Unlocking Consumer Behavior: How Own Price Elasticity Shapes Market Decisions

Unlocking Consumer Behavior: How Own Price Elasticity Shapes Market Decisions

At the heart of pricing strategy lies Own Price Elasticity, a pivotal economic metric that reveals how sensitive demand is to price changes—offering businesses the insight needed to price wisely, maximize revenue, and navigate competitive landscapes. Measured as the percentage change in quantity demanded in response to a percentage change in price, Own Price Elasticity determines whether a 1% price increase leads to a 1%, 2%, or even more dramatic shift in consumer behavior. In an era where data drives every decision, understanding this elasticity allows companies to fine-tune pricing, forecast sales, and anticipate market reactions with precision.

What Is Own Price Elasticity?

Fundamentals and Formula

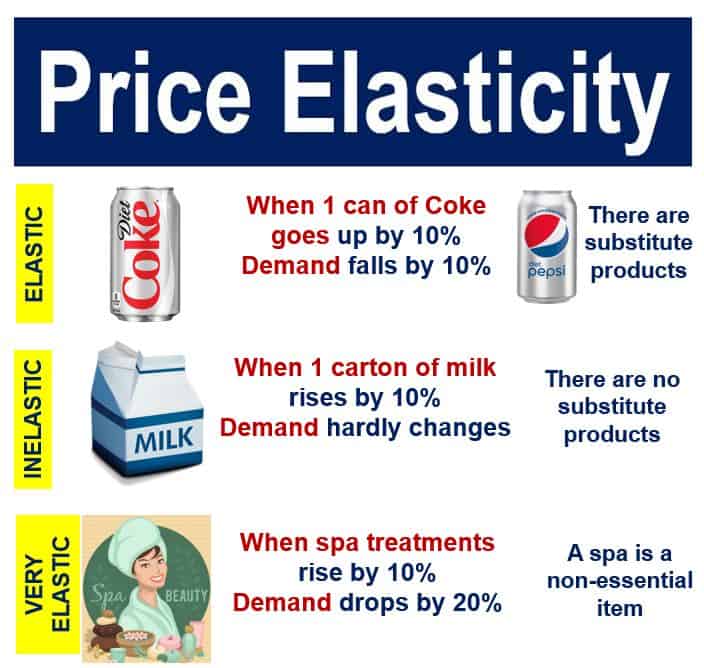

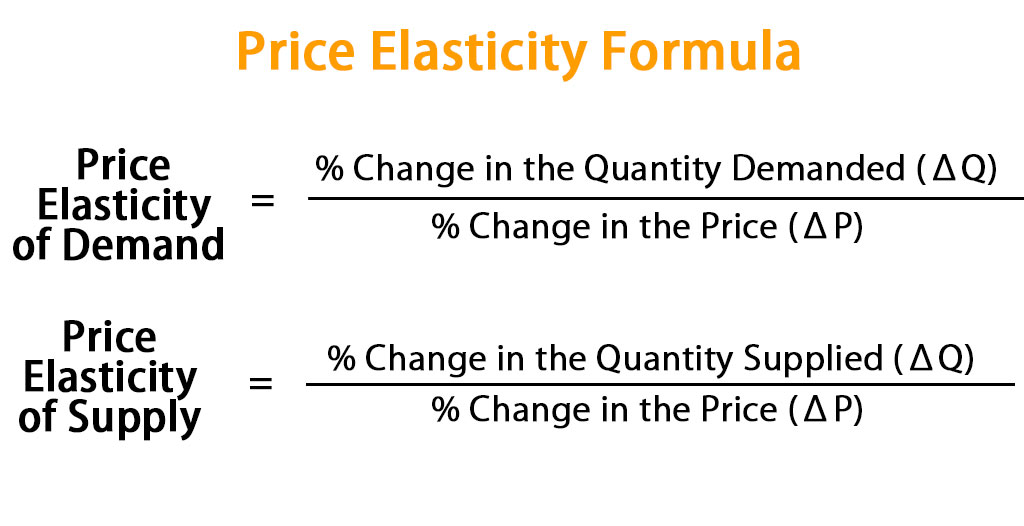

Own Price Elasticity of Demand (PED) quantifies the responsiveness of consumer purchases to variations in a product’s own price. The formula is simple: PED = (% change in quantity demanded) ÷ (% change in price). When expressed numerically, elasticity values guide strategic planning: demand with a PED greater than 1 is elastic, meaning small price hikes trigger steep demand drops; values less than 1 indicate inelastic demand, where price changes have muted effects.

A PED of exactly 1 signals unitary elasticity—where revenue remains stable as prices shift. This mathematical clarity transforms raw sales data into actionable intelligence.

The significance of Own Price Elasticity extends beyond theory. For every unit sold—whether a luxury gadget, staple food, or seasonal告аров—pricing choices ripple across revenue and market share.

Retailers, manufacturers, and service providers rely on this metric to evaluate how elastic their offerings truly are, enabling calculated trade-offs between volume and margin. “The more elastic a product, the riskier aggressive price cuts become—since demand sours quickly,” explains Michael Chen, senior economist at the Global Pricing Institute. “Inelastic demand, by contrast, gives companies pricing power, allowing premium strategies without dramatic volume loss.”

Factors Influencing Own Price Elasticity Across Industries

Elasticity is not a one-size-fits-all measure; it varies dramatically across sectors, product types, and consumer segments.

Key determinants include the availability of substitutes, the product’s necessity level, the share of consumer budget, and time horizon. - **Availability of Substitutes**: Products surrounded by alternatives—like bottled water versus tap water—tend to be highly elastic. When one brand raises prices, shoppers switch quickly.

Clean beauty products, with numerous options, typically register high elasticity (often above 1.5). - **Necessity vs. Luxury**: Staple goods such as bread or insulin exhibit inelastic demand (elasticity below 0.5), meaning consumers absorb price increases without slashing purchases.

Luxury items, conversely, often see elastic demand: a 10% price jump on designer handbags may trigger a 20% drop in sales among non-essential buyers. - **Budget Share**: Products consuming a large portion of household budgets—such as housing or cars—tend toward inelasticity. Small price adjustments for these categories rarely disrupt consumption patterns.

- **Time Horizon**: Demand elasticity evolves over time. Short-term reactions to price hikes are often muted—consumers may stick with habits—but over weeks or months, behavior shifts as alternatives are researched and habits adjust. Pricing analysts use this dynamic to forecast long-term revenue impacts.

Retailers in fast-moving consumer goods (FMCG) often segment products by elasticity: essentials with stable pricing, luxury segments with promotional flexibility, and niche items with elastic sensitivity. “A 1% price increase on organic milk might cut demand by 0.8%—acceptable for stable margins,” notes Sarah Lopez, demand strategist at EcoPack Solutions. “But a 5% hike on premium probiotic supplements could drop sales by over 3%, requiring reinvestment in differentiation.”

Practical Applications: How Businesses Leverage Own Price Elasticity

Businesses apply Own Price Elasticity not just to set prices, but to shape entire revenue strategies.

From dynamic pricing models to promotional planning, elasticity data informs decisions with scientific rigor. - **Revenue Optimization**: Companies use elasticity curves to identify the “sweet spot” where price changes fuel maximum revenue. If PED is inelastic, raising prices boosts income; if elastic, lowering prices can expand market share and total sales.

Airlines and ride-sharing apps employ real-time elasticity modeling to adjust fares dynamically. - **Promotions and Discount Strategy**: Promotions are most effective on elastic products. A 20% discount on smartwatches—priced with low elasticity—may fail to move buyers, but the same cut on budget headphones triggers surge demand.

Marketing teams target elastic categories with urgency-driven campaigns, amplifying conversion. - **Product Line Adjustments**: Firms analyze elasticity across SKUs to prioritize profitable items. High-elasticity products may face margin compression—promoting private labels or bundling to maintain volume—while low-elasticity goods support premium tiers and scarcity pricing.

- **New Market Entries and Pricing Launches**: Entering a market with elastic consumer behavior demands careful pricing. Tech startups launching affordable smart home devices test elasticity through pilot pricing, calibrating launch prices to avoid volume drops that erode initial gains.

“Own Price Elasticity is the compass for pricing in uncertainty,” says David Rennie, pricing analytics lead at MarketForge.

“It turns speculative pricing into a data-backed strategy—balancing risk, revenue, and competitive positioning.”

Real-World Examples: Elasticity in Action

Take consumer electronics: a $50 price hike on a mainstream wireless earbud (with elastic PED around 1.8) could slash demand 30% or more, wiping revenue. Conversely, a luxury smartwatch retailing at $2,000 with PED below 0.4 absorbs a 10% price raise with minimal volume loss—profit margins expand. In grocery retail, butter pricing embodies elasticity: modest increases on essential dairy have near-zero demand impact, while premium imported versions see sharper reactions.

In emerging markets, elasticity reveals hidden patterns. Mobile data plans, seen as essential, display low elasticity; users absorb price hikes, yet sharp increases suppress new subscriber growth. Telecom firms counter this by bundling services—turning perceived value and reducing effective price sensitivity through value-added features.

Seasonal demand also reshapes elasticity. Holiday gift baskets, once inelastic at year-end, may become elastic mid-season as

Related Post

Own Price Elasticity of Demand: The Hidden Sense of Value Shaping What We Buy

Meet Radhika Shakya: The Steady Force Behind KP Sharma Oli’s Political Empire

As 106: Unlocking Innovation in a Defining Regulatory Shift

Unlocking the Power of Kost: How a Revolutionary Framework Is Reshaping Industry Standards