Uzbekistan Medical Insurance Explained: Navigating Healthcare Coverage in the Heart of Central Asia

Uzbekistan Medical Insurance Explained: Navigating Healthcare Coverage in the Heart of Central Asia

Uzbekistan’s healthcare system, supported by a structured medical insurance framework, plays a critical role in ensuring accessible and affordable care for its population. As the country advances administratively and economically, understanding its insurance mechanisms becomes essential—especially for residents and expatriates seeking clarity on coverage, benefits, and access. This detailed exploration unpacks the layers of Uzbekistan’s medical insurance system, revealing how it operates, who benefits, and what challenges remain.

The Architecture of Uzbekistan’s Medical Insurance System

Uzbekistan’s model of medical insurance blends public funding, mandatory contributions, and contracted private providers to deliver comprehensive healthcare support.At its core lies a mandatory national health insurance scheme enforced through Law No. 326-II “On Medical Insurance,” which legally requires citizens and authorized residents to participate in the state-backed system. The system operates on three pillars: - **State-Obligatory Public Coverage**: Mandatory enrollment ensures near-universal access, with contributions funded through payroll deductions—typically 7–12% of salary split between employer and employee, directed to specialized insurance funds.

- **Supplementary Private Insurance**: An opt-in market segment allows voluntary coverage for enhanced services, faster access, and private clinics, bridging gaps where public facilities face strain. - **Regional Administrative Execution**: Insurance oversight is decentralized, managed by local authorities who coordinate facility accreditation's parameters and claim processing. “This system reflects Uzbekistan’s commitment to universal health coverage,” says Dr.

Lila Kurbanova, public health analyst at Tashkent Institute of Public Health. “It’s designed to balance affordability with quality, ensuring basic medical services remain within reach for all.”

The Ministry of Health, in partnership with regional insurance funds, manages trust organizations responsible for payouts, provider networks, and beneficiary registration. These funds receive state subsidies to cover costs for low-income and vulnerable groups, including children, the elderly, and rural populations.

Who Benefits and How Coverage Is Structured

The structure ensures broad inclusivity, though access varies by employment status and contribution history. Full coverage applies to: - Employees under formal contracts through payroll-mandated contributions. - Self-employed individuals opting into the voluntary insurance program.- All residents legally present in Uzbekistan during periods of active residence. Care delivery spans primary clinics, regional hospitals, and specialized centers—especially in urban hubs like Tashkent, Samarkand, and Fergana Valley. Yet rural areas face supply limitations, prompting targeted state investments to expand insured provider networks outside major cities.

“The system prioritizes equity,” notes a representative from Uzbekistan Health Insurance Fund (UHIF). “Even remote communities gain access to basic services, thanks to mobile clinics and telemedicine pilots supported by insurance funding.”

Coverage includes hospital inpatient stays, outpatient consultations, preventive screenings, maternity care, pediatric services, and critical emergency treatments—configured with developmentally tailored protocols emphasizing maternal and child health. Chronic disease management, including diabetes and hypertension, benefits from dedicated funding streams, though out-of-pocket costs persist for non-essential procedures.

Funding Sources, Contribution Rates, and Contributor Dynamics

Funding flows from multiple streams: - **Payroll Deductions** – Primary source: 7–12% of monthly income, split equally between employer and employee.- **State Subsidies** – Compensate for unoffset costs in low-income and high-need regions. - **Government Budget Allocations** – Support national health priorities, including disease prevention campaigns and public facility upgrades. - **International Partnerships** – Incorporated via WHO and World Bank technical aid, enhancing system transparency and long-term sustainability.

For employees, the mandatory contribution ensures predictable, pooled financing for public care. Self-funded participants in private insurance plan customizable premiums, enabling tailored packages based on health needs and lifestyle expectations. Despite structure, affordability remains a nuanced point.

“While mandatory contributions are modest—averaging 9% of take-home pay—the transitional cost of voluntary options can challenge low-wage workers,” explains Dr. Kurbanova. Still, government outreach programs aim to reduce disparities through informational campaigns and subsidized enrollment drives.

The balance between mandatory risk-sharing and voluntary flexibility aims to adjust responsiveness to fluctuating demand, especially post-pandemic, where surge capacity became paramount. Health authorities report improved trust since 2020, with coverage rates climbing to over 85% nationwide—though full parity across urban-rural divides remains a policy focus.

Claims Process and Healthcare Accessibility

Enrolling is straightforward via state portals or local health departments, requiring minimal documentation: proof of identity, residence, and employment or self-employment status. Once registered, beneficiaries gain direct access to contract hospitals and clinics, with straightforward referral and billing protocols.“Claims are processed electronically, with receipts automatically recorded and reimbursements disbursed within 10–15 business days,” notes UHIF. “Teleconsultations and remote diagnostics now trigger funding instantly, expanding access beyond physical facility reach.” Geographic reach is a key strength: insured facilities are mapped to ensure rural outreach, with mobile units supplementing fixed centers. Yet wait times at top-tier facilities still peak during seasonal flu outbreaks, underscoring the need for ongoing workforce expansion.

Self-insured contributors enjoy dedicated medical advocates assisting bear essential claims, especially during complex hospitalizations or multi-specialty treatments. This support network enhances user experience significantly.

Challenges and Ongoing Reforms

Persistent hurdles include uneven insured provider density, bureaucratic processing delays in some regions, and limited awareness among remote communities.To address these, Uzbekistan’s government is investing in digital infrastructure, expanding health information systems, and launching mobile health initiatives integrated with insurance data. “We’re transforming medical insurance from a passive coverage tool into an active enabler of preventive and timely care,” said a senior policymaker during a 2024 forum. “Digital records, AI-driven fraud detection, and real-time data sharing will streamline everything from enrollment to claim resolution.” Regional equity remains central: upcoming reforms prioritize upgrading clinics and training staff in underserved zones, funded through targeted insurance allocations and international development loans.

Public health experts agree: enhanced transparency and community outreach are vital. Expanding multilingual resources and leveraging local leaders to disseminate benefits information could boost enrollment among traditionally underserved groups.

In sum, Uzbekistan’s medical insurance system reflects a deliberate evolution—rooted in legal mandate, driven by public-private collaboration, and increasingly responsive to citizen needs.

While challenges persist, structured access, expanding coverage, and deliberate equity efforts position the model as a cornerstone of the nation’s healthcare advancement. Understanding its mechanics is key for anyone navigating health services in Uzbekistan, whether resident or visitor seeking reliable, affordable protection.

Related Post

Best Month to Visit Cancun: The Perfect Time for Sun, Culture, and Serenity

What Is the Definition of Ornate? The Elegant Art of Excessive Beauty

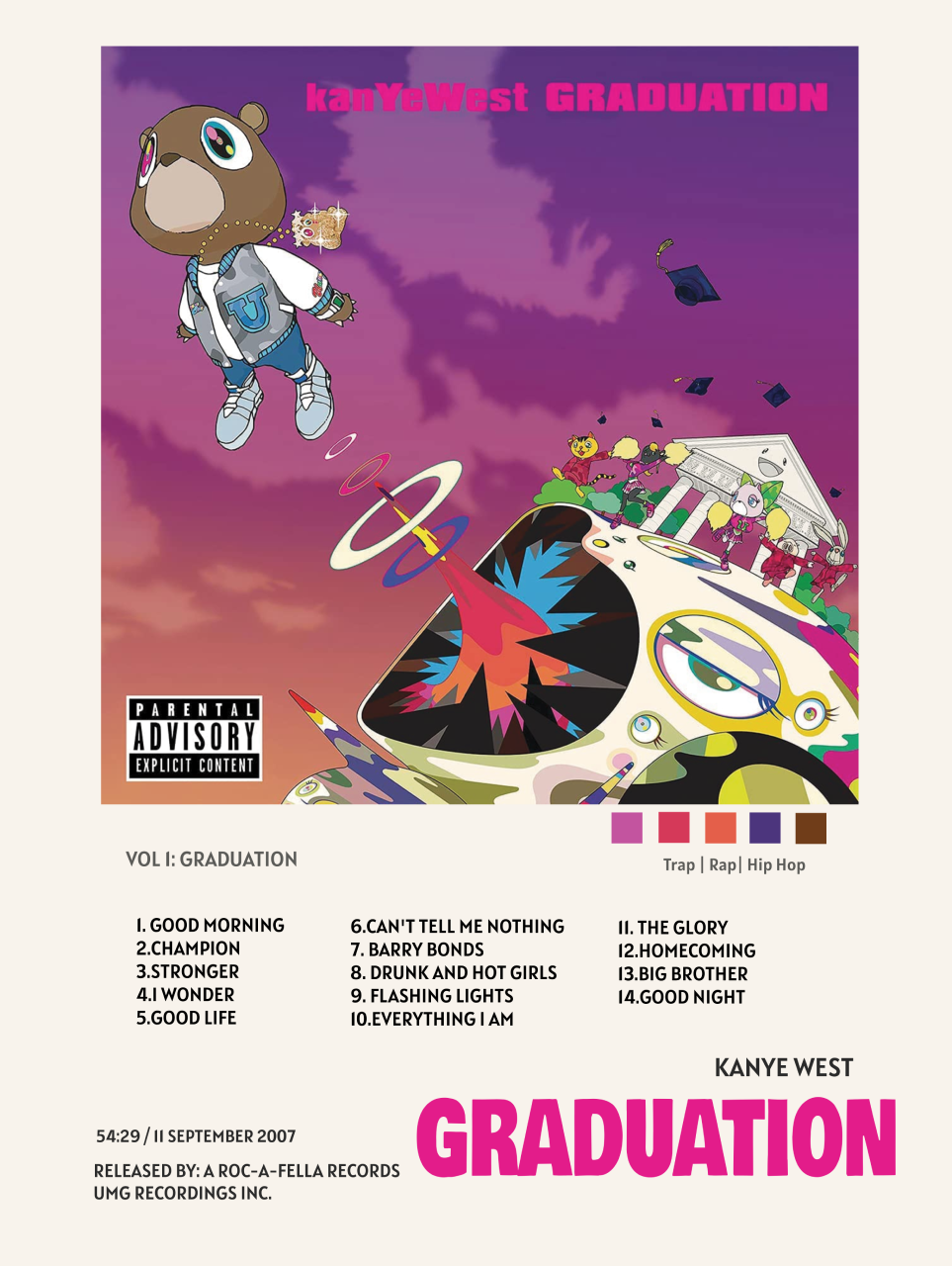

Kanye West’s Kanye Graduation: A Cultural Milestone Redefining Art, Identity, and Achievement

Marcus Moore Salary: The Rising Star at $180K — What Sets His Compensation Pattern?