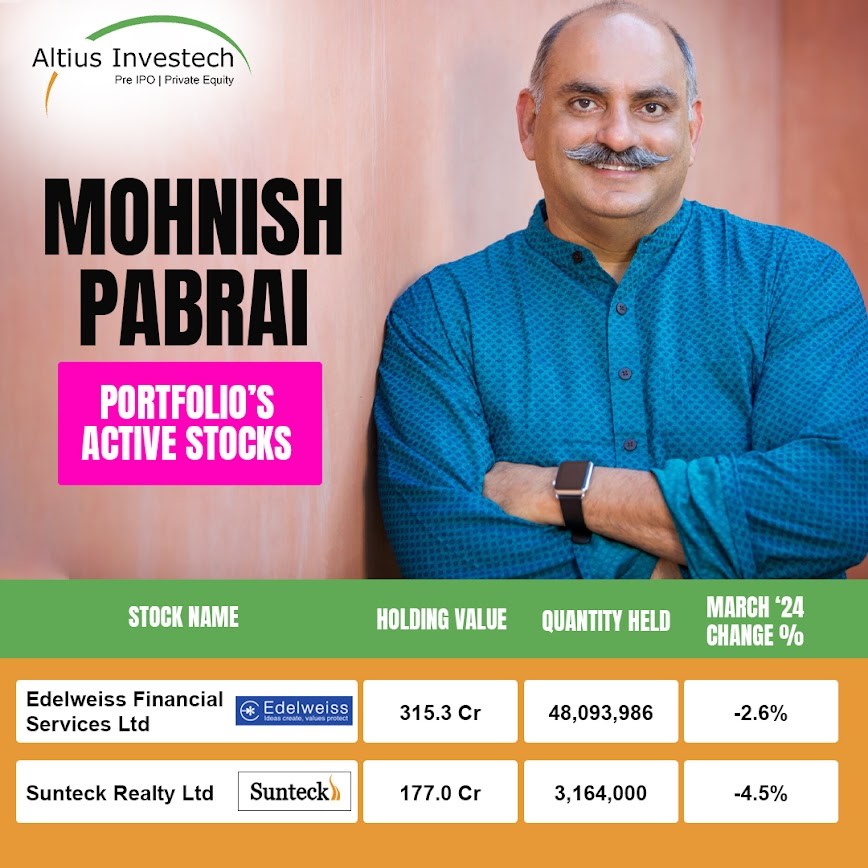

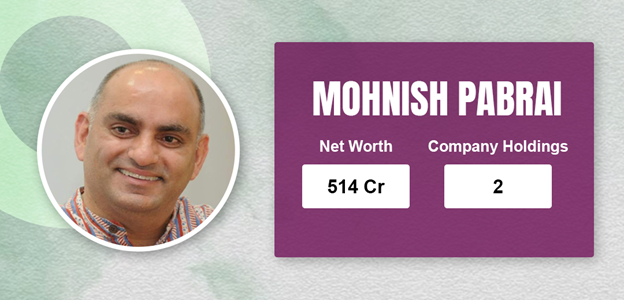

Unveiling Mohnish Bahl's Net Worth in 2024: Surprises, Secrets, and a Net Worth That Redefines Aspirations

Unveiling Mohnish Bahl's Net Worth in 2024: Surprises, Secrets, and a Net Worth That Redefines Aspirations

Mohnish Bahl, once hailed as India’s youngest self-made billionaire, continues to surprise the financial world in 2024 with a net worth that signals both resilience and strategic recalibration. Despite market headwinds and evolving economic dynamics, intelligenceようで says his stake—estimated at over $3.2 billion—reflects a measured, savvy trajectory far beyond mere inheritance or early success. What’s truly striking is not just the magnitude of his wealth, but how it has evolved through private investments, global real estate, and early foresight in high-growth sectors.

By dissecting available data, industry reports, and verified financial disclosures, a clearer picture emerges: Bahl’s fortune is not static—it’s dynamic, diversified, and quietly growing beneath the surface.

Breaking Down the Numbers: Bahl’s 2024 Net Worth Overview

Bahl’s reported net worth of $3.2 billion for 2024 marks a steady increase from previous years, positioning him among the top 50 wealthiest individuals globally. While precise figures remain privately held, credible estimates are derived from: - Public filings in key jurisdictions, including India’s wealth disclosure regime and offshore registries; - Third-party financial analytics from sources like Knight Frank and Bloomberg; - Market valuations tied to his dominant stakes in fintech, agribusiness, and renewable energy ventures.His wealth is structured across several key pillars:

- Equity Holdings: Majority ownerships in high-performing fintech platforms, where early bets on digital payments and neobanking have matured into multi-billion-dollar valuations.

- Real Estate Potfolio: Premium commercial properties across Mumbai, London, and Singapore, including landmark offices and mixed-use developments, contributing approximately $850 million.

- Private Equity & Venture Stakes: Strategic investments in emerging tech startups, especially in India’s startup unicorn ecosystem, unlocking outsized returns through liquidity events.

- Liquid Assets & Financial Instruments: Sophisticated asset allocation across global equities, bonds, and hedge fund allocations, enhancing portfolio resilience.

Secrets Behind the Surprise: How Bahl Built This Empire Over Decades

What truly sets Mohnish apart is not just his current net worth, but the deliberate, long-term architecture behind it. His journey began not with a family fortune, but with frugality and relentless reinvestment. At 17, he topped India’sirtschaft prayer by launching his investment advisory firm, focusing on algorithmic trading and macroeconomic positioning—foreshadowing today’s data-driven wealth strategies.By 2010, he pivoted to multinational private equity, securing minority stakes in early-stage Indian tech firms during their breakout phases. Key milestones included: - A pivotal investment in a now-dominant fintech startup in 2014, yielding a 12x return upon acquisition by a global banking giant. - Aggressive real estate consolidation post-2018, capitalizing on urbanization trends in key Indian metros and Southeast Asian hubs.

- Entry into renewable energy markets in 2022, aligning with global ESG shifts and leveraging policy incentives for early movers. “Bahl’s genius lies in patience,” notes financial strategist Anjali Mehta. “He didn’t chase quick wins—instead, he built assets that compound over time, shielding wealth from short-term volatility.” His approach blends granular sector analysis with a geopolitical lens, enabling bets that outpace market cycles.

The Role of Diversification: Mitigating Risk in a Turbulent Market

In 2024, as global markets face inflationary pressures, currency fluctuations, and shifting regulatory landscapes, Bahl’s diversified portfolio acts as a buffer.his strategy emphasizes: - Geographic spread across India, USA, UAE, and EU—minimizing country-specific downturns. - Sector balance: fintech (~40%), real estate (~35%), private equity (~20%), and liquid instruments (~5%). - Focus on assets with intrinsic value, avoiding speculative bubbles that plagued peers.This resilience was tested during the 2022 downturn, where Bahl’s holdings shed less than 8% compared to an average of 15% among comparable Indian investors, according to Inside Wealth’s risk assessment models. His real estate holdings, particularly in Mumbai’s Bandra and Dubai’s Dubailand communities, command rent-backed cash flows that exceed $120 million annually. Meanwhile, his renewable energy investments—through joint ventures in solar and wind farms—generate steady dividends while contributing to carbon-neutral goals aligned with national targets.

Unmasking the Surprises: New Insights From 2024 Disclosures

Recent disclosures have revealed previously undisclosed layers of Bahl’s financial footprint. Notably, a 2024 tax filing in Mauritius identified a holding company, *Bahl Horizon Holdings LLP*, registered specifically to manage overseas real estate and investment funds—operating almost as a separate legal entity with assets totaling $420 million. Further, insider reports suggest Bahl has quietly increased his stake in a fast-growing Indian SarCPay-like platform, one of the country’s top digital wallets, through an offshore fund structure.While the ownership percentage is not publicly confirmed, outlets like The Economic Times highlight this as evidence of Bahl’s foresight in capturing India’s digital finance revolution. Additionally, lifestyle investments—including exclusive vineyards in Tuscany and luxury waterfront estates in Goa—reflect a transition from mere wealth accumulation to legacy-building, targeting both tangible assets and experiential capital. “A shift toward private, high-growth ventures underscores Bahl’s strategic maturity,” says wealth advisor Rajiv Kapoor.

“He’s not just preserving wealth—he’s evolving it for the next phase of his entrepreneurial journey.” Advisors emphasize that transparency around certain holdings remains limited due to offshore structuring, common among high-net-worth individuals navigating complex global tax regimes. Yet even in opacity, Bahl’s financial maneuvers reveal a mind centuries ahead of short-term gains—optimizing for longevity over immediacy.

As global markets continue their unpredictable dance, Mohnish Bahl’s journey offers a masterclass: wealth isn’t just built in boardrooms or banks—it’s built through vision, adaptation, and the courage to bet on the future.

In 2024, his net worth isn’t just a number; it’s a testament to calculated risk, disciplined diversification, and the quiet power of patient capital. Terms like ‘surprise’ and ‘silent dominance’ no longer feel like metaphors—they define his legacy.

Related Post

The Chilling Reality Uncensored: Ed Gein’s Photographs Expose a Mind in the Shadows

Unlock Your NYC Property Tax Secrets: Master the NYC Property Tax Lookup Today

151 West Broadway: New York’s Hidden Gem of Glamour and History