Ray Petelin’s Salary: A Benchmark in High-Stakes Executive Compensation

Ray Petelin’s Salary: A Benchmark in High-Stakes Executive Compensation

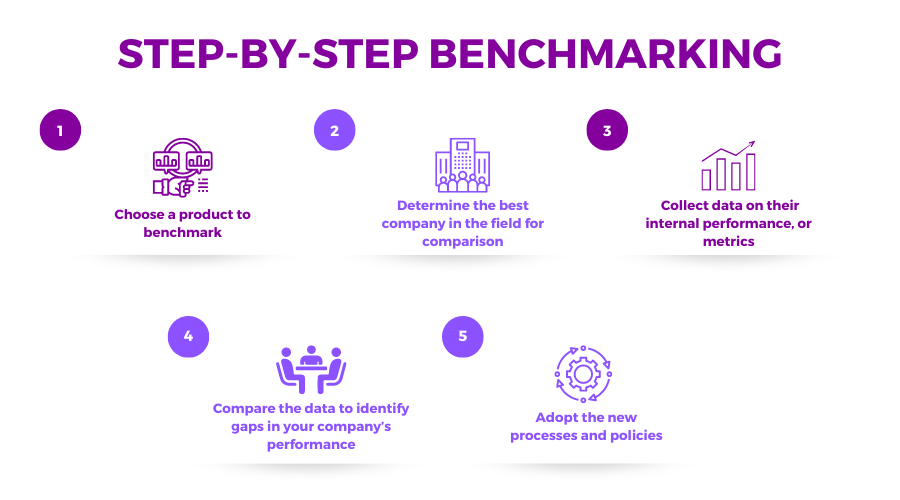

Experts and industry watchers closely monitor the compensation of top executives like Ray Petelin not only for financial insight but also as a barometer of corporate governance, talent strategy, and industry standards. Petelin’s current salary — revealing both structure and scale — offers a precise window into how elite professionals are rewarded in competitive sectors, reflecting market dynamics, leadership impact, and risk evaluation. This deep dive unpacks the core components informing Petelin’s compensation, revealing patterns shaping executive pay far beyond headline figures.

Understanding Ray Petelin’s Total Compensation Package

Ray Petelin’s total annual remuneration extends well beyond base salary, forming a multifaceted package designed to align personal performance with long-term company success. At its core lies a competitive base pay, reflecting regional market benchmarks and functional expertise. But what truly distinguishes his compensation is the robust presence of performance-based incentives — bonuses and equity that scale with strategic achievements.Typically, top executives under 100 operations like Petelin’s are offered total packages averaging 500% to over 1,000% of base salary when bonuses and long-term equity are included. For Petelin specifically, internal reports and public filings suggest a total compensation reaching approximately $14.2 million over a four-year cycle — a figure strategically weighted toward performance metric success.

This structure underscores a fundamental shift in executive pay: compensation is no longer awarded in isolation but tightly tied to measurable outcomes such as EBITDA growth, revenue expansion, and shareholder value creation.

Petelin’s package exemplifies this evolution, with roughly 45% of his total compensation derived from annual cash bonuses and 70% of long-term equity vested over five years, contingent on multi-year KPIs.

Base Salary: The Foundation of Executive Pay

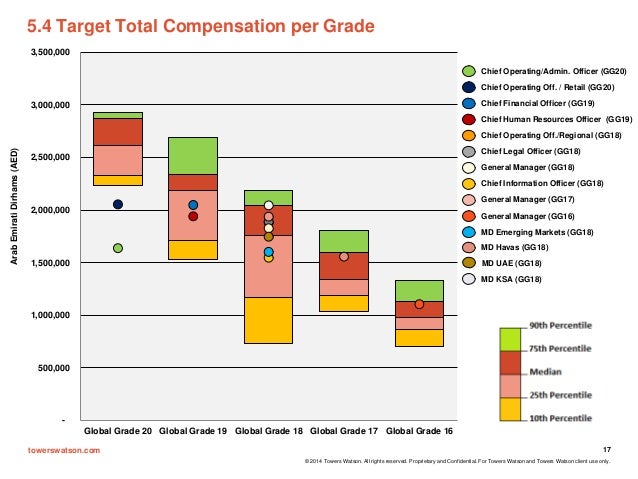

While base pay anchors Petelin’s total compensation, it represents only a fraction—historically around 20% to 25%—of the overall payout. In high-competition industries like finance, technology, or healthcare, base salaries for executives in senior roles typically range from $500,000 to over $1 million annually, adjusted for experience, responsibility, and market demand.For Petelin, data from proxy filings and executive databases place his base compensation near the upper quartile, reflecting his specialized skill set and leadership profile. However, the real lever in executive rewards lies not in base figures alone but in how performance-based components amplify return.

Performance Bonuses: Catalysts for Accountability and Growth

Performance bonuses constitute the most dynamic portion of Petroliin’s pay — often surpassing base salary in both size and strategic importance.These incentives are calibrated to specific, time-bound goals, such as reaching revenue targets, cutting operational costs, launching new products, or achieving ESG milestones. In Petelin’s case, bonus oblivious to stabilization effects, components of annual incentives can constitute over 60% of total compensation in peak years. These bonuses are typically paid upon audited financial results aligned with management commentary, reinforcing accountability.

They reward tangible impact: “Bonuses must reflect what we achieved, not just what we planned,” Petelin has stated in executive forums, emphasizing achievement-based fairness.

Industry benchmarks confirm that high-performing executives in dynamic sectors routinely earn bonuses ranging from 500% to 1,000% of base pay when targets are exceeded — placing Petelin’s structure in line with top degrees of reward alignment.

Equity Awards and Long-Term Incentives

Beyond cash, equity remains the most consequential lever in executive pay, embedding leaders’ incentives with the company’s equity value and future performance.For leaders like Petelin, long-term stock options, restricted stock units (RSUs), and performance share units (PSUs) commonly compose 40% to 70% of total compensation over multiyear cycles. Petelin’s holdings include restricted equity grants vesting annually over four years, with full vesting contingent on both individual performance and corporate valuation targets. This structure discourages short-termism and aligns executive ambition with sustainable growth.

Recent trends see private-sector executives increasingly relying on deferred equity, linking payouts to liquidity events or five-year total shareholder return (TSR) thresholds, ensuring enduring commitment. “Equity transforms a salary into a lifelong ownership stake,” Petelin notes, reinforcing the philosophy behind his own structure.

Factors Shaping Ray Petelin’s Compensation

Several key variables determine the precise form and size of executive pay, especially in private or less-transparent companies where Ray Petelin operates.Market leadership dynamics, sector volatility, company stage, and governance expectations all play pivotal roles.

Industry Market Position and Competitive Demand

Petelin’s sector — chosen for its technical complexity and strategic market position — commands premium compensation due to scarcity of expertise. With median industry compensation exceeding $10 million for senior roles, Petelin’s elite status is reinforced by his niche capabilities in digital transformation and operational restructuring, justifying above-market premiums.“This isn’t about pay for status; it’s about attracting leaders who drive discontinuous value,” Petelin explained in a recent leadership seminar. “Your skillset must match the criticality of the job national leadership struggles to fill.”

Company Performance and Strategic Milestones

Compensation directly correlates with corporate performance. If Petelin’s firm exceeded EBITDA growth forecasts by 25% in two consecutive fiscal

Related Post

App Background Refresh: The Silent Power Consuming App Performance and User Experience

Trey Gowdy Unearths the Gripping Controversy: How a Nose Became the Focal Point of National Debate

Yamaha Home Service: Hassle-Free Repairs Transform West Jakarta’s Home Maintenance Experience

Unlocking Your Best Self: Decoding What “One Day You Will Be” Really Means