Retire in Peace: How Nyslrs Retirement Online Transforms Post-Work Life

Retire in Peace: How Nyslrs Retirement Online Transforms Post-Work Life

Nyslrs Retirement Online stands at the forefront of a digital revolution in retirement planning, offering a powerful, user-driven platform that empowers Washington state retirees and future pensioners to manage benefits, access resources, and plan with confidence. With seamless online access, personalized tools, and comprehensive support, Nyslrs eliminates much of the friction traditionally associated with retirement administration. This digital gateway not only simplifies the complexities of pension claims and benefit tracking but also places control directly in the hands of individuals—redefining what modern retirement outreach means.

At the core of Nyslrs Retirement Online is a streamlined interface designed for accessibility and clarity. Users can log in to view accurate pension statements, project retirement income, and monitor account balances—all updates in real time. “It’s not just about data access—it’s about transparency and empowerment,” explains state retirement services director Elena Torres.

“Retirees no longer need to rely on long phone wait times or fill out paper-heavy forms; they can manage everything from their favorite chair, at their own pace.”

One of the platform’s standout features is its robust retirement calculator and scenario planning tools. These instruments allow users to simulate different retirement timelines, adjust contribution rates, and estimate how various income sources will blend over time. This functionality supports informed decision-making, crucial for navigating today’s uncertain financial landscape.

Users can input variables such as age of retirement, investment returns, and expected expenses to generate realistic projections—a critical advantage in estimating sustainable income streams.

Revolutionizing Access: Why Nyslrs Stands Out in Retirement Administration

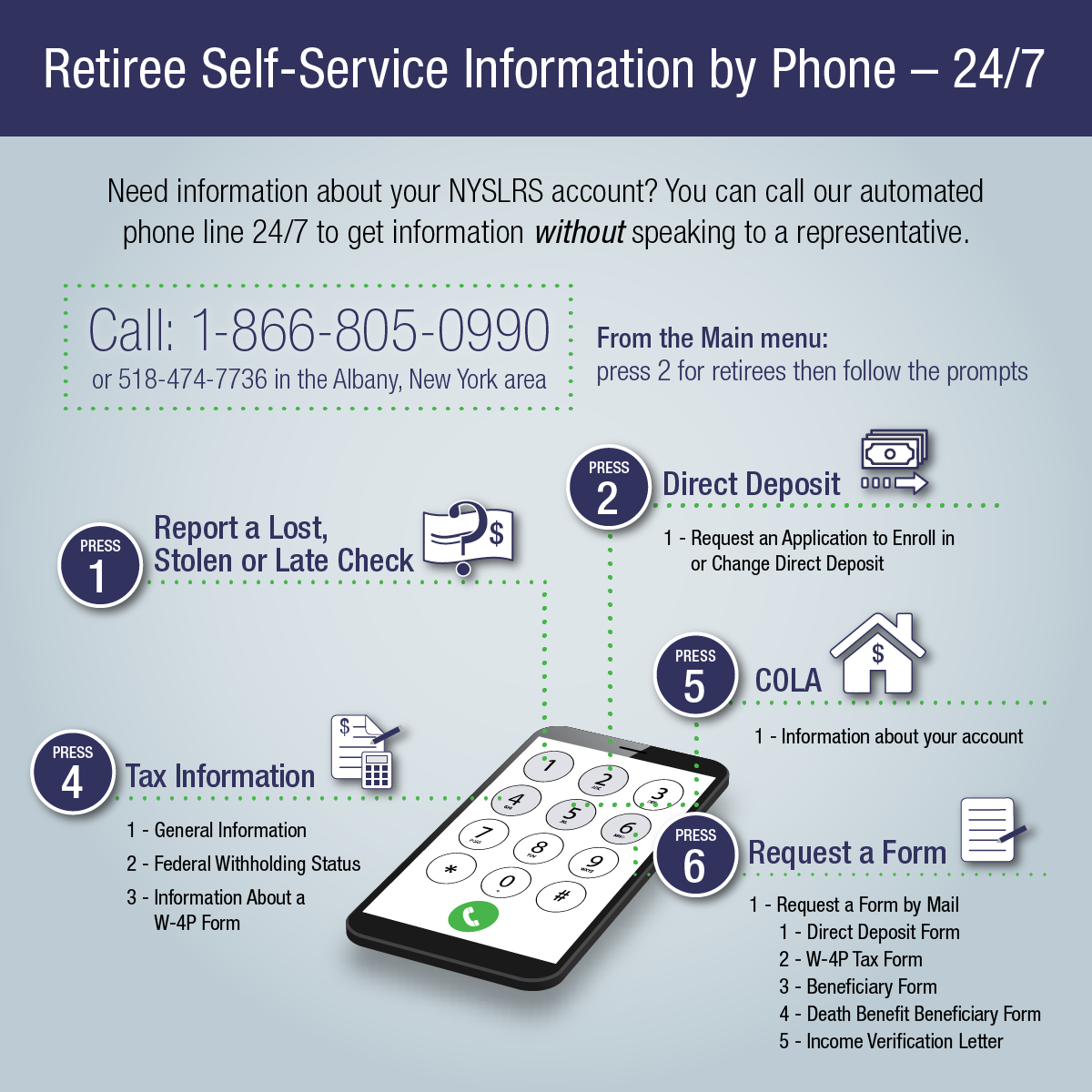

What distinguishes Nyslrs is its deliberate fusion of user-centered design and state-of-the-art financial technology. Unlike legacy systems that overload retirees with rigid processes, Nyslrs adapts to individual needs through responsive web and mobile compatibility, ensuring access wherever and whenever required. The platform integrates secure login, encrypted data transfer, and 24/7 support—safeguarding sensitive personal information while fostering trust.Beyond basic account access, Nyslrs Retirement Online delivers value through educational resources and direct assistance. Recognizing that financial literacy varies widely among retirees, the portal offers explainer modules on pension types, benefit formulas, and tax implications, empowering users to engage meaningfully with their retirement portraits. Interactive tools guide individuals through claim submissions, document uploads, and benefit elections—reducing errors and friction that often delay critical payments.

Core functionalities include:

- Pension Statement Generation: Instant access to detailed benefit statements with breakdowns of income sources, vesting dates, and adjustment remarks.

- Real-Time Balance Monitoring: Track balances, contribution histories, and projected growth without waiting for postal mail or in-person visits.

- Retirement Date Simulation: Use dynamic calculators to explore late vs.

early retirement impacts, factoring in inflation, life expectancy, and market volatility.

- Direct Communication with Retirement Oudiencia: Secure messaging, live chat, and phone support available at login—eliminating bureaucratic delays.

- Resource Hub: Re() 3. Financial guides, legal FAQs, and step-by-step tutorials tailored to Washington’s unique pension structure.

The system’s architecture supports interoperability with state databases, enabling automatic updates when employment or pension records change—reducing manual input and ensuring data accuracy. This real-time synchronization not only enhances reliability but also conserves time, a precious commodity in retirement.

Feature-Driven Support That Meets Real-World Needs

Nyslrs Retirement Online doesn’t just offer tools—it offers peace of mind.The interface’s intuitive design caters to diverse user groups, including those less comfortable with digital platforms. Simple navigation, clear instructions, and multitiered help options ensure inclusivity across age ranges and technological familiarity. For example, senior users benefit from voice-assisted prompts and high-contrast modes, reducing frustration and fostering confidence.

Special attention is given to sensitive operations like benefit elections and demographic updates. These processes are guided by layered disclosures and confirmation steps, preventing errors that could delay retirement income. “We’ve built in redundancies to protect against missteps,” says senior Nyslrs support architect Marco Delgado.

“A late-form submission or misunderstood instruction isn’t a barrier—it’s a chance to guide, not disappoint.”

Integration with regional financial services further enhances the platform’s utility. Retirees can link Kavout accounts, manage Social Security coordination, and access tax-preparation partners—all within the same digital ecosystem. This interconnectivity supports holistic retirement planning, shifting focus from administrative tasks to quality of life.

Real-World Impact: How Retirees Are Using Nyslrs Today

Across Washington, early adopters report notable improvements in how they manage retirement.Karen Whitmore, a 67-year-old former state educator, praises the platform’s clarity: “After decades of paperwork behind every decision, Nyslrs made my pension look transparent as if someone had boiled the complex into plain language. Now I feel in charge—not nervous.”

Comparative analytics from state audits indicate reduced processing delays and fewer benefit disputes following Nyslrs adoption. Automated alerts for aging eligibility thresholds and compliance updates proactively guide users, preventing costly oversights.

These measurable outcomes underscore how technology, when thoughtfully applied, serves the foundational goal of retirement security: dignity in transition.

Why Nyslrs Is More Than a Tool—it’s a Partner in Retirement

Nyslrs Retirement Online represents a paradigm shift in how retirement is experienced, managed, and secured. By merging financial transparency, digital convenience, and human-centered support, it transforms retirement administration from a source of anxiety into a structured, empowering journey.It proves that modern systems, when built with retirees’ needs in mind, can deliver both operational efficiency and emotional reassurance.

As workforce demographics evolve and pension systems adapt, platforms like Nyslrs stand as vital infrastructure—bridging legacy structures with digital innovation. For those approaching retirement or navigating its aftermath, Nyslrs offers a reliable, evolving partner equipped to guide, clarify, and protect during one of life’s most significant transitions.

With continuous updates, community feedback integration, and a commitment to accessibility, Nyslrs Retirement Online is not just redefining pension management—it is redefining retirement itself, one secure login at a time.

Related Post

Unlocking Retirement: The Complete Nyslrs Online Access Guide

Revealed: Emily Compagno’s Wedding Details & Photos – A Celebration of Timeless Beauty and Personal Touch

The Ultimate Guide to Being a Hoe: Power, Precision, and Purpose

What Does Sow Discord Mean? Unraveling the Hidden Layers of a Pervasive Social Phenomenon