Unlock Instant Payments with A Simple Guide to Using Gpay

Unlock Instant Payments with A Simple Guide to Using Gpay

Gpay — the digital wallet from Paytm — has transformed everyday transactions in India and beyond, making peer-to-peer payments, bill splitting, and merchant recharges faster and more secure than traditional methods. With millions already relying on it, understanding how to use Gpay efficiently can streamline daily financial interactions. This comprehensive guide breaks down everything you need to know, from setup to advanced features, ensuring you master this powerful payment platform with confidence.

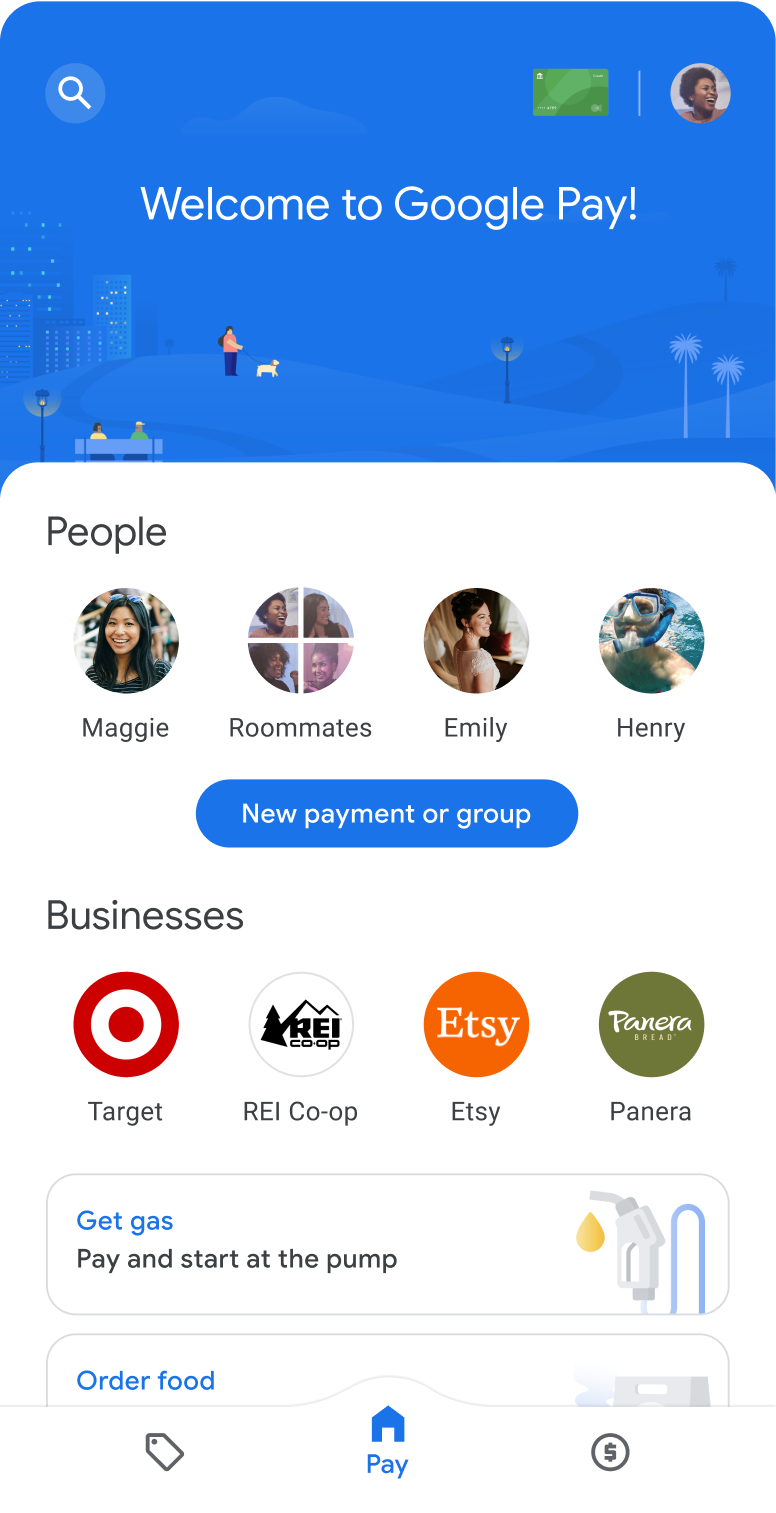

At its core, Gpay functions as a recharging, payment, and wallet app designed to consolidate your financial tools into one intuitive interface. Whether splitting dinner bills, paying utility companies, or recharging mobile data, Gpay delivers speed and convenience. With real-time fund transfers, merchant acceptance across thousands of retailers, and built-in security features, Gpay positions itself not just as a payment app but as a full-fledged financial companion.

Step-by-Step Setup and Downloading Gpay

Installing Gpay is simple and accessible for users across smartphones.To begin, download the app from your device’s official app store—available for both iOS and Android platforms. Once installed, launching Gpay requires a basic onboarding process: creating a user profile with a valid mobile number, linking a bank account or debit card, and verifying identity through OTP-based authentication. While many users complete setup in under five minutes, the inclusion of One-Time Passwords (OTPs) ensures compliance with financial regulatory standards and protects against unauthorized access.

- Open the Gpay app from your home screen.

- Tap ‘Get Gpay’ and enter your phone number (valid for India).

- Follow verification prompts, including OTP input sent to your registered number.

- Complete KYC using documents or biometric verification as required.

- Link a bank account or debit card via net banking or UPI for real fund transfers.

- Customize settings for preferences, notifications, and cash-back options.

For those prioritizing security, Gpay leverages multi-factor authentication, AES-256 encryption, and AI-driven fraud detection—ensuring your funds and personal data remain protected throughout every transaction.

Essential Features That Make Gpay Stand Out

What truly distinguishes Gpay is its ecosystem of integrated services designed for convenience.Key features include:

- Gpay Wallet: Store funds securely, recharge mobile plans, and make UPI and card payments—all within a single app. Recharge and Top-Up: Connect banks instantly to recharge Postpaid, OTT bundles, or telecom services without visiting a store.Instant UPI Payments: Execute seamless peer-to-peer transfers, split bills with precision, and accept payments from merchants endorsed by major retailers.Gpay Payments for Merchants: Enable cashless payments at over 10 million offline and online POS terminals nationwide.Rewards and Cashbacks: Earn instant discounts, loyalty points, and offers from partner brands on payments made through the app.Tip-Joining and Social Payments: Send digital tips to friends, family, or content creators instantly during live streams or shared videos.Bank Loans and Insurance: Access instant loan eligibility checks and insurance products tailored to your banking history via Gpay.

These capabilities make Gpay far more than a simple wallet—it’s a financial operating system for modern mobile users, especially in urban and semi-urban areas where UPI adoption is now ubiquitous.

How to Perform Transactions Safely and Efficiently

Making a payment with Gpay is purpose-built for simplicity. To execute a transaction:- Launch Gpay and select ‘Pay’ from the home screen.

- Choose the payee or payment method: either a saved bank account, debit card, or a linked wallet array.

- Input the receiving amount or merchant amount; in split bills, designate each contact’s share exactly.

- Review charge details—including fees or offers—and confirm.

- Complete payment with biometric verification or PIN, then receive instant confirmation.

For those managing multiple finances, Gpay offers category-based transaction tracking and receipt archiving. Users report saving time by accessing layered summaries that highlight recurring subscriptions, large outflows, or merchant preferences, allowing smarter budget control and faster dispute resolution.

Mastering advanced functionalities for daily use

Beyond basic payments, Gpay delivers advanced tools that enhance financial agility.Set up scheduled transfers to automate rent, tuition, or savings deposits, ensuring consistent timely payments without manual effort. Configure card alerts—such as low balance warnings or large transaction notifications—to remain alerted dynamically. Use Gpay’s ‘Split Bill’ feature to fairly divide expenses with exact amounts per person, supported by split-screen UPI edit functions that streamline fairness.

For business users and micro-entrepreneurs, linking a Gpay Business account enables managing employee payrolls, tracking POS sales, and generating income statements with real-time analytics—turning Gpay into an entrepreneurial financial hub, not just a consumer wallet.

Multi-user profiles are a game-changer for families or roommates; assign separate sub-accounts with specific spending limits, preventing accidental overspending while maintaining transparent shared funds.

This feature encourages accountability and financial literacy, particularly among younger users, fostering responsible spending habits from an early age.

Integrating Gpay with Other Financial Tools and Services

Gpay thrives not in isolation but within a broader digital finance ecosystem. Seamlessly connect it with Paytm’s investment platform, e-commerce portals, and advertising apps to unify shopping, savings, and daily spending. The app also integrates with UPI’s nationwide payment rail, enabling instant peer-to-peer and merchant transactions at over 11 million merchant POS terminals.One of its most impactful integrations is the partnership with banks and NBFCs, allowing users to apply for loans, switch accounts, or manage credit scores directly through Gpay—bridging the gap between cashless convenience and formal financial services.

Additionally, Gpay syncs with major telecom, entertainment, and utility providers, delivering unified access to recharge services, live streaming payments, or utility bill settlements—all without switching apps or providing multiple credentials.

The Role of Security in Building User Trust

Security remains central to Gpay’s design philosophy.The app employs end-to-end encryption, hardware-based key storage, and real-time transaction monitoring powered by AI algorithms that detect unusual spending patterns instantly. Two-factor authentication (2FA) via UPI PIN, SMS, or biometrics adds layered protection, making unauthorized access nearly impossible.

User feedback consistently highlights trust in Gpay’s security—fewer reports of fraud than other digital wallets in comparable usage statistics, according to recent Fintech Security Reports released by NPCI (National Payments Corporation of India).

Regular security updates, mandatory KYC, and proactive fraud alerts keep users informed and fortified. This robust defense triggers peace of mind, encouraging repeated use and deeper engagement with the platform’s multifaceted capabilities.

Real-World Use Cases: Gpay in Everyday Moments Consider Maria, a college student splitting her monthly food budget with roommates: with Gpay, she splits bills precisely down to the rupee, avoids accounting confusion, and sends instant tips to classmates—turning dwindling coffees into streamlined coordination.

For Raj, a small shop owner, the Partner Merchant mode lets him accept mobile recharges, bill payments, and inventory referrals all via Gpay, replacing cash r declarations and lowering operational friction.

In rural areas, Gpay’s offline payment feature enables grocery purchases at local kirana stores without stable internet—charges synced automatically when connectivity returns. These use cases reveal Gpay’s adaptability across socioeconomic contexts, proving it’s more than a payment tool—it’s a lifestyle enabler.

Leveraging Gpay’s Loyalty and Financial Incentives One of Gpay’s standout features is its strategic rewards ecosystem. Partner merchants—from food delivery to retail—offer exclusive cashbacks, 5–15% discounts, and bonus points on Gpay transactions, directly redeemable within the app or claimed at partner locations.

These offers aren’t generic; many are triggered by spending thresholds or seasonal campaigns, tailored to user behavior.

How it works: Every payment earns points or cashback, visible instantly in transaction receipts. Users track rewards through personalized dashboards, and alerts notify when campaigns expire or new opportunities arise.

This gamification not only drives user retention but also encourages thoughtful spending, aligning financial activity with tangible value.

Financial inclusion experts note that such incentive structures significantly increase user loyalty—particularly among first-time digital payers—who transition from occasional users to daily active participants due to integrated benefits beyond basic transfers.

Future Horizons: Gpay’s Roadmap and Continued Innovation

Looking ahead, Gpay continues evolving with AI-driven financial insights, expanded cross-border payment features, and deeper integration with India’s digital public infrastructure like UPI GAI and Aadhaar-based methoded authentication. Planned enhancements include automated expense categorization, predictive budget alerts, and improved merchant onboarding for unbanked populations.As the digital economy expands, Gpay’s commitment to usability, security, and inclusivity positions it not only as a current leader but as a cornerstone of India’s cashless future.

In a nation where mobile penetration exceeds 800 million and UPI transactions surpass millions daily, Gpay has become more than a wallet—it’s a gateway to seamless financial participation.

With its intuitive design, robust features, and user-first ethos, mastering Gpay isn’t just convenient—it’s essential for anyone navigating modern payment landscapes. Whether splitting a meal, recharging your phone, or accessing rewards, Gpay continues proving that simplicity and strength go hand in hand.

Related Post

Why Do Bodybuilders Tan? The Science Behind the Glow

Beneath the Tongue: The Hidden Power of Frog Vomerine Teeth

The Surprising Road of Robyn Brown: From Mid-Career Shift to Mature Independence in Her Sisters’ Spotlight

Limestone Chapel Funeral Home: Where Legacy Meets Legacy — A Deep Dive into Careers, Obituaries, and the Human Touch in Legacy Care