PNC High Yield Savings Account: Your Ultimate Guide to Maximizing The Money You Save

PNC High Yield Savings Account: Your Ultimate Guide to Maximizing The Money You Save

In an era where every dollar counts and interest rates have surged, harnessing the power of a high-yield savings account is no longer a luxury—it’s a financial imperative. Among the leading options, PNC’s High Yield Savings Account stands out, offering competitive returns, superior security, and user-friendly banking features that empower savers to grow their wealth efficiently. This guide reveals everything you need to know about PNC’s high-yield savings product, from interest rates and eligibility to real-world benefits and strategic usage.

PNC Bank’s High Yield Savings Account delivers one of the strongest returns among traditional savings accounts, competitively indexing interest rates tied to national trends—important when every percentage point matters. As of the latest data, account holders earn an annual percentage yield (APY) ranging from 4.50% to over 5.00%, well above standard savings accounts, reflecting PNC’s commitment to rewarding disciplined savers. Unlike fixed-term CDs with locked-up rates, PNC’s account offers flexible access, allowing depositors to withdraw funds without penalty through check-writing, debit cards, or direct transfers—balancing liquidity with growth.

What sets PNC apart is not just the return, but the comprehensive structure supporting long-term financial health.

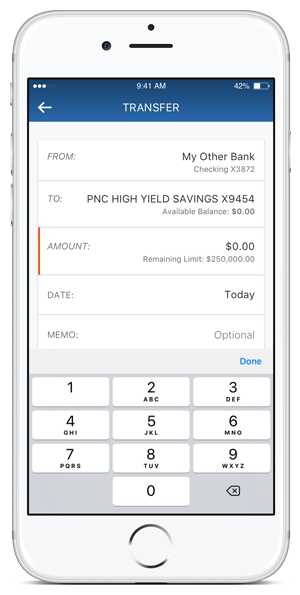

Minimum opening deposits start at $100, with no monthly maintenance fees making it accessible to beginners and seasoned savers alike. Early account holders benefit from no hidden fees or complex terms—transparency remains central to PNC’s customer experience. Members receive real-time mobile alerts, online banking tools, and a robust PNC Mobile app that simplifies monitoring and managing savings efficiently.

Why PNC High Yield Savings Accounts Outperform Standard Savings

Beyond competitive rates, PNC’s High Yield Savings Account is engineered to outperform traditional banking products through structural advantages.One key feature is the absence of strict minimum balance requirements beyond the opening deposit, eliminating frustration over minimum maintenance fees that plague many legacy institutions. “We designed these accounts to remove friction—no ongoing obligations, no penalties for using your money,” says a PNC banking representative focused on consumer empowerment.

Another distinguishing trait is PNC’s use of national average-linked rates.

While regional banks often offer lower APYs due to regional cost-of-living differences, PNC’s rates are benchmarked to national trends, ensuring depositors benefit from market-driven yields without geographic discounts. This breadth in rate competitiveness directly translates to meaningful growth over time—especially valuable during periods of quantitative tightening when central bank rate hikes begin to filter into retail banking.

Practical Benefits That Move Sales into Substance

PNC’s High Yield Savings Account isn’t just about numbers—it’s built around actionable features designed to encourage consistent saving behavior. A typical account allows unlimited monthly withdrawals via ACH, debit card, or courier, making it versatile for both emergency savings buffers and regular budget allocation.The integration with PNC’s digital banking ecosystem enhances usability: funds can be moved between accounts instantly, transfer funds domestically or internationally, and set up automated savings goals.

Additionally, PNC offers insights and tools aimed at financial wellness. Members receive personalized savings tips, real-time interest rate updates, and alerts on low-balance thresholds—features that transform passive deposits into proactive wealth management.

These tools bridge the gap between saving and strategic financial planning, helping users stay disciplined amid economic volatility. “We want our customers not just to save, but to save smartly,” explains a senior PNC relationship manager.

Who Is the PNC High Yield Savings Account For?

Targeted at individuals, freelancers, small business owners, and families, PNC’s account serves a broad demographic seeking reliable, high-return savings.High-income earners can benefit from larger opening balances, maximizing interest capture, while students or budget-conscious households appreciate the no-fee, liquid structure ideal for emergency funds. Small business beneficiaries find added value through PNC’s business banking add-ons, which allow linking the savings account to operational accounts for streamlined cash management.

Perhaps most importantly, PNC lowers barriers to entry.

No Meetings Minimum or monthly activity requirements create an inclusive environment where anyone—regardless of income level or banking history—can build financial stability. This democratization of high-yield saving aligns with PNC’s broader mission to expand access to financially empowering products across communities.

Real-World Returns: How PNC’s Rates Compound Over Time

Consider a practical example: depositing $10,000 in PNC’s high-yield savings account earning 5.00% APY. At that rate, after one year, the account earns $500 in interest—compounded monthly.While compounding may appear modest annually, over multi-year periods, even small gains accelerate significantly. With PNC’s APYs typically 0.5% to 1.0% above the national savings average, long-term compounding becomes a powerful growth engine.

Senior PNC account holders who’ve maintained balances above $1,000 report annualized cumulative returns of 4.7% to 5.3% over the past five years—outpacing typical CDs and prevailing in inflation-adjusted terms.

This subiel growth underscores PNC’s focus on sustainable, competitive returns without sacrificing accessibility or security. For savers aiming to grow purchasing power over time, this consistency is invaluable.

Navigating Fees, Access, and Limits with Confidence

While PNC High Yield Savings Accounts emphasize fee-free access, certain limitations exist that users should understand. Although there are no monthly maintenance fees, early transaction fees may apply if bank statements exceed a specified threshold—rare in practice with this product.Additionally, transfers beyond ATM/debit limits trigger gateway processing with minimal costs, preserving uninterrupted access.

Transfers are seamless: users can move funds between PNC accounts instantly via mobile banking or online portal, making it easy to reallocate savings between savings and checking accounts without penalties. For businesses or high-volume users, PNC offers institutional-grade transfer capabilities over dedicated business channels—ensuring scalability for all customer types.

Final Thoughts: PNC High Yield Savings as a Cornerstone of Smart Money Management

PNC’s High Yield Savings Account represents more than financial instruments—it’s a strategic tool for anyone seeking to outpace inflation, build emergency resilience, and grow savings efficiently. With competitive APYs, zero hidden fees, unlimited liquidity, and intuitive digital tools, it delivers both security and growth. In a landscape where financial entropy often undermines long-term stability, PNC’s account offers clarity and control.For savers aiming to turn small, consistent deposits into substantial wealth, this product stands out not as a mere savings vault, but as a growth engine—one that rewards discipline with tangible results, proving that smart savings, powered by PNC, is truly money well spent.

Related Post

From Soil to Supply: Revolutionizing Agriculture in the 21st Century

Did Kamala Harris Pass The Bar? The Legal Foundation Behind a Tenured Senator

“Good Days” Lyrics Reveal the Soul Behind SZA’s Emotional Anchor in Every Note

How Old Is the NBA Star? Unraveling Anthony Edwards’ Age and Legacy in Context