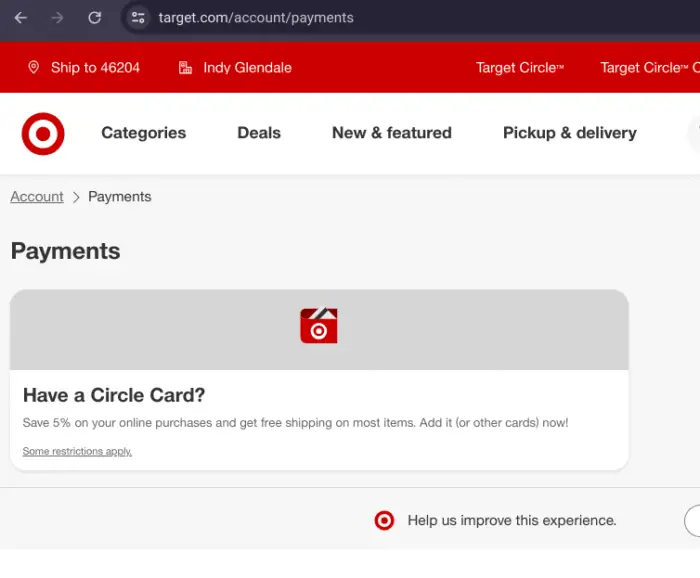

Target Red Card Payment

Target Red Card Payment Sparks Controversy: How a Simple Financial Move Became a High-Stakes Game Reshaping Consumer Trust

Supply chain delays, global inflation, and shifting payment behaviors have thrust Target’s red card payment system into the spotlight—now not just as a shopping perk, but as a financial flashpoint. When Target introduced its Target Red Card Payment service, it promised seamless, cash-forward transactions with exclusive rewards. Yet, a growing wave of red card-related disputes has turned what was meant to streamline shopping into a battleground over red card payment issues, triggering red card payment complaints from frustrated consumers demanding accountability.This case reveals deeper tensions between corporate payment innovation and consumer expectations in an era where payment systems are no longer just transactions—they’re trust contracts.

Target’s Red Card Payment platform offers a variety of benefits: instant rewards, early sale access, free shipping, and free delivery. But beneath the convenience, a growing number of users are encountering roadblocks—delayed processing, failed transactions, disputed charges, and opaque refund policies. What began as a streamlined checkout alternative has morphed into a flashpoint for systemic payment friction, exposing how technical glitches and unclear communication erode confidence in digital payment solutions.From Sydney Smith’s experience at a suburban Target store, the problem is all too real: “I scanned my red card, expected instant approval—but the system froze halfway. When I called, they couldn’t confirm if it was a fraud check or a glitch. Now I’m questioning why such powerful perks come with such unreliable payment sacrosanity.”

### The Core Mechanics of Target Red Card Payment Target’s rewards-linked payment card integrates with in-store and online checkout, offering points or cashback on every dollar spent.The red card functions as both a payment tool and membership—a gateway to exclusive discounts and free services. When a purchase is completed using the card, real-time reconciliation should trigger immediate benefit accrual and transaction confirmation. However, technical inconsistencies regularly disrupt this workflow:

- **Payment Delays and Failed Rejections**: Users report transactions being incorrectly flagged or stuck in processing, causing unexpected declines—even when sufficient funds exist.This creates a disconnect between perceived transactions and bank settlements. - **Reward Redemption Gaps**: Despite earning points, some customers face hurdles aligning their red card usage with reward accrual, undermining trust in promised benefits. - **Refund and Chargeback Confusion**: Disputes over charged items often stall red card-related reimbursements, leaving customers caught in payment limbo despite official policies guaranteeing fair resolution.

- **Communication Failures**: Limited transparency from Target on red card transaction statuses fuels anxiety, especially when automated alerts offer vague or delayed info.

According to financial analyst Laura Chen of Retail Payment Insights, “Target’s model thrives on user trust, but payment hiccups act like silent trustbreakers. When a red card user can’t verify their transaction, it’s not just a payment issue—it’s a credibility crisis.”

### Spike in Red Card Payment Complaints: What Are Consumers Demanding?Data from consumer advocacy platforms and social media indicate a clear uptick in red card payment grievances since the program’s launch. Key demands include:

- ✅ **Clear Transaction Status Updates**: Users insist on real-time, reliable transaction confirmations, including instant notifications for declines or refunds. - ✅ **Streamlined Dispute Resolution**: Faster, simpler processes for charging back errors and incorrect fees, especially for reward-linked purchases.- ✅ **Transparent Reward Integration**: Clearer rules linking card usage directly to earned points, avoiding delays or misalignment. - ✅ **Accessible Support Channels**: Multichannel assistance—live chat, phone, and in-store help—contacted swiftly to resolve issues without excessive waiting times. Many users report feeling dismissed when calling support, with automated systems offering limited guidance.

“I’ve been on hold for 20 minutes pretending to explain a declining red card transaction,” shared Marcus Tran, a loyal red card member affected by two recent billing standoffs. “It’s infuriating when you pay premiums for perks but face obfuscation instead.”

How Target Can Restore Trust and Reduce Payment Friction To maintain momentum and legitimacy, Target must evolve its red card payment service beyond a mere promotional tool into a robust, reliable financial interface. How?

- **Invest in Transparent Infrastructure:** Upgrading backend systems to prevent overlooked declines and ensure immediate reward point synchronization may reduce disputes at source. - **Humanize Customer Support:** Training agents to handle red card-specific issues with empathy and speed reinforces accountability. - **Empower Real-Time Communication:** Implementing push notifications and SMS alerts for key payment milestones—including failed attempts, refund applications, and reward crediting—builds proactive trust.

- **Open Channels for Feedback:** Actively gathering user input on red card performance creates a closed-loop system for continuous improvement. According to payment technology expert Raj Patel, “Consumers won’t forgive consistent red card payment failures masked by flashy perks. Retailers must treat these cards less like transaction tokens and more like trust instruments—secure, clear, and consistently reliable.”

Target’s red card payment program stands at a pivotal crossroads.

While it revolutionized how shoppers earn rewards through seamless payments, technical and service shortcomings risk undermining its long-term success. Addressing red card payment issues isn’t just about fixing backend glitches—it’s about rebuilding faith in a platform that blends retail loyalty with digital finance. Without swift, user-centric improvements, Target risks losing more than payments—it may lose the loyalty of the very customers it seeks to reward.

Related Post

Wow Server Status: The Real-Time Pulse Behind Your Online Success

Is Sara Donchey Married? Unveiling the Truth Behind the Public Figure’s Relationship Status

Kingsman Actors: The Elite Architects Behind the Global Spy Spectacle

Chicote Calderón: The Flavor That Redefines Tequila’s Bold Legacy