Secure One Financial: The Bold New Paradigm in Personal Finance Security

Secure One Financial: The Bold New Paradigm in Personal Finance Security

In an era defined by digital sophistication and escalating cyber threats, Secure One Financial emerges as a pioneering force, redefining how individuals protect, manage, and grow their financial lives. More than a financial platform, Secure One Financial integrates cutting-edge encryption, intuitive design, and proactive safeguards to deliver a holistic security experience. For users navigating complex portfolios, sensitive banking data, and evolving financial technologies, this platform offers not just tools—but peace of mind—through responsible innovation and customer-centric design.

At its core, Secure One Financial is built on three pillars: advanced encryption, real-time risk monitoring, and personalized financial oversight. Unlike legacy systems that rely on reactive measures, Secure One embeds security into every layer of its architecture. “We don’t just respond to breaches—we anticipate them,” says Clara Mendez, Head of Cybersecurity Initiatives at Secure One Financial.

“Our adaptive architecture learns from global threat patterns and adjusts dynamically to protect user assets before any risk materializes.” Each Secure One Financial account begins with a zero-knowledge password policy and end-to-end encryption across all sessions and data transfers. But the real differentiator lies in real-time behavioral analytics. The platform employs machine learning algorithms to detect anomalies—unusual login attempts, abrupt transaction shifts, or deviations from spending patterns—and alerts users instantly.

This proactive vigilance reduces exposure while empowering users with granular visibility into their financial behaviors.

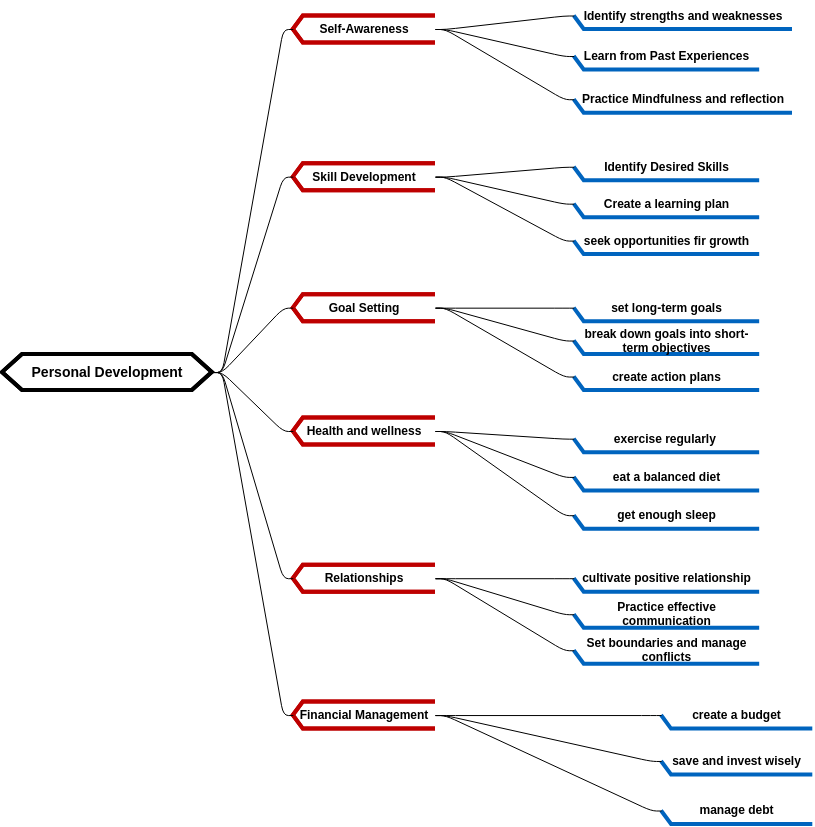

Secure One Financial distinguishes itself through deeply personalized risk assessment tools. Users are not only protected but also guided—through interactive dashboards that highlight vulnerabilities and suggest actionable improvements. For example, if a user routinely transacts in high-risk categories or holds overlapping financial products with redundant fees, Safe One offers tailored recommendations: consolidate accounts, automate savings, or adjust security protocols.

“Security isn’t just about firewalls—it’s about understanding user habits and enhancing protection where it matters most,” explains Mendez.

One particularly innovative feature is the integrated digital wallet with biometric authentication. Beyond fingerprint and facial recognition, users can set context-aware access—such as requiring verification when logging in from a new device or during large transfers. This layered control minimizes unauthorized access without sacrificing convenience.

Beyond individual accounts, Secure One Financial serves small businesses, family offices, and institutional clients through scalable security frameworks. Multi-client vaults with role-based access controls allow pension fund managers or investment advisors to securely compartmentalize data while maintaining audit trails. “Enterprise clients demand consistency and compliance,” states digital policy lead Rajiv Patel.

“Secure One delivers batched security policies, regulatory reporting tools, and real-time breach simulations—so partners and clients operate with confidence and zero lateral risk exposure.”

But what truly sets Secure One apart is its commitment to education and empowerment. The platform offers an in-app learning hub with certified tutorials on cybersecurity best practices, fraud prevention, and investment due diligence. Users gain access to live webinars with financial psychologists, encryption experts, and crisis management consultants—bridging technical sophistication with human insight.

“We see our role not only as financiers but as guardians of financial confidence,” Mendez notes. “Our tools work harder when our users understand how to use them wisely.”

Real-world impact

Related Post

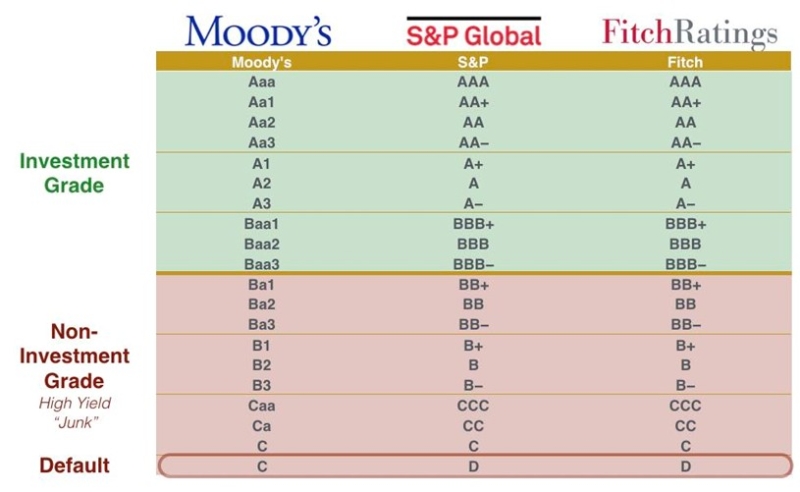

Secure One Financial Ratings Under BBB: What Your Credit Review Means for Your Future Prosperity

Is WorldOfBooksLegit the Trusted Library of the Digital Age? A Deep Dive into Its Validity and Value

MLB Bullpen Rankings Reveal The Finest Firepower Among Relievers—Who’s Currently Dominating?

Uncovering the Language: Exploring the Wide Range of Vagina Synonyms Across Contexts and Cultures