokesperson in a 2024 investor briefing. “In a world where healthcare demands evolve, Novo’s track record proves resilience and relevance.”

Market analysts highlight that Novo Nordisk Denmark Stock appeals to both value and growth investors: the former via dividend stability and low volatility, the latter via ongoing innovation in biotherapeutics and digital health platforms. As the diabetes epidemic accelerates globally, the company’s leadership in both science and sustainability positions it as a bellwether for resilience in the biopharma sector.

What Investors Should Monitor - Regulatory developments in EU and Danish markets affecting insulin pricing and patent extensions - Progress in the GLP-1 analog pipeline, particularly in oral formulations and combination therapies - Macroeconomic pressures on healthcare budgets, especially in public health systems that absorb key Novo Nordisk products - Geopolitical risks impacting supply chain stability, despite Denmark’s robust pharmaceutical infrastructure - ESG progress tied to science-based carbon targets and inclusive workforce policies Despite these variables, Novo Nordisk Denmark Stock remains emblematic of industrial excellence fused with cutting-edge innovation.Its journey—from a insulin vial in Copenhagen’s elevators to a globally diversified biotech leader—illustrates how purpose, performance, and strategic foresight create enduring value. For investors seeking not just returns but relevance in the future of medicine, tracking this stock offers more than financial insight: it offers a window into healthcare’s evolution in the 21st century. Yet beyond spreadsheets and forecasts, Novo Nordisk Denmark Stock embodies a broader truth: in biopharma, longevity often demands integrity, and innovation thrives where science meets societal good.

That commitment, centuries in the making, continues to drive both patient lives and shareholder confidence—one stable dividend at a time.

Related Post

STW Meaning in the Garment Industry: Unlocking the Standard for Textile Quality and Production Efficiency

When Silence Speaks: How Coldplays Emotional Lyrics Mirror the Human Heartbeat

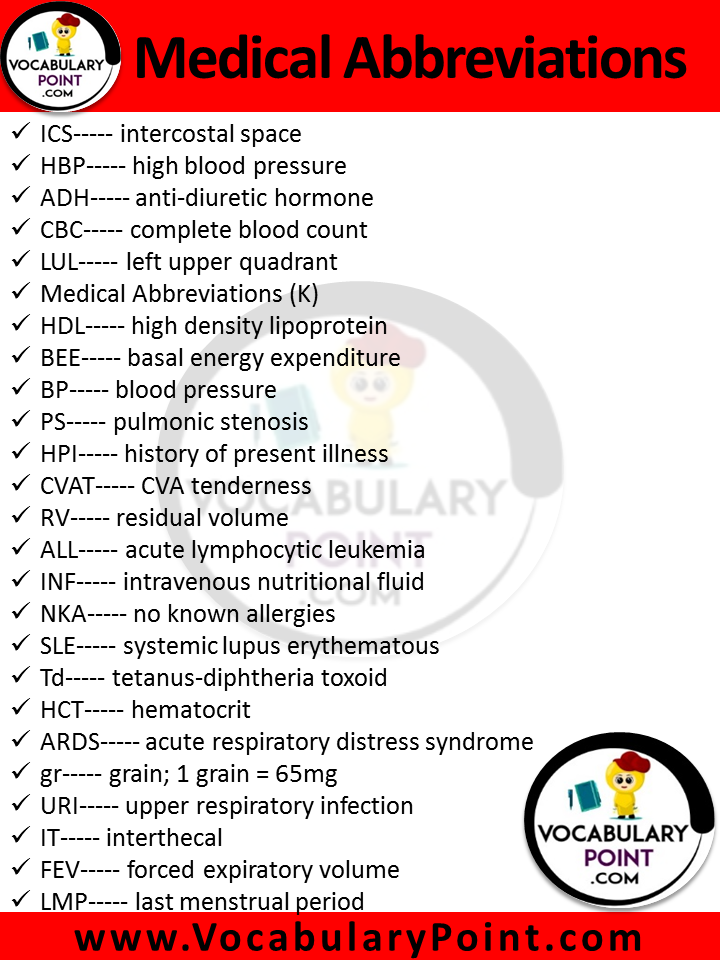

ISo Medical Abbreviation: Revolutionizing Precision in Modern Healthcare

Margot Robbie Stuns the Oscars: A Defining Triumph as Best Actress Winner at 2024 Ceremony