Understanding Jani Defi: Pioneering the Future of Decentralized Finance

Understanding Jani Defi: Pioneering the Future of Decentralized Finance

At the heart of decentralized finance (DeFi) lies a vision not just of replacing banks, but of democratizing financial power—empowering anyone, anywhere with full control over their assets, without intermediaries. Among the emerging architects shaping this revolution is Jani Defi, a name increasingly central to the evolution of trustless, transparent financial systems. Through innovative protocol design and a deep commitment to user-centric architecture, Jani Defi is helping define the next era of DeFi—one where access, security, and autonomy converge.

<

“It’s about enabling users to own, govern, and benefit from the financial systems they participate in—directly, transparently, and reliably.” This philosophy is evident in Jani’s approach to protocol development. Rather than relying on layered orgy of DeFi platforms that often replicate siloed inefficiencies, Jani advocates for composable, interoperable systems—layers of trust built on open standards rather than proprietary gatekeeping. “Every DeFi application should be a building block,” Jani explains.

“Interconnectedness without central control is the key to resilience and scalability.”

Architecting Trust: The Technical Pillars Behind Jani Defi’s Innovations

Jani Defi’s contributions span multiple technical dimensions critical to DeFi’s maturation. At the core is a focus on secure, modular smart contract design. In a landscape rife with exploits and vulnerabilities, Jani’s protocols implement rigorous formal verification, modularity for auditability, and fail-safe mechanisms that minimize risk.These choices drastically improve platform integrity—early indicators of a new DeFi paradigm where security is built in, not bolted on. Beyond smart contracts, Jani emphasizes user experience and economic sustainability. By integrating intuitive wallets, low-cost transactions, and governance models that reward active participation, Jani ensures decentralized applications remain accessible to non-technical users and economically viable for long-term contributors.

“Most DeFi platforms serve early adopters and technologists,” Jani observes. “We’re building for inclusion—so finance works for everyone, not just a select few.” Real-world examples include decentralized lending platforms with dynamic interest rate models based on real-time market data, and cross-chain asset aggregators that preserve user sovereignty while enabling seamless liquidity navigation. These innovations exemplify Jani Defi’s ethos: technology that scales in functionality but never in complexity.

Decentralization Beyond Theory: Bridging Real-World Finance

Jani Defi’s vision extends beyond abstract theory into tangible, real-world impact. By integrating DeFi mechanisms with regulated compliance frameworks, Jani’s protocols are enabling secure access to financial services for unbanked populations and SMEs excluded from traditional banking. A 2024 pilot with several African microfinance institutions demonstrated how blockchain-based DeFi tools enabled transparent credit scoring and instant lending, reducing default risks through on-chain data provenance.Moreover, Jani champions cross-border remittance solutions leveraging stablecoins and decentralized networks—eliminating exorbitant fees and delays common in legacy systems. “DeFi isn’t just for tech enthusiasts,” Jani asserts. “Its power lies in making finance work differently for real people—faster, cheaper, fairer.” Investors and developers alike are taking notice.

Institutional interest is growing as proof-of-concept deployments deliver measurable ROI, transparency, and auditability—key levers for mainstream adoption.

The Road Ahead: Challenges and the Path Forward for DeFi

Despite momentum, Jani Defi acknowledges persistent challenges: scalability bottlenecks, evolving regulatory scrutiny, and the persistent threat of smart contract vulnerabilities. Yet, rather than retreat, Jani advocates a proactive evolution—advancements in Layer 2 solutions, privacy-preserving zero-knowledge proofs, and governance models that align community incentives with platform long-term health.“Decentralization is not static,” Jani notes. “It requires continuous adaptation—balancing innovation with resilience, permissionless access with responsible stewardship.” This philosophy fuels ongoing research into adaptive risk models, cross-chain interoperability standards, and user-driven protocol governance. As DeFi matures, the distinction between legacy finance and decentralized systems blurs.

Jani Defi remains a guiding force—championing not just technological breakthroughs, but a reimagined financial order rooted in equity, transparency, and participation. Jani Defi’s work underscores a central truth: the future of finance isn’t just decentralized—it is democratized, permissionless, and built by architects who see technology not as a barrier, but as a bridge to financial empowerment for all. In this ongoing transformation, Jani Defi stands as a pivotal figure—shaping protocols that don’t merely disrupt, but restore trust, by design.

Related Post

Understanding Chappell Roan’s Height: A Comprehensive Overview of the Singer-Songwriter’s Stature and Legacy

Siemens Oven Symbols Decoded: The Ultimate Guide to Perfect Baking with Your Siemens Oven

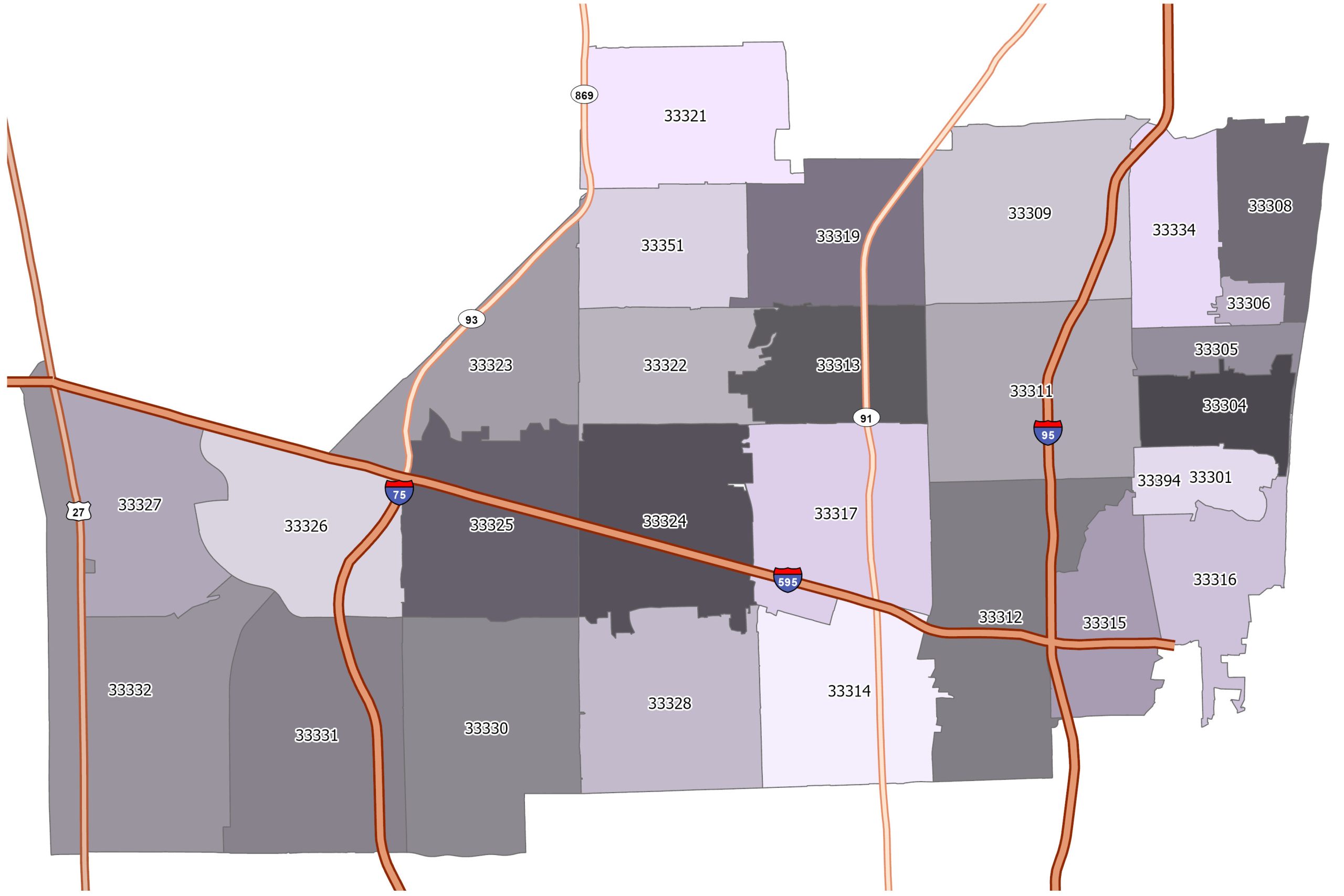

Fort Lauderdale Zip Code 33401: The Pulse of a Coastal Urban Neighborhood

Erj Website Mugshots: The Chilling Reality Behind Public Safety Visual Databases