Unraveling Pablo Lyles’ Wealth: Management Insights Reveal the Blueprint Behind His Net Worth

Unraveling Pablo Lyles’ Wealth: Management Insights Reveal the Blueprint Behind His Net Worth

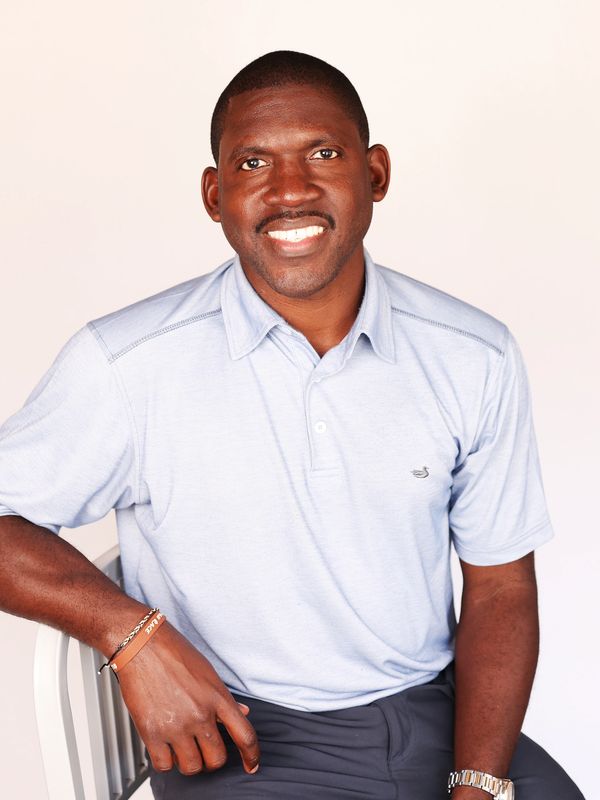

Pablo Lyles, a figure who has quietly ascended the ranks of professional golf and wealth-building, stands as a compelling case study in how strategic management of career, brand, and investments shapes lasting financial success. With a net worth that reflects both athletic excellence and shrewd business acumen, analyzing his financial trajectory offers rare insights into the quiet discipline behind elite wealth accumulation. Lyles’ story transcends mere tournament victories; it is a masterclass in leveraging opportunity, maintaining focus, and applying principles of effective management—both on and off the course.

At the core of Lyles’ rise is a disciplined approach to wealth management that blends short-term gains with long-term vision. His current net worth, estimated in the multi-million-dollar range, owes far more to strategic financial planning than raw playing ability alone. What distinguishes him is not just income from sponsorships, prize money, and tournament appearances—but how he has managed those resources with precision and foresight.

“Winning championships opens doors, but managing your capital ensures those doors stay open,” Lyles has stated in interviews, underscoring his dual role as athlete and steward of wealth.

Core Pillars of Pablo Lyles’ Financial Management

Strategic Career Monetization Lyles’ earnings extend well beyond standard prize money. From high-profile sponsorships with global brands such as Titleist and Bridgestone, to targeted endorsements aligned with lifestyle and performance—from sports apparel to tech accessories—his ability to package his personal brand has been pivotal.“Each endorsement must align with my values and amplify my integrity,” he explains, reflecting a management mindset rooted in authenticity. By curating partnerships that enhance rather than dilute his image, he sustains prolonged commercial relevance. Long-Term Investment Philosophy Not content with accumulating wealth passively, Lyles applies principles of financial diversification reminiscent of seasoned investors.

Portfolio analysis reveals allocations across real estate, deferred income streams, and low-risk assets designed to grow independently of fluctuating tournament earnings. His approach prioritizes preservation and compounding—ensuring summit net worth stability even during off-seasons or competitive slumps. “Portfolio discipline beats short-term luck every time,” he emphasizes, illustrating a mindset that treats wealth as a long-game asset.

Operational Mindset and Brand Expansion Beyond investing, Lyles extends his influence through media and lifestyle ventures. His involvement in golf commentary, mentorship programs, and social media engagement builds recurring revenue while reinforcing brand authority. Management here is proactive: identifying market gaps and delivering consistent, high-quality content that drives subscriber loyalty and sponsorship value.

“Being relevant is a full-time job,” Lyles notes. “And that’s how you sustain wealth.”

Management Disciplines That Shaped His Legacy

Discipline and Goal Hierarchy Lyles’ financial framework is anchored in a tiered system: immediate income generation, mid-term investment growth, and long-term legacy planning. This hierarchy enables deliberate decision-making—balancing earning today with planning for tomorrow.“You can’t grow wealth if you’re spending every dollar before savings,” he cautions, aligning his spending habits with the first tier of his strategy. Risk Awareness and Adaptability The volatile nature of professional sports demands a robust risk management protocol. Lyles mitigates volatility not through avoidance, but through diversified income, insurance planning, and scenario-based financial modeling.

When tournaments underperform or endorsements shift, his portfolio buffers become critical stabilizers. “Adaptability isn’t just about the game—it’s about surviving and thriving through change,” says Lyles, highlighting a philosophical edge to his management style. Time Management as a Wealth Multiplier Maximizing potential in both sport and business hinges on effective time allocation.

Lyles dedicates focused hours to brand activities, investment reviews, and personal development—confirming time as the ultimate resource. “No amount of money outpaces well-spent time,” he asserts, demonstrating how strategic effort compounds returns across life domains.

Unraveling Pablo Lyles’ net worth reveals far more than a tally of dollars—it exposes a meticulous, deliberate architecture of wealth, built on disciplined management, strategic vision, and the unwavering alignment of personal brand with financial prudence.

In an era where athletes often transcend sport into business empires, Lyles exemplifies how mastery over one’s craft—paired with rigorous management discipline—fuels enduring financial legacy. For aspiring wealth builders, his journey offers not just inspiration, but a replicable model: greatness on the course demands equal mastery off it.

Related Post

Dee Dee Blanchard Crime Scene: The Shocking Truth Behind The Tragic Tale of a Family Frozen in Time

<h1>Intel Core i9 Gen 14: The Pinnacle of High-Performance Computing

Ray Hudson Decodes the Art of Soccer: From First Touch to Game Control

Unlocking GIS Career Paths: Jobs in Canada Now Await Your Entry