Understanding Index Futures: Decoding the Market’s Hidden Engine for Beginners

Understanding Index Futures: Decoding the Market’s Hidden Engine for Beginners

For investors navigating the fast-moving world of financial markets, index futures stand as one of the most vital yet misunderstood tools—offering a strategic lever to manage risk, speculate on market direction, and gain efficient exposure to broad market performance. Unlike standard stocks or options, index futures are contracts that obligate buyers and sellers to exchange a predetermined index value at a future date, all priced with precision based on collective market expectations. This guide demystifies index futures, explaining how they work, their core purposes, key benefits and risks, and practical applications—empowering even novice traders to grasp their role in modern investing.

Index futures are standardized derivative agreements tied to major stock market indices, such as the S&P 500, Nasdaq 100, or Dow Jones Industrial Average. These indices reflect the aggregate performance of hundreds of underlying stocks, making index futures a powerful way to bet on broad market movements without owning individual shares. Trading occurs on global exchanges like the Chicago Mercantile Exchange (CME), where futures contracts lock in prices for months ahead, enabling price discovery and liquidity across time horizons.

At their core, index futures serve three pivotal functions: hedging, speculation, and arbitrage. Institutional investors—like pension funds and hedge funds—use them to hedge equity portfolios, reducing exposure to sudden market downturns. A fund manager worried about a broad market correction might sell index futures to offset potential losses across their stock holdings, effectively locking in downside protection.

Conversely, speculators see futures as an efficient vehicle to profit from market direction without transferring ownership of hundreds of equities. “Index futures allow speculators to gain leveraged exposure with lower margin requirements than trading individual stocks,” explains financial strategist Elena Torres of Mercatus Analytics. <

Futures contracts specify the exact strike price, settlement date, and margin requirements, all determined by the exchange. For example, a May 2024 S&P 500 futures contract might settle at $5,200 per point, with a margin guard—daily mark-to-market adjustments ensuring disciplined risk management. Pricing reflects real-time supply and demand, influenced by macroeconomic data, geopolitical events, Federal Reserve policy shifts, earnings reports, and global market sentiment.

Futures contracts trade with tight bid-ask spreads, offering high liquidity, especially for the largest indices. Most importantly, price movements are driven not by actual delivery but by price volatility—buyers and sellers adjust positions anticipating shifts in market direction. “Volume and volatility in index futures often signal institutional positioning,” notes market analyst James Chen.

“A steady rise paired with light selling pressure typically indicates bullish conviction ahead of the contract’s execution.” Key terms every beginner must master include: - **Contract Size**: Defines the notional value; for S&P 500 futures, one contract equals 250 times the index level, allowing leveraged exposure with relatively modest capital. - **Margin Requirements**: Brokers require initial and maintenance margins to mitigate counterparty risk; typically, 10–15% of contract value. - **Settlement Mechanism**: Unlike tangible delivery, settlement occurs in cash—buyers pay the difference if the price moves against them, or receive a profit when it moves in their favor, at contract end.

- **Expiration Cycles**: Futures mature in discrete 1- to 12-month blocks, with rolling cash settlements to avoid physical delivery, simplifying long-term strategy planning. Many assume index futures are inherently riskier than stocks, but their utility lies precisely in controlled risk and efficiency. Unlike equities, futures offer leverage—trading thousands of dollars with a fraction of that capital—but this amplifies both gains and losses, demanding disciplined risk controls.

Beginners should grasp fondamentals like roll yield—the return induced by transitioning from a contracting to a rising futures curve—and basis risk, which arises when the futures price diverges from the physical index due to supply dynamics or trading patterns. These nuances affect long-term positioning and should not be ignored.

Index futures offer a gateway to sophisticated market participation, combining accessibility with powerful strategic tools.

By understanding their mechanics, functions, and inherent risks, investors gain a platform to hedge portfolios, gain targeted exposure, and profit from macro trends—all through a single, liquid instrument. Mastering index futures isn’t about speculation alone; it’s about harnessing precision and leverage in today’s interconnected financial ecosystem.

The journey into index futures begins not with confusion, but with clarity—equipping investors to navigate volatility with confidence and precision. In a world where market momentum drives outcomes, index futures stand as indispensable allies for those ready to learn, adapt, and invest smarter.

Related Post

Behind the Barbareans: The Fallout Between Ben Foley and Mike Stud Uncovered

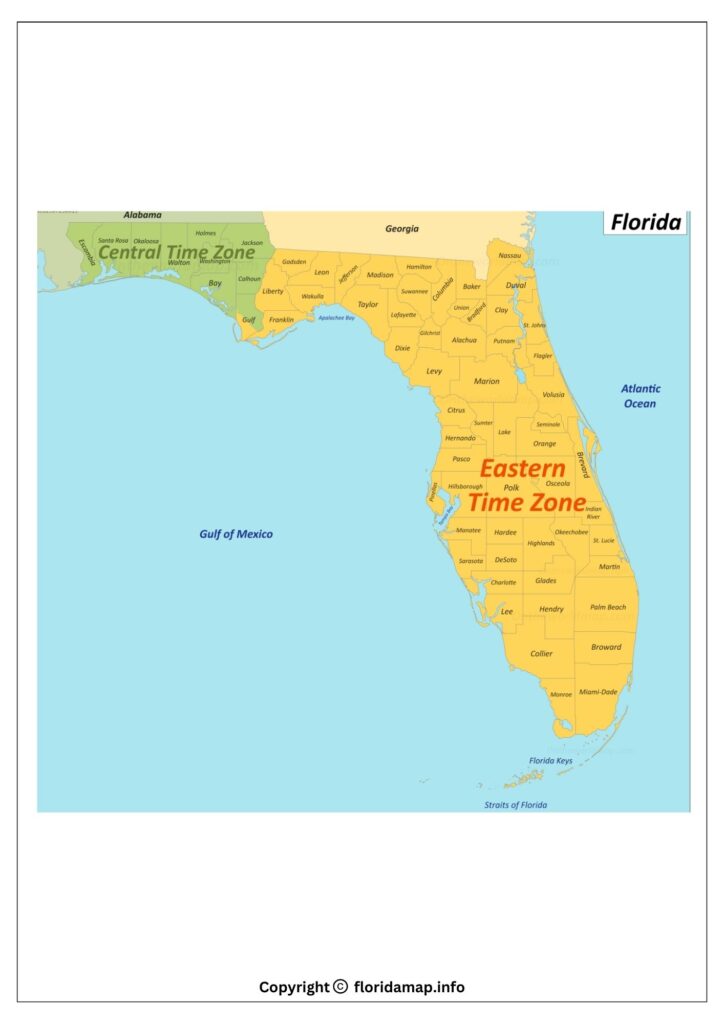

What the Time Zone in Florida Reveals About Its Unique Rhythm of Life

Twitches: Where Skill, Community, and Magic Converge in the Live-Streaming Revolution

Medical Insurance: Mastering Revenue Cycle Processes with Strategic Insight