Receiving Money From Western Union: How, Why, and What You Need to Know

Receiving Money From Western Union: How, Why, and What You Need to Know

Western Union remains a household name in cross-border payments, offering a trusted, fast, and widely accessible way to receive money from across the globe. Whether vous collect surprising tax refunds, emergency disbursements, or earnings from overseas work, understanding the mechanics of receiving money via Western Union is essential to securing timely, safe transfers.

With over 200 million customers worldwide and presence in more than 200 countries, receiving funds through Western Union blends convenience with speed—though users must navigate key operational details to avoid delays or errors.

This article explores the compelling dynamics of getting money from Western Union, from select deposit methods to security practices and user experiences.

Western Union doesn’t operate like a traditional bank but relies on a network of licensed agents, ATMs, and digital platforms to deliver funds. Here’s what definitions and processes really mean for senders and receivers alike:Receiving money from Western Union typically begins the moment funds are credited into a merchant’s account. Unlike bank transfers that move through centralized clearinghouses, Western Union payments settle through a decentralized agent network, enabling quick local pickup—often same-day—especially at physical locations.

This hybrid model means funds arrive via cash, check, or prepaid card, depending on how the recipient chooses.

In recent years, digital integration has expanded options: users may receive an electronic transaction code to access funds via mobile apps or prepaid debit cards, eliminating the need for physical cash retrieval in many cases.

Main Methods to Receive Western Union Money

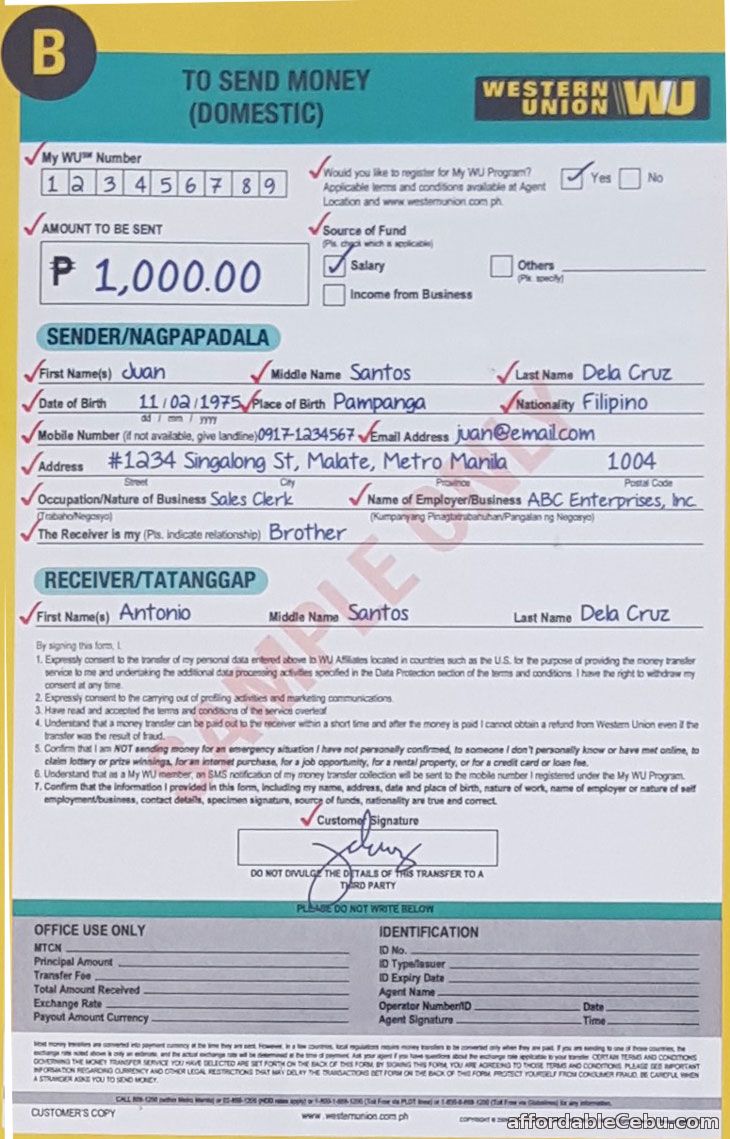

There are several proven pathways to receive funds efficiently through Western Union, each tailored to different user needs and circumstances:- At a Physical Agent Location: The classic and most common method. Users visit a Western Union kiosk—often found in convenience stores, gas stations, and airports—and present valid identification to receive cash, cashier’s checks, or card-based deposits. Agents verify identities using government-issued ID, a process designed to prevent fraud.

Agents can also accept digital payments, allowing push-to-card options.

- By Mail: For larger sums or documents requiring proof of deposit, users send checks or money orders to a Western Union address. Once verified—typically through signature matching and address confirmation—funds are credited within days at the agent location.

- Wire or Electronic Transfer (limited): Though not typical full Nordic-style wire automation, Western Union offers digital deposit services through its app, enabling bank transfers or mobile wallet payments directly into a local agent account, accelerating pickup.

- Mobile Kiosks and Partner Platforms: In emerging markets, Western Union partners with telecom and fintech platforms to offer cashless receipt via scanned codes, combining speed with digital traceability.

Transaction fees vary by method: retrieving cash at an agent usually incurs modest charges, while digital deposits may reduce overhead, making some options far more cost-effective for large transfers.

Security and Verification: Safeguarding Received Funds

Given the sensitivity of receiving external funds, Western Union employs layered security protocols to protect both senders and receivers. These include:ID verification at the point of deposit—requiring a passport-sized photo ID and meeting age or residency requirements—deters identity fraud and illicit activity.

Federal regulations, including Bank Secrecy Act compliance and Know Your Customer (KYC) rules, mandate strict monitoring of large or unusual transactions.

Recipients are encouraged to verify agent legitimacy—Western Union vets all locations and screens for suspicious patterns. Suspicious activity alerts help protect users from scams, especially in regions prone to fraud.

Digital wallets and PIN codes add an extra layer when funds are transferred electronically, ensuring only authorized access. Users should also guard personal information and report lost cards or codes immediately to prevent unauthorized use.

“We prioritize our customers’ security above all,” notes Western Union’s public communications, “with real-time monitoring, agent training, and support to keep every transaction safe.”

Timing and Practical Expectations

How fast does Western Union money arrive? The timeline hinges on deposit method:- **Cash at Agent:** Typically same-day, if within operating hours.

- **Check or Money Order:** Credit ranges from 1 to 5 business days, depending on postal transit to the agent.

- **Cards or Electronic Deposits:** Instant online activation, though cash pickup at a kiosk may take a few hours.

No matter the method, delays often stem from external factors—postal delivery for checks, agent downtime, or verification processing—not Western Union policy.

Advanced tracking via app or SMS enables real-time updates, reducing uncertainty.

For urgent needs, selecting cash pickup or value-added digital options minimizes wait time and enhances control.

User Experiences and Real-World Applications

Feedback from millions of users highlights recurring themes: ease of access, fairness in fees, and reliable service. Many praise Western Union’s global brand trust—knowing funds will reach a local agent quickly.Others note variability in agent efficiency, especially in remote areas, where longer wait times or staff shortages can delay pickup.

Business owners frequently use Western Union to receive payments from international clients, with small business operators estimating 87% of deposits accepted within 24 hours when delivered via agent, according to recent customer surveys. Personal remittances—common among immigrant families—largely rely on the network’s speed and community trust, keeping funds available when needed most.

Western Union’s model permanently bridges financial inclusion gaps by adapting to modern habits without sacrificing security or reach.Whether you’re receiving a long-awaited payment, an unexpected windfall, or international earnings, understanding the process—from choosing your deposition method to recognizing security safeguards—ensures a seamless, stress-free experience. In an era of instant digital finance, Western Union remains a dependable anchor, proving that trust, speed, and accessibility still matter.

Related Post

Pomona’s Seasonal Pulse: Decoding Weather Patterns in the Heart of the San Gabriel Valley

Unveiling The Life And Journey Of Asonta Gholston: From Resilience to Renewal

Where Luxury Meets Nature: The Rise of B&B Hospitality in Jackson Hole, Wyoming

1985 Horoscope Chinese Reveals How the Year Shaped Destiny, Fortune, and fate in the Chinese Zodiac Cycle