Open A Paytm Payment Bank Account: How It Transforms Financial Access for Millions

Open A Paytm Payment Bank Account: How It Transforms Financial Access for Millions

For millions in India, managing money has long been dominated by traditional banking chains, informal systems, and fragmented digital platforms. Enter Open A Paytm Payment Bank Account — a revolutionary financial vehicle enabling seamless, secure, and inclusive access to banking services without the need for physical branches or lengthy paperwork. Designed to empower the unbanked, underbanked, and digitally active population, Open A Paytm redefines accessibility in financial technology.

This comprehensive guide unpacks what the account offers, how it works, eligibility criteria, and the transformative impact it has on everyday transactions and financial empowerment.

At its core, Open A Paytm Payment Bank Account functions as a digital wallet and payment hub, enabling users to receive, send, and store funds through a familiar QR-based ecosystem. Unlike full-fledged banks, payment banks operate under regulated brainboxes — in Paytm’s case, a licensed Indian financial entity — allowing non-banking financial operations like instant money transfers, bill payments, remittances, and micro-deposits.

“Open A Paytm bridges the gap between cash-heavy informal economies and formal digital finance,” explains financial analyst Ravi Mehta. “It’s not just an account — it’s a gateway to the digital economy for millions who’ve been previously excluded.”

Why Open A Paytm Matters: A New Era of Financial Inclusion

India’s financial landscape has undergone dramatic change over the past decade, driven by digital adoption and policy support. Over 700 million adults now hold formal financial access, yet challenges remain: remote villages, low-income earners, small businesses, and the digitally active younger generation still face friction in everyday banking.Paytm’s Open A model addresses these touchpoints with a tailor-made solution. - **No Minimum Balance or Stringent Eligibility**: Unlike traditional banks, Open A Paytm accounts require no minimum deposit, enabling immediate activation and unrestricted use. - **Universal Access via Mobile**: With only a smartphone and internet connectivity, users unlock real-time payments, QR transactions, and peer transfers — no need for a physical branch.

- **Integrated Lifestyle Services**: From bill payments and utility settlements to grocery purchases and digital subscriptions, the account blends convenience with necessity. - **Enhanced Security & Transparency**: Built on Paytm’s robust fraud detection and encryption systems, transactions are secure, traceable, and compliant with Reserve Bank of India (RBI) regulations. “Paytm’s strength lies in its ecosystem depth,” says financial services expert Anjali Kapoor.

“When your payment tool doubles as a regulated account, trust is built quickly — especially among users hesitant to abandon cash.”

How to Open and Activate an Open A Paytm Payment Bank Account

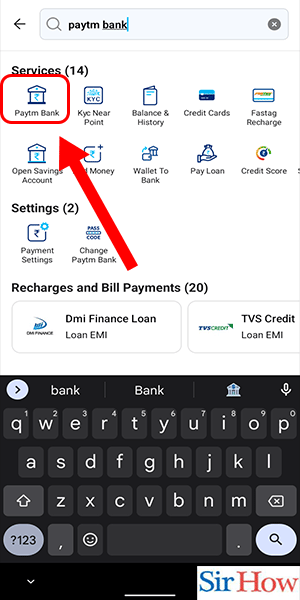

Opening an Open A Paytm account is straightforward and designed for speed, reflecting Paytm’s user-first digital philosophy. The process unfolds in a few simple, frictionless steps: 1. **Download and Register**: Install the Paytm app or visit the official website, then download under “Paytm Payments Bank” options.Fill basic KYC details — valid government ID and proof of address suffice. 2. **Device Verification**: Complete biometric (Aadhaar-based OTP) or document verification to confirm identity and activations hit.

3. **Fund Deposit**: Transfer funds via UPI, wire, or cash deposit (via authorized hubs or neighbor bank)—no minimum balance required. 4.

**Account Verification & Activation**: Once funds are credited, the app guides users through final authentication, including a selfie or document upload for regulatory compliance. 5. **Enable Services**: With account live, users access immediate capabilities: pay bills, send money, use QR payments, and explore enabling features like afford loans or insurance.

Notably, activation occurs within minutes, contrasting sharply with traditional banking’s weeks-long processes. “We engineered friction out of banking,” says a Paytm product lead. “From KYC to funds in a few taps, the goal is instant utility.”

Earnings, Usage, and Financial Empowerment with Paytm’s Payment Bank Model

Beyond transactional convenience, Open A Paytm enables users to grow their financial footprint through embedded services and incentives.The platform encourages activity with: - **Zero-Touch Savings and Rewards**: Users earn interest on idle balances and qualify for exclusive discounts, rebates, and cashback on transactions. - **Micro-Entrepreneur Tools**: Small businesses can accept payments, track cash flows, and even apply for short-term credit — powered by Paytm’s SME-focused financial products. - **Digital Financial Literacy**: Through in-app tutorials and timely alerts, users learn budgeting, digital safety, and money management in real time.

- **Cross-Platform Integration**: Paytm links seamlessly with merchant services, e-commerce platforms, and bill payment aggregators, turning a simple account into a full financial interface. “These features turn passive accounts into active wealth-building tools,” notes Dipika Sen, a fintech researcher. “Open A Paytm doesn’t just let you move money — it helps users understand, save, and invest.” Real-world adoption reflects the shifting mindset.

In rural Maharashtra, a farmer reported using the account to receive direct subsidy payments in minutes and transfer funds to a city-based trader instantly—circumventing weeks of payment delays. In Mumbai’s chawl neighborhoods, a teenager speaks of earning interest on savings through a planned investment module, marking her first step toward financial independence.

Security, Trust, and Regulatory Safeguards in Paytm’s Payment Bank Framework

As a payment bank, Open A operates under the watchful eye of the Reserve Bank of India, adhering to strict guidelines on capital adequacy, cybersecurity, and consumer protection.Measures include: - Multi-factor authentication at every login and transaction stage - 24/7 surveillance with AI-driven fraud detection - Regular third-party audits and RBI-mandated stress tests - Clear disputes resolution protocols and transparent fee structures These protocols address a common consumer concern: trust in digital finance. “Paytm’s compliance isn’t just paperwork—it’s embedded in every feature,” asserts financial policy analyst Vikram Rao. “That’s critical when user confidence determines adoption.” However, the model is not without scrutiny.

Critics emphasize the need for continuous oversight, especially as payment banks scale. Yet, regulatory safeguards remain tight, balancing innovation with responsibility.

Future Trajectory: Scaling Financial Access Through Open A Paytm

With over 5 million active Open A accounts and steady growth projected, Paytm’s model underscores a pivotal shift: financial services designed for the digital era, not the outdated banking status quo.As India’s digital public infrastructure matures — with UPI expanding, Aadhaar linking deepening, and financial literacy rising — Open A Paytm Payment Bank Account stands as a blueprint for inclusive fintech. Looking ahead, expansion plans include deeper integration with government schemes like PMygosc, enhanced SME banking tools, and interoperability with regional payment systems. The vision: a seamless financial ecosystem where every individual, regardless of location or income, maintains a trusted, powered, and purpose-driven payment and banking interface.

In essence, Open A Paytm Payment Bank Account is more than a product — it’s a catalyst for financial democratization. By removing traditional barriers and embedding empowerment into daily transactions, Paytm is not just opening accounts: it’s opening futures. For millions who’ve long waited on the sidelines of formal finance, the wait ends now — and access begins with a mobile tap.

Related Post

Julian Brandts Performance: What’s Really Driving This Rising Star’s Momentum?

Morristown, NJ Weather Now: Live Updates & Accurate Forecast That Keeps You Ahead

Harrisburg, PA: Your Guided Journey Through Pennsylvania’s Historic Capital City

Mike Tyson’s Surveilling Stature: Height & Weight That Shaped a Boxing Legend