USAA Auto Loan Payoff: How To Get Your Payoff Amount with Clarity and Confidence

USAA Auto Loan Payoff: How To Get Your Payoff Amount with Clarity and Confidence

For servicemembers and military families, financial precision isn’t just a preference—it’s a necessity. When managing auto loans, knowing exactly how much you owe at any moment empowers smarter decisions, whether planning to pay early, refinance, or assess net worth. The USAA Auto Loan Payoff: How To Get Your Payoff Amount guide reveals the accessible, step-by-step process of retrieving your exact payoff balance—guaranteed to demystify a seemingly complex financial snapshot.

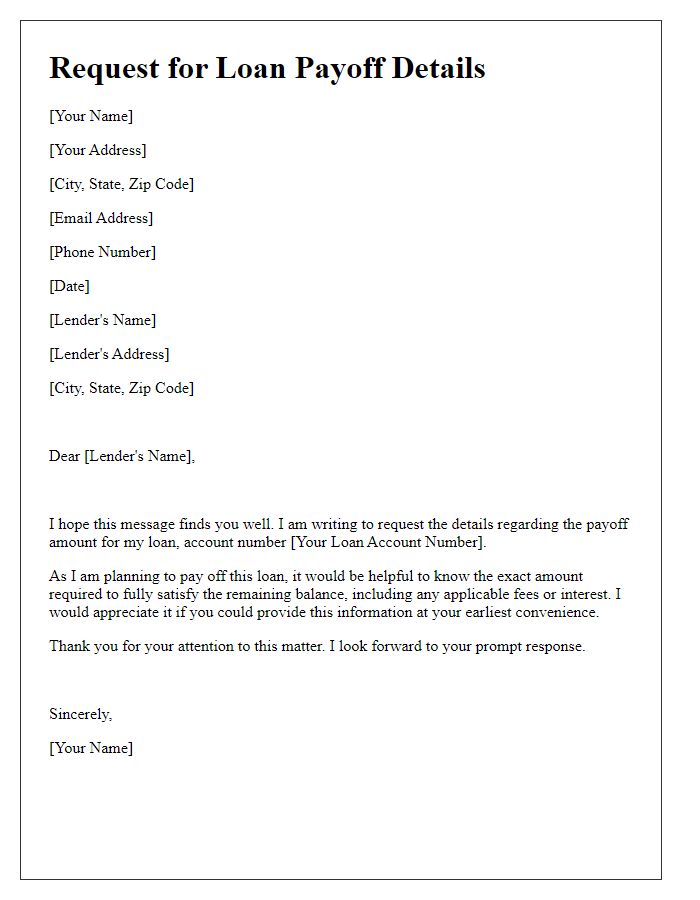

Understanding your payoff amount is more than a number—it’s a strategic tool. Unlike monthly payments or interest rates, the payoff balance reflects your total outstanding loan cost, including principal, accrued interest, and fees. This figure is critical when evaluating buyout options, comparing refinance offers, or simply gaining clarity on your long-term financial health.

Harvesting accurate payoff data begins with leveraging official USAA channels. USAA provides multiple secure entry points to access your loan summary: 1. Log into Your USAA Auto Loan Dashboard Access your personalized account via the USAA mobile app or website.

Login requires your username and a verified password or biometric authentication, ensuring secure, real-time access. Once logged in, navigate to the “Loans” section, where detailed loan statements and payoff calculators are available with one click. The dashboard displays immediate access to the current payoff balance, allowing quick verification without third-party intermediaries.

2. Generate a Loan Summary Statement Within the loan portal, use the “View Loan Details” or “Get Your Loan Statement” tool. These options compile all relevant data into a clean, detailed PDF or interactive web summary.

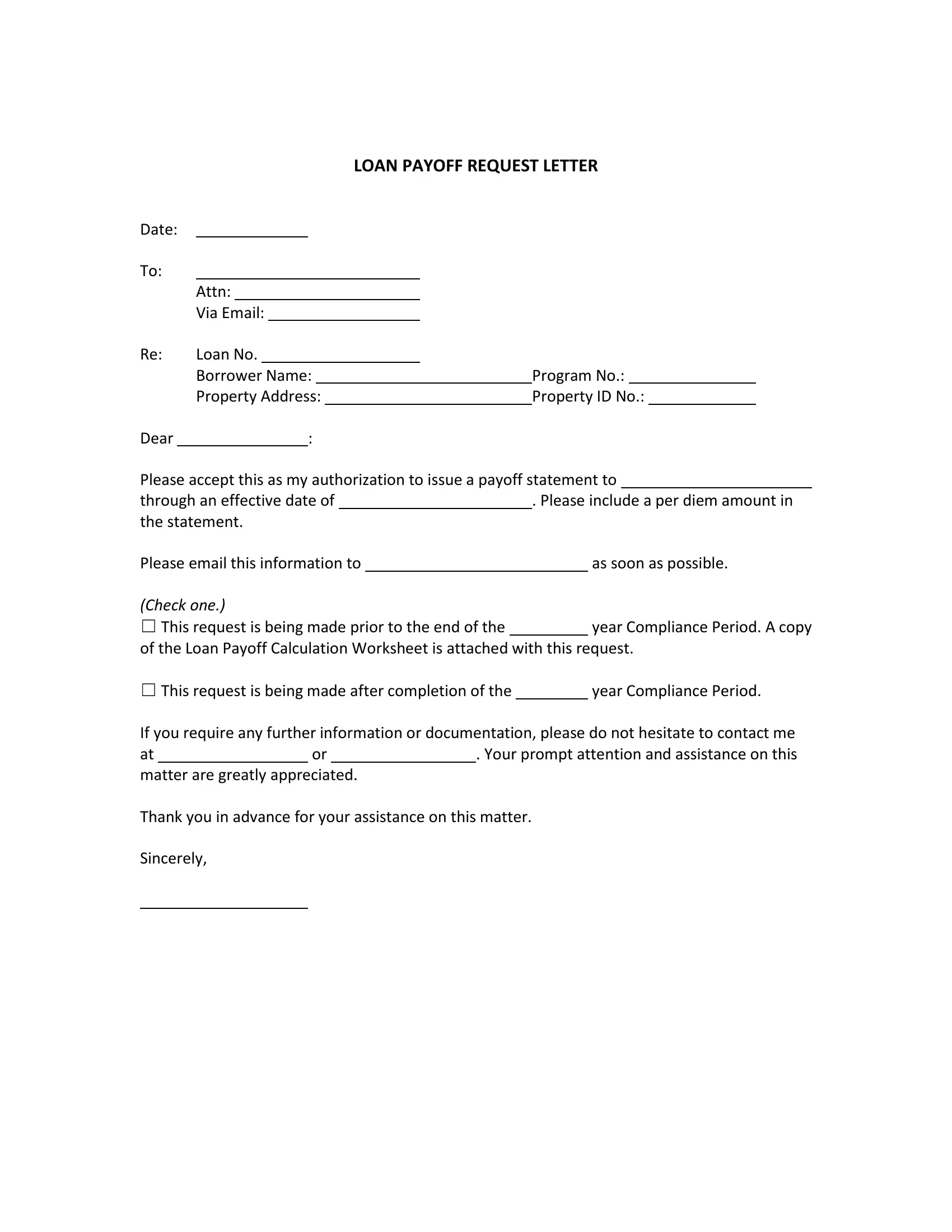

You’ll find: - Official payoff balance (own principal plus total interest and fees) - Down payment and term breakdown - Past payment history and current status - Itemized interest and principal components, useful for financial analysis This summary serves not only as proof but as your primary reference for payoff calculations. Not all borrowers rely solely on digital tools—many turn to USAA’s dedicated loan officers for personalized support. These certified professionals, trained in auto loan intricacies, can retrieve your payoff amount over the phone or via secure messaging.

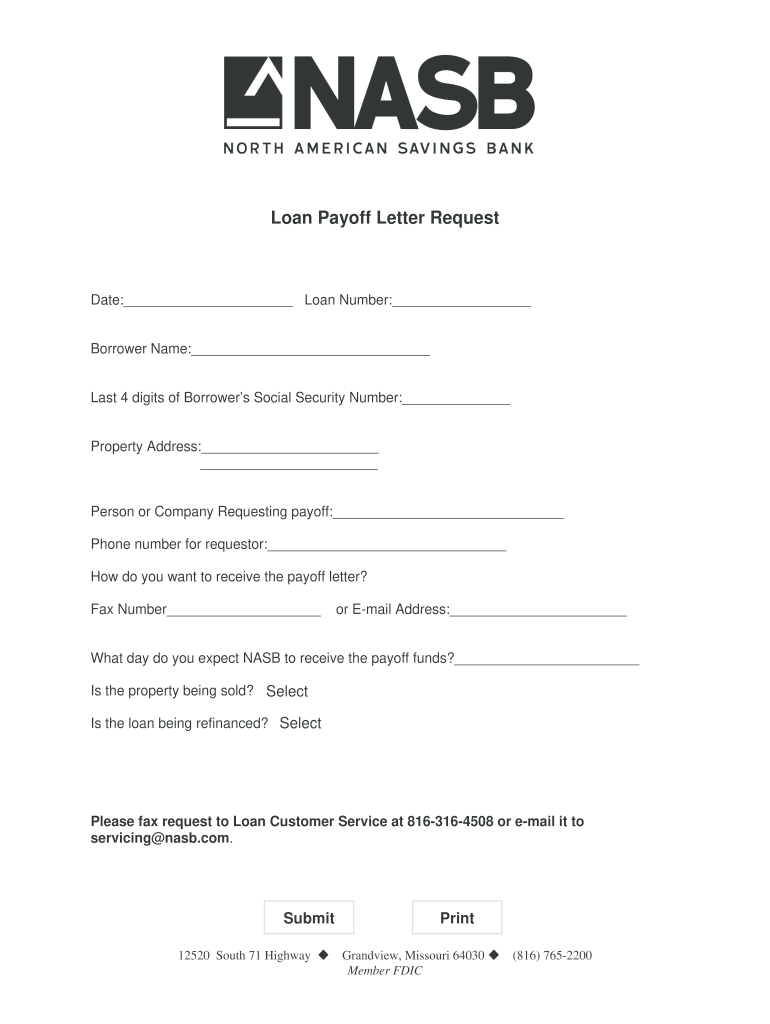

Ideal for those who prefer human guidance or need clarification on loan terms, USAA’s dedicated loan service ensures direct, accountable access: - Contact via the “Ask a Loan Specialist” chat or call center - Provide member ID, loan account number, and verification for instant retrieve - Receive a printed summary or digital document with your payoff amount within minutes Equally powerful is the USAA mobile app, engineered for on-the-go financial oversight. Using features like transaction history alerts and deductible-tracking tools, usuaries can monitor their payoff balance alongside other critical loans. Notifications update in real time when payments are applied, fees accrue, or majors changes occur—keeping payoff data perpetually current without manual checks.

Verifying your payoff amount isn’t just about transparency—it’s about control. USAA’s data architecture ensures every figure reflects the most up-to-date loan records, updated automatically with each payment processed. For clarity, cross-referencing payoff statements across channels helps prevent discrepancies, especially if multiple loan agents or financial platforms are involved.

Public feedback from USAA auto loan members underscores the clarity these tools deliver. One servicemember noted, “Accessing my payoff amount through the app made it easy to see a clear picture before deciding to pay off early—no more guessing.” Another praised the dedicated loan line, stating, “Talking directly to a USAA expert gave me full confidence that my numbers were accurate and secure.” To safeguard your payoff data, USAA employs industry-leading encryption and secure login protocols. Member accounts are protected with multi-factor authentication, and every access request is logged and encrypted.

There’s no obligation to share sensitive information externally—only verified, secure channels grant entry to your financial details. For those navigating loan transitions—whether refinancing, selling a vehicle, or transitioning deployment—knowing your payoff amount is non-negotiable. It forms the foundation for sound financial planning, helping servicemembers maintain fiscal discipline in a demanding career environment.

USAA’s tools transform what could be a complex puzzle into a straightforward path, enabling timely decisions with confidence. Whether through the mobile app, dedicated online portal, or direct support from a loan specialist, retrieving your payoff amount has never been more immediate or accurate. In an era demanding both

Related Post

Ghost Spectre: The Darkest Edge of Cyber Espionage and Digital Anarchy

What Time Zone Is California In Right Now? The Precise Answer Everyone Should Know

Most Environmentally Friendly Countries: The Green Benchmark Saving Our Planet

Deccan Chronicle Illuminates the Rise of Decentralized Renewable Energy in Rural India