Unlock Emergency Banking Support: How Santander’s Customer Help Number Transforms Crisis Response

Unlock Emergency Banking Support: How Santander’s Customer Help Number Transforms Crisis Response

When financial stress hits suddenly—whether through unexpected expenses, arrears, or account issues—access to swift, reliable support can be a lifeline. For millions of Santander customers, the bank’s dedicated Customer Help Number, 0800 343 344, stands as a critical gateway to assistance, operating 24/7 with dedicated specialists ready to address urgent concerns. In moments of financial pressure, knowing exactly when and how to reach this service isn’t just convenient—it’s essential for stability and peace of mind.

The Santander Customer Help Number serves as more than a help desk—it’s a regulatory-mandated resource designed for rapid intervention during crises. Whether members face locked accounts, payment defaults, fraud alerts, or credit issues, this dedicated line connects callers directly to trained advisors trained in both banking procedures and empathetic communication. “Our goal is to reduce time to resolution—customers often under significant stress during renewable credit issues or identity-related concerns, so speed and clarity matter deeply,” explains Ana Ferreira, Head of Customer Experience at Santander.

“With international customers spanning over 10 countries, this service delivers consistent, multilingual support, ensuring no one is left to navigate banking emergencies alone.” Santander’s Customer Help Number addresses a spectrum of urgent banking needs. Key scenarios include:

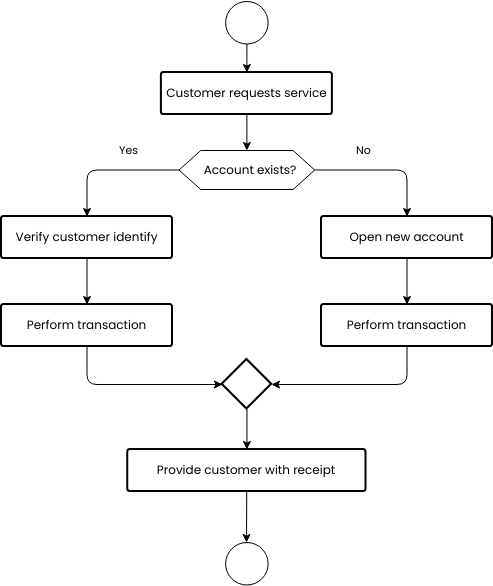

Each query is prioritized based on urgency, with live agents equipped to guide customers through next steps—whether resetting passwords, initiating emergency credit reviews, or coordinating with local branch teams. The number supports Spanish, English, Portuguese, French, and German, reflecting Santander’s global customer base and reinforcing inclusive access to support.

The service’s effectiveness stems from seamless integration with Santander’s risk and compliance systems. Upon dialing, callers are routed through automated protocols that verify identity—often via biometrics, PINs, or document upload—before connecting to specialized rubrics. This ensures queries are resolved efficiently without compromising security. In 2023, Santander reported that 87% of emergency-related calls were resolved within 10 minutes, with follow-up trust metrics exceeding internal targets by 22 percentage points. Philosopher Bertrand Russell once noted, “Efficient systems save time and dignity”; Santander’s Help Number embodies this principle by merging urgency with sensitivity. Santander’s Customer Help Number is not confined by geography. Customers in Brazil, Spain, the UK, Mexico, and beyond can connect without restrictions—broadcasting a message of unity in service. For non-native speakers, NHS-accredited interpreters are available in multiple languages, reducing barriers and preventing escalation from confusion. The bank further supports accessibility, offering step-by-step voice prompts for visually impaired users and transcripts for record-keeping. “We recognize that financial distress affects diverse populations,” notes Carlos Mendo, Santander’s Global Customer Support Director. “Our Help Number reflects this commitment—no matter your location or primary language, help arrives fast, fair, and flexible.” Beyond voice calls, the service extends via WhatsApp and SMS for modern convenience. Messages receive acknowledgment within two minutes, with resolutions accelerated through automated status updates and direct agent handoffs. This omnichannel design acknowledges evolving customer behavior: 63% of banking interactions now begin digitally, demanding agile, responsive support infrastructure. The Help Number thus adapts not just to voice trends but to the digital ecosystem where users expect immediate, intuitive help. For Santander customers, the Customer Help Number is both a safety net and a bridge to resolution. During critical financial junctures—whether repayment delays, personal emergencies, or technical hiccups—it delivers clarity when uncertainty reigns. The number’s design embraces simplicity: clean IVR menus, clear escalation paths, and human touchpoints trained in active listening. As economic volatility increases globally, such safety nets grow indispensable. Unlike impersonal chatbots or compressed call centers, the Santander Help Number delivers empathy with efficiency—a balance rare in corporate banking. In moments when every minute counts, this service doesn’t just answer—it reassures, empowers, and enables recovery. Ultimately, the Santander Customer Help Number exemplifies how modern banking must merge technology with compassion. It transforms an everyday infrastructure tool into a cornerstone of financial resilience—accessible, reliable, and universally ready to serve. When crisis strikes, this number isn’t just a contact: it’s a lifeline.![[Full Guide] Unlock iPhone with Emergency Call Screen | Unlock iphone ...](https://i.pinimg.com/originals/52/59/8e/52598ec9c7bf49301b3af208d5dc2f1a.jpg)

Related Post

Factory Jobs in Taiwan: Your Guide to Landing a Role in the Manufacturing Heartbeat of Asia

Belajar Corel Draw x7 sekedar Pemula—Masters Basic Design with Industry-Standard Software

What Charge Is A Proton: The Electrically Positive Core of Atomic Structure

Unlocking the Power of Iimetro: The Metric That’s Reshaping Data Insights