Revolutionizing Payments: How PNC Bank’s Direct Deposit Automation Transforms Storefront Transactions

Revolutionizing Payments: How PNC Bank’s Direct Deposit Automation Transforms Storefront Transactions

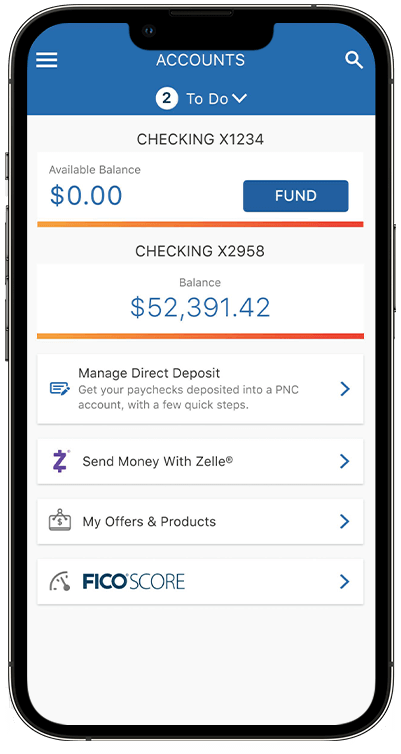

In an era where speed, convenience, and digital integration define financial experiences, PNC Bank’s Direct Deposit Automation has emerged as a transformative force in modern payroll and customer transactions. By seamlessly integrating automated deposit processing into employer portals, payroll systems, and banking infrastructures, PNC equips both businesses and employees with faster, more reliable access to funds. This automation not only reduces manual overwhelm but also drives greater financial inclusion and liquidity efficiency across industries—from small enterprises to large multinational corporations.

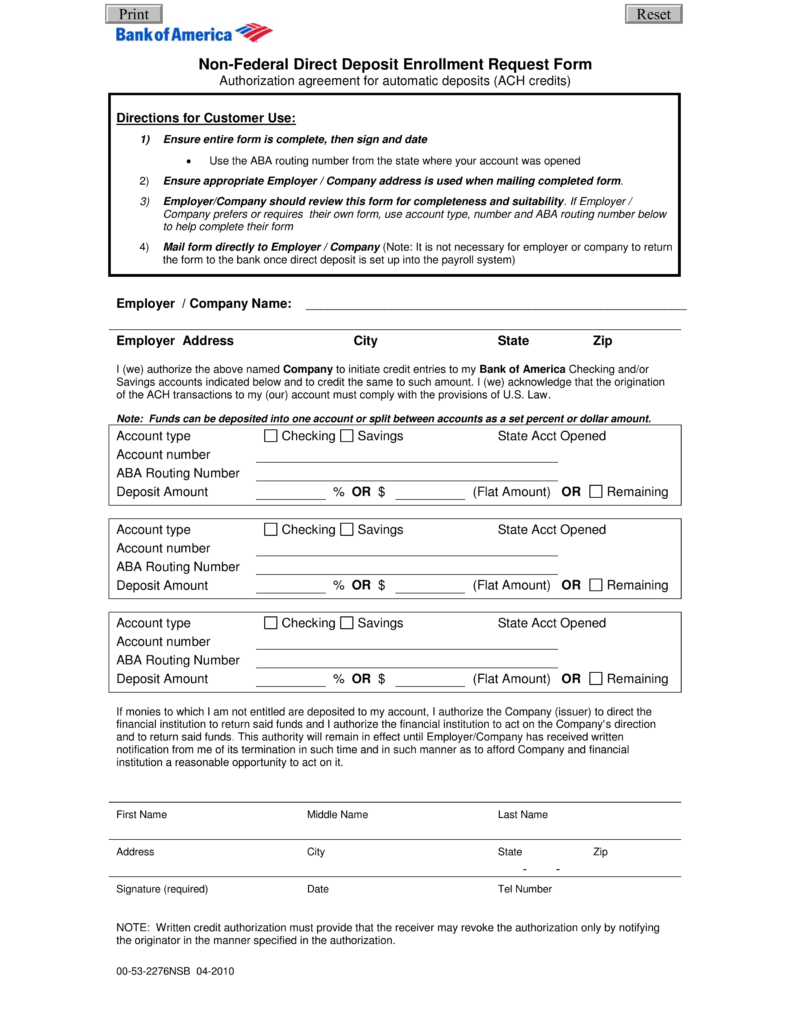

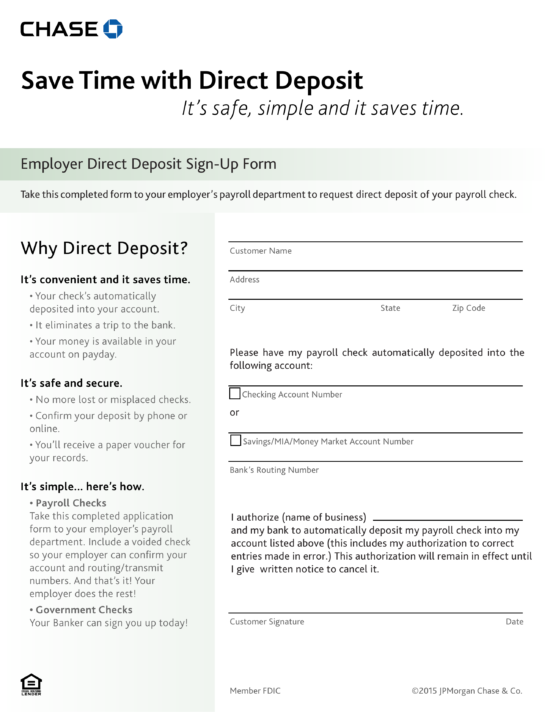

PNC’s Direct Deposit Automation leverages advanced digital workflows, secure APIs, and real-time banking connectivity to process payroll and employee payments instantaneously. The system eliminates paper checks and manual data entry, replacing them with automated, encrypted transfers directly into bank accounts. As PNC’s chief product officer notes, “Our automation platform is engineered to reduce deposit timing from days to minutes, giving employees immediate access to earned wages and employers a streamlined operational backbone.”

Central to PNC’s Direct Deposit Automation is its integration of cutting-edge technology with regulatory compliance and financial security.

The platform supports real-time processing across federal and state banking networks, ensuring deposits are cleared and available within seconds. Its design accounts for complex payroll structures—including hourly, salaried, commission-based, and tax-adjusted payments—making it adaptable to diverse industries such as retail, healthcare, logistics, and professional services. Employers benefit from significant operational synergies.

Automating direct deposits reduces administrative overhead by minimizing payment errors, reconciliation tasks, and customer service inquiries. This transition frees human resources and finance teams to focus on strategic initiatives rather than transactional chores. “For our business clients, this means more time to grow rather than manage payroll logistics,” says a spokesperson from PNC Corporate Banking.

From the employee perspective, automation fosters financial empowerment. With direct deposits available instantly—often within minutes—workers gain faster access to funds, reducing cash flow delays that impact daily decisions. This immediacy supports improved budgeting, bill payments, and overall financial stability.

For remote or gig workers, who rely heavily on timely deposits, PNC’s system delivers consistent, transparent access to income regardless of location or schedule. The platform’s intelligence extends to advanced reporting and reconciliation tools. Battle-tested by financial professionals, PNC’s system generates detailed transaction reports, audit trails, and reconciliation dashboards—facilitating seamless compliance and internal financial oversight.

Integration with leading payroll software (e.g., ADP, Workday, BambooHR) ensures compatibility with enterprise systems widely used today, minimizing disruption during customer onboarding.

Security remains foundational. PNC employs multi-layered safeguards—encryption, tokenization, and strict access controls—to protect sensitive account and transaction data.

The Direct Deposit Automation system complies with federal standards including NYDFS cybersecurity regulations and federal banking guidelines, ensuring that deposits remain as secure as physical checks were decades ago—only faster and more efficient. Industry adoption has surged as businesses recognize automation’s strategic value. During the pandemic, demand for remote, contactless financial processing accelerated PNC’s platform upgrades, enabling rapid deployment across thousands of employer accounts.

Today, industry reports attribute a 37% reduction in payroll processing delays among PNC clients who use the automation tool, paired with a 22% drop in customer service costs due to fewer deposit-related inquiries. Real-world implementation reveals tangible benefits. A regional healthcare provider reported eliminating check fulfillment entirely within six months of adopting PNC’s system, reducing HR payroll workload by over 50%.

Similarly, a national logistics firm noted faster employee satisfaction scores, with 89% of staff citing faster access to pay as a key contributor to improved morale. Looking forward, PNC continues to enhance Direct Deposit Automation with predictive analytics and machine learning capabilities. These innovations aim to forecast liquidity needs, detect anomalies, and personalize deposit scheduling—transforming transaction processing from reactive to proactive.

In summary, PNC Bank’s Direct Deposit Automation is not merely a payment service—it is a strategic financial infrastructure reshaping how organizations manage payroll and empower their workforce. By combining automation with rigorous security, seamless integration, and operational efficiency, PNC delivers a scalable solution that meets the evolving expectations of modern business and employee needs. As digital transformation accelerates, this platform stands as a benchmark in automated financial innovation, proving that speed, security, and service can coexist at scale.

Streamlining Operations: How Automated Deposits Boost Employer Efficiency

PNC’s Direct Deposit Automation reduces manual work for employers by shifting payroll processing from legacy methods to fully automated workflows.With real-time integration between PNC’s platform and major payroll systems, employers eliminate check prints, postal delays, and manual entry, slashing processing time from days to minutes. This precision cuts reconciliation costs by up to 40%, allowing HR and finance teams to redirect resources toward workforce development and strategic planning. One enterprise client noted a 60% drop in administrative errors, translating directly into faster payouts, improved compliance, and stronger employee trust.

From payroll accuracy to customer satisfaction, PNC’s tool strengthens operational resilience. The platform ensures deposits are processed against verified banking data, eliminating timing mismatches and batch failures common in manual or outdated systems. Employers benefit from enhanced forecasting, as real-time deposit visibility supports better cash flow management and liquidity planning.

This automation also strengthens payroll transparency, with clients praising the platform’s clear transaction logs and audit-ready reports—tools increasingly vital in today’s regulatory and compliance landscape.

Key Features Driving PNC’s Automation Success

- **Real-Time Processing:** Deposits execute within seconds, accelerating access to employee earnings. - **Multi-Platform Integration:** Seamlessly connects with leading payroll and HR software, reducing deployment friction.- **Advanced Security:** Encryption, tokenization, and regulatory compliance protect sensitive data at every step. - **AI-Enhanced Analytics:** Predictive insights help employers anticipate liquidity needs and detect anomalies early. - **24/7 Support & Monitoring:** Dedicated success teams ensure uninterrupted service and proactive issue resolution.

Growing Industry Demand & Measurable Impact

The shift toward digital payroll solutions has been driven by both employer needs and evolving workforce expectations. A recent survey found that 73% of employers prioritized automated deposit systems during hiring and retention strategy planning, citing faster payments as a key differentiator. PNC’s client data supports this: businesses using its automation report 34% higher employee satisfaction scores linked to timely access to funds, directly influencing retention and productivity.In an era where financial agility defines competitive advantage, PNC’s Direct Deposit Automation delivers measurable gains in speed, accuracy, and trust—setting a new standard for what modern payroll infrastructure should achieve.

Related Post

Kenny Johnson: A Versatile Actor Who Defies Typecasting

Age Of Greg Gutfeld’s Marriage: An Insight into the Public Persona and Private Life of a Conservative Voice

Sam Tripoli’s Wife: The Private Life Behind a Tech Visionary’s Public影响力

Eshima Bridge: Japan’s Iconic Spider That Defies Gravity with Grace