Unlock Hidden Value: Mastering Financial Algebra Through the Workbook Answers PDF

Unlock Hidden Value: Mastering Financial Algebra Through the Workbook Answers PDF

Every financial equation tells a story—of growth, risk, and decision-making. Whether predicting cash flow, sizing investment returns, or modeling debt structures, financial algebra stands as the language that turns abstract variables into actionable insights. The Financial Algebra Workbook Answers PDF delivers more than just solutions; it bridges theory and real-world application through step-by-step problem resolution.

For students, professionals, and lifelong learners, mastering this resource means transforming complex financial scenarios into solvable models. This article explores how the workbook’s carefully structured answers empower users to decode financial expressions, build analytical confidence, and apply powerful algebraic techniques beyond the classroom or office.

Decoding the Language of Financial Equations

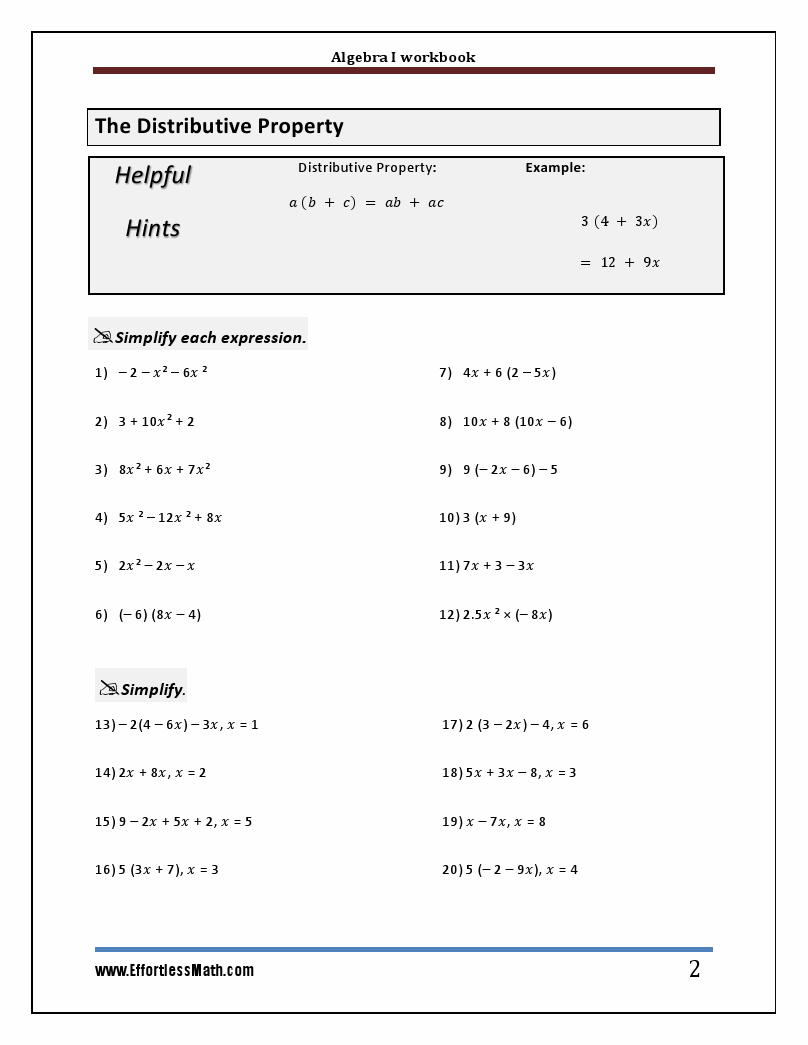

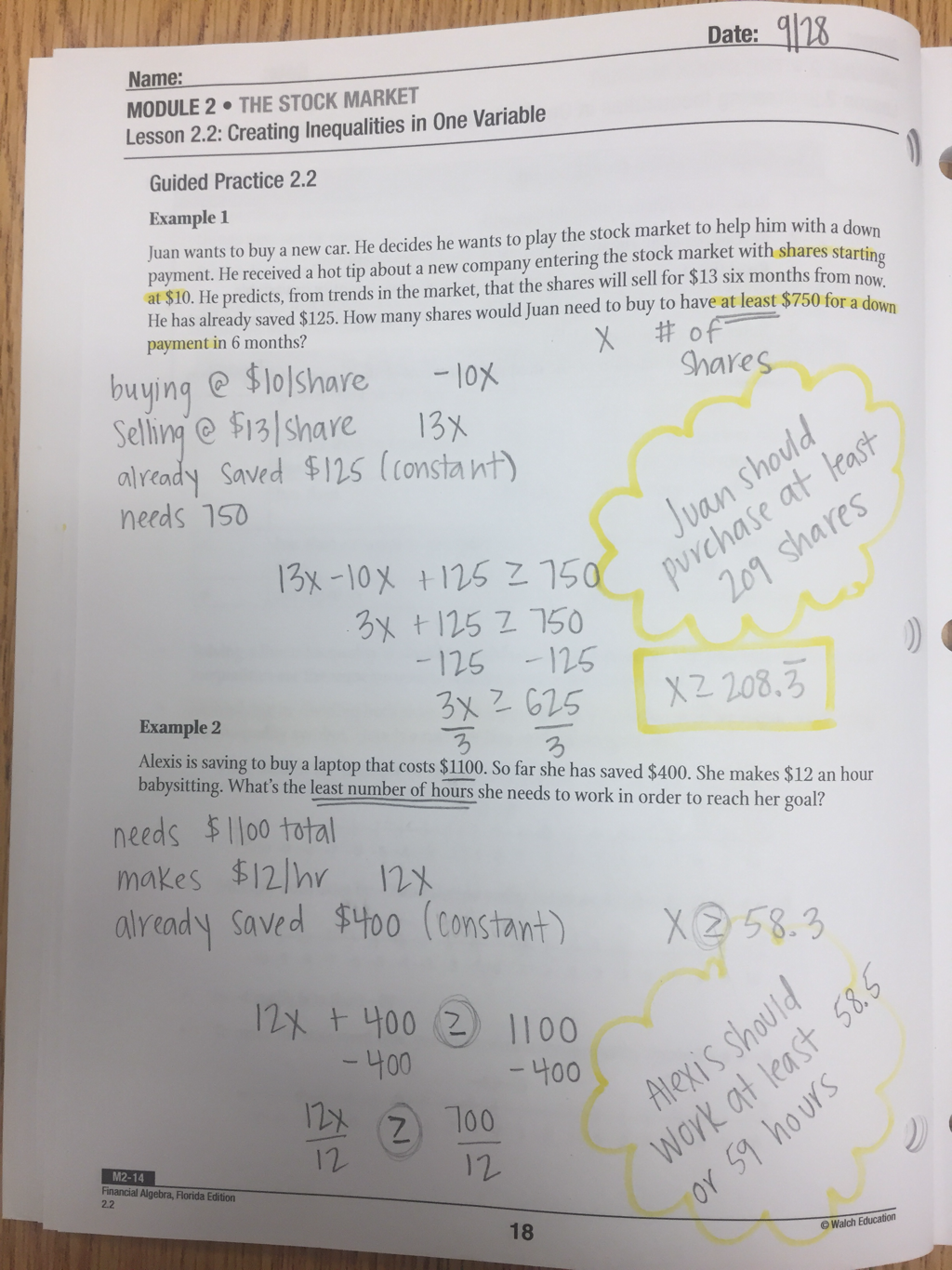

At its core, financial algebra translates economic relationships into mathematical form, allowing users to manipulate variables such as time, interest rates, principal amounts, and expenses.These equations underpin critical decisions—from budgeting and forecasting to loan structuring and capital planning. Understanding how to isolate variables, balance equations, and isolate cost drivers is essential for effective financial literacy. The workbook answers PDF offers a systematic approach, guiding learners through processes like rearranging formulas, substituting known values, and verifying results through inverse operations.

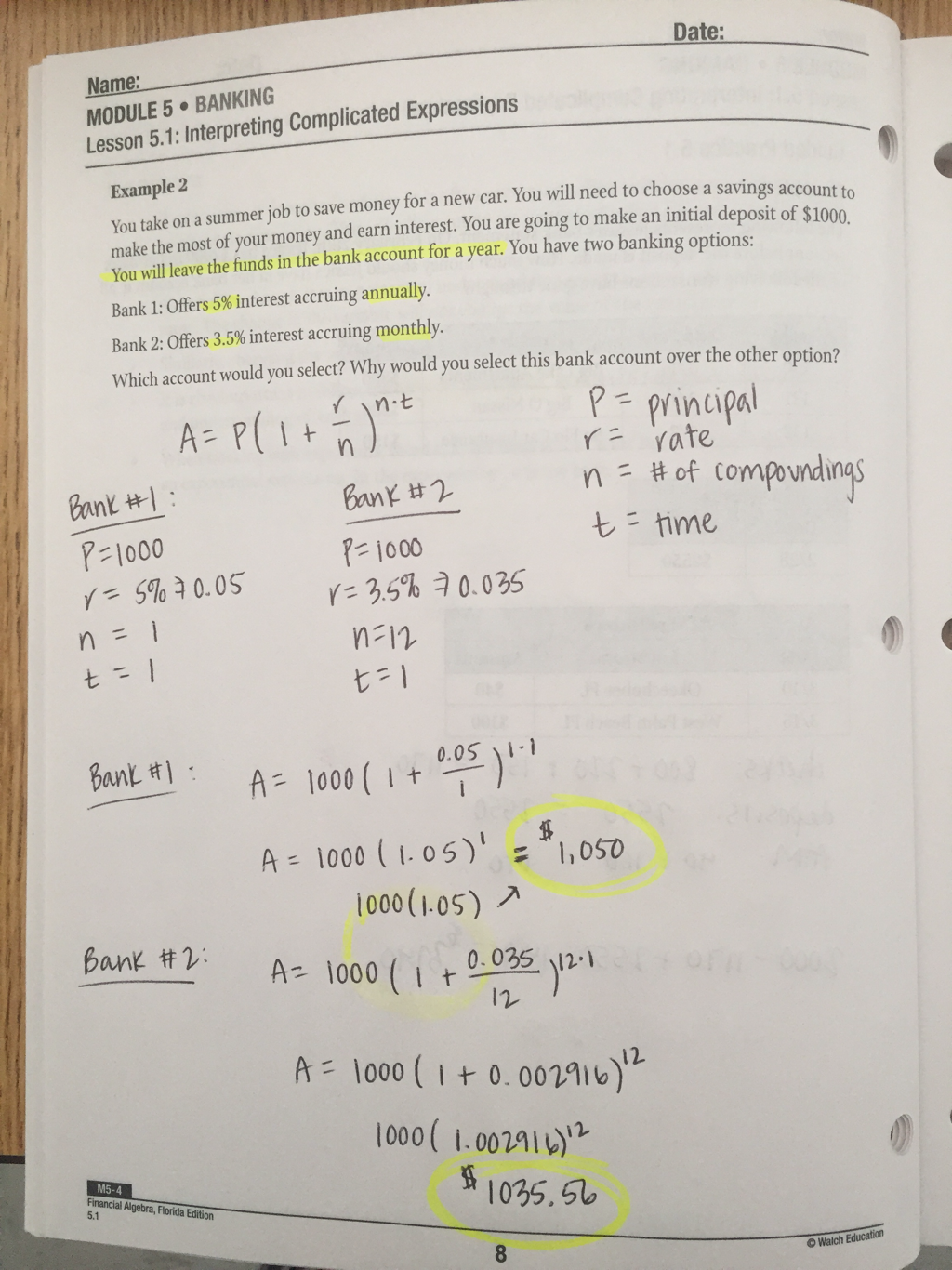

The framework relies on fundamental algebraic principles: - **Isolating unknowns**: Rearranging equations such as $ A = P(1 + rt) $ to solve for $ r $ reveals the time rate needed for a target amount. - **Compound interest modeling**: Applying $ A = P(1 + i/n)^{nt} $ enables precise projections of investments over time, accounting for discrete compounding frequency. - **Break-even analysis**: Identifying fixed and variable costs through equations like $ R = px $ and $ C = f + vx $, then equating revenue and cost to solve for quantity $ x $.

These tools are not merely academic—they mirror the analytical rigor required in corporate finance, personal budgeting, and market forecasting.

Core Problem-Solving Workflows in the Financial Algebra Workbook

The workbook answers PDF emphasizes structured problem-solving, providing annotated, correct solutions that reveal not just the final answer but the logical journey to reach it. This transparency supports deeper comprehension and long-term retention.Problem-solving follows a repeatable, logical sequence: Define the variable: Clearly identify what is unknown. Substitute known values: Enter accurate numbers into the equation. Manipulate algebraically: Apply inverse operations, factoring, and distribution.

Verify and interpret: Confirm the solution by plugging it back into the original equation and contextualizing the result. For example, in a capital budgeting exercise: - Define $ r $: the discount rate. - Known: Initial investment $ I = \$250,000 $, annual cash inflow $ C = \$75,000 $, annual operating cost $ O = \$15,000 $.

- Net cash flow: $ CF = C - O = \$60,000 $. - The basic payback period equation: $ t = -I / CF $. - Plug in: $ t = -250000 / 60000 = -4.17 $ → adjusted for negative time, use $ t = -\frac{250000}{60000} \approx 4.17 $ years in practical terms.

- The final answer is not just 4.17 years, but insight into the time needed to recover capital and assess project viability. Other typical workflows include solving for monthly payment in a loan amortization: \[ M = \frac{P \cdot r(1 + r)^n}{(1 + r)^n - 1} \] where $ M $ is the monthly payment, $ P $ the principal, $ r $ the monthly interest rate, and $ n $ the number of payments. Understanding how changes in $ r $ or $ n $ affect $ M $ empowers borrowers and lenders alike.

These exercises build analytical resilience. Learners repeatedly confront how small changes in variables ripple through financial outcomes—whether adding a new revenue stream or increasing operational costs. This iterative practice develops precision and adaptability, core competencies in financial planning.

Real-World Impact: From Book to Business

The true value of the Financial Algebra Workbook Answers PDF lies in its bridge between textbook theory and enterprise-level application. Financial professionals use similar equation-solving techniques daily—whether stress-testing balance sheets, modeling revenue growth, or evaluating merger synergies. The workbook mirrors this by embedding real-world contexts: tax computations, depreciation schedules, and multi-period cash flow projections.From a business perspective, precise financial modeling reduces uncertainty. Companies that integrate algebraic forecasting into strategic planning demonstrate stronger decision-making around funding, scaling, and risk management. Students gain not just the ability to solve equations, but the mindset to ask: “What if?”—a question that drives innovation and financial foresight.

Even personal finance benefits: using algebra, individuals can plan for retirement by back-calculating required monthly savings, factoring in expected returns, inflation, and life expectancy. The workbook teaches the confidence to translate vague goals into concrete, actionable plans.

For example, saving for a $50,000 down payment in 5 years at 6% annual interest requires identifying the compound growth needed.

Using $ FV = PV(1 + r)^t $, rearranged to solve $ r $: \[ r = \left(\frac{FV}{PV}\right)^{1/t} - 1 = \left(\frac{50000}{P}\right)^{1/5} - 1 \] Assuming no contributions, the time alone shows short-term lack of growth. Instead, solving for $ P $ reveals the required initial deposit—demonstrating how algebra transforms aspiration into plan.

The Financial Algebra Workbook Answers PDF is far more than an answer key; it is a catalyst for financial literacy powered by logic and precision.

By decoding financial relationships algebraically, users unlock clarity across personal, academic, and professional domains. Mastery of these skills enables proactive, informed decisions—turning complex financial landscapes into predictable, manageable equations. As real-world financial complexity grows, this structured, mathematical approach provides not just knowledge, but empowerment.

The workbook answers PDF opens the door to controlling financial outcomes with confidence. For anyone seeking to move beyond guesswork and into strategic certainty, this resource is indispensable. Through disciplined practice and real-world application, financial algebra ceases to be abstract—it becomes the foundation of rational, effective action.

In a world where numbers speak volume, the ability to read, manipulate, and interpret financial equations determines long-term success. The Financial Algebra Workbook Answers PDF delivers that critical edge—one equation at a time.

Related Post

Drew Gulliver’s OnlyFans Empire: Inside the Secrets Behind His Content Dominance

Legal Aid Fresno

The AirAsia Story Revised Edition: From Humble Beginnings to Aviation Empire

Decoding Life’s Blueprint: Mastering Biological Classification Through the Pogil Model 2 Approach