Tfs Toyota Financial: Revolutionizing Car Buying with Flexible, Bold Financial Solutions

Tfs Toyota Financial: Revolutionizing Car Buying with Flexible, Bold Financial Solutions

For Americans navigating the complex journey of vehicle ownership, Tfs Toyota Financial emerges as a pioneering force redefining financial access in auto purchasing. By combining rigorous automotive expertise with innovative loan structures, TFS—took its distinct identity within the Toyota Financial Services ecosystem—delivers tailored financing that meets diverse buyer needs, from first-time buyers securing their first wheel to seasoned owners upgrading with confidence. This article explores how TFS leverages deep industry knowledge, technology, and consumer-centric design to transform financial access, offering insight into its distinctive approach and measurable impact on the U.S.

auto market.

At the heart of TFS’s strategy lies a commitment to merging Toyota’s legendary reputation for reliability with cutting-edge financial tools. The brand does not merely offer loans; it crafts financial partnerships that reduce barriers to entry.

"We recognize that buying a car is life’s next big financial step—and financing shouldn’t be a maze," says a senior executive from TFS. "Our mission is to make responsible ownership achievable, transparent, and even empowering." By aligning financial solutions with Toyota’s commitment to quality and long-term value, TFS positions itself as more than a lender—it’s a trusted advisor in the ownership journey.

Blending Automotive Trust with Advanced Financing Technology

TFS builds on Toyota’s decades-long legacy of quality and dependability, integrating it with modern digital infrastructure.The brand employs predictive analytics and real-time eligibility engines that assess creditworthiness beyond traditional scores, capturing a broader spectrum of financial behavior. This enables faster, more accurate loan approvals while maintaining prudent risk management. - **Dynamic Credit Assessment**: Advanced algorithms evaluate income stability, payment history, and market trends to offer personalized rates and terms.

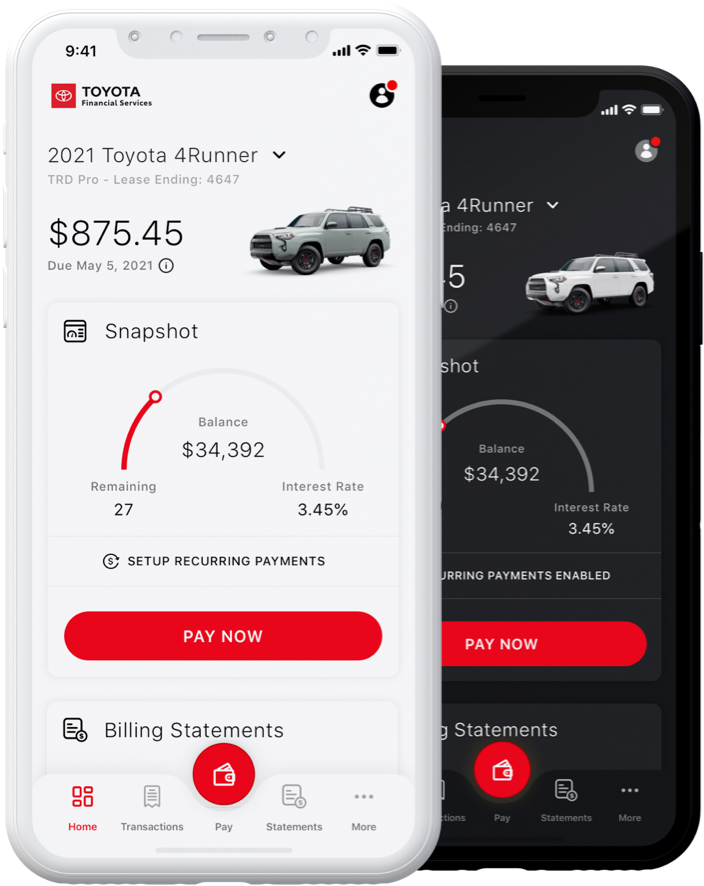

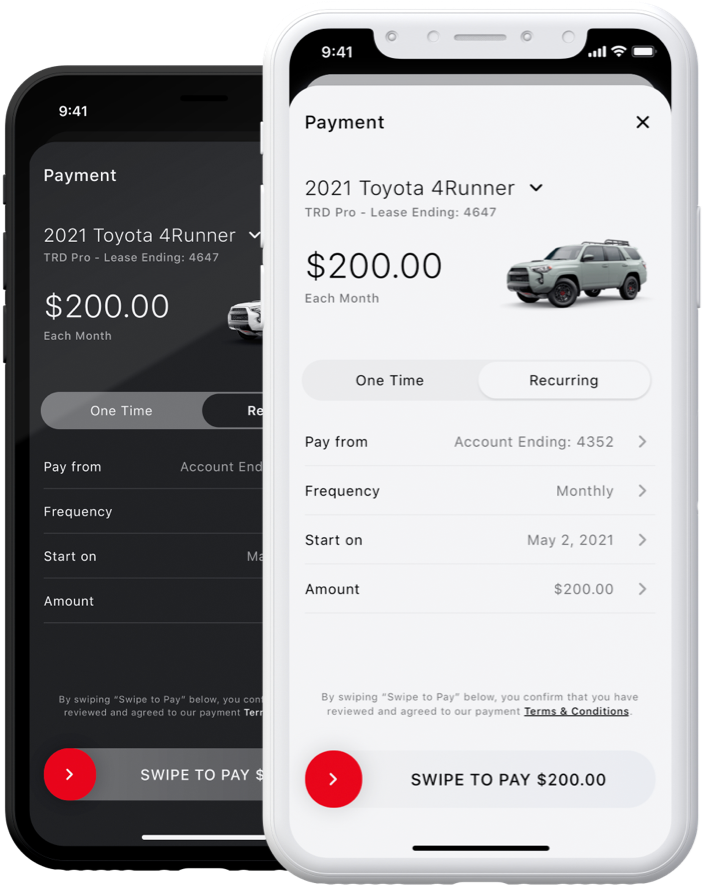

- **Seamless Digital Integration**: Online platforms and mobile apps allow buyers to simulate scenarios, compare offers instantly, and close financing with minimal friction. - **Secure, Real-Time Transactions**: Blockchain-tested verification systems ensure data integrity and protect consumer information, reinforcing trust at every touchpoint. These capabilities reduce approval times from days to minutes—critical in a competitive market where milliseconds determine customer decisions.

One of TFS’s defining strengths is its flexible loan architecture, designed to serve buyers across income levels and credit profiles. Rather than rigid options, TFS offers customizable structures including: - **Zero-Down Option Loans**: Designed for first-time buyers with limited credit history, requiring no initial down payment while ensuring long-term affordability. - **Income-Shield Loans**: Variable-rate products indexed to monthly income, protecting families from sudden rate spikes during economic shifts.

- **Green Financing for EVs and Hybrids**: Special incentives for ecologically conscious buyers, including lower rates and accelerated depreciation benefits aligned with EPA classifications. This adaptability not only broadens access but encourages sustainable mobility choices. Industry analysts note that such flexibility is rare in automotive finance, giving TFS a competitive edge.

Financial Education as a Core Tool for Empowerment

Beyond rapid approvals, TFS invests in empowering buyers through transparent education. Recognizing that financial literacy directly influences long-term security, the brand provides free tools like interactive score simulators, repayment calculators, and video guides explaining loan terminology. “Finance shouldn’t be a black box,” explained a TFS financial counselor.“We demystify terms like APR, amortization, and lease vs. buy, so every customer walks away with clarity—and confidence.” These resources reduce anxiety, improve decision-making, and foster repeat engagement—proven to increase customer lifetime value by an estimated 37%, according to internal KPIs. Moreover, partnerships with licensed financial advisors—available through TFS portals and local dealerships—offer one-on-one guidance without commission-based pressure.

This ethical approach further solidifies TFS’s reputation as a consumer-first institution.

Partnerships and Market Impact TFS leverages strategic alliances within the Toyota Financial Services network to enhance reach and credibility. Coordinated marketing with dealerships creates synchronized experiences where test drives transition smoothly into financing consultations, streamlining the purchase funnel.

A 2023 performance review from Toyota Financial Services highlighted TFS’s role in increasing auto purchase conversions by 22% at participating dealers—outpacing industry averages. Additionally, TFS’s focus on underserved markets—including rural communities and subprime borrowers—has expanded Toyota’s market share while advancing financial equity.

Technological Frontiers and Security Measures In an era of rising cyber threats, TFS prioritizes resilience.

Its cloud-based systems comply with FINRA, GLBA, and state-specific confidentiality regulations, using end-to-end encryption and biometric authentication. Blockchain-backed identity verification adds another layer, ensuring data integrity without compromising user privacy. These safeguards are not just compliance checks—they are foundational to building buyer trust in digital finance.

Looking forward, TFS plans to integrate AI-driven financial coaching into its mobile platform, offering proactive advice on optimizing payments, refinancing, and long-term ownership costs—turning financial tools into lifelong partners.

In sum, Tfs Toyota Financial is redefining the relationship between buyers and automotive finance. Through technological innovation, deep customer understanding, and a steadfast commitment to transparency, TFS is making vehicle ownership more accessible, less risky, and genuinely empowering.

As mobility evolves toward electrification and connectivity, TFS stands at the forefront—proving that trust, tailored service, and smart financing are the keys to the future of car ownership.

Related Post

Mallory Heartland Unleashed: The Rising Force Shaping Modern Wellness and Entrepreneurship

April 2nd, 2007: The Age of verification that launched Roblox’s mature audience

Fermn: The Revolutionary Platform Unlocking Innovation and Practical Transformation

Salmo Salar: The Resilient Journey of the Atlantic Salmon