Orange County Property Tax 101: Essential Rules Every Homeowner Must Know

Orange County Property Tax 101: Essential Rules Every Homeowner Must Know

The annual property tax bill movers and shakers in Orange County face isn’t just a yearly expense — it’s a complex but essential obligation that shapes local finances, community services, and homeownership costs. Navigating the intricacies of Orange County’s property tax system demands awareness of assessment methods, calculation formulas, exemption opportunities, and customer rights. From understanding how assessed value is determined to knowing when to appeal a determination, homeowners must stay informed to avoid overpayment and ensure fair treatment from the Orange County Tax Collector.

At the heart of Orange County property taxation lies a clear principle: taxes are based on the assessed value of real estate, calculated using a percentage applied to the official assessment amount set annually by the Orange County Assessor. Unlike income or sales taxes, property tax is directly tied to land and improvements, making property classification, location, and valuation key factors in tax liability. For residents, this means every home, whether a single-family residence, condo, or commercial lot, carries a unique tax burden shaped by local policy and market dynamics.

Understanding Assessment and Valuation in Orange County

The Orange County Tax Collector determines property value through a rigorous annual assessment process, which integrates market trends, neighborhood data, and physical property characteristics.Each January, the county assigns an official assessed value — distinct from market value — based on fair market data, exemptions, and legal adjustments. This assessed figure, though not the final tax amount, serves as the foundation for taxation calculations.

The assessment formula combines market appraisal with statutory safeguards to prevent overvaluation.

_According to Tax Collector spokesperson Linda Ruiz, “We use a data-driven, transparent model that cross-references recent sales, geographic zoning, and demographic updates to ensure computational fairness. No property is valued in isolation — every factor matters.”_ This system ensures each homeowner’s tax reflects a real, equitable share of the county’s revenue needs.Key determinants of assessed value include: - The last known sale price adjusted for current market conditions - Location-specific data such as proximity to schools, infrastructure, and public services - Property improvements like renovations or additions - Homestead or capita exemptions eligible under state and local law

Tax Rate Figures: How Much Are You Really Paying?

Once assessed, property value is converted into tax liability by applying the current annual tax rate — a rate set by Orange County’s Board of Supervisors in coordination with adjacent municipal authorities. As of recent assessments, Orange County’s average effective tax rate hovers near 1.3% to 1.4%, though individual rates vary across districts based on local funding requirements for schools, public safety, and roads. Property owners must check their annual tax notice, which breaks down how their rate applies, including any tiered or progressive elements unique to certain zones.Example: A $1 million home in Anaheim Hills might face a 1.35% rate, translating to roughly $13,500 annually—compared to a $200,000 property in Newport Mesa at 1.28%, costing about $12,800.

_rates are not static; they shift incrementally each year, influenced by ballot measures, state legislation, and county budget projections.For homebuilders, investors, and long-term residents, understanding these rate fluctuations is crucial.

Local assessments and rate trends directly impact cash flow planning, particularly for retirees on fixed incomes or first-time buyers===

Exemptions and Relief Programs: Reducing Your Tax Burden

Orange County offers several property tax relief programs designed to ease the burden on eligible residents, including homeowners, seniors, veterans, and people with disabilities. Among the most impactful is the Homeowner Exemption, which reduces assessed value by up to 50% for primary residences—effective immediately reducing tax exposure without changing market price.Key exemption programs include:

- Homeowner Exemption (SB 775): Caps assessed value at 50% for primary homes, freeing residents from surcharges

Related Post

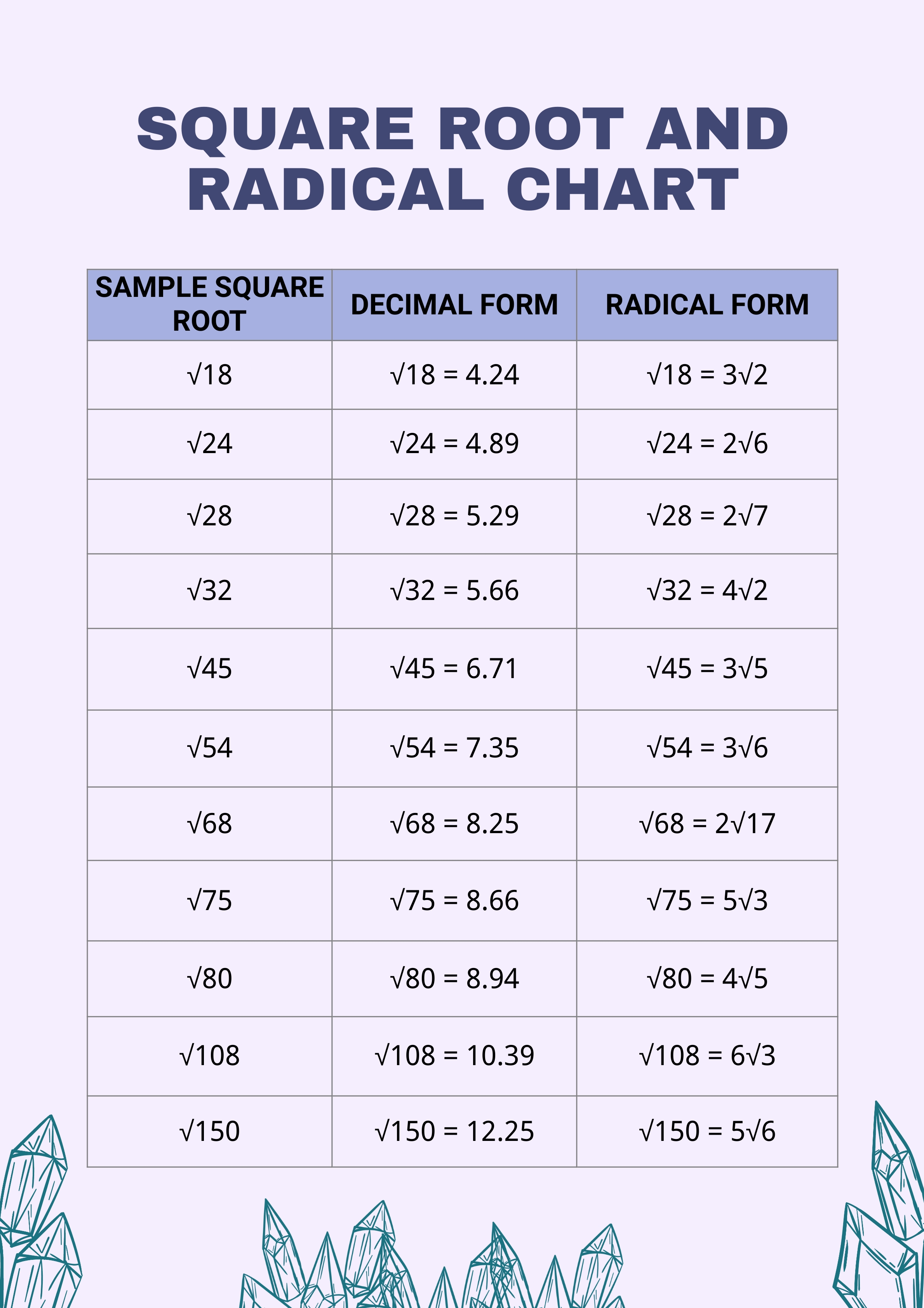

The Derivative of A Square Root: Unlocking the Rules Under the Curve

And I Love Youuuu: The Quiet Power of Affection in a Digital World

Ramen Noodle Recall 2024: What Consumers Need to Know and How to Act Fast

Discovering Murray Hone: The Charismatic Builder Behind a Lasting Legacy